Spain: Outlook on petrol RVs lowered as BEVs gain momentum

12 August 2019

12 August 2019

By Neil King

The new car market is struggling in Spain because of economic weakness and the usage of higher NEDC-correlated CO2 emissions figures to calculate registration tax. Used car demand and residual values (RVs) remain strong, however, and with tax liabilities on new cars set to increase further as Spain adopts WLTP figures from 2021, this will continue to support RVs. Petrol cars will still fare better than diesels but the RV Outlook for the former has been downgraded in 2020 and 2021 as battery electric vehicles (BEVs), hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) strengthen.

New car market weakness bolsters used car demand and values

New car registrations in Spain fell by 11% year-on-year in July and are down by 6.5% in the first seven months of the year, according to the latest figures released by the carmakers’ association ANFAC. This is due to a combination of economic weakness and the usage of higher NEDC-correlated CO2 emissions figures (calculated using the new WLTP testing process), which means that many cars have moved up a tax band in Spain, generating additional tax revenues in the process.

A positive side effect of the weak demand for new cars in Spain, however, is that the used car market is performing well. The volume of used car transactions increased by 6.1% in the first half of 2019 compared to the same period in 2018, according to data provided to Autovista by the Ideauto unit of the Spanish carmakers’ association ANFAC.

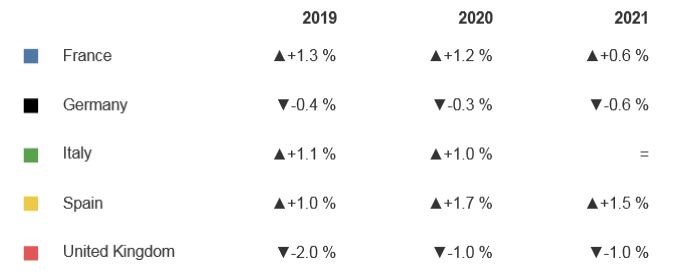

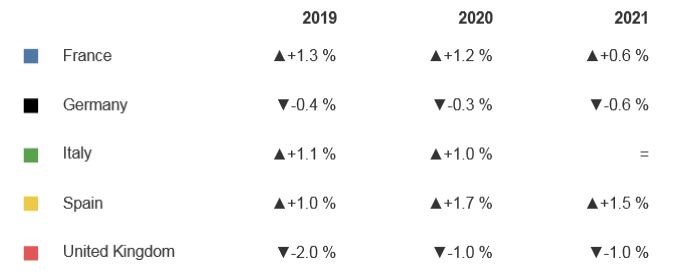

The healthy used car demand is underpinning RVs, which are forecast to gain 1% in 2019, behind only France and Italy. In the latest Autovista Group RVÂ Outlook, RVs of cars in the 36month/60,000km scenario in Spain, which are already the highest in the EU5, are forecast to grow at the quickest rate among the EU5 markets in 2020 and 2021.

Residual Value Outlook, EU5, 36months/60,000km, 2019-2021

Source: Autovista Group

Petrol down but not out

RV growth will be more pronounced for petrol cars than diesel, assuming the tax structure remains based on emissions of CO2 and not nitrogen oxide (NOx).

Ana Azofra, Valuations and Insights Manager for Eurotax Espana, part of Autovista Group, notes, however, that ′there has been a slight increase in the volume of petrol cars offered in the used car market and we expect this trend to continue.’ Accordingly, the RV outlook for petrol cars has been downgraded by one percentage point in 2020 and 2021 in our July forecast round.

Battery electric vehicles (BEVs) have now gained sufficient momentum in Spain that we have a healthy outlook for their values too, as well as for hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs).

′We have started to include the RV outlook for BEVs in Spain. We have a high forecast for BEVs now despite of the lack of charging infrastructure as the vehicles offered are improving with better range, batteries and warranties. The low volume in the used car market also means prices are not under pressure. It is question of the balance of the offer and demand’ Azofra comments.

Given the reduced supply and thawing of the cold consumer reaction to diesels, we anticipate that the decline in diesel RVs will level out in 2019, with values falling by just 1.5%. Azofra highlights that ′In the used car market, we have noted that over the last two years, the number of fleet diesel sales has declined, meaning there are less used diesels in the market. We expect a further decrease in diesel registrations in the short term but a stabilisation in sales by the end of the year.’

For 2020 and 2021, our latest outlook still calls for a decline in diesel RVs, albeit of just 0.5%, whereas RVs of petrol-powered cars are now forecast to gain by 1.0% in 2019 and 2020 and by 0.5% in 2021.

WLTP will indirectly support used car values

Spain originally intended to use purely WLTP figures for tax calculations from 1 January 2019 but at the end of August 2018, the Government postponed this implementation to 1 January 2021. With tax liabilities on new cars set to increase further, this is expected to fuel demand and, in turn, RVs of used cars in Spain from 2021 onwards.

Source: Autovista Group

Petrol down but not out

RV growth will be more pronounced for petrol cars than diesel, assuming the tax structure remains based on emissions of CO2 and not nitrogen oxide (NOx).

Ana Azofra, Valuations and Insights Manager for Eurotax Espana, part of Autovista Group, notes, however, that ′there has been a slight increase in the volume of petrol cars offered in the used car market and we expect this trend to continue.’ Accordingly, the RV outlook for petrol cars has been downgraded by one percentage point in 2020 and 2021 in our July forecast round.

Battery electric vehicles (BEVs) have now gained sufficient momentum in Spain that we have a healthy outlook for their values too, as well as for hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs).

′We have started to include the RV outlook for BEVs in Spain. We have a high forecast for BEVs now despite of the lack of charging infrastructure as the vehicles offered are improving with better range, batteries and warranties. The low volume in the used car market also means prices are not under pressure. It is question of the balance of the offer and demand’ Azofra comments.

Given the reduced supply and thawing of the cold consumer reaction to diesels, we anticipate that the decline in diesel RVs will level out in 2019, with values falling by just 1.5%. Azofra highlights that ′In the used car market, we have noted that over the last two years, the number of fleet diesel sales has declined, meaning there are less used diesels in the market. We expect a further decrease in diesel registrations in the short term but a stabilisation in sales by the end of the year.’

For 2020 and 2021, our latest outlook still calls for a decline in diesel RVs, albeit of just 0.5%, whereas RVs of petrol-powered cars are now forecast to gain by 1.0% in 2019 and 2020 and by 0.5% in 2021.

WLTP will indirectly support used car values

Spain originally intended to use purely WLTP figures for tax calculations from 1 January 2019 but at the end of August 2018, the Government postponed this implementation to 1 January 2021. With tax liabilities on new cars set to increase further, this is expected to fuel demand and, in turn, RVs of used cars in Spain from 2021 onwards.

Source: Autovista Group

Petrol down but not out

RV growth will be more pronounced for petrol cars than diesel, assuming the tax structure remains based on emissions of CO2 and not nitrogen oxide (NOx).

Ana Azofra, Valuations and Insights Manager for Eurotax Espana, part of Autovista Group, notes, however, that ′there has been a slight increase in the volume of petrol cars offered in the used car market and we expect this trend to continue.’ Accordingly, the RV outlook for petrol cars has been downgraded by one percentage point in 2020 and 2021 in our July forecast round.

Battery electric vehicles (BEVs) have now gained sufficient momentum in Spain that we have a healthy outlook for their values too, as well as for hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs).

′We have started to include the RV outlook for BEVs in Spain. We have a high forecast for BEVs now despite of the lack of charging infrastructure as the vehicles offered are improving with better range, batteries and warranties. The low volume in the used car market also means prices are not under pressure. It is question of the balance of the offer and demand’ Azofra comments.

Given the reduced supply and thawing of the cold consumer reaction to diesels, we anticipate that the decline in diesel RVs will level out in 2019, with values falling by just 1.5%. Azofra highlights that ′In the used car market, we have noted that over the last two years, the number of fleet diesel sales has declined, meaning there are less used diesels in the market. We expect a further decrease in diesel registrations in the short term but a stabilisation in sales by the end of the year.’

For 2020 and 2021, our latest outlook still calls for a decline in diesel RVs, albeit of just 0.5%, whereas RVs of petrol-powered cars are now forecast to gain by 1.0% in 2019 and 2020 and by 0.5% in 2021.

WLTP will indirectly support used car values

Spain originally intended to use purely WLTP figures for tax calculations from 1 January 2019 but at the end of August 2018, the Government postponed this implementation to 1 January 2021. With tax liabilities on new cars set to increase further, this is expected to fuel demand and, in turn, RVs of used cars in Spain from 2021 onwards.

Source: Autovista Group

Petrol down but not out

RV growth will be more pronounced for petrol cars than diesel, assuming the tax structure remains based on emissions of CO2 and not nitrogen oxide (NOx).

Ana Azofra, Valuations and Insights Manager for Eurotax Espana, part of Autovista Group, notes, however, that ′there has been a slight increase in the volume of petrol cars offered in the used car market and we expect this trend to continue.’ Accordingly, the RV outlook for petrol cars has been downgraded by one percentage point in 2020 and 2021 in our July forecast round.

Battery electric vehicles (BEVs) have now gained sufficient momentum in Spain that we have a healthy outlook for their values too, as well as for hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs).

′We have started to include the RV outlook for BEVs in Spain. We have a high forecast for BEVs now despite of the lack of charging infrastructure as the vehicles offered are improving with better range, batteries and warranties. The low volume in the used car market also means prices are not under pressure. It is question of the balance of the offer and demand’ Azofra comments.

Given the reduced supply and thawing of the cold consumer reaction to diesels, we anticipate that the decline in diesel RVs will level out in 2019, with values falling by just 1.5%. Azofra highlights that ′In the used car market, we have noted that over the last two years, the number of fleet diesel sales has declined, meaning there are less used diesels in the market. We expect a further decrease in diesel registrations in the short term but a stabilisation in sales by the end of the year.’

For 2020 and 2021, our latest outlook still calls for a decline in diesel RVs, albeit of just 0.5%, whereas RVs of petrol-powered cars are now forecast to gain by 1.0% in 2019 and 2020 and by 0.5% in 2021.

WLTP will indirectly support used car values

Spain originally intended to use purely WLTP figures for tax calculations from 1 January 2019 but at the end of August 2018, the Government postponed this implementation to 1 January 2021. With tax liabilities on new cars set to increase further, this is expected to fuel demand and, in turn, RVs of used cars in Spain from 2021 onwards.