Swiss used-car registrations back to pre-crisis level, but new car demand still weak

23 August 2021

Robert Madas, regional head of valuations Austria, Poland, Switzerland at Autovista Group analyses how the Swiss automotive market is holding up.

Like elsewhere, the Swiss new-car market has been in crisis as a result of the COVID-19 pandemic. The hope for improvement that sprouted after the opening of the showrooms in summer 2020 was dashed by long delivery times, and, was compounded by the global lack of micro-chips, among other things.

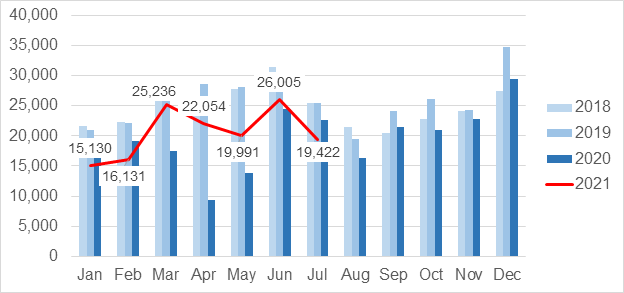

In July 2021, 19,422 new-passenger cars were registered, down by 14.2% compared with the previous year. In total 143,969 new-passenger cars were registered by end of July 2021, resulting in an increase of 14.4% compared with last year, but still -21% behind 2019. Only electric and hybrid vehicles and, with significantly smaller numbers, hydrogen vehicles were able to make significant gains in 2020 and 2021. No significant improvement is in sight for the rest of the year either, and new registration figures are not expected to recover until 2022.

New-car registrations by month 2018-2021

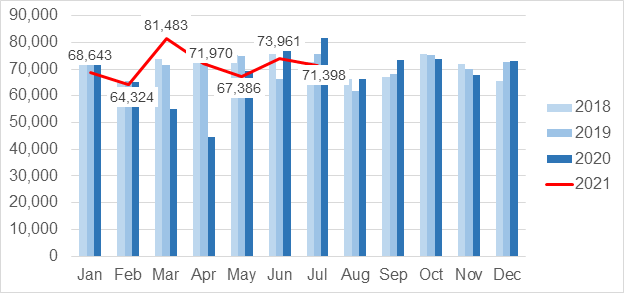

The used-car market, on the other hand, has been at a high since the start of the pandemic and is underpinned by stable demand with low supply. Even in 2020, the number of used-car registrations was 830,634 (-2.1%), only slightly below the previous year’s figure of 848,100. In the first seven months of 2021, the number of used-car registrations increased by 4.8% to a total of 499,165, compared to 476,176 in 2020.

In terms of the used-car market: the volume of active offers on the market is currently 20% lower than it was at the beginning of February 2020 before COVID. Prices for petrol and diesel vehicles have particularly increased due to this shortage, whereas hybrid and electric vehicles have only reacted to it with a delay and to a lesser extent.

Used Car Registrations by Month: 2018 – 2021

With regard to the future development of the used-car market, the supply situation is decisive. As long as the number of new-car registrations is significantly lower than before the crisis, the supply of used vehicles will remain scarce and prices will continue to rise. Residual values are likely to rise further this year, and at the beginning of next year, before stabilising over the course of 2022. Only when new-car markets pick up significantly, and volumes subsequently increase on the used-car market, are RVs likely to come under pressure. This will probably not be before 2023.