May ray of hope for Switzerland’s new-car market but clouds for used cars

14 June 2022

Hans-Peter Annen, head of valuations and insights Switzerland at Eurotax (part of Autovista Group), sees some positivity in the country’s new-car markets, as used-car sales struggle.

May’s figures give a glimmer of hope for Switzerland and Liechtenstein, as they show a slight levelling off of the negative trend in the new-car market. But the war in Ukraine and the COVID-19 lockdown in China are still causing major production problems due to a lack of raw materials and components.

With 18,450 passenger cars registered last month, there were 7.7% fewer new-car registrations than in May 2021, and as much as 34.3% fewer than in 2019. The first five months of the year were also markedly down by 10.4% compared to the previous year (down by 31.4% vs 2019). Despite the end of the lockdown in China, no significant improvement is in sight for the rest of the year due to the ongoing war in Ukraine.

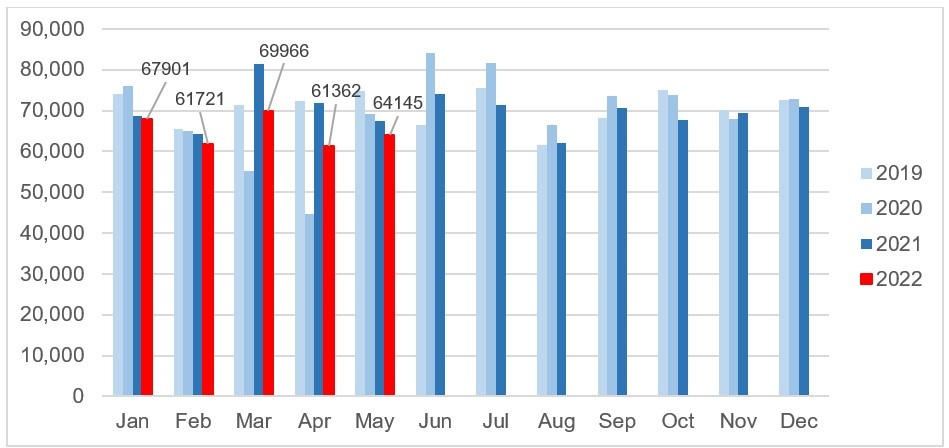

New-car registrations by month: 2019-2022

Used-car market riding high

Switzerland’s used-car market has been at a high since the summer of 2020, driven by strong demand. This is set against supply that has been shrinking for a long time and is now at a stable low level. Last year, the number of used-car transactions was 840,044, 1.1% above the value of 2020 and almost reaching 2019 levels.

This upward trend broke in the first months of 2022, and used-car registrations in May were still 4.8% below the previous year’s figure of 67,386, at 64,145 changes of ownership. The first five months of the year were also down by 8.1% (-9.3% vs 2019). This trend is likely to continue as long as new-car registration figures remain as low as they are.

Although the supply situation has recovered slightly over the past few weeks, the volume of active offers on the market is still around 23% lower than at the beginning of February 2020 before COVID-19. Prices for diesel and petrol vehicles have benefited particularly from this shortage.

Hybrid-electric vehicles and plug-in hybrids have also been able to profit steadily since autumn 2021, but less strongly. However, residual values of all these powertrains have been stagnating recently.

Meanwhile, battery-electric vehicles are showing a positive trend (across all age groups), after a dip in mid-2021 and stagnation until early 2022.

Used-car registrations by month: 2019-2022

With COVID-19 taking a bit of a back seat, with the exception of lockdowns in China, the war in Ukraine and sanctions are exacerbating the difficult supply situation for new cars.

These events continue to have an impact on supply and the price level of second-hand cars. This has improved slightly, and as a result the price increase for used cars is flattening out.

As long as new-car registrations are significantly lower than in the years before 2020, the supply of used vehicles will remain scarce, and prices will remain high. Residual values are therefore likely to remain high for a while and only stabilise or decline when the supply of newly-registered vehicles increases significantly again. Unfortunately, this is not yet to be expected on a large scale in the foreseeable future.