Swiss new-car registrations up in first quarter as transactions recover in March

26 April 2023

Switzerland’s new and used-car markets continue to recover with positive trends in the first quarter of the year. Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of Autovista Group), examines the figures.

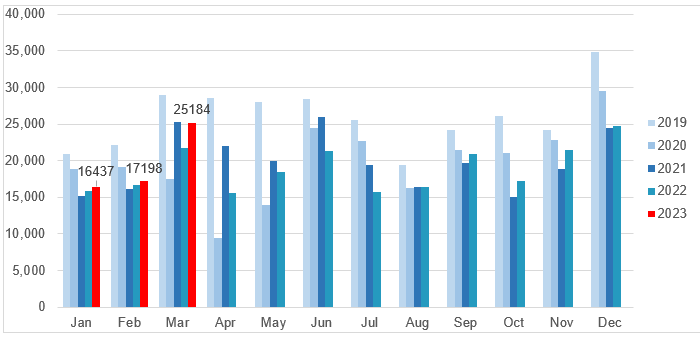

New-car registrations in Switzerland have seen positive developments since autumn 2022, and this trend continued into the first quarter of this year. Figures for the first three months of 2023 are up 8.5% year on year but are still 18.4% down on the same period in 2019.

In March, 25,184 passenger cars were registered, up 15.9% year on year, but still down 13% when compared to the pre-COVID-19-pandemic figures of March 2019. Electrified and all-electric powertrains (mild hybrid-electric vehicles, hybrid-electric vehicles, plug-in hybrids, battery-electric vehicles) captured a 53% market share in the first quarter of this year.

Although there are ongoing challenges within the automotive industry, Eurotax Switzerland expects a further new-car registration recovery in the coming months.

New-car registrations by month, 2019-2023

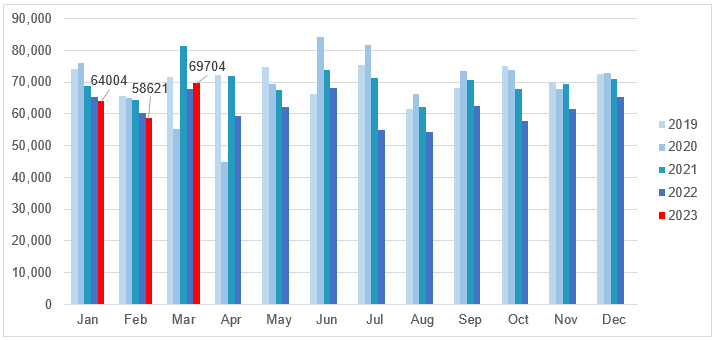

Used-car supplies increase

Characterised by high demand, the used-car market has been booming since the summer of 2020. For a while, this stood in contrast with very low supply, which has since increased markedly. While used-car transactions in 2021 almost returned to pre-COVID-19 levels, they declined again in the first half of 2022*.

This positive trend in ownership changes could continue for the rest of the year, provided that registrations also continue to recover. But new cars not sold between 2020 and 2022 will be permanently missing from the used-car market.

Residual values (RVs) in the second half of 2022 were also below the previous year. However, the number of changes in ownership in March 2023 was around 2.7% above the previous year, which is probably related to the rise in registrations and an increased number of used cars on offer.

Used-car transactions by month, 2019-2023

The number of used cars available in Switzerland is improving and has almost reached levels last seen in February 2020. However, this recovery is dependent on the age group of the vehicles on offer. Supplies of used cars up to two-years-old, for example, are still 17% lower than in February 2020, while supplies in other age ranges are tracking slightly higher.

Supplies are still tight, while demand has remained stable. This means offer prices on the used-car market in Switzerland remain high, but with a declining trend. Vehicles not sold as new cars between 2020 and 2022 are impacting the supply of young-used cars, a situation at odds with current good demand in this market.

While new-car registrations are still lower than before the COVID-19 pandemic impacted the automotive market, prices will slowly move downwards as well. Petrol and diesel vehicle prices have benefitted from this ongoing supply shortage, yet diesel has lost ground again since autumn of last year.

The trend for battery-electric vehicles (BEVs), which showed significant price increases in the first six months of last year, has also come to an end. Among 12-month-old cars, BEVs take first place in RV terms, with an average sale value of 82.6%, just ahead of hybrids.

*Since the beginning of 2022, the Federal Roads Office, ASTRA, has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s evaluations from 2022 onwards. Therefore, the figures for 2022 are based on ASTRA data. The values up to and including 2021 are shown according to the previous method. This must be taken into account when comparing the figures for 2022 with previous years. Comparisons are therefore only possible to a very limited extent, if at all.