TCO advantages of D-segment BEVs highlight absence of key players

23 February 2021

23 February 2021

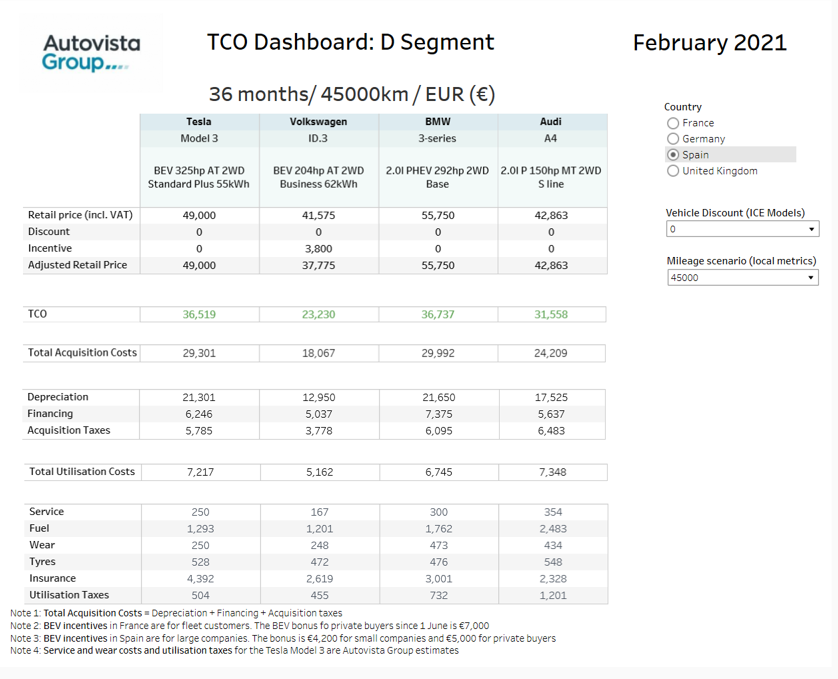

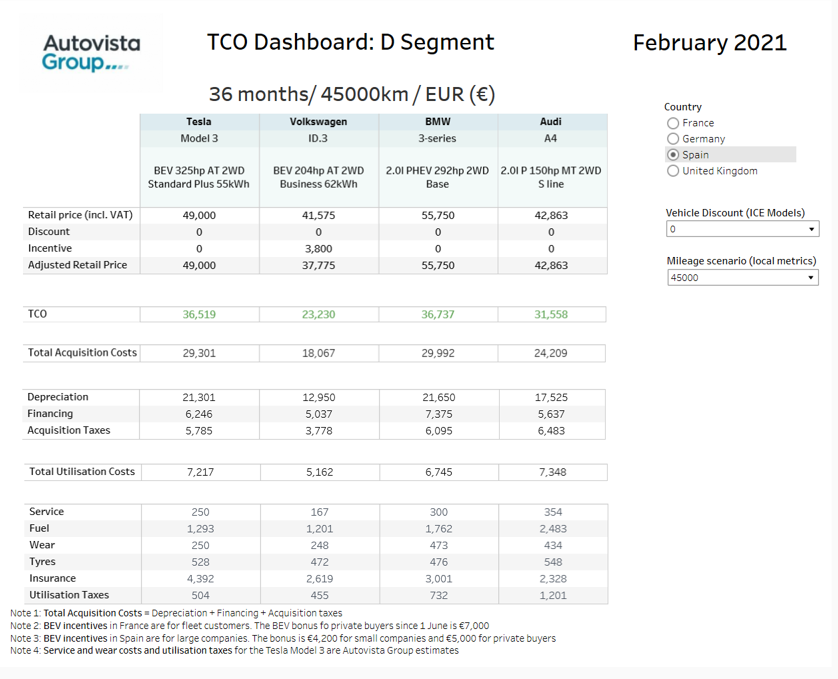

In the latest Autovista Group update on total cost of ownership (TCO), we compare retail prices (including taxes) and TCO of leading D-segment battery-electric vehicles (BEVs), plug-in hybrids (PHEVs) and petrol cars in France, Germany, Spain and the UK. Senior data journalist Neil King discusses the findings.

Autovista Group’s TCO analysis reveals that the rear-wheel drive, long-range variant of the Tesla Model 3 BEV offers a significant TCO advantage, of at least €6,000, over PHEV and petrol rivals in France and Germany. Both countries offer generous purchase incentives. The BEV offers a competitive TCO compared to the BMW 330e PHEV even in countries where subsidies are comparatively low. For example, in the UK (with subsidies of £3,000), and Spain.

There are petrol D-segment alternatives that offer a lower TCO than the Tesla in the UK and Spain. One such option is the 2-litre petrol Audi A4 35TFSI. However, this variant of the A4 is significantly less powerful than the Tesla, with 150 horsepower.

Notable absenteeism

If consumers seek a D-segment BEV alternative to the Tesla, the only option is the Polestar 2, for which complete pricing and TCO data were not available at the time of publication. This highlights the absence of key players in the market. Neither the leading premium brands in Europe – Audi, BMW and Mercedes-Benz – nor popular fleet brands such as Ford, Peugeot, Renault and Opel/Vauxhall offer a D-segment BEV.

This situation will soon change, however, as BMW speeds up its shift to electric production. The German carmaker will roll out the i4 D-segment BEV in its Munich plant later in 2021 and a fully-electric variant of the new 5-Series is also planned for production in Dingolfing. Similarly, recent announcements by Ford and Jaguar point to fully-electric D-segment offerings from the brands in the foreseeable future. In the meantime, the Tesla has ample opportunity to attract D-segment buyers with its attractive TCO.

One BEV alternative to the Model 3 is the Volkswagen (VW) ID.3. Although this is strictly a C-segment model, it offers roominess and power output to compete with D-segment petrol and PHEV models. It has therefore also been included in the dashboard for reference. The ID.3 is eligible for the full incentives in all four markets under review. In Spain for example, this gives the 204-horsepower VW a TCO advantage of more than €8,000 over the 150-horsepower Audi A4 35TFSI in both the 36-month/45,000km and 36-month/60,000km scenarios.

Previous Autovista Group analysis has revealed that the VW ID.3 also offers a TCO and equipment advantage over the Golf VIII in Germany.

Discounts

Pricing data is provided in the local currency for the same four models in each market. The data features retail list prices (including taxes), incentives, discounts, and a final adjusted retail price. The TCO is calculated as the sum of total acquisition and utilisation costs in both the 36-month/45,000km and 36-month/60,000km scenarios. Acquisition costs cover depreciation, financing and acquisition taxes. Total utilisation costs consist of servicing, fuel, wear, tyres, insurance, and utilisation taxes.

These standard TCO results do not factor in discounts that buyers may negotiate on petrol competitors such as the Audi A4. For this reason, TCO calculations are also provided with discounts of 10% and 20% applied to the 2.0-litre, 150-horsepower Audi A4 35TFSI in this analysis.

The Audi, with its lower TCO than the Tesla in Spain and the UK, does however have significantly less power. Furthermore, in France, the A4 would require a discount of at least 12% to compete against the Model 3 in TCO terms. In Germany, the discount would have to be over 20%.

Emissions implications

There is therefore a compelling argument for consumers to switch to D-segment BEVs across Europe. These market forces also explain the sales success of the Tesla Model 3 (and VW ID.3). This will spur carmakers to roll out competitor models in the segment drive down their fleet-average emissions further.

Whereas B-segment and C-segment BEVs offer competitive TCO, albeit only because of incentives, affordable electromobility is even more important for larger cars and SUVs. As governments and carmakers alike seek to reduce pollution levels, higher incentives across Europe, especially in Spain and the UK, would provide a much-needed boost. Lower prices and incentive ceilings would also offer relief from the fallout from the COVID-19 pandemic.

Click here or on the screenshot above to view the pricing and TCO dashboard for the D-segment models under review in France, Germany, Spain and the UK.

Autovista Group has previously published dashboards analysing the TCO of BEV, hybrid and petrol models in the B-segment and C-segment, as well as D-segment SUVs.

Notable absenteeism

If consumers seek a D-segment BEV alternative to the Tesla, the only option is the Polestar 2, for which complete pricing and TCO data were not available at the time of publication. This highlights the absence of key players in the market. Neither the leading premium brands in Europe – Audi, BMW and Mercedes-Benz – nor popular fleet brands such as Ford, Peugeot, Renault and Opel/Vauxhall offer a D-segment BEV.

This situation will soon change, however, as BMW speeds up its shift to electric production. The German carmaker will roll out the i4 D-segment BEV in its Munich plant later in 2021 and a fully-electric variant of the new 5-Series is also planned for production in Dingolfing. Similarly, recent announcements by Ford and Jaguar point to fully-electric D-segment offerings from the brands in the foreseeable future. In the meantime, the Tesla has ample opportunity to attract D-segment buyers with its attractive TCO.

One BEV alternative to the Model 3 is the Volkswagen (VW) ID.3. Although this is strictly a C-segment model, it offers roominess and power output to compete with D-segment petrol and PHEV models. It has therefore also been included in the dashboard for reference. The ID.3 is eligible for the full incentives in all four markets under review. In Spain for example, this gives the 204-horsepower VW a TCO advantage of more than €8,000 over the 150-horsepower Audi A4 35TFSI in both the 36-month/45,000km and 36-month/60,000km scenarios.

Previous Autovista Group analysis has revealed that the VW ID.3 also offers a TCO and equipment advantage over the Golf VIII in Germany.

Discounts

Pricing data is provided in the local currency for the same four models in each market. The data features retail list prices (including taxes), incentives, discounts, and a final adjusted retail price. The TCO is calculated as the sum of total acquisition and utilisation costs in both the 36-month/45,000km and 36-month/60,000km scenarios. Acquisition costs cover depreciation, financing and acquisition taxes. Total utilisation costs consist of servicing, fuel, wear, tyres, insurance, and utilisation taxes.

These standard TCO results do not factor in discounts that buyers may negotiate on petrol competitors such as the Audi A4. For this reason, TCO calculations are also provided with discounts of 10% and 20% applied to the 2.0-litre, 150-horsepower Audi A4 35TFSI in this analysis.

The Audi, with its lower TCO than the Tesla in Spain and the UK, does however have significantly less power. Furthermore, in France, the A4 would require a discount of at least 12% to compete against the Model 3 in TCO terms. In Germany, the discount would have to be over 20%.

Emissions implications

There is therefore a compelling argument for consumers to switch to D-segment BEVs across Europe. These market forces also explain the sales success of the Tesla Model 3 (and VW ID.3). This will spur carmakers to roll out competitor models in the segment drive down their fleet-average emissions further.

Whereas B-segment and C-segment BEVs offer competitive TCO, albeit only because of incentives, affordable electromobility is even more important for larger cars and SUVs. As governments and carmakers alike seek to reduce pollution levels, higher incentives across Europe, especially in Spain and the UK, would provide a much-needed boost. Lower prices and incentive ceilings would also offer relief from the fallout from the COVID-19 pandemic.

Click here or on the screenshot above to view the pricing and TCO dashboard for the D-segment models under review in France, Germany, Spain and the UK.

Autovista Group has previously published dashboards analysing the TCO of BEV, hybrid and petrol models in the B-segment and C-segment, as well as D-segment SUVs.

Notable absenteeism

If consumers seek a D-segment BEV alternative to the Tesla, the only option is the Polestar 2, for which complete pricing and TCO data were not available at the time of publication. This highlights the absence of key players in the market. Neither the leading premium brands in Europe – Audi, BMW and Mercedes-Benz – nor popular fleet brands such as Ford, Peugeot, Renault and Opel/Vauxhall offer a D-segment BEV.

This situation will soon change, however, as BMW speeds up its shift to electric production. The German carmaker will roll out the i4 D-segment BEV in its Munich plant later in 2021 and a fully-electric variant of the new 5-Series is also planned for production in Dingolfing. Similarly, recent announcements by Ford and Jaguar point to fully-electric D-segment offerings from the brands in the foreseeable future. In the meantime, the Tesla has ample opportunity to attract D-segment buyers with its attractive TCO.

One BEV alternative to the Model 3 is the Volkswagen (VW) ID.3. Although this is strictly a C-segment model, it offers roominess and power output to compete with D-segment petrol and PHEV models. It has therefore also been included in the dashboard for reference. The ID.3 is eligible for the full incentives in all four markets under review. In Spain for example, this gives the 204-horsepower VW a TCO advantage of more than €8,000 over the 150-horsepower Audi A4 35TFSI in both the 36-month/45,000km and 36-month/60,000km scenarios.

Previous Autovista Group analysis has revealed that the VW ID.3 also offers a TCO and equipment advantage over the Golf VIII in Germany.

Discounts

Pricing data is provided in the local currency for the same four models in each market. The data features retail list prices (including taxes), incentives, discounts, and a final adjusted retail price. The TCO is calculated as the sum of total acquisition and utilisation costs in both the 36-month/45,000km and 36-month/60,000km scenarios. Acquisition costs cover depreciation, financing and acquisition taxes. Total utilisation costs consist of servicing, fuel, wear, tyres, insurance, and utilisation taxes.

These standard TCO results do not factor in discounts that buyers may negotiate on petrol competitors such as the Audi A4. For this reason, TCO calculations are also provided with discounts of 10% and 20% applied to the 2.0-litre, 150-horsepower Audi A4 35TFSI in this analysis.

The Audi, with its lower TCO than the Tesla in Spain and the UK, does however have significantly less power. Furthermore, in France, the A4 would require a discount of at least 12% to compete against the Model 3 in TCO terms. In Germany, the discount would have to be over 20%.

Emissions implications

There is therefore a compelling argument for consumers to switch to D-segment BEVs across Europe. These market forces also explain the sales success of the Tesla Model 3 (and VW ID.3). This will spur carmakers to roll out competitor models in the segment drive down their fleet-average emissions further.

Whereas B-segment and C-segment BEVs offer competitive TCO, albeit only because of incentives, affordable electromobility is even more important for larger cars and SUVs. As governments and carmakers alike seek to reduce pollution levels, higher incentives across Europe, especially in Spain and the UK, would provide a much-needed boost. Lower prices and incentive ceilings would also offer relief from the fallout from the COVID-19 pandemic.

Click here or on the screenshot above to view the pricing and TCO dashboard for the D-segment models under review in France, Germany, Spain and the UK.

Autovista Group has previously published dashboards analysing the TCO of BEV, hybrid and petrol models in the B-segment and C-segment, as well as D-segment SUVs.

Notable absenteeism

If consumers seek a D-segment BEV alternative to the Tesla, the only option is the Polestar 2, for which complete pricing and TCO data were not available at the time of publication. This highlights the absence of key players in the market. Neither the leading premium brands in Europe – Audi, BMW and Mercedes-Benz – nor popular fleet brands such as Ford, Peugeot, Renault and Opel/Vauxhall offer a D-segment BEV.

This situation will soon change, however, as BMW speeds up its shift to electric production. The German carmaker will roll out the i4 D-segment BEV in its Munich plant later in 2021 and a fully-electric variant of the new 5-Series is also planned for production in Dingolfing. Similarly, recent announcements by Ford and Jaguar point to fully-electric D-segment offerings from the brands in the foreseeable future. In the meantime, the Tesla has ample opportunity to attract D-segment buyers with its attractive TCO.

One BEV alternative to the Model 3 is the Volkswagen (VW) ID.3. Although this is strictly a C-segment model, it offers roominess and power output to compete with D-segment petrol and PHEV models. It has therefore also been included in the dashboard for reference. The ID.3 is eligible for the full incentives in all four markets under review. In Spain for example, this gives the 204-horsepower VW a TCO advantage of more than €8,000 over the 150-horsepower Audi A4 35TFSI in both the 36-month/45,000km and 36-month/60,000km scenarios.

Previous Autovista Group analysis has revealed that the VW ID.3 also offers a TCO and equipment advantage over the Golf VIII in Germany.

Discounts

Pricing data is provided in the local currency for the same four models in each market. The data features retail list prices (including taxes), incentives, discounts, and a final adjusted retail price. The TCO is calculated as the sum of total acquisition and utilisation costs in both the 36-month/45,000km and 36-month/60,000km scenarios. Acquisition costs cover depreciation, financing and acquisition taxes. Total utilisation costs consist of servicing, fuel, wear, tyres, insurance, and utilisation taxes.

These standard TCO results do not factor in discounts that buyers may negotiate on petrol competitors such as the Audi A4. For this reason, TCO calculations are also provided with discounts of 10% and 20% applied to the 2.0-litre, 150-horsepower Audi A4 35TFSI in this analysis.

The Audi, with its lower TCO than the Tesla in Spain and the UK, does however have significantly less power. Furthermore, in France, the A4 would require a discount of at least 12% to compete against the Model 3 in TCO terms. In Germany, the discount would have to be over 20%.

Emissions implications

There is therefore a compelling argument for consumers to switch to D-segment BEVs across Europe. These market forces also explain the sales success of the Tesla Model 3 (and VW ID.3). This will spur carmakers to roll out competitor models in the segment drive down their fleet-average emissions further.

Whereas B-segment and C-segment BEVs offer competitive TCO, albeit only because of incentives, affordable electromobility is even more important for larger cars and SUVs. As governments and carmakers alike seek to reduce pollution levels, higher incentives across Europe, especially in Spain and the UK, would provide a much-needed boost. Lower prices and incentive ceilings would also offer relief from the fallout from the COVID-19 pandemic.

Click here or on the screenshot above to view the pricing and TCO dashboard for the D-segment models under review in France, Germany, Spain and the UK.

Autovista Group has previously published dashboards analysing the TCO of BEV, hybrid and petrol models in the B-segment and C-segment, as well as D-segment SUVs.