The global challenge to China’s EV battery dominance

19 April 2023

Carmakers are rushing to secure adequate supplies of raw materials to build electric-vehicle (EV) batteries. China has long been a major player in this market, accounting for 75% of global battery-cell manufacturing capacity, according to BloombergNEF.

But efforts are being made to lessen this dependence. Other countries, such as Indonesia, show promising potential to move up the ranks when it comes to battery production and raw-material supply.

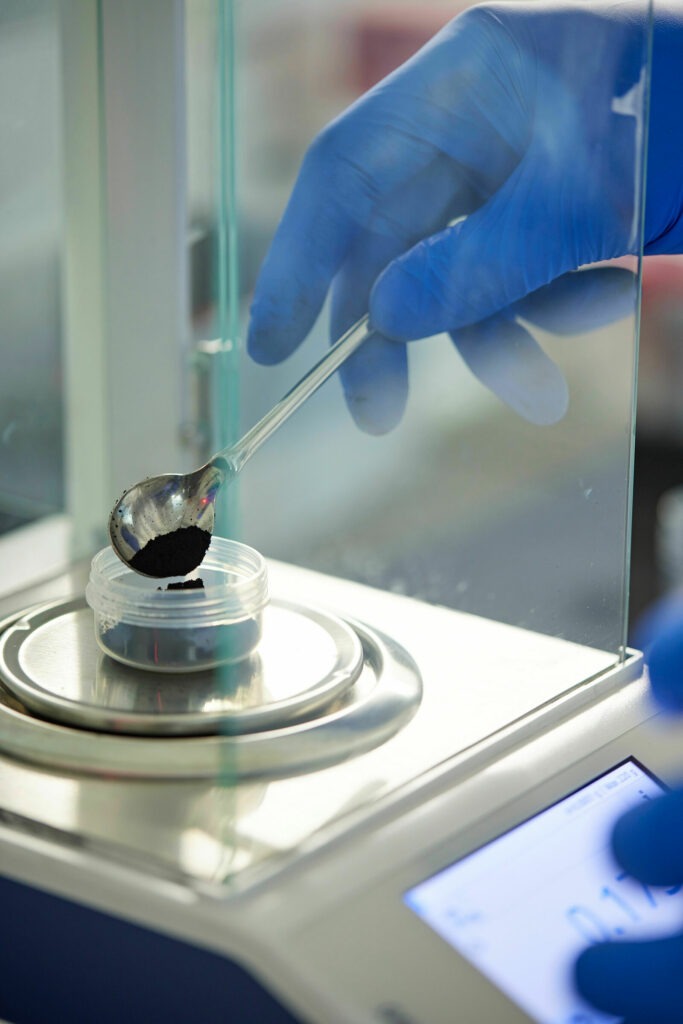

Indonesia is the world’s largest nickel producer, responsible for 37% of global mined production. It is also among the largest automotive markets in the region and of growing interest to international carmakers.

Ford, alongside its partners, is planning to invest in a nickel-processing plant in the Southeast Asian country to help make EV batteries more affordable. Meanwhile, Volkswagen (VW) Group plans to establish a battery ecosystem in Indonesia, the country’s investment minister Bahlil Lahadalia announced.

While details still seem to be under wraps, the minister revealed that VW is aiming to work with various companies, including Ford and mining giant Vale. The focus looks to lie on the supply of raw materials and building joint ventures.

In a statement to Autovsita24, VW Group confirmed that its battery company PowerCo is holding talks worldwide on securing critical raw materials.

‘Indonesia is an important and interesting country in terms of raw materials. We are in good contact with the government and suppliers. The talks are currently being deepened and we will inform about the results in due course,’ a VW spokesperson said.

EU battery supply

While China’s grip on global EV battery supply chains remains tight, the EU is eager to make Europe less reliant on imported raw materials by diversifying domestic supply. More than 90% of EU supply often comes from a single third country, with China remaining a major player.

Green NGO Transport & Environment (T&E) recently highlighted that the EU could end its reliance on China for lithium-ion battery cells by 2027. It claimed the region is on track to produce enough battery cells by then to meet domestic demand for EVs.

In April, Renault announced a partnership with French startup Verkor to produce batteries for its premium and Alpine EV models. The high-performance batteries, dubbed as low-carbon, will be produced at Verkor’s planned gigafactory in Northern France.

The French carmaker said the deal underlines its ambitions to develop a robust electrical ecosystem of vehicle, engine, and battery factories in France. In other parts of Europe, several cathode production projects are also in the works.

Suppliers such as Umicore and BASF are aiming to set up projects in Poland and Germany. Swedish battery producer Northvolt is one of the European companies hoping to challenge its Chinese counterparts.

The startup, backed by major carmakers such as BMW and VW, is said to be in talks to secure around $5 billion (€4.5 billion) in funding as it aims to become Europe’s biggest battery manufacturer. While no agreement has been announced yet, the deal could give production in Europe a major boost.

Northvolt’s main mission is to establish a European supply of ‘green’ batteries with an 80% lower carbon footprint compared to those made with coal energy. The company also wants half of its raw material requirements to be sourced from recycled batteries by 2030 – plans that fit well into Europe’s green technology aspirations.

While the EU has responded to the US Inflation Reduction Act (IRA) – a set of incentives and benefits aimed at making the country more competitive and productive – there are still concerns that planned European projects could be lured across the Atlantic. Northvolt had previously said it was reconsidering its German gigafactory project although no decision has been made yet.

‘Europe needs to put more money on the table or risk losing planned battery factories and jobs to America,’ said Julia Poliscanova, senior director for vehicles and e-mobility at T&E.

Across the pond

Like Europe, the US is keen on diversifying and localising battery supply chains to lessen its dependence on imports, as it attempts to switch half its vehicle sales to EVs by 2030. The country recently signed a critical minerals agreement with Japan to promote the adoption of EV battery technologies. The minerals include lithium, nickel, cobalt, graphite, and manganese.

The US administration is currently in talks with Europe too. This could help ease trade frictions following the IRA’s announcement and news that certain EV models from BMW, VW, Volvo, and Rivian will lose access to US tax credits.

Building battery capacity

Projections laid out by the US Department of Energy show that a wave of new plants will increase North America’s battery manufacturing capacity from 55GWh a year in 2021 to nearly 1,000GWh a year by 2030.

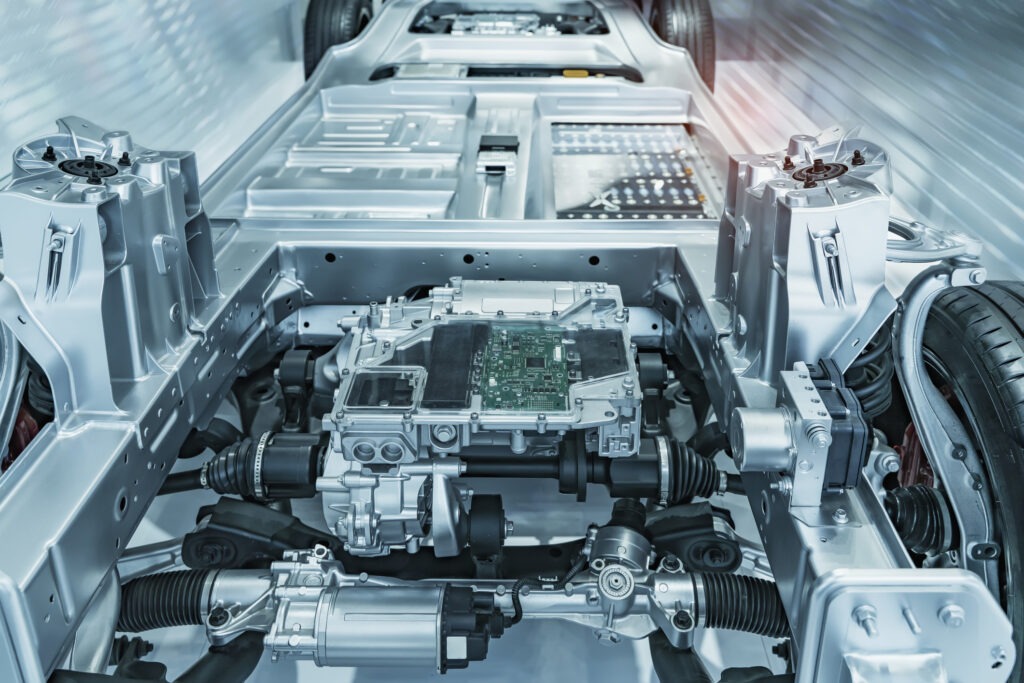

Kentucky, Tennessee, Georgia, and Michigan will see the highest growth in battery manufacturing capacity. Ford plans to build a $3.5 billion EV battery factory in Michigan. But the manufacturer will still rely on Chinese technology from CATL, which has 13 plants in Europe and Asia. This could be a sign that moving away from made-in-China batteries might not be as easy as it sounds.

In neighbouring Canada, Ford is also eager to create an EV hub that will include vehicle and battery pack assembly. Canada itself remains a vital location for battery manufacturing, given the country’s rich resources and wide access to clean energy.

VW’s PowerCo unit plans to build its first overseas gigafactory in Canada. The site will produce sustainable unified cells, with the start of production planned for 2027. The carmaker is eager to turn PowerCo into a global battery player.

In a Reuters interview, VW board member Thomas Schmall said the company wants to meet half its battery demand with plants in Europe and North America. Seizing greater control of the battery value chain remains a core agenda point for carmakers, with Schmall indicating that VW is planning to directly invest in mines in the future.

While Chinese firms still dominate major parts of the battery supply chain, other manufacturers are eager to set up battery plants and improve access to raw materials. A focus on new and sustainable technologies could help these companies, but it is likely to be an uphill task.