Three-speed RVs: UK and France benefit from pent-up demand post-lockdown

11 September 2020

11 September 2020

Following the emergence of Europe’s automotive sector from coronavirus (COVID-19) lockdowns, a ′three-speed’ development of residual values (RVs) has prevailed across the region. Senior data journalist Neil King explores the region’s variations.

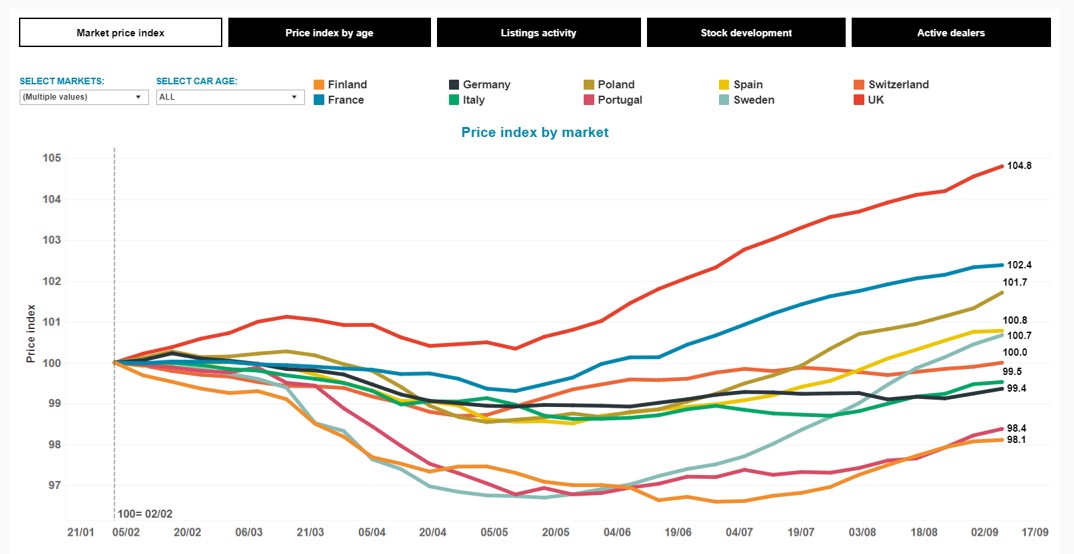

The UK and France have enjoyed a rally, driven by pent-up demand in the initial post-lockdown period. Autovista Group’s COVID-19 tracker, which tracks 12 European markets, shows that the index of RVs, compared to early February, has risen since mid-May and peaked at 104.8 (a 4.8% rise) in the UK and 102.4 (a 2.4% rise) in France in the week to 6 September. The start month was February, with a value of 100.

The UK is enjoying the release of pent-up demand, both from the lockdown and the uncertainty running up to the country’s departure from the European Union on 31 January. It also faces a starker vehicle-supply challenge than any other market, which is filtering through to higher RVs as used-car demand outstrips supply. ′Stock of both new and used cars is the biggest issue in the UK. This is driving up used prices and we do not see the bubble bursting quite yet. It’s September and even convertible demand is still high, with values increasing,’ commented Anthony Machin, head of content and product at Glass’s.

French Revolution

France benefitted from pent-up demand and a new incentive scheme that came into effect on 1 June. The €8 billion package includes a €7,000 grant for private buyers of new battery-electric vehicles (BEVs) costing less than €45,000 (€5,000 for fleet buyers), while buyers of new plug-in hybrids (PHEVs) can claim a €2,000 subsidy.

Additionally, France doubled its premiums for those looking to trade in older vehicles for a cleaner model, with a €3,000 grant for vehicles with internal combustion engines (ICE) and €5,000 for BEVs and PHEVs. Crucially, the enhanced trade-in bonus also applies to used cars and hence the notable rise in RVs. However, the scheme reached its 200,000-vehicle cap before the end of July and the Ministry of Ecological Transition announced the replacement of the recovery scheme with a conversion bonus, applicable from 3 August.

′In France, OEM plants restarted late and slowly, creating a lack of new-car stock in July and even more in August. Moreover, as people have defected from the new-car market to the used-car market, increasing demand, the low stock of used cars explains the ongoing increase in residual values. This is especially true in the A- and B-segments, where the conversion bonus is working really well, but this is not the case for all fuel types and segments,’ commented Yoann Taitz, operations director of Autovista Group in France.

Used-car transactions surged; 595,942 used cars changed ownership in France in June, 29.1% more than in June 2019, according to data published by the French carmakers’ association CCFA. This was followed by year-on-year growth of 13.3% in July and 16.8% in August. Nevertheless, there were still 9.2% fewer used-car transactions in the first eight months of 2020 than in the same period in 2019.

Autovista Group anticipates a slowdown in the RV development in France and our latest RV outlook calls for prices of used cars to be 0.3% lower in France at the end of 2020 than when the COVID-19 crisis erupted in Europe, in March. In the forthcoming September update of Autovista Group’s whitepaper, How will COVID-19 shape used car markets?, we will reveal which market is forecast to be the most resilient among the 18 European countries covered.

Source: Autovista Group, Residual Value Intelligence, COVID-19 tracker

Rapid-reaction markets

Sweden, Finland and Portugal all had rapid negative reactions to COVID-19. Dramatic lockdown measures were not introduced in Sweden and Finland, but RVs fell from early February to mid-May in both markets.

However, RVs have climbed in Sweden since mid-June and recorded 100.7 on the index in the week to 6 September, i.e. 0.7% higher than in early February. ′The used-car market has recovered fine as stocks are decreasing and sales volumes and values are rising,’ said Johan Trus, chief editor of Autovista Group in Sweden. ′People were not allowed to travel to other countries, so the summer vacation has been spent in the country, and then people needed a car to travel. In addition, car exports have picked up.’

In Finland, the index of RVs fell from early February to only 97 in mid-June and has remained at the lowest level in Europe since. ′Finland is still running on low numbers, and we don’t see the same quick recovery as in Sweden. The import of young used Swedish cars has picked up again too, in combination with lower used-car values than normal, already before the crisis started,’ Trus commented.

Portugal also endured falling RVs since the tracker index started in February but a more pronounced downturn commenced at the end of March. As in Finland, the price index is only showing a modest increase and has not recovered to pre-coronavirus levels.

′Used-car sales continue to recover quicker than new-car sales. In July, used-car sales grew 25% year-on-year whereas new-car sales fell 16.9%, although this was a significant improvement on June, when the drop was 56.2%. There was just a small 0.1% decline in new-car sales in August but the drop was 8.6% including light commercial vehicles,’ said Joao Areal, editorial manager of Autovista Group in Portugal.

′In the next months, we will understand if the demand for used cars continues to grow or if this was due to pent-up demand built during the lockdown. The car market represented more than half of consumer credit in July but of this amount, 85% was for used cars. Although we can see a recovery in the car market, we are still far from pre-COVID-19 values,’ added Areal.

Late starters

The rest of Europe’s tracked markets remain ′late starters’, where several effects are balancing each other out.

The first reason for the ongoing stability in many markets is that they have essentially remained ′on hold.’ In Italy for example, ′the market has been waiting for a better understanding of the full impact of the economic crisis, especially considering that many experts are convinced that we could face a second wave and a new lockdown in autumn,’ explained Marco Pasquetti, forecast and data specialist of Autovista Group in Italy.

RVs fell again in Italy from late June to late July. This is partly because of the incentives to support the country’s automotive industry, which came into effect on 1 August. ′There is also the Ecobonus incentive scheme, but the amount allocated is insufficient in our opinion (so far). We think that we’ll see an impact on values starting from September,’ Pasquetti added.

The significant disruption to new-car supply and registrations is also impacting RVs in ′late-starter’ markets.

In Germany for example, used-car transactions were just 6% lower in the first eight months of the year than in the same period in 2019, according to the KBA. They have even performed better than last year for two consecutive months. New-car registrations have been far more affected, however, and are still 29% lower in the year-to-date than in 2019.

′The lack of new-car supply still boosts young used-car sales but dealers seem to be unnecessarily discounting them even more than before the crisis – probably in favour of a quicker turnaround of stock. After a proper autumn, we expect stronger price competition at dealers in the last two months of the year as they compensate for the loss in new-car sales with higher used-car turnover,’ commented Andreas GeilenbrÃœgge, head of valuations and insights at Schwacke.

The situation is a bit more optimistic than before in Spain, but the country faces the same challenge. ′The automotive sector is resisting the crisis better than expected, helped by the measures to boost the sector that the government put in place. The production stoppages have also reduced pressure on used-car stock and the average number of stock days is much longer now. However, there are fewer new used cars coming into the dealers and I think the MOVES and RENOVE plans and/or the high discounts for new cars and young used cars will end up affecting transaction prices in the coming months,’ said Ana Azofra, valuation and insights manager at Autovista Group in Spain.

Switzerland saw the same dramatic decline in new-car sales volumes as elsewhere. ′So, nearly new cars, aged 0-6 months, served to fill the gap left by missing new cars and increased their values temporarily. However, used cars aged 0-6 months, as well as those aged seven to 17 months, are losing ground again as new-car sales slowly regain some of the terrain lost during the lockdown,’ commented Hans-Peter Annen, head of editorial for Autovista Group in Switzerland.

′Now manufacturers have resumed production and all the individual new-car incentives are back, this will most likely increase the used-car stock volume and the pressure on RVs,’ Annen added.

Meanwhile, there has been continued positive development of RVs in Poland.

′I can observe continuous good demand for young used vehicles. They are a lower financial risk for buyers in the volatile market situation. Besides, list prices are growing very fast. That’s probably due to expected penalties for CO2 targets and the introduction of WLTP and the new Euro 6d norm, with more complicated engines (mild-hybrids),’ commented Marcin Kardas, head of the Autovista Group editorial team in Poland.

′On the one hand, the financial contracts between companies and fleet suppliers are extended, which will cause a lack of the youngest used cars on the market. But a lot of people still work from home so don’t need a car and the economy remains unstable. In this environment, it is really hard to predict the direction of RVs. Growing list prices will decrease them but strong demand for used cars will positively influence them. To recognise the real post-COVID effect, we should wait a bit longer but I don’t expect significant changes in the coming months,’ concluded Kardas.