UK car manufacturing grows in August due to shutdown discrepancy

26 September 2019

UK car manufacturing grows in August due to shutdown discrepancy

26 September 2019

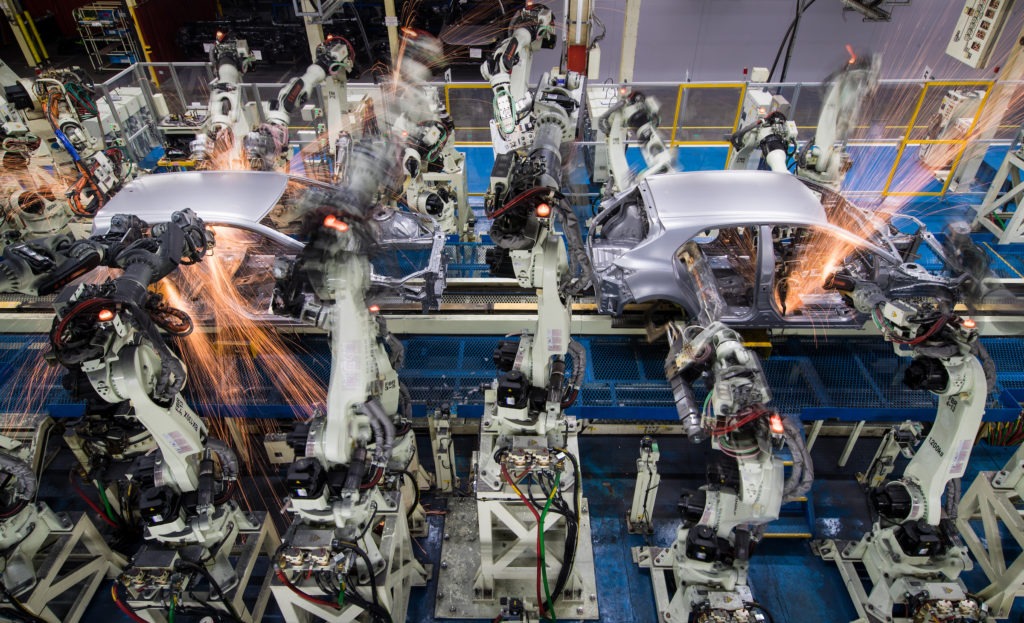

UK car production rose 3.3% year-on-year in August as the industry started to catch up with itself after a number of closures were initiated earlier in the year.

The country saw its first rise in production in 15 months. However, it was due mainly to a number of plants remaining open during a month that traditionally sees shutdowns for maintenance purposes. Several plants brought forward these plans to April ahead of the UK's original Brexit deadline at the end of March.

Making up

At 92,158, just 2,903 more cars were produced in August 2019 than in the same month last year. This was not enough to compensate for April's 56,999-unit loss, a prediction SMMT chief executive Mike Hawes made to Autovista Group in June, resulting in a 17% (or 177,961-unit) deficit in the year-to-date. SMMT figures show that 866,918 cars were produced in the first eight months of the year – the first time output has dipped below one million units in the period since 2014, and the biggest year-on-year decline since 2011.

In August, production for the domestic market was up 15.2% year-on-year following a significant fall in the same month in 2018 when several factors, notably preparation for the new EU-wide WLTP testing regulations, affected volumes. Exports, meanwhile, registered a marginal 0.6% growth. This disguises ongoing weakness in major global markets with production for China down two-fifths (43.8%), exports to the US falling 9.1% and those to the EU dropping 13.7% in the first eight months. However, exports still account for eight out of every 10 cars built in Britain – with the EU taking more than half (55.4%).

Brexit worries

The news comes in the same week that industry representatives from 17 of the EU's biggest car producing and buying countries joined forces in united opposition to a ′no deal' Brexit. Countries including Germany, Italy, France, Belgium, Spain and Turkey (with which the UK enjoys beneficial trading terms through its membership of the EU) warned the repercussions of a hard Brexit would be severe, with tariffs threatening consumer choice and affordability on both sides of the Channel. The bloc also flagged that the end of barrier-free trade would bring disruption to the industry's efficient just-in-time operating model. In the UK alone, just one minute of production stoppage caused by border delays would amount to £50,000 (€54,700) of lost value add, or £70 million (€79 million) a day, ACEA has claimed.

′While growth is always welcome, today's figures mask the underlying downward trend and strengthening global headwinds facing the sector, including international trade tensions, massive technological upheaval and, in the UK, political and economic uncertainty,' stated Hawes.

′Softening of global demand is compounding the challenge to UK manufacturers for whom a no-deal Brexit would be a hammer blow. The mere threat of no deal has undermined investment, and the potential imposition of tariffs, border delays and additional administrative burdens would damage competitiveness. We now need parliament and government to redouble efforts to get a deal that maintains free and frictionless trade. Given the ongoing challenges and costs being incurred, there is not a moment to lose,' Hawes added.