UK LCV market buoyant in August but supply shortages persist

14 September 2021

Andy Picton, chief commercial vehicle editor at Glass’s (part of Autovista Group), considers the developments of the new and used light-commercial vehicle (LCV) markets in the UK in August.

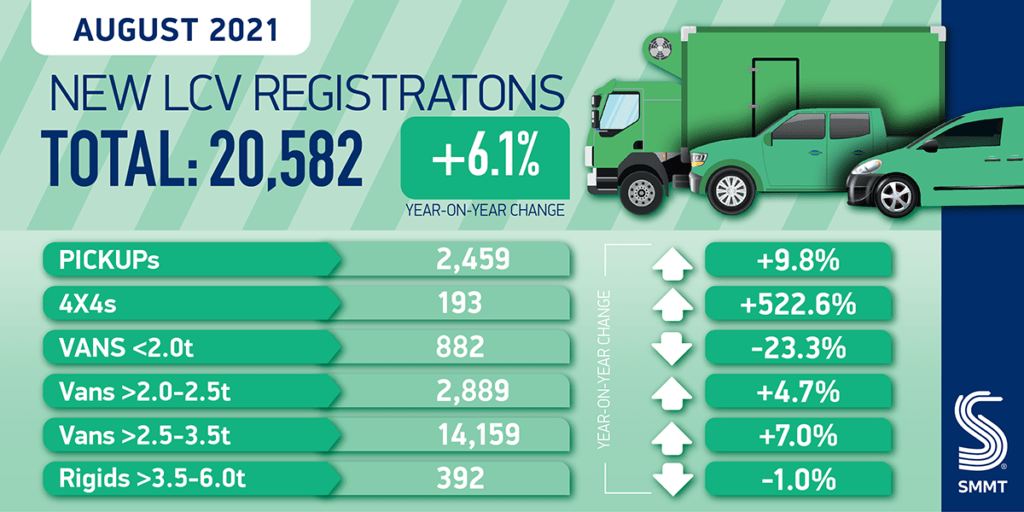

The UK LCV market returned its second-best August on record, with 20,582 new vehicles hitting the road, according to the Society of Motor Manufacturers and Traders (SMMT). This was 1,175 units more (+6.1%) than in COVID-19-impacted August 2020. In the year-to-date, LCV registrations, totalling 235,701 units, were 2.6% up on the pre-pandemic five-year average for January to August 2015-2019. This is 51.1% higher than at the same point last year.

This year has seen semiconductor and raw-material shortages affect commercial-vehicle (CV) manufacturing in both the UK and abroad. New van registrations have been buoyed by strong demand and a recovering economy, but CV manufacturing is currently down 21.3% on the pre-pandemic average with current supply-chain challenges expected to have an impact well into next year.

In August, all sectors except for vans under 2.0 tonnes GVW recorded a year-on-year increase in demand. The pickup sector was up 9.8%, vans in the 2.5-3.5 tonne sector – which made up 68.8% of all vans registered in August – increased by 7%, whilst vans between 2.0 tonnes and 2.5 tonnes increased 4.7%. Demand for vans under 2.0 tonnes declined 23.3%.

August was another strong month for both Ford and Stellantis, with both seeing four of their product ranges finish in the top ten registrations for August. However, Ford secured the top three positions with the Transit Custom, its big brother the Transit, and the Ranger pickup. The Transit Connect was sixth.

Top five LCV registrations

| Model | YTD 2021 | Model | Aug 2021 | Model | Aug 2020 |

| Ford Transit Custom | 34,137 | Ford Transit Custom | 3,592 | Mercedes-Benz Sprinter | 3,471 |

| Ford Transit | 21,563 | Ford Transit | 2,161 | Ford Transit Custom | 2,181 |

| Volkswagen Transporter | 16,018 | Ford Ranger | 1,776 | Ford Transit | 1,211 |

| Mercedes-Benz Sprinter | 14,719 | Mercedes-Benz Sprinter | 1,654 | Volkswagen Transporter | 1,090 |

| Ford Ranger | 13,115 | Volkswagen Transporter | 1,488 | Peugeot Partner | 934 |

Although new registrations in the LCV market look strong at present, there is still a high level of caution as the effects of the pandemic continue to distress the automotive industry. Many manufacturers have highlighted delays and shortages for Q4 and have already started to prioritise production. With COVID-19 restrictions and ongoing supply-chain shortages continuing to affect manufacturing, delivery of many vehicles has already been pushed back well into 2022, with the industry unsure as to when production will return to normal.

Low stocks drive high used prices

With average auction prices now exceeding £10,000 (€11,700), this is a sure-fire reminder that there are big supply shortages in the used LCV market and huge demand for retail-ready vehicles. Euro 6 stock accounted for nearly 64% of all vehicles sold during August, but only 10.4% of those vehicles under two years old.

Although demand is healthy for new vehicles, production and raw-material issues, resulting in extended lead-in times, remain a major concern. This has seen many de-fleets delayed and current vehicles are running for longer, with replacements not available until Q2 2022.

Volumes of new stock entering the used market will remain low for the rest of the year, with expectations that shortages will persist well into 2022. As a result, used prices look set to remain high not only for the remainder of the year, but well into H1 2022.

Auction sales lowest since December 2020

Glass’s auction data shows the overall number of vehicle sales in August decreased by a further 11.9% compared to July, and now stand at their lowest level since December last year. This number was also 4.5% lower than twelve months ago and is a reflection of the shortage of stock currently available in the used marketplace.

Average sales prices paid increased by 1.1% versus July and stand 24.8% higher than at the same point last year. In over 38,000 used vehicles observed for sale in the wholesale market, 49% were on sale for in excess of £20,000, 16% were on sale for less than £10,000 and 4% for less than £5,000.

The average age of vehicles sold increased slightly from 73.3 months in July to 73.9 months in August, and the average mileage increased from 75,917 miles to 77,249. The latest average mileage is 3,615 miles higher (+4.7%) than in August 2020. Medium-sized vans were again the most popular at auction last month, accounting for 38.6% of all sales, whilst the highest proportion of all LCVs sold (36.2%) were more than six years old.

Glass’s continues to monitor the LCV market closely and has an open dialogue with auction houses, manufacturers, leasing and rental companies, independent traders and dealers as well as the main industry bodies. This information, combined with the wealth of knowledge in our CV team, ensures Glass’s valuations remain relevant in the marketplace.