UK needs financial and charging support to build public confidence in EV market

19 September 2023

As the UK automotive industry continues its transition to electric vehicles (EVs), it needs support to ensure public confidence does not stall. Phil Curry, Autovista24 special content editor, attended SMMT Electrified 2023 to find out what can be done to build the sector.

Consumer confidence in EVs needs to improve, as the market shifts from early adopters to the mass market. At the same time, further investment is needed in charging solutions, to ensure all drivers have access to public plug-in points. This will reduce charging anxiety and make the technology more attractive, especially to those without access to domestic infrastructure.

At the recent SMMT Electrified conference, hosted by the Society of Motor Manufacturers and Traders (SMMT), the consensus was that EV technology is no longer an ‘alternative’ fuel, with registration rates rising month on month. However, this increase is being driven primarily by businesses and fleets, which are buying battery-electric vehicles (BEVs) to improve their environmental credentials.

‘Individual consumers now only account for a quarter of sales,’ SMMT chief executive Mike Hawes told the press, including Autovista24. ‘This has come down from a third, as the EV market is now emerging from the early-adopter phase. To move it to mass market, we need something more for individual consumers support, not just the manufacturers to invest, but for the consumers to purchase. We know we must help consumers make that transition more quickly.’

Incentives would help drive sales

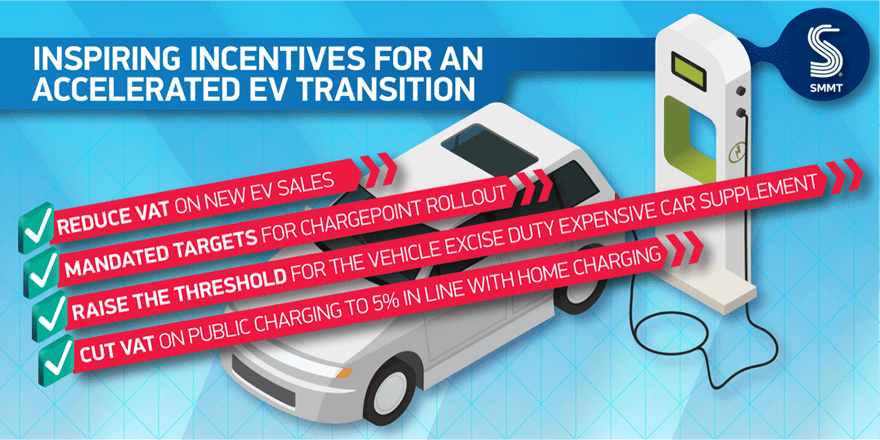

A survey, conducted by Savanta on behalf of the SMMT, showed that 68% of non-EV drivers said they want to make the switch, but just 2% plan to invest this year and 17% in 2024. More than half said they will not be ready until 2026 or later. Getting consumers to buy sooner depends on financial incentives, according to 68% of respondents. Access to affordable, reliable public charging, was important to 67% of respondents.

‘We believe every option needs to be considered for targeted fiscal support to deliver a national benefit,’ added Hawes. ‘To start with, take VAT off the bonnet. There also needs to be a plan to match VAT on public charging to domestic charging. Electric vehicles, like solar panels and heat pumps, are net-zero products and should have similar benefits.

‘There should also be no hesitation to recalculate or even exempt EVs from vehicle excise duty [expected to be levied in 2025]. When decarbonisation is a vital necessity, treating EVs as a luxury item is not the answer.’

The need for some form of financial incentive was echoed by Alex Smith, managing director at Volkswagen UK. ‘Deliveries to private consumers are pretty much flatlining at the moment, and why is that?’ he questioned.

‘We have seen the progressive withdrawal of incentivisation to private consumers and we have seen a very healthy, very supportive level of incentivisation to company car drivers. So there needs to be some kind of levelling up if we are going to start to re-accelerate this transition.’

The affordability factor

Discussions during SMMT Electrified turned to the overall issue of EV affordability. Purchasing an EV is a different experience from buying a traditional petrol or diesel vehicle, with much more research required into the overall cost. While a BEV is more expensive at the initial point of purchase, the total cost of ownership (TCO) is something that needs to be considered.

‘I think there is a perception that electric vehicles are inherently expensive or prohibitively expensive,’ Smith continued. ‘I think it is a more complicated scenario to explain than we have had to explain in the past, because in the past there was a retail price of the vehicle and that is more or less all we really need to consider.

‘But taking into account the cost of charging, if you charge at home, it is going to cost you a certain amount. If you charge on the road at a certain speed, it is going to cost another amount. If you use an ultra-rapid charger on the road, it is going to cost you another amount. So, the predictability of how much a vehicle will cost to use is actually quite difficult to discern at the moment.’

Smith highlighted an example of the company’s ID.3 BEV against the current VW Golf diesel. The ID.3 is around £4,000 more expensive than its counterpart, but if the purchaser can take advantage of domestic charging rather than filling up with diesel, plus the reduced servicing costs associated with a BEV over the first three years of its life, then the electric model starts to level out compared to its combustion-engine equivalent.

‘The majority of private consumers will buy a vehicle on a finance contract, where the residual value risk is taken by someone else,’ he added. With this taken by a bank or captive finance company, then the affordability of a BEV is actually very compelling, and the issue of electric cars being really expensive becomes a myth.’

But is the automotive industry doing enough to promote this financial equality? ‘Consumers need to understand how much owning a vehicle is going to cost them,’ stated Lynn Calder, CEO of Ineos Automotive. ‘Are they going to be able to afford a vehicle? They need to be given the comfort that the automotive industry is there to support them in the future. And I think that we are struggling on that right now.’

‘OEMs can go so far in terms of the marketing material we produce, in terms of the calculators that we have got on our websites and so on,’ Smith said. ‘But it needs more reinforcement, it needs common standards, it needs great communication. Also, incentivisation has a role to play in signalling the direction that we all want to go in. And the direction that we want to go in, obviously, is decarbonisation road transport.’

Industry needs clarity

The UK’s EV market is awaiting confirmation on major pieces of legislation that could change the sector and impact its ability to compete with internal-combustion engines.

The first is the introduction of new Rules of Origin targets which, if not met, have the potential to add tariffs to the import of new models into the UK or the EU. The 10% additional cost at the border could be added to the vehicle list price.

Hawes stated that there is currently no plan to extend the deadline for the next target increase, which is due to begin on 1 January 2024. The industry has struggled to adapt its supply chains – especially for batteries which make up the biggest portion of an EV’s manufacturing value – to ensure they meet localisation requirements under Rules of Origin. The COVID-19 pandemic and following supply-chain crisis are mostly responsible for this.

Although both UK and EU-based automotive manufacturers and authorities would welcome targets being shifted, with an ideal deadline extension of three years, there is confusion about whether this will happen. Hawes suggested it may be Christmas before a conclusion is reached, and that carmakers are already planning for the next Rules of Origin step to be introduced as planned.

There is also the issue of the zero-emission vehicle (ZEV) mandate. The regulation looks to set targets for the number of zero-emission vehicles manufacturers must sell. Next year currently has a proposed target of 22%, which will increase to 100% in 2035 when the UK will ban the sale of any new vehicle with a combustion-engine element. However, with around 100 days until this comes into force, there is still no sign of the final legislative document.

‘We need a solution to the threats of damaging Rules of Origin tariffs on the very vehicles we need consumers to buy, like the need to maintain free and fair trade collaboration across borders, and especially clarity on what precisely the ZEV Mandate will mean for our transition. Until we see the regulations, we cannot plan, and therefore we cannot deliver,’ added Hawes.

‘We still do not even know what vehicles can be sold from 2030. Uncertainty creates doubt, and doubt stokes negativity, and we have read a lot of negativities fairly recently, with calls for the government to drop [the 2030 ban on sales of new petrol and diesel vehicles] and to U-turn on the mandate to ditch net zero,’ he said.

It does seem, however, that the ZEV Mandate will be available in the near future. During his keynote speech, Mark Harper MP, secretary of state for transport, said: ‘I know above all else, businesses want certainty and a level playing field, which is what our zero-emission vehicle mandate is for, why we have recently consulted with you on how it should work and will be able to formally announce it soon. Indeed, very soon.

‘It will require a minimum number of new zero-emission car sales in the run-up to 2030, giving manufacturers the certainty to increase capacity and prioritising UK drivers for future supplies of zero-emission vehicles. It will be one of the most advanced and ambitious regulatory schemes of its kind in the world, reflecting the progress already made by the sector,’ he added.

There is also speculation around the UK’s ban on the sale of new petrol and diesel cars, which is due to come into effect in 2030. This will be followed by a ban on the sale of any new car that uses fossil fuels by 2035. With the industry waiting for the ZEV mandate, preparations for 2030 have been more challenging, but Hawes was adamant that the legislation needs to go ahead.

‘We need that clarity of the end of sale date,’ he stated. ‘There is a misconception between 2030 and 2035, and what technologies will be banned, but it is key that 2035 will signal the end of all fossil fuels in passenger cars.’

Hawes also commented that if the 2030 ban did not come into effect, it would set back not only the transition to EVs but also the country’s industry and economy.

‘If you think about what we are trying to do, we need to get the consumers behind us. The infrastructure transition accelerated the investment climate. If you were to turn around now and say, no, we are not going to do that, well we cannot. You cannot do that for environmental progression. You cannot do it for the industry,’ he added.

Charging infrastructure has to grow

When it comes to EV charging infrastructure, the consensus throughout SMMT Electrified was that more needs to be done to increase the number of public charge points in the UK.

With so many electric models available and many more on the way, as well as developments in battery technology to help increase the range of driving, the issue of charging infrastructure is a big barrier to EV adoption.

‘Two-thirds of all consumers say they would shift sooner if more working charge points were available. We need national infrastructure delivery, and we need it mandated,’ stated Hawes. ‘A proper programme for charge points throughout the country, in urban and rural locations, is not just a commercial imperative for our industry. It is the matter of social justice, a fair transition.’

Richard Bruce, director of transport decarbonisation at the Department for Transport also connected competitive charging infrastructure with increased EV sales. ‘If we do not have the energy and charging infrastructure to make people want to buy these vehicles, we cannot make [the transition to net-zero] work.’

Over £6 billion in private investments have been made in the UK’s charging network, and new plug-in points are being installed across the country every week. Bruce highlighted that targets for charge points are difficult to create as they will inevitably be wrong, with more demand created for every BEV sold. However, there are inconsistencies in installation locations.

‘The offer is not perfect geographically,’ he said. ‘It is not perfect for certain people in certain locations in terms of how they work and how they live. So, we need to specifically target the consumer experience of using charge points to find out information about them, prices paid for charging, access to them and how they pay, to target charging especially for long journeys. Drivers often ask if they can complete a long-distance drive in an EV, and what will happen when they reach their destination. This level of confidence is going to take some time to fix, but we are confident it will be.’

There is, however, clear dissatisfaction at how slowly the UK’s charging infrastructure is progressing. ‘When we asked consumers about their experience of the public charging infrastructure, I think we were quite surprised that almost three quarters said that they were dissatisfied,’ highlighted Justin Macmullan, principal policy adviser at Which?. ‘They raised various issues, the biggest of which was reliability, but also around ease of use, often around sort of payment methods.

‘The third area of contention was availability as well. So, the industry needs to ensure that charge points are available where consumers need them and in sufficient numbers so that, for instance, at the motorway service station, they do not have to wait a long time to access charging,’ he said.

The concern is that there has been no real reliance on the public charging network. Macmullan highlighted that 83% of EV owners Which? spoke with currently charge their vehicles at home. This is a natural part of early EV adoption, the vehicles are bought by those who can utilise them best, and that includes those who can install a charge point at home, with off-road parking.

Mass-market adoption, however, will require those without this ability to purchase and run EVs. Therefore, as the industry pushes into the path of increased BEV sales, there will likely be more pressure on charging infrastructure. This will be a true test of current capabilities, and one which must be passed, lest more bad publicity is generated.

Joined-up thinking required

An issue that companies are facing when it comes to installing charging points is red tape around planning and grid connectivity. Combined, these issues mean installation takes longer, stunting the number of active charging points. Yet in mainland Europe, gaining grid access is more straightforward.

‘I asked a colleague in Holland how long it would take to get a grid contract there, and he replied that it would be three to four weeks,’ said Tom Hurst, UK country manager at Fastned. ‘I would be happy if I could get a contract in three-to-four months. It takes us just four-to-eight weeks to physically build a grid connection to one of our charging sites, and this uses high-powered transformers requiring 11,000 volts or above from the energy grid.

‘This paperwork is therefore holding back expansion, with procedures that are not currently fit for purpose. When we are talking about doing everything we can across the economy, whether it is hydrogen or electrics, whether it is renewables, you name it, we need to go quicker,’ he added.

Rachel Fletcher, director for regulation and economics at Octopus Energy, commented that the issue is not just one felt by the automotive charge point market. ‘The point about trying to get grid connections is one that we hear from renewable energy and storage developers, so it is not unique to it does not give you any comfort. But basically, I think we have a network industry that needs to recognise the absolutely vital role they are playing in helping us get to net zero and the need for real revamping of the entire connections process as well as the technical standards and approach.

‘Historically the requirement for additional connections has been incredibly risk averse based on an old-style level of demand, which has been fairly slow and steady. I think when you are facing a massive uptick in requests from charging point operators, as well as from renewable developers, then you need to start thinking about changes to process.

‘We would love to see the government stepping up as well, to really provide some leadership in this area, because changing the habits and internal processes across six electricity distribution companies is not a straightforward task. So, we need regulatory and government support,’ she said.

One small step

Overall, the message from SMMT Electrified was one of positivity, but also caution. The UK’s automotive market is in a transitional phase, and the industry is finding its way on a path to zero emissions. Hawes suggested that the global race to net zero has no less significance than the plans to put a man on the moon.

‘Like the Apollo programme, we are charting new territories, pushing the bounds of technology,’ Hawes stated. ‘It is pursuit of progress that demands action, demands grit, demands determination. We recognise the dangers of the climate crisis, we recognise our sector’s contribution, and the industry has seized the initiative. We have developed technologies that move us away from fossil fuels. That was not evolution, that is revolution.’

For the revolution to continue, and for the UK market to build on its impressive rate of BEV uptake, it is clear that the automotive industry needs to work together. Cooperation is needed not just with the government, but with energy companies, investment specialists and more, to build the market and continue the country’s path to a net-zero future.