Used-car market update: improvement continues in the UK through May

07 July 2021

Glass’s forecast editor Robert Redman provides analysis of how used-car market channels are holding up in the UK as COVID-19 restrictions subside.

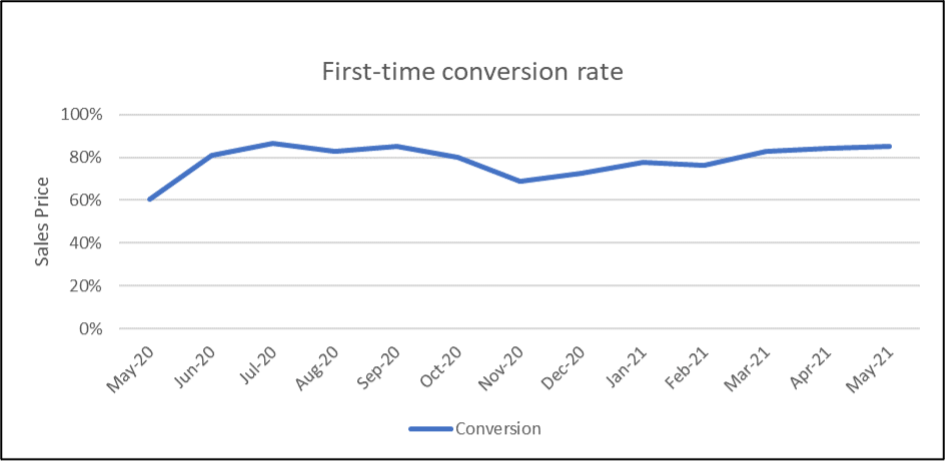

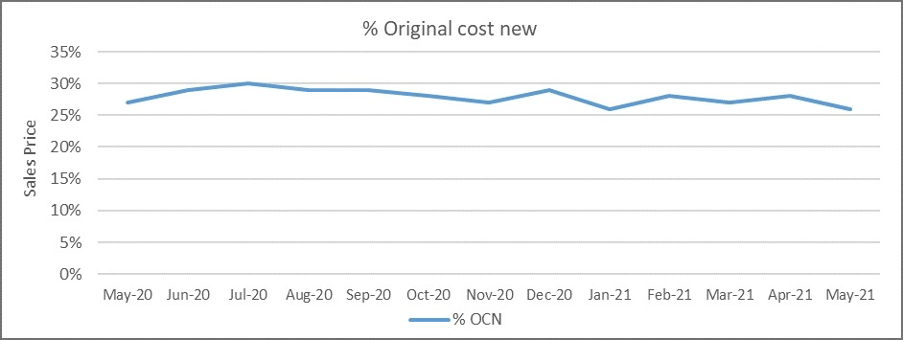

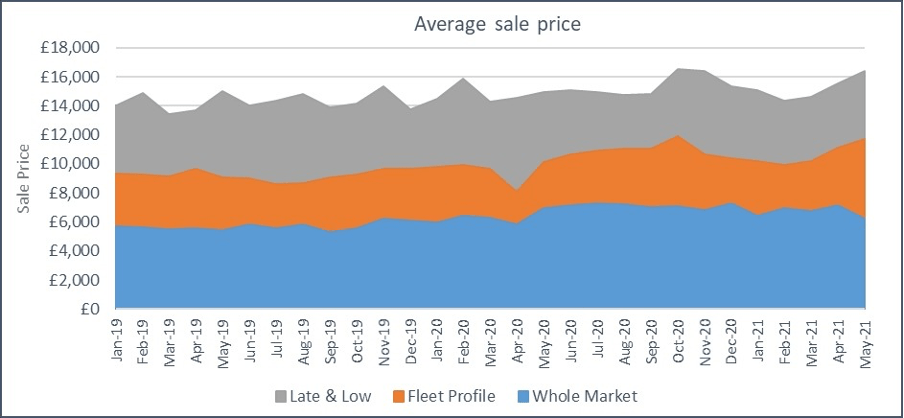

The UK used-car auction market continued to perform well in May. The first-time conversion rate increased, albeit slightly, despite an increase in sales volume. The overall average percentage of cost new achieved dropped a little, but that is not too surprising given the average age increased by 12 months from April. However, values of fleet profile and late and low-mileage vehicles rose markedly, continuing the trend seen in the previous month.

This is likely to be due to lower volumes in these sectors – especially late and low-mileage examples – due to the substantially lower number of new vehicles registered in the last 12 months or so. Overall, however, the auction market remained healthy.

All sectors performed well, with SUVs and convertibles still very strong, although pretty much any car that was in good condition found a buyer relatively quickly.

Retail

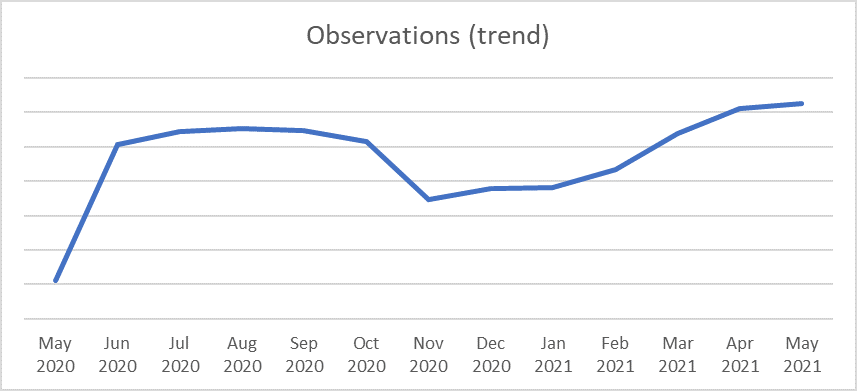

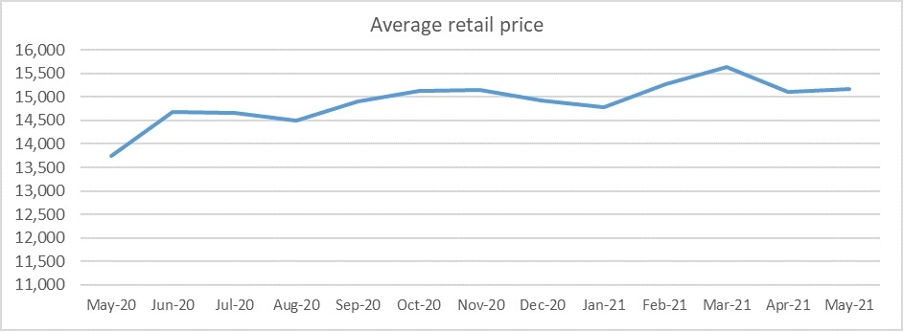

Unsurprisingly, the used-car retail market continued to improve in May. The number of observed sales and their average value increased from the previous month, albeit at a slower rate compared with the movements from March to April. The average discount required to achieve a sale also reduced, down from 2.5% to 1.4%.

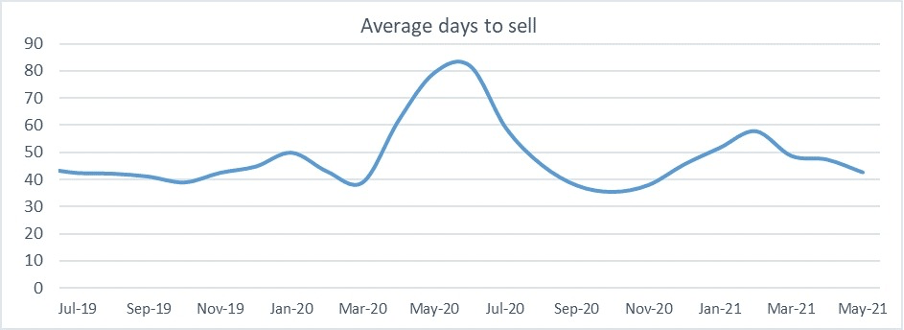

Average days to sell, or the amount of time a car spends on the forecourt, is generally a good barometer for the health of the used-car retail market. This measure continues to decrease, dropping from 47.3 days in April to an average of 42.6 days in May, and is now back to pre-COVID levels. This is great news as it reflects strong used retail demand.

Strength to continue, for now

Reports from the first part of June are of an even stronger used-car auction market, with heightened demand and lower-than-usual availability driving values up. Glass’s therefore expects to see more improvements in the key metrics for this part of the market.

The big question is how long will this unusually strong market continue? Typically, we would expect a slowing as we pass from July into August, with summer holidays taking the focus away from the purchase of used cars, but 2021 is not going to be a typical year. Foreign holidays are going to be substantially down this year, so the high level of demand may possibly continue all the way into September. Such a level of sustained activity would be unprecedented, but if the last 15 months or so has taught us anything, it is that almost anything could happen.