Used-car sales resist COVID-19 better than new cars across Europe

15 May 2020

15 May 2020

Autovista Group senior data journalist Neil King considers the impact of the coronavirus (COVID-19) crisis on Europe’s big 5 used-car markets, which have fared better than new-car registrations so far in 2020.

The latest data from the respective associations in the major European markets reveal that the volume of used-car transactions declined in the first quarter of 2020 compared to Q1 2019. This was to be expected given the lockdowns introduced across Europe in March but only Italy suffered a double-digit decline in changes of ownership. The impact on new-car registrations in the first quarter was more severe in all countries as both dealerships and registration centres closed.

Used-car sales and new-car registrations, year-on-year percentage change, Q1 2020

Sources: CCFA, KBA, ANFIA, ANFAC, GANVAM, SMMT

Nevertheless, sharp downturns in March negated any growth in used-car markets in January and February. In the UK for example, the market contracted by 8.3% in the first quarter of 2020, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT) on 12 May. ′Growth in January and February, up 2.9% and 4.0% respectively, was wiped out by a -30.7% fall in March, making it the lowest March on record as coronavirus lockdown measures that came into effect partway through the month closed retailers,’ the SMMT commented.

There was a similar contraction of the used-car market in Spain, where ′the coronavirus crisis has caused the used market to close the quarter in negative for the first time since 2013′ according to the national vehicle retailers association, GANVAM. In March itself, used-car sales fell by 35% ′as a consequence of the stoppage of commercial activity derived from the state of alarm decreed in mid-March.’

Residual-value resilience

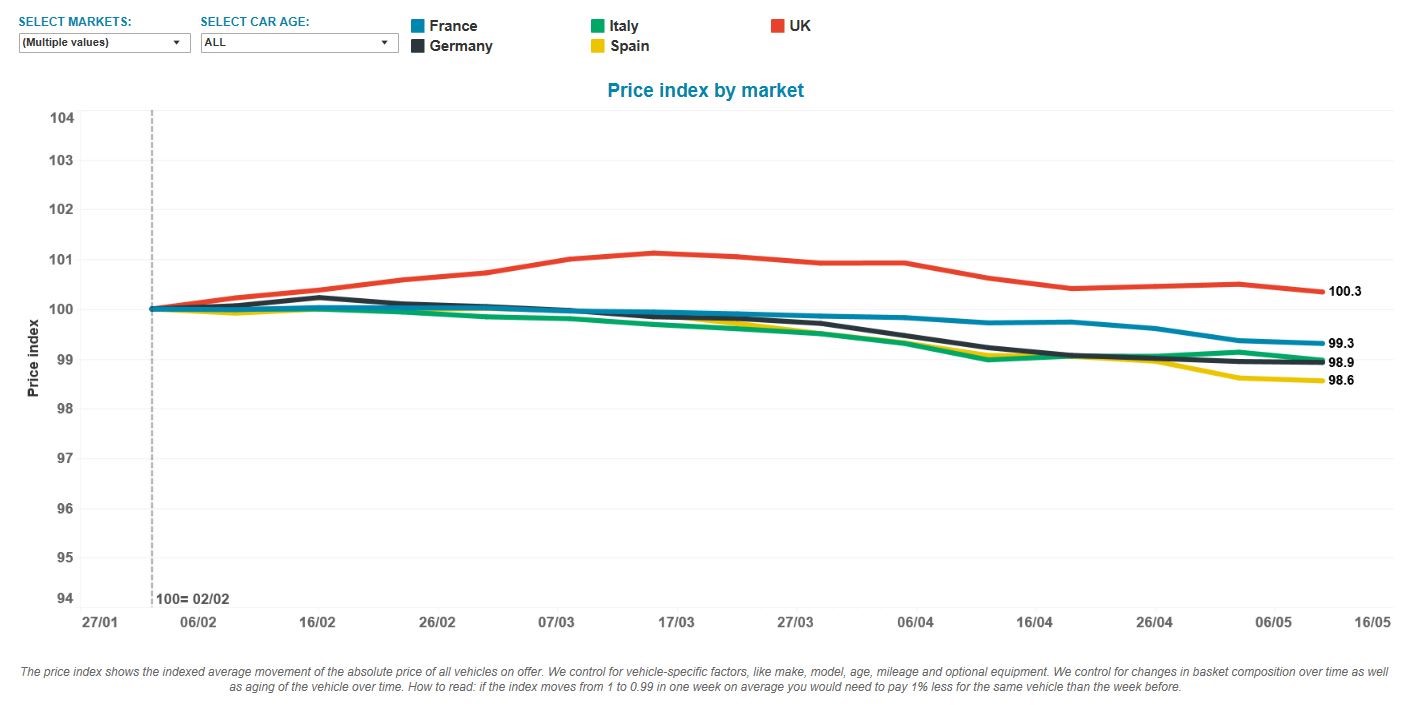

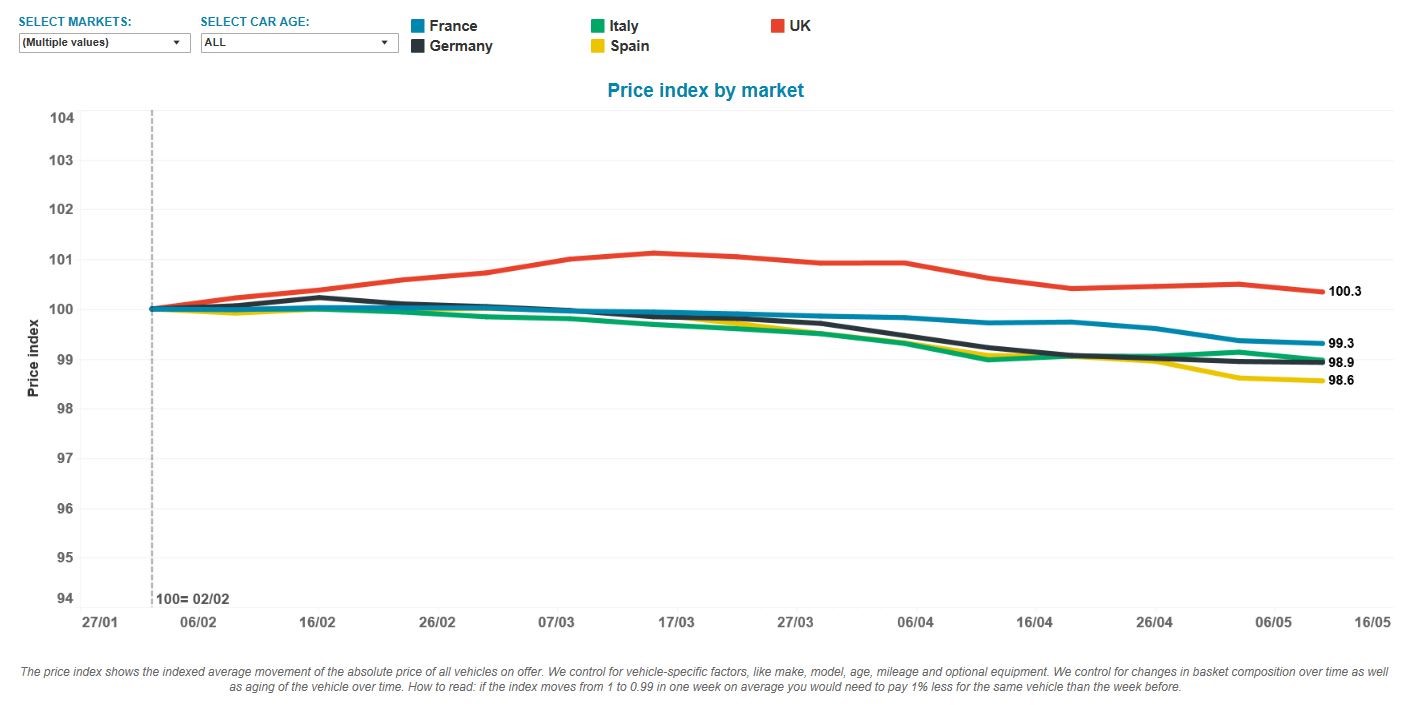

As used-car markets have proven more resilient than new-car markets, Autovista Group has previously reported that the impact on residual values (RVs) has also been marginal so far.

To mid-March, the largest decline in RVs had been in Italy but values have since deteriorated the most in Spain. Even here, RVs are only 1.4% lower than at the start of February.

Sources: CCFA, KBA, ANFIA, ANFAC, GANVAM, SMMT

Nevertheless, sharp downturns in March negated any growth in used-car markets in January and February. In the UK for example, the market contracted by 8.3% in the first quarter of 2020, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT) on 12 May. ′Growth in January and February, up 2.9% and 4.0% respectively, was wiped out by a -30.7% fall in March, making it the lowest March on record as coronavirus lockdown measures that came into effect partway through the month closed retailers,’ the SMMT commented.

There was a similar contraction of the used-car market in Spain, where ′the coronavirus crisis has caused the used market to close the quarter in negative for the first time since 2013′ according to the national vehicle retailers association, GANVAM. In March itself, used-car sales fell by 35% ′as a consequence of the stoppage of commercial activity derived from the state of alarm decreed in mid-March.’

Residual-value resilience

As used-car markets have proven more resilient than new-car markets, Autovista Group has previously reported that the impact on residual values (RVs) has also been marginal so far.

To mid-March, the largest decline in RVs had been in Italy but values have since deteriorated the most in Spain. Even here, RVs are only 1.4% lower than at the start of February.

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

RVs have proven the most resilient in the UK and are even 0.3% higher than recorded at the beginning of February. ′Despite the challenging market conditions, the latest industry data indicates that average used car residuals are holding firm, with prices in March remaining broadly stable, down only 0.2% year-on-year at £13,601 [€15,345]. Data also suggests that, despite lockdown measures being in effect, consumers are continuing to search and browse used cars online with many still looking to buy when the time is right,’ the SMMT commented in its Q1 used-car sales release.

Trend continues in April

Used-car sales data for the UK have not yet been released for April but data for the other major European markets confirm that although the downturns in the month were especially severe in France, Italy and Spain, they were not quite as dramatic as the contractions in new-car registrations. In Germany, there were 44% fewer changes of ownership in April than a year earlier, supported by the reopening of dealerships later in the month, whereas new-car registrations declined by 61%.

Used-car sales, year-on-year percentage change, April and year-to-date 2020

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

RVs have proven the most resilient in the UK and are even 0.3% higher than recorded at the beginning of February. ′Despite the challenging market conditions, the latest industry data indicates that average used car residuals are holding firm, with prices in March remaining broadly stable, down only 0.2% year-on-year at £13,601 [€15,345]. Data also suggests that, despite lockdown measures being in effect, consumers are continuing to search and browse used cars online with many still looking to buy when the time is right,’ the SMMT commented in its Q1 used-car sales release.

Trend continues in April

Used-car sales data for the UK have not yet been released for April but data for the other major European markets confirm that although the downturns in the month were especially severe in France, Italy and Spain, they were not quite as dramatic as the contractions in new-car registrations. In Germany, there were 44% fewer changes of ownership in April than a year earlier, supported by the reopening of dealerships later in the month, whereas new-car registrations declined by 61%.

Used-car sales, year-on-year percentage change, April and year-to-date 2020

Sources: CCFA, KBA, ANFIA, GANVAM

Used-car sales will remain subdued, especially in the UK as dealers cannot yet reopen, but the impact of the economic crisis on RVs will be felt differently depending on the country and circumstances.

′While it is tricky to predict future demand, the impact of social-distancing requirements on public transport means that, for many people, the car will play an even more important role in helping them travel safely to work. Re-opening new and used-car outlets will support this, enabling more of the latest, cleanest vehicles to filter through to second owners,’ Mike Hawes, SMMT chief executive, commented.

More detail on the early impact of the coronavirus and the outlook for market recovery is available in Autovista Group’s updated whitepaper: How will COVID-19 shape used car markets? Scenarios for residual value development in Europe for 2020, 2021 and 2022. Download your copy here.

Sources: CCFA, KBA, ANFIA, GANVAM

Used-car sales will remain subdued, especially in the UK as dealers cannot yet reopen, but the impact of the economic crisis on RVs will be felt differently depending on the country and circumstances.

′While it is tricky to predict future demand, the impact of social-distancing requirements on public transport means that, for many people, the car will play an even more important role in helping them travel safely to work. Re-opening new and used-car outlets will support this, enabling more of the latest, cleanest vehicles to filter through to second owners,’ Mike Hawes, SMMT chief executive, commented.

More detail on the early impact of the coronavirus and the outlook for market recovery is available in Autovista Group’s updated whitepaper: How will COVID-19 shape used car markets? Scenarios for residual value development in Europe for 2020, 2021 and 2022. Download your copy here.

Sources: CCFA, KBA, ANFIA, ANFAC, GANVAM, SMMT

Nevertheless, sharp downturns in March negated any growth in used-car markets in January and February. In the UK for example, the market contracted by 8.3% in the first quarter of 2020, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT) on 12 May. ′Growth in January and February, up 2.9% and 4.0% respectively, was wiped out by a -30.7% fall in March, making it the lowest March on record as coronavirus lockdown measures that came into effect partway through the month closed retailers,’ the SMMT commented.

There was a similar contraction of the used-car market in Spain, where ′the coronavirus crisis has caused the used market to close the quarter in negative for the first time since 2013′ according to the national vehicle retailers association, GANVAM. In March itself, used-car sales fell by 35% ′as a consequence of the stoppage of commercial activity derived from the state of alarm decreed in mid-March.’

Residual-value resilience

As used-car markets have proven more resilient than new-car markets, Autovista Group has previously reported that the impact on residual values (RVs) has also been marginal so far.

To mid-March, the largest decline in RVs had been in Italy but values have since deteriorated the most in Spain. Even here, RVs are only 1.4% lower than at the start of February.

Sources: CCFA, KBA, ANFIA, ANFAC, GANVAM, SMMT

Nevertheless, sharp downturns in March negated any growth in used-car markets in January and February. In the UK for example, the market contracted by 8.3% in the first quarter of 2020, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT) on 12 May. ′Growth in January and February, up 2.9% and 4.0% respectively, was wiped out by a -30.7% fall in March, making it the lowest March on record as coronavirus lockdown measures that came into effect partway through the month closed retailers,’ the SMMT commented.

There was a similar contraction of the used-car market in Spain, where ′the coronavirus crisis has caused the used market to close the quarter in negative for the first time since 2013′ according to the national vehicle retailers association, GANVAM. In March itself, used-car sales fell by 35% ′as a consequence of the stoppage of commercial activity derived from the state of alarm decreed in mid-March.’

Residual-value resilience

As used-car markets have proven more resilient than new-car markets, Autovista Group has previously reported that the impact on residual values (RVs) has also been marginal so far.

To mid-March, the largest decline in RVs had been in Italy but values have since deteriorated the most in Spain. Even here, RVs are only 1.4% lower than at the start of February.

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

RVs have proven the most resilient in the UK and are even 0.3% higher than recorded at the beginning of February. ′Despite the challenging market conditions, the latest industry data indicates that average used car residuals are holding firm, with prices in March remaining broadly stable, down only 0.2% year-on-year at £13,601 [€15,345]. Data also suggests that, despite lockdown measures being in effect, consumers are continuing to search and browse used cars online with many still looking to buy when the time is right,’ the SMMT commented in its Q1 used-car sales release.

Trend continues in April

Used-car sales data for the UK have not yet been released for April but data for the other major European markets confirm that although the downturns in the month were especially severe in France, Italy and Spain, they were not quite as dramatic as the contractions in new-car registrations. In Germany, there were 44% fewer changes of ownership in April than a year earlier, supported by the reopening of dealerships later in the month, whereas new-car registrations declined by 61%.

Used-car sales, year-on-year percentage change, April and year-to-date 2020

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

RVs have proven the most resilient in the UK and are even 0.3% higher than recorded at the beginning of February. ′Despite the challenging market conditions, the latest industry data indicates that average used car residuals are holding firm, with prices in March remaining broadly stable, down only 0.2% year-on-year at £13,601 [€15,345]. Data also suggests that, despite lockdown measures being in effect, consumers are continuing to search and browse used cars online with many still looking to buy when the time is right,’ the SMMT commented in its Q1 used-car sales release.

Trend continues in April

Used-car sales data for the UK have not yet been released for April but data for the other major European markets confirm that although the downturns in the month were especially severe in France, Italy and Spain, they were not quite as dramatic as the contractions in new-car registrations. In Germany, there were 44% fewer changes of ownership in April than a year earlier, supported by the reopening of dealerships later in the month, whereas new-car registrations declined by 61%.

Used-car sales, year-on-year percentage change, April and year-to-date 2020

Sources: CCFA, KBA, ANFIA, GANVAM

Used-car sales will remain subdued, especially in the UK as dealers cannot yet reopen, but the impact of the economic crisis on RVs will be felt differently depending on the country and circumstances.

′While it is tricky to predict future demand, the impact of social-distancing requirements on public transport means that, for many people, the car will play an even more important role in helping them travel safely to work. Re-opening new and used-car outlets will support this, enabling more of the latest, cleanest vehicles to filter through to second owners,’ Mike Hawes, SMMT chief executive, commented.

More detail on the early impact of the coronavirus and the outlook for market recovery is available in Autovista Group’s updated whitepaper: How will COVID-19 shape used car markets? Scenarios for residual value development in Europe for 2020, 2021 and 2022. Download your copy here.

Sources: CCFA, KBA, ANFIA, GANVAM

Used-car sales will remain subdued, especially in the UK as dealers cannot yet reopen, but the impact of the economic crisis on RVs will be felt differently depending on the country and circumstances.

′While it is tricky to predict future demand, the impact of social-distancing requirements on public transport means that, for many people, the car will play an even more important role in helping them travel safely to work. Re-opening new and used-car outlets will support this, enabling more of the latest, cleanest vehicles to filter through to second owners,’ Mike Hawes, SMMT chief executive, commented.

More detail on the early impact of the coronavirus and the outlook for market recovery is available in Autovista Group’s updated whitepaper: How will COVID-19 shape used car markets? Scenarios for residual value development in Europe for 2020, 2021 and 2022. Download your copy here.