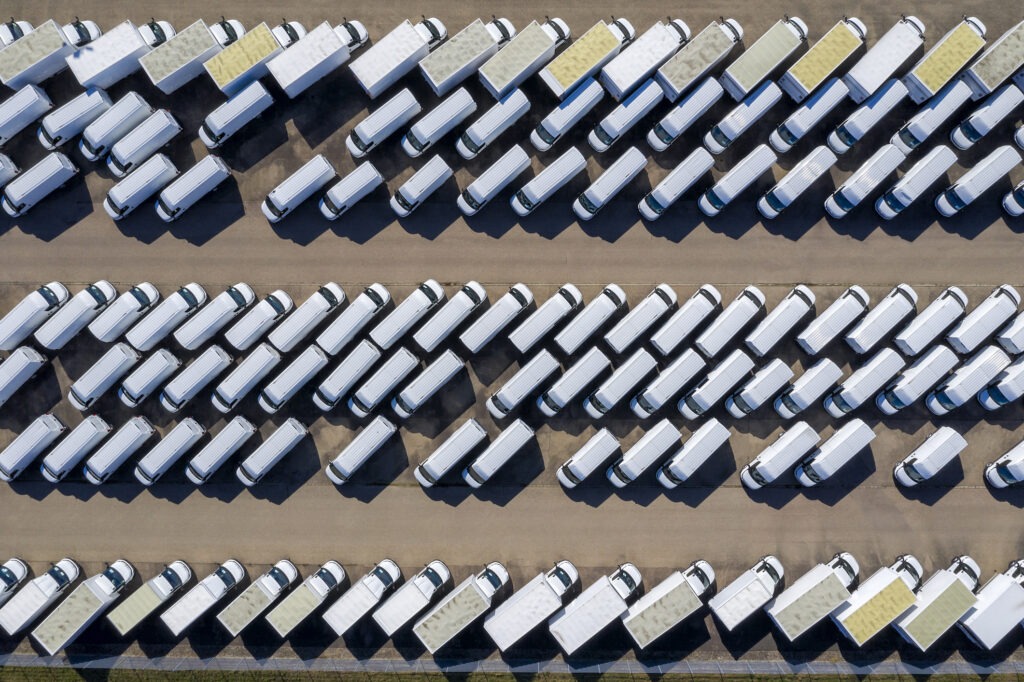

Used LCV prices fall across Germany, Poland and the UK

18 July 2024

Light-commercial vehicle (LCV) prices fell across three of Europe’s largest used markets in the first half of 2024. Autovista Group experts from Germany, Poland and the UK review the trend with Autovista24 editor, Tom Geggus.

Used LCV prices fell in Germany, Poland and the UK across the first half of 2024. The effect has been widespread across the different age categories and powertrains. However, light-commercial battery-electric vehicles (BEVs) have fared particularly badly.

The sector is still heavily reliant on diesel engines that are comparatively quick to refuel and more affordable. On the other hand, commercial BEVs do not inspire confidence, with charging infrastructure and downtime still major concerns. This has resulted in low levels of demand, driving down prices of models sold on the used market.

Older LCVs have seen prices fall too. With increased supplies of these aged vehicles, buyers are exercising more caution while waiting for the right stock. This means that as soon as younger, more well-equipped models become available, they sell more quickly.

A major influencing factor behind these declining prices is the process of market normalisation. Between 2020 and 2022, LCV values climbed exponentially as the COVID-19 pandemic saw consumers shop online amid lockdowns. Commercial vehicles were in high demand, which drove up used prices.

Post-pandemic, the market is deflating. So, while declining prices might appear to be the new normal, current levels are still far higher than they were at the start of 2020.

Prices fall in Germany

‘Price levels on Germany’s used-commercial vehicle market have continued to fall’, said Kai Seidemann, LCV market analyst at Schwacke (part of J.D. Power).

The extent of this decline becomes apparent when compared to the country’s passenger-car market. Used-car prices dropped by 0.9% between 1 January and 30 June 2024. Across the same period, prices of used LCVs declined more dramatically, down 3.3%.

All age categories have been affected by these falling prices. However, vehicles older than 54 months appear to be the most heavily affected. The overall trend across the last few months is negative, but this is not a surprising development.

‘Even with this recent trend, prices are still well above the levels recorded before the pandemic,’ Seidemann explained. ‘This means Germany’s used-LCV market is still going through a period of adjustment.’

A similar trend

Examining powertrains, BEVs and diesel-powered LCVs have followed a similar trend, although the downturn is more pronounced for all-electric models. Plug-in vans have seen prices fall by 5.6% since the start of the year.

Only those vehicles powered by petrol have seen consistency. A key reason for this is the very small number of these powertrains available on the market, driving the price consistency.

Manufacturers are currently trying to navigate the withdrawal of government electric vehicle (EV) purchase subsidies by reducing the price of new BEVs. This means that new-vehicle prices are also shrinking on average, which in turn is stabilising used prices.

‘This does not immediately transform actual used-LCV transaction prices,’ Seidemann pointed out. ‘However, the relationship between new and used models will change in percentage terms, which could ensure stability.’

Differentiating it from other European markets, Germany does not ban vehicles from its urban centres. This sets it apart from countries like Austria, where a malus system for diesel engines is currently in place. Without the need for a BEV to operate in cities, there is less motivation for German buyers.

Additionally, the price per kWh in Germany is comparatively higher on average. These factors mean there is less motivation to buy an all-electric model in the country than in other European markets.

Poland’s situation not clear cut

‘The state of Poland’s used-LCV market is not clear-cut,’ said Marcin Kardas, head of valuations at Eurotax Poland (part of J.D. Power). ‘Since last year, values have suffered significant ongoing declines.

This trend is affecting all segments, suggesting broader issues with the country’s economy and logistics sector. This decline has been most noticeable for vehicles between 31 and 53 months of age. However, the price pressure is minimal for older vehicles, with a far smaller number of units on offer.

The importance of imports

So far this year, the country’s overall market trend has matched the situation in Germany. Poland has seen a growing number of LCV imports since the beginning of the year, many of which came from Germany.

Alongside demand, the discounting policy of importers plays a large role in shaping the value of used vehicles. Presently, discounts mainly apply to 2023 stock vehicles, the volume of which is starting to fall. Despite the fierce competition, 2024 vehicles are no longer discounted so heavily and their prices may increase again in the near future.

This is because of the introduction of vehicles that are compliant with General Safety Regulation 2 (GSR2). As of July 2024, all new vehicles sold in the EU must be fitted with safety systems designed to protect pedestrians and other road users.

This includes intelligent-speed assistance technology, fatigue-monitoring capabilities, as well as emergency braking and lane-keeping systems. These new technologies will likely drive up the price of new models.

Values cushioned

In the long term, increasing new-vehicle prices should cushion used values from further decline, although demand could remain a problem. At first glance, order numbers do not appear to be a cause for alarm, and importers have confirmed large figures since the beginning of 2024.

In the first half of this year, 31,705 LCVs were registered in Poland, up 3.8% year on year according to PZPM. However, June’s rate of growth was exceptional at 11.4%. This was because a large number of vehicles were delivered ahead of the GSR2 deadline in July. Overall, the registration rate is starting to slow.

Interest in new and used all-electric LCVs in Poland is still minimal, and their market share is falling. Values continue to decline regardless of segment, with BEVs dropping significantly faster than diesel-powered LCVs.

All-electric LCVs currently on the market feature some particularly poor performance figures. Newer generations with greater capacities are starting to enter the market and may help improve the perception of used BEV LCVs. ‘However, this will be a difficult task as EVs are still treated with a great deal of distrust in Poland,’ Kardas concluded.

Increasing supply in UK

The UK’s used-LCV market saw supply levels continue to climb in the second quarter of 2024. A large proportion of these vehicles were ex-fleet, low-spec, with varying amounts of damage.

‘This has led to weaker prices and greater buyer caution at auction,’ pointed out Andy Picton, chief commercial vehicle editor at Glass’s (part of J.D. Power).

Conversion rates for these harder-worked, higher-mileage models have dropped as they require more preparation before sale. The exception to this high-supply, low-demand trend is younger, better-equipped LCVs with low-mileages. Ready-to-sell models with a complete service history are being snapped up by buyers.

Between April and June, demand for used all-electric commercial vehicles fell further from an already low point. The powertrain made up 1.4% of transactions in April, then 1.2% in May, before dropping to 0.6% in June. By this point, the average age of a used electric LCV sold at auction had climbed to 85 months.

A new government

In July, the UK voted in a Labour government after 14 years of Conservative party rule. In its manifesto, Labour set out plans to restore the 2030 phase-out of new-car sales powered by petrol and diesel. However, there was no specific mention of whether LCVs would also be included.

The document also made no mention of restoring the plug-in vehicle grant that was withdrawn in June 2022. Additionally, there was no mention of whether the plug-in-van grant would be extended beyond 2025. There were also no assurances over whether the current rate of fuel duty would change.

While the party did commit itself to accelerating the rollout of charging points, the manifesto did not highlight the need for dedicated commercial infrastructure. Alongside this, there was no confirmation of whether VAT on public charging would be lowered to 5%, in line with domestic rates. There was also no mention of these points in the King’s Speech, which sets out the government’s legislative plans in the new sitting of parliament.

A long-forgotten change is also just over the horizon for London motorists. From 25 December 2025, zero-emission vehicles will be subject to the city’s Congestion Charge, as the current 100% discount is withdrawn.

‘This will not help drive the uptake of electric commercial vehicles. However, it is possible this change will be challenged, as commercial vehicles cannot avoid the zone and would require some kind of exception,’ Picton concluded.