What does the future hold for diesel?

09 May 2019

9 May 2019

By Christof Engelskirchen

More than three years have passed since Dieselgate erupted and its aftermath started to shake the automotive industry to its very core. There has been extensive – and at times high-pitched – media coverage on the topic and we have received countless questions at Autovista Group on the impact on remarketing potential and risks for diesel. Is diesel really ″dead″ in Europe? No, and there is no need to panic.

Diesel has lost ground in the EU5 with the exception of Italy, where the diesel share of market has remained largely stable over the past three years. In France and Spain, roughly two out of three registered passenger vehicles had been diesels in 2015, now roughly just one out of three. In Germany, the diesel share fell from 50% to 30%. This drop was picked up by petrol-powered vehicles almost entirely. BEV vehicles still only account for only 1% of registrations in the EU5 with the largest share being in France at 1.5% and 1.4% in the UK.

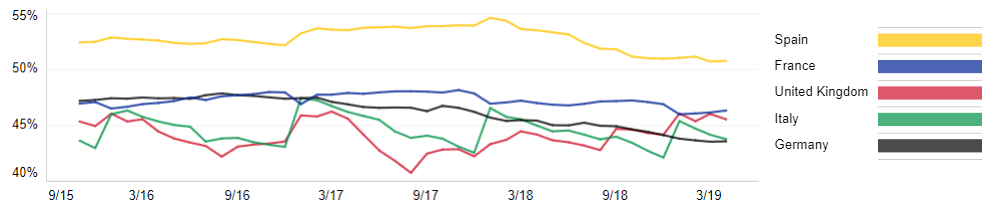

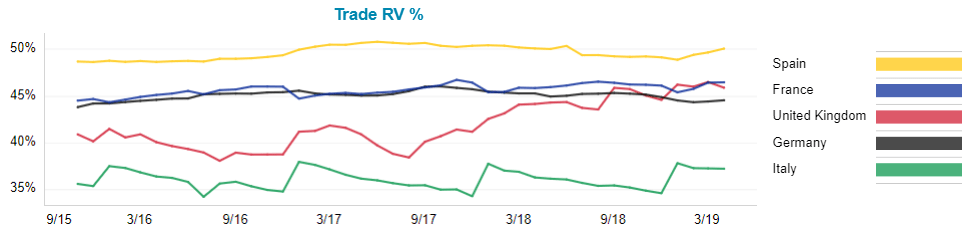

This change in new car demand should have affected residual values (RVs) of diesel-powered vehicles. But the corrections have been less dramatic than some might think. Germany has had the strongest market correction in terms of RVs (see Graph 1, black line) moving from 47% to 44%, on average across segments. In some segments the decline has been more pronounced, e.g. C-SUV and D-SUV segments. Diesel RVs have been stable in France, Italy, and the UK. In Spain, we could observe a decline of roughly 2% on average across segments. At the same time, we have been seeing rising RVs for petrol-powered cars during the last 3.5 years (Graph 2).

Graph 1: Diesel-powered passenger cars, Trade RV% on a scenario of 36m/ 60,000km

Source: Residual Value Intelligence, Autovista Group

Graph 2: Petrol-powered passenger cars, Trade RV % on a scenario of 36m/ 60,000km

Source: Residual Value Intelligence, Autovista Group

Looking towards 2025, we expect only the slightest of declines in RVs for diesel-powered engines in Germany; the correction has already taken place. The biggest corrections should occur in France with medium-to-high single digit percentage declines depending on segment. Italy, Spain and UK will see substantial single digit percentage declines in our most likely development scenarios, but lower than those anticipated for France.

Check out Autovista Group’s latest report on the remarketing risk of diesel-powered engines to get our full perspective on eleven segments in five countries for diesel, petrol and battery electric vehicles.

Source: Residual Value Intelligence, Autovista Group

Looking towards 2025, we expect only the slightest of declines in RVs for diesel-powered engines in Germany; the correction has already taken place. The biggest corrections should occur in France with medium-to-high single digit percentage declines depending on segment. Italy, Spain and UK will see substantial single digit percentage declines in our most likely development scenarios, but lower than those anticipated for France.

Check out Autovista Group’s latest report on the remarketing risk of diesel-powered engines to get our full perspective on eleven segments in five countries for diesel, petrol and battery electric vehicles.

Source: Residual Value Intelligence, Autovista Group

Looking towards 2025, we expect only the slightest of declines in RVs for diesel-powered engines in Germany; the correction has already taken place. The biggest corrections should occur in France with medium-to-high single digit percentage declines depending on segment. Italy, Spain and UK will see substantial single digit percentage declines in our most likely development scenarios, but lower than those anticipated for France.

Check out Autovista Group’s latest report on the remarketing risk of diesel-powered engines to get our full perspective on eleven segments in five countries for diesel, petrol and battery electric vehicles.

Source: Residual Value Intelligence, Autovista Group

Looking towards 2025, we expect only the slightest of declines in RVs for diesel-powered engines in Germany; the correction has already taken place. The biggest corrections should occur in France with medium-to-high single digit percentage declines depending on segment. Italy, Spain and UK will see substantial single digit percentage declines in our most likely development scenarios, but lower than those anticipated for France.

Check out Autovista Group’s latest report on the remarketing risk of diesel-powered engines to get our full perspective on eleven segments in five countries for diesel, petrol and battery electric vehicles.