What happens to vehicle prices at different mileage thresholds?

26 August 2024

Besides age, mileage is the most important driver of used-vehicle prices. But what happens at the 100,000km threshold? Dr Christof Engelskirchen, chief economist of Autovista Group (part of J.D. Power), explores the psychological barrier of accumulated mileage.

Deciding to buy a used vehicle triggers a significant amount of research. There is the inherent challenge of assessing a vehicle’s true quality in relation to the price suggested by the seller. This may be overcome to some degree by used-vehicle programmes and warranties, which provide a security blanket for the buyer.

Another challenge is that buyers may not find a used vehicle which meets their desired specifications. Even if they do, there is the potential for some buyers to look at alternatives, willing to compromise if the price is right. A typical option is expanding a search to include older models and those with higher mileages.

Matching age and mileage

Buyers look to balance age and mileage when purchasing a used vehicle. This means sorting models into usage categories:

- One age-mileage cluster considered when buying a used vehicle is ‘nearly new’. This can include demonstration vehicles, usually with very low mileages.

- A second category often taken into account is ‘young used vehicles’. These models are often off-rental, or driven as manufacturer-registered company vehicles, possibly around one to two years old.

- A third and typical bracket covers vehicles ‘between three and four years of age’, driven under leasing or subscription contracts.

- Last but not least, ‘older used vehicles’ are at least five years old and have passed through multiple sets of hands. If these vehicles only had one previous owner, they were usually privately acquired when new.

Buyers assess a used vehicle by comparing these age clusters with expected patterns of usage. Mileage is an important indicator for this assessment. A remarkably low mileage for an older age cluster can be suspicious and may point to an under-used engine. If the mileage is too high for the age cluster, this can point to an exhausted vehicle.

These simple rules of thumb make sense from a technical perspective, particularly when applied to internal-combustion-engine (ICE) vehicles, rather than electric vehicles. Buyers might also assume that higher mileages are far less concerning for diesel engines than for ones powered by petrol.

Psychological mileage barriers

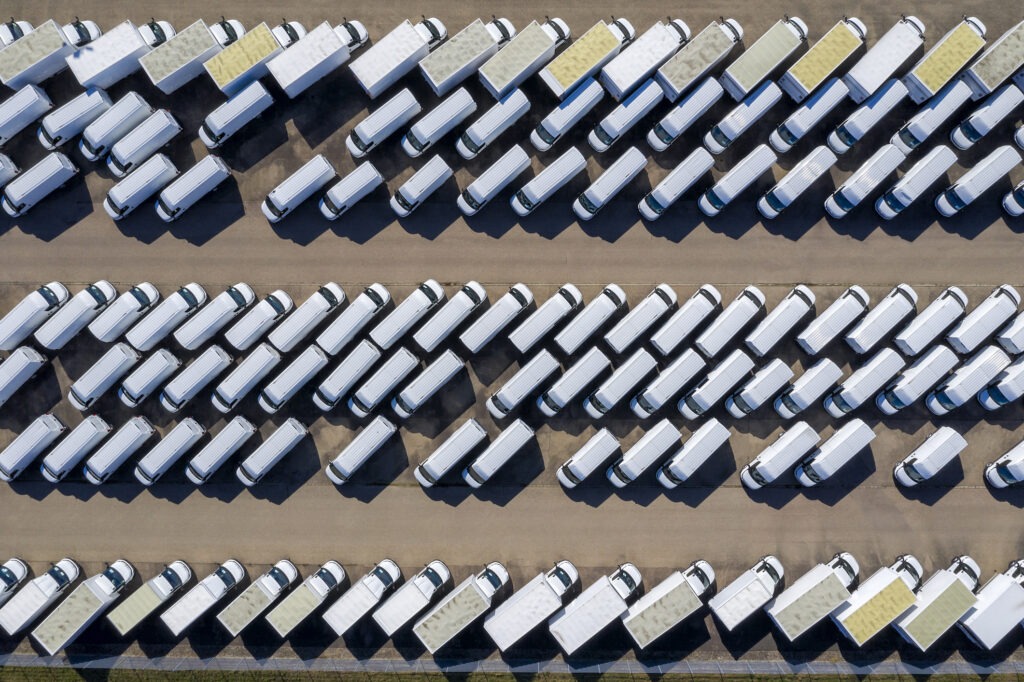

Autovista Group analysis reveals how prices of used vehicles, including passenger cars and light-commercial vehicles, develop from one mileage cluster to the next. With last-observed prices spread over 10,000km intervals, values decline by 5% on average with each advancing mileage cluster. Collected data spans Austria, Belgium, Finland, France, Germany, Italy Portugal, and Spain.

Immediately apparent is how much value is lost when vehicles move from the first cluster (0km to <10,000km) to the second (10,00km to <20,000km). On average, used vehicles lose 15% of their absolute value when crossing this threshold. So, vehicles in the second category are worth 15% less than those in the first.

This makes sense, as prices will be more elastic as vehicles accumulate their first significant amount of mileage and age. Moving up two clusters to the <40,000km bracket, the loss is between approximately 10% and 9% respectively. However, this average loss is halved to around 4% to 5% once used vehicles hit the 40,000km category. This change continues to be quite steady up until the 99,000km cluster.

Out of the ordinary

Something seemingly out of the ordinary happens once used vehicles pass the 100,000km boundary. These models suddenly accumulate an average loss of 8% as they move into the mileage cluster.

One explanation for this pattern is that buyers experience irrational anxiety on crossing this threshold. Another explanation is that many prospective buyers are setting online search filters that discriminate against vehicles at the 100,000km mark and above.

Sellers might also make a greater effort when it comes to clearing these vehicles out of their portfolio. Vehicles in the 90,000km to <100,000km category spend more time in stock than the previous and following clusters. However, it is likely a combination of all these factors.

After this point, the losses revert to between 4% and 6%. Unsurprisingly, the same phenomenon occurs at the 200,000km threshold. However, the losses are slightly greater at 9%, then vehicles see a very small drop of 0.4% moving into the next bracket.

Once again, the mileage-cluster-induced losses revert to between 4% and 6%. Not surprisingly, the same pattern occurs at the 200,000km threshold. Although, the losses are slightly more accentuated at 9% and vehicles lose very little as they move into the next mileage category.

Larger losses for petrol

These trends are more accentuated for petrol powertrains than for diesel models. Petrol vehicles lose more value as they accumulate mileage. This makes sense, as these engines are recognised as having shorter lifespans than ones powered by diesel.

From one mileage bracket to the next, petrol vehicles see greater losses in price on average. Meanwhile, diesel-powered vehicles depreciate slightly more slowly between each benchmark.

The psychological barriers at the 100,000km and 200,000km thresholds trigger a higher loss of 11% for petrol vehicles at both markers. Diesel vehicles see a loss of between approximately 7% and 9%, respectively. This illustrates how higher mileages are less of an issue for diesel engines on the used-vehicle market.

The takeaway

This analysis reveals that there are quantifiable psychological barriers to buying and selling vehicles at the 100,000km and 200,000km thresholds. These models trigger a step change as their perceived attractiveness drops. At this point, they enter a different used-vehicle category as their values come under pressure.

For buyers, there might be an opportunity to get a very similar vehicle at a reduced price at this point. Sellers should ideally try to avoid models in these clusters. This could be achieved by keeping vehicles in a fleet for possibly just a few more months to move them into the next cluster or sell them slightly earlier