What is the residual-value impact of improved sales of higher-end cars in Germany post-dieselgate?

13 July 2021

Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group) discusses the impact of dieselgate and the COVID-19 pandemic on sales and residual values (RVs) of vehicles in the upper-medium segment in June.

In terms of volume, the diesel crisis has not affected the classic higher-end company-car segment as much as one might assume. The diesel share was still over 70% in 2019 and only lost ground to plug-in hybrids in 2020 due to the pandemic-related eco bonus. The share of estate cars has not changed much since 2014 and it remains the most important body type at 50-60%.

This makes it difficult for the non-German competitors who keep trying to enter the market, as estate cars do not enjoy the same status outside Germany as they do within it. In global sales terms, and with limited development budgets, players like Tesla, Lexus, Genesis or DS Automobiles have, therefore, focused on saloon versions. If, as is the case with DS and Lexus, the diesel fuel type is also dropped, the market potential in Germany is quickly reduced to less than 20% of the segment.

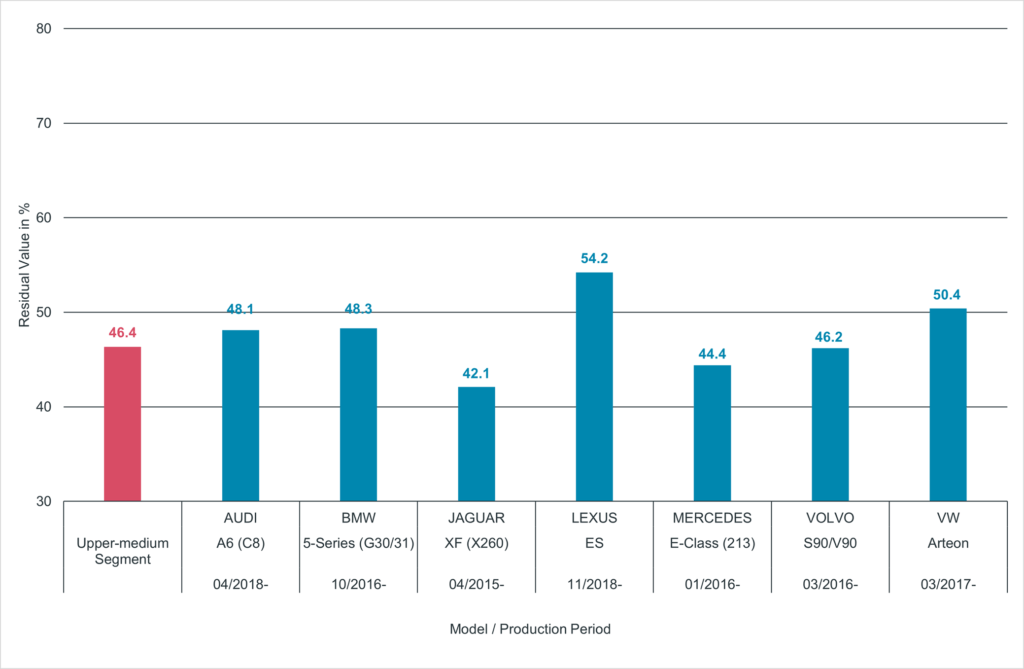

Forecast retail values in %, upper-medium segment with segment-specific

optional equipment

Source: Schwacke GmbH

In terms of RVs, this German-dominated segment has lost ground in the wake of dieselgate. Now, however, the bottom seems to have been reached and since 2020 there has even been a slight upward trend in used-car prices, observes Geilenbruegge. The RV percentage has only slowed down mathematically because of the above-average, list-price development of these cars – most recently, by 4% in half a year. Currently, the forecast values are still well below the 50% mark on average, which is not least due to the lack of new-model launches.

Important new models such as the BMW 5-Series and Mercedes E-Class are due in 2023. In the case of the Mercedes, this is launching with a purely electric EQE variant, and the Audi A6 e-tron is already making its first rounds as a concept. So, following on from plug-in hybrids, it is now time for fleet managers to prepare company-car policies for battery-electric vehicles, he concludes.