What is in store for Europe’s car dealers?

30 October 2020

The dealer sector in Europe has undergone the most substantial changes over the past 10 years, with the number of dealer outlets falling by 16% to 52,000 across Europe. Autovista Group chief economist Dr Christof Engelskirchen explores the challenges facing the sector.

Consolidation started well before 2009, driven mostly by margin pressures, and looks set to continue: digitisation and OEMs wanting to take more control in the sales process will serve as catalysts to this trend. Is this bad news for the sector? No, it is not.

In search of economies of scale, we see a trend of strong investment activities in the dealer sector. For example, in the UK Anders Hedin Invest has bought an 11.6% stake in Pendragon, the country’s biggest dealer group and Europe’s fourth-largest. US company Penske is now Europe’s second-largest dealer group, primarily because of its UK investment. The top 50 dealer groups in the country captured 42% of new-car sales in 2018, compared with only 27% in 2008. On average, UK dealers sell around 600 cars per year. Europe’s average is 331. More consolidation is highly likely. The Swiss dealer group Emil Frey, which is Europe’s biggest dealer group, has dominated consolidation.

New-car sales: agency model and margin pressure

New-car sales operations were already the least profitable activity for dealers, far behind aftermarket and used-car sales. Margin pressure will continue in this area. The dealer role in new-car sales will change, and as a result of more units selling online, OEMs seeking more direct customer interaction and the continuing trend to more leasing or personal contract purchase (PCP). New players will enter the market with new business models like car subscriptions. Car sharing, while economically challenged, will likely see a recovery as well.

An agency model for dealers adopting a consultative approach to selling is a likely future activity in the new-car sector. It will also be required, because a friction-less online and offline experience (some call it omnichannel) is an attractive future for car seekers. The process of vehicle purchase will move between the online and offline worlds, as customers seek information, personal contact, and test drives. However, it should not matter where the final deal is done.

Megatrends bridge profitability gap

- There are new opportunities for dealers linked to automotive megatrends, that can close a large portion of the profitability gap:

- New business models, like maintaining and operating car-sharing fleets, or installing and running battery-charging stations;

- Streamlining processes and services sales operations – consolidation and economies of scale play a role as well;

- Strengthening the customer experience by employing big data analysis, addressing individual customer needs and offering new loyalty and incentive models;

- OEMs understanding the importance of a strong and accessible network of car dealers. Staff at dealerships will become increasingly salaried, rather than on commission, to encourage consultative selling rather than hard-selling; and

- The sale of a vehicle will happen in an ′omnichannel’ environment, where dealers will help customers configure their vehicles, arrange test drives, deliver vehicles and provide services. For example, linking electric-vehicle (EV) ownership to car-sharing options, such as for holidays, will present revenue-generation opportunities.

Rising number of used-car transactions

Behind aftermarket, used-car operations are already the second biggest contributor to a dealer’s profitability. Used-car operations will continue to remain a most important pillar of dealer success. The good news is that while new-car sales might have peaked in Europe, the number of used-car transactions will rise. The main drivers are the growing trend of vehicle leasing and car subscriptions. These business models create more used cars than regular car buying, as holding periods are shorter. For alternative powertrains, leasing is particularly dominant as private buyers are less willing to take on the associated higher asset risks. Moreover, OEMs have started to encourage leasing as it keeps the customer close.

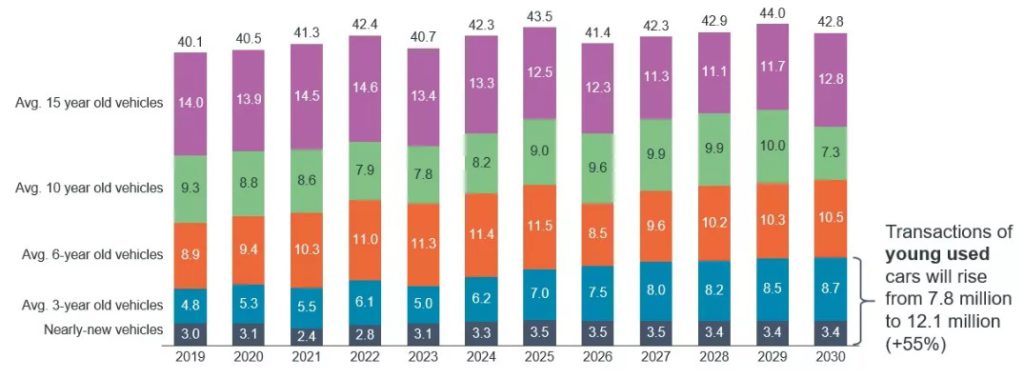

Autovista Group foresees that the number of young used cars will rise over the next decade, a much-needed boost for the dealer sector. These transactions will increase from 7.8 million transactions in Europe in 2019, to 12.1 million transactions in 2030, an increase of 55%.

Figure 1: Used-car transactions Europe + UK 2019-2030, by age group, incl. UK, in million units

Consolidation professionalises dealers

Dealer groups are aware of the growing number of used cars and have adopted a strategy that reflects this. For example, Penske Automotive Group Inc. is bullish on its standalone used-vehicle store strategy and sold almost twice as many retail used cars than retail new cars in Europe. The company announced that Q3 2020 was the most profitable quarter in its history. It has 16 standalone used-vehicle ′supercenters’ in the US and the UK, which saw a rise in revenues of 8%. Expense reduction also contributed to the success.

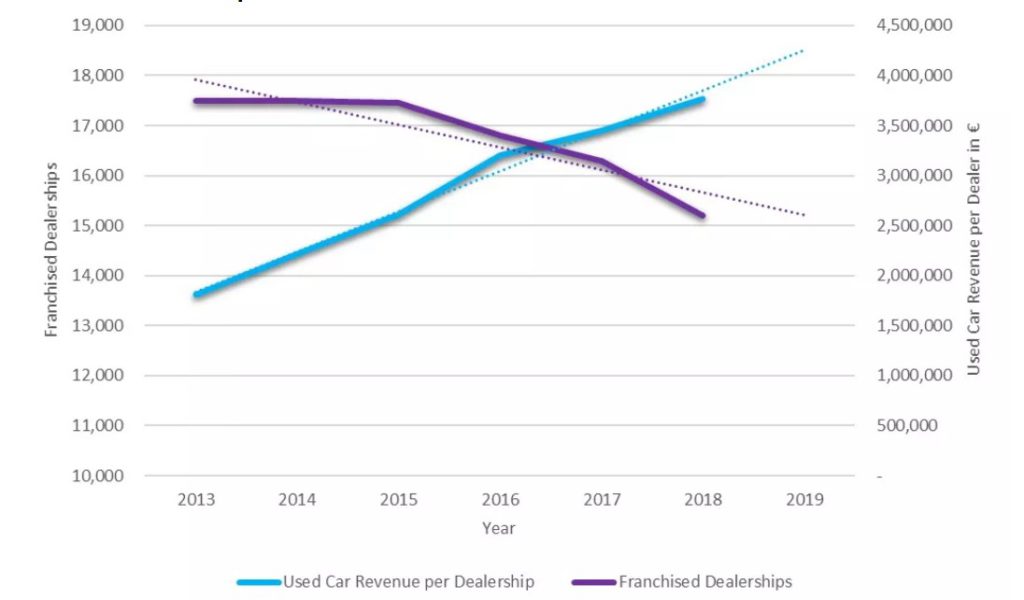

In Germany, the number of franchised dealerships reduced from roughly 17,500 in 2013 to some 15,000 in 2018. At the same time, the used-car revenue per dealer rose from approximately €1,800,000 to €3,750,000 (Figure 2). The value generated therefore rose from €31.5 billion to €56.3 billion.

Figure 2: Number of franchised dealers vs. used-car revenue per dealer in €, 2013-2019

New opportunities

New business opportunities around the automotive megatrends, a different role in new-car sales and professionalised used-car operations represent great opportunities for dealers and dealer groups. Economies of scale will be more important than ever before. It will also be important to make the right investment decisions during these challenging times. The smallest change will likely be a new name for the old-fashioned term ′dealer,’ which many associated with the outdated concept of haggling. There are plenty of options to choose from, e.g. retail specialists, sales agents, sales consultants or service factory. It will be exciting to see how the sector will evolve over the coming years.