Which factors will affect manufacturer profits the most this year?

15 February 2019

15 February 2019

This year could see some manufacturers suffer further profit hits, following a challenging 2018 which has already seen businesses release negative financial results.

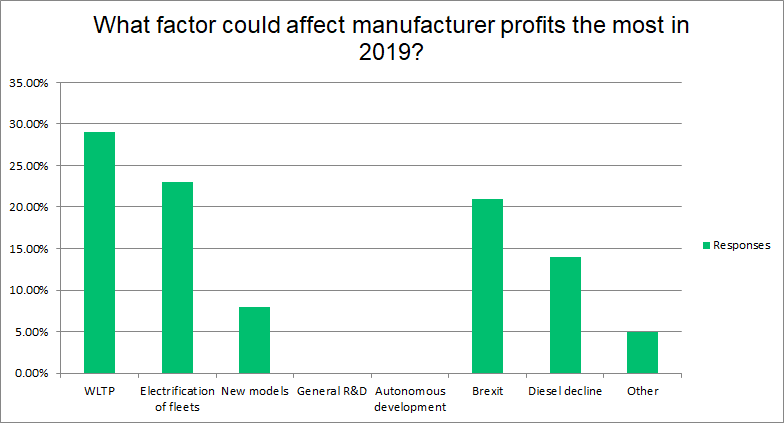

With this in mind, Autovista Group asked readers of its website and Daily News Brief which issue would cause the most problems for manufacturer profits in 2019.

The biggest factor that respondents felt would affect profits in 2019 was WLTP, with 29%. There are further changes to the test this year, with nitrogen oxide (NOx) level checks through the RDE portion of the test being implemented from September, while the process itself will be refined with stricter CO2 limits from 2020 (for type approval) and 2021 (for registrations). This, together with the need to put vehicles through the existing procedure and seek approval for all potential model and option packages before allowing them to go on sale, could still cause problems for carmakers in 2019.

Electrification of fleets (24%) was next and the development of alternative fuel vehicles (AFV) is one area where research and development costs are mounting, especially in conjunction with the CO2 deadline of 2021 looming. EVs and hybrids were once the staples of Japanese manufacturers, with Nissan (EVs) and Toyota (hybrids) leading the way. However, this year sees the launch of numerous AFVs from Audi, Daimler, Porsche, Volkswagen and others, with the Geneva Motor Show expected to be a cavalcade for electric technology. Therefore, the need to spend to ensure models are performing to the best of their ability, together with trying to produce market-leading products, is going to cost money.

Brexit (21%) is also going to cost car manufacturers money and impact financial results throughout the year. With the UK leaving the EU on 29 March, carmakers will incur costs by stockpiling supplies and/or halting production to ensure there are no supply bottlenecks. There could also be the need to invest in production facilities elsewhere. For example, Nissan will likely lose UK government incentives for pulling their X-Trail model from its Sunderland plant.

The diesel decline garnered 14% of the vote as sales of the technology continue to fall. Manufacturers who have invested most in the technology continue to suffer, with Jaguar Land Rover pointing to falling diesel sales as one reason for their recent losses. The fall in diesel is also linked to the increased expenditure on electric vehicles as carmakers need to manage their fleet CO2 levels.

The launch of new models (8%) will also impact sales, with carmakers updating fleets and taking advantage of the need for type approval through WLTP to push new models through to launch before 2020. Many will also be using the time to release electrified versions of their models as 2019 continues.

Finally, 5% of respondents checked the ′other’ box. Comments included ′too optimistic RVs [residual values]’ and ′other environmental pressures’. Another point was the changes in car registrations taxes due to the new emissions testing procedures.