WLTP Countdown: Impact on consumers

18 July 2018

18 July 2018

There is good news and bad news for consumers in the countdown to WLTP in September. The good news is the increased possibility of vehicle discounting before the implementation of WLTP and the availability of cheaper pre-registered cars afterwards. The bad news is that consumers face higher tax liabilities for numerous model variants and delivery times that may extend to months. Whether consumers accept the increased costs and/or delays remains to be seen. There is one certainty though: market shares will be erratic due to the implementation of WLTP.

Autovista Group has noticed that model variants are being withdrawn from sale due to the new WLTP testing regime. In order for new cars to be registered from 1 September, they need to have been homologated under the new WLTP process. In Germany for example, we have calculated that the number of model variants that can now be ordered is about 10% lower than a year ago.

There are three scenarios that explain the temporary – or even permanent – withdrawal from sale of numerous model variants because of the implementation of WLTP:

The usual industry summer shutdown period is expected to be hectic for many manufacturers as numerous models are re-engineered, with the addition of PPF technology for example. This puts additional pressure on OEMs to gain WLTP type approval for all their model variants in time for 1 September at a time when many manufacturers already face difficulty in securing timely WLTP testing slots.

In the first scenario, consumers stand to benefit by being able to negotiate discounts on models that cannot be registered after 1 September. They will also be able to purchase cars that have been pre-registered prior to September as discounted, nearly new models.

In the second scenario, consumers in several markets already face a higher tax liability for most model variants as new NEDC-correlated values (based upon the results of WLTP testing) are typically higher than the figures previously reported under NEDC testing. This is a bigger issue in markets such as Spain and the UK that have tax bands based on CO2 emissions. In Spain, for example, if a vehicle moves into a higher tax band, this can add approximately 4% to the price of the car and so consumers may opt for an alternative.

The increase in liabilities is even greater if tax regimes switch to using WLTP emissions figures, given the higher deviation between WLTP and NEDC figures than between NEDC-correlated and NEDC figures. At the time of writing, however, only Germany and Finland have confirmed that taxes on new cars will be calculated based on WLTP emissions figures – from 1 September in both cases. The additional tax liability is minimal in Germany, typically amounting to no more than €150. The cost implications are significantly higher in Finland though as registration taxes can add up to 50% to the cost of a new vehicle. As CO2 emissions are used to determine the percentage of the list price (including 24% VAT) that is payable as the registration tax, the implementation of WLTP figures will add thousands of Euros to the cost of some model variants.

From a pan-European perspective, the biggest concern for consumers is scenario 3, because countless model variants cannot be registered as they await WLTP homologation. This raises questions as to whether consumers will simply wait for their choice of car to be available or opt for an alternative. This especially affects fleet buyers as their contracts end. Leasing companies have already stopped offering some model variants and end users cannot wait months for their vehicle of choice, unlike private buyers. Company car buyers, therefore, have no choice but to select an alternative model variant, often from another brand. This will clearly have a notable impact on new car market shares in the immediate aftermath of the implementation of WLTP across the EU on 1 September.

The usual industry summer shutdown period is expected to be hectic for many manufacturers as numerous models are re-engineered, with the addition of PPF technology for example. This puts additional pressure on OEMs to gain WLTP type approval for all their model variants in time for 1 September at a time when many manufacturers already face difficulty in securing timely WLTP testing slots.

In the first scenario, consumers stand to benefit by being able to negotiate discounts on models that cannot be registered after 1 September. They will also be able to purchase cars that have been pre-registered prior to September as discounted, nearly new models.

In the second scenario, consumers in several markets already face a higher tax liability for most model variants as new NEDC-correlated values (based upon the results of WLTP testing) are typically higher than the figures previously reported under NEDC testing. This is a bigger issue in markets such as Spain and the UK that have tax bands based on CO2 emissions. In Spain, for example, if a vehicle moves into a higher tax band, this can add approximately 4% to the price of the car and so consumers may opt for an alternative.

The increase in liabilities is even greater if tax regimes switch to using WLTP emissions figures, given the higher deviation between WLTP and NEDC figures than between NEDC-correlated and NEDC figures. At the time of writing, however, only Germany and Finland have confirmed that taxes on new cars will be calculated based on WLTP emissions figures – from 1 September in both cases. The additional tax liability is minimal in Germany, typically amounting to no more than €150. The cost implications are significantly higher in Finland though as registration taxes can add up to 50% to the cost of a new vehicle. As CO2 emissions are used to determine the percentage of the list price (including 24% VAT) that is payable as the registration tax, the implementation of WLTP figures will add thousands of Euros to the cost of some model variants.

From a pan-European perspective, the biggest concern for consumers is scenario 3, because countless model variants cannot be registered as they await WLTP homologation. This raises questions as to whether consumers will simply wait for their choice of car to be available or opt for an alternative. This especially affects fleet buyers as their contracts end. Leasing companies have already stopped offering some model variants and end users cannot wait months for their vehicle of choice, unlike private buyers. Company car buyers, therefore, have no choice but to select an alternative model variant, often from another brand. This will clearly have a notable impact on new car market shares in the immediate aftermath of the implementation of WLTP across the EU on 1 September.

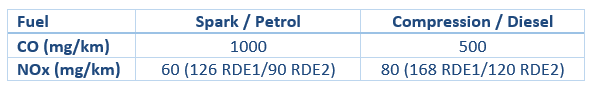

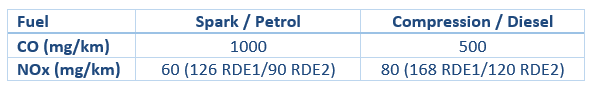

- The model variant has failed to meet the emissions limits of Euro 6 during the WLTP test. CO2 emissions are already proving to be higher under WLTP than under the outgoing NEDC process, but there is also a ceiling limit to carbon monoxide (CO) and nitrogen oxide (NOx) emissions (see Table below). If these limits are exceeded, the car cannot be registered after 1 September and will be withdrawn from sale. This could either be a permanent measure or just applied temporarily while a technical solution is effected, such as fitting a petrol particulate filter (PPF) or selective catalytic reduction (SCR). Once the reengineered vehicle meets Euro 6 standard under the WLTP type approval process, it may be reintroduced.

- The model variant has emissions levels that subject it to a higher tax burden in some markets. In this case, too, the car may be withdrawn from sale – either permanently or until a technical solution is effected that satisfactorily improves the vehicle’s emissions under the WLTP type approval process.

- The model variant has simply not undergone WLTP testing yet. In this case, the vehicle cannot be registered from 1 September – derogation aside – until it has gained WLTP type approval. Given the lag between cars being ordered and registered, the model is being withdrawn from sale already and may not be reintroduced until it has gained WLTP type approval.

The usual industry summer shutdown period is expected to be hectic for many manufacturers as numerous models are re-engineered, with the addition of PPF technology for example. This puts additional pressure on OEMs to gain WLTP type approval for all their model variants in time for 1 September at a time when many manufacturers already face difficulty in securing timely WLTP testing slots.

In the first scenario, consumers stand to benefit by being able to negotiate discounts on models that cannot be registered after 1 September. They will also be able to purchase cars that have been pre-registered prior to September as discounted, nearly new models.

In the second scenario, consumers in several markets already face a higher tax liability for most model variants as new NEDC-correlated values (based upon the results of WLTP testing) are typically higher than the figures previously reported under NEDC testing. This is a bigger issue in markets such as Spain and the UK that have tax bands based on CO2 emissions. In Spain, for example, if a vehicle moves into a higher tax band, this can add approximately 4% to the price of the car and so consumers may opt for an alternative.

The increase in liabilities is even greater if tax regimes switch to using WLTP emissions figures, given the higher deviation between WLTP and NEDC figures than between NEDC-correlated and NEDC figures. At the time of writing, however, only Germany and Finland have confirmed that taxes on new cars will be calculated based on WLTP emissions figures – from 1 September in both cases. The additional tax liability is minimal in Germany, typically amounting to no more than €150. The cost implications are significantly higher in Finland though as registration taxes can add up to 50% to the cost of a new vehicle. As CO2 emissions are used to determine the percentage of the list price (including 24% VAT) that is payable as the registration tax, the implementation of WLTP figures will add thousands of Euros to the cost of some model variants.

From a pan-European perspective, the biggest concern for consumers is scenario 3, because countless model variants cannot be registered as they await WLTP homologation. This raises questions as to whether consumers will simply wait for their choice of car to be available or opt for an alternative. This especially affects fleet buyers as their contracts end. Leasing companies have already stopped offering some model variants and end users cannot wait months for their vehicle of choice, unlike private buyers. Company car buyers, therefore, have no choice but to select an alternative model variant, often from another brand. This will clearly have a notable impact on new car market shares in the immediate aftermath of the implementation of WLTP across the EU on 1 September.

The usual industry summer shutdown period is expected to be hectic for many manufacturers as numerous models are re-engineered, with the addition of PPF technology for example. This puts additional pressure on OEMs to gain WLTP type approval for all their model variants in time for 1 September at a time when many manufacturers already face difficulty in securing timely WLTP testing slots.

In the first scenario, consumers stand to benefit by being able to negotiate discounts on models that cannot be registered after 1 September. They will also be able to purchase cars that have been pre-registered prior to September as discounted, nearly new models.

In the second scenario, consumers in several markets already face a higher tax liability for most model variants as new NEDC-correlated values (based upon the results of WLTP testing) are typically higher than the figures previously reported under NEDC testing. This is a bigger issue in markets such as Spain and the UK that have tax bands based on CO2 emissions. In Spain, for example, if a vehicle moves into a higher tax band, this can add approximately 4% to the price of the car and so consumers may opt for an alternative.

The increase in liabilities is even greater if tax regimes switch to using WLTP emissions figures, given the higher deviation between WLTP and NEDC figures than between NEDC-correlated and NEDC figures. At the time of writing, however, only Germany and Finland have confirmed that taxes on new cars will be calculated based on WLTP emissions figures – from 1 September in both cases. The additional tax liability is minimal in Germany, typically amounting to no more than €150. The cost implications are significantly higher in Finland though as registration taxes can add up to 50% to the cost of a new vehicle. As CO2 emissions are used to determine the percentage of the list price (including 24% VAT) that is payable as the registration tax, the implementation of WLTP figures will add thousands of Euros to the cost of some model variants.

From a pan-European perspective, the biggest concern for consumers is scenario 3, because countless model variants cannot be registered as they await WLTP homologation. This raises questions as to whether consumers will simply wait for their choice of car to be available or opt for an alternative. This especially affects fleet buyers as their contracts end. Leasing companies have already stopped offering some model variants and end users cannot wait months for their vehicle of choice, unlike private buyers. Company car buyers, therefore, have no choice but to select an alternative model variant, often from another brand. This will clearly have a notable impact on new car market shares in the immediate aftermath of the implementation of WLTP across the EU on 1 September.