WLTP Countdown: Impact on taxation

25 July 2018

25 July 2018

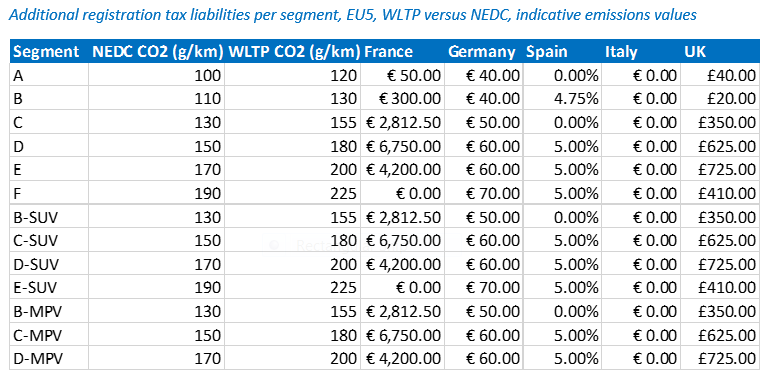

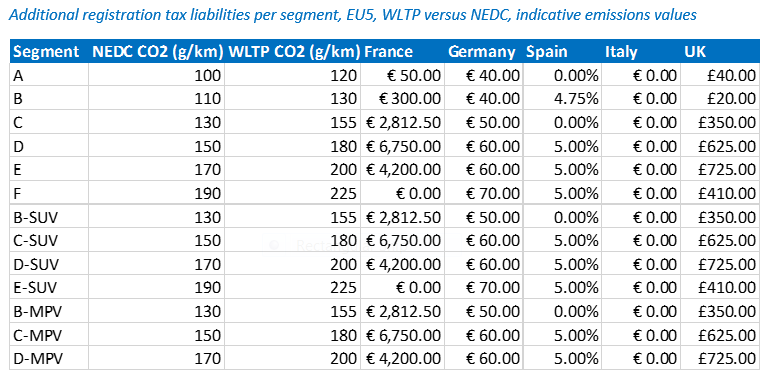

Many cars are subject to higher registration taxes in certain markets as their new NEDC-correlated values (based upon the results of WLTP testing) are typically higher than the figures previously reported under NEDC testing. The increase in tax liabilities will be greater if tax regimes switch to using WLTP emissions figures, given the higher deviation between WLTP and NEDC figures than between NEDC-correlated and NEDC figures. Autovista Group has conducted analysis that highlights the additional taxes that will be levied on new cars in the EU5 markets if they were to simply switch to using WLTP emissions figures.

As previously reported, only Germany and Finland have confirmed that taxes on new cars will be calculated based on WLTP emissions figures – from 1 September in both cases. The additional tax liability is minimal in Germany as only €2 is payable for each g/km of CO2 over 95g/km. If a car emits 20g/km more CO2 under WLTP testing than under NEDC, it will only be subject to an extra €40 in registration tax. The cost implications are significantly higher in Finland though as registration taxes can add up to 50% to the cost of a new vehicle. As CO2 emissions are used to determine the percentage of the list price (including 24% VAT) that is payable as the registration tax, the simple implementation of WLTP figures would add thousands of Euros to the cost of some model variants. Finland has therefore introduced a lower tax table to calculate the registration tax of WLTP approved cars and vans from 1 September.

With this in mind, Autovista Group has calculated the additional tax implications in the other EU5 markets if they were to follow the lead of Germany and switch to using WLTP emissions figures to calculate registration tax without amending their tax regimes. First, representative NEDC and WLTP emissions figures have been assigned to each segment. Second, the registration tax rate has been calculated based on both the NEDC and WLTP figures. Finally, the difference between the two tax liabilities has been calculated to indicate the additional tax liability per segment in each of the EU5 markets.

As discussed above, the additional tax liability in Germany is negligible. This explains why Germany could easily adapt their existing tax regime to use WLTP figures already from 1 September. This approach will naturally generate additional tax income for Germany but with limited impact on consumers. Moreover, it presents Germany in a favourable light as they will already be calculating registration taxes on new cars based on the more accurate WLTP regime.

Italy’s new car registration taxes are based on the output (measured in kilowatts), the difference between NEDC and WLTP emissions figures will not impact taxation. In fact, the tax liability may even be lower for some cars as the addition of a petrol particulate slightly reduces the power output. Italy could therefore easily follow Germany’s lead, but the same cannot be said for the other EU5 markets.

In the UK, the vehicle excise duty (VED) payable in the first year of registration would not change significantly for smaller cars in the A and B segments (and environmentally-friendly variants of larger cars). However, the additional VED liability in the first year of registration could amount to an additional £725 (€817). This is the calculation based on an executive car in the E segment (or a D-SUV or D-MPV), which has NEDC CO2 emissions of 170g/km but 200g/gm under the new WLTP test. Additional VED would be payable in subsequent years of ownership, but in most cases, the additional cost to a UK new car buyer over the vehicle’s life cycle would not exceed £1000 (€1130).

In Spain, registration taxes are structured by CO2 emissions bands of ≤120g/km, >120-<160g/km, ≥160-<200g/km and ≥200g/km. Some model variants have already moved into a higher tax band as a result of the new NEDC-correlated emissions figures, but significantly more variants would be affected if Spain adopted WLTP emissions figures to calculate the tax rate. For example, a car which has CO2 emissions equal to or less than 120g currently pays no tax. However, most cars between 100g and 120g CO2/km under NEDC testing have figures in excess of 120g under WLTP testing. There is speculation that Spain may introduce a WLTP-based tax system from January as all cars have to publish WLTP emissions figures from that date. If this is the case, many cars which are currently not subject to tax would be taxed at a rate of 4.75% of their price. Similarly, cars which move from the >120-<160g/km band to the ≥160-<200g/km band or from the ≥160-<200g/km to the ≥200g/km band would be subject to an additional 5% of their price in registration taxes.

The biggest impact on registration taxes in the EU5 if WLTP emissions figures were to be used is in France. New car buyers pay an increasingly punitive ′malus’ penalty tax dependent on the official emissions figures. This ranges from €50 for a car which emits 120g CO2/km to a maximum of €10,500 for cars which emit 185g CO2/km or more. Yoann Taitz, Valuations and Operations Director at Autovista France, has previously commented: ′An owner of a car having a CO2 that has increased from 120g to 130g will see his 50€ malus now increase to 300€. There would probably not be any potential consequences for discounting or tactical registrations in this scenario. Now, let’s consider an MPV having a CO2 increase from 120g to 140g. From a 50€ malus, the owner would now face a malus of 1050€. This is significant. The customer could review his priorities and may choose instead to buy a recent used car in order to avoid paying the malus. This will obviously hurt the OEMs if they fail to hit their new car targets, and they may be tempted to offer a 1000€ discount. However, this is very variable from one situation to another.’

This is already an issue with the switch from NEDC to NEDC-correlated figures in France but would be even more pronounced if the country adopted WLTP figures. For example, a car which has a current CO2 reading of 150 g/km under NEDC but 180g/km under WLTP would be subject to an additional €6750 in registration taxes. Admittedly, the increase for cars with lower emissions would be negligible but, rather worryingly, there would be no additional tax penalty for cars which already have reported CO2 emissions over 185g/km.

For these reasons, it is not expected that the governments of most European markets will follow the lead of Germany and Finland and introduce WLTP-based tax regimes in the near future. Certainly not without at least considering the deviation from NEDC to WLTP figures and adjusting the tax bands (in UK and Spain) or the emissions level from which a tax penalty is payable (in France).

As discussed above, the additional tax liability in Germany is negligible. This explains why Germany could easily adapt their existing tax regime to use WLTP figures already from 1 September. This approach will naturally generate additional tax income for Germany but with limited impact on consumers. Moreover, it presents Germany in a favourable light as they will already be calculating registration taxes on new cars based on the more accurate WLTP regime.

Italy’s new car registration taxes are based on the output (measured in kilowatts), the difference between NEDC and WLTP emissions figures will not impact taxation. In fact, the tax liability may even be lower for some cars as the addition of a petrol particulate slightly reduces the power output. Italy could therefore easily follow Germany’s lead, but the same cannot be said for the other EU5 markets.

In the UK, the vehicle excise duty (VED) payable in the first year of registration would not change significantly for smaller cars in the A and B segments (and environmentally-friendly variants of larger cars). However, the additional VED liability in the first year of registration could amount to an additional £725 (€817). This is the calculation based on an executive car in the E segment (or a D-SUV or D-MPV), which has NEDC CO2 emissions of 170g/km but 200g/gm under the new WLTP test. Additional VED would be payable in subsequent years of ownership, but in most cases, the additional cost to a UK new car buyer over the vehicle’s life cycle would not exceed £1000 (€1130).

In Spain, registration taxes are structured by CO2 emissions bands of ≤120g/km, >120-<160g/km, ≥160-<200g/km and ≥200g/km. Some model variants have already moved into a higher tax band as a result of the new NEDC-correlated emissions figures, but significantly more variants would be affected if Spain adopted WLTP emissions figures to calculate the tax rate. For example, a car which has CO2 emissions equal to or less than 120g currently pays no tax. However, most cars between 100g and 120g CO2/km under NEDC testing have figures in excess of 120g under WLTP testing. There is speculation that Spain may introduce a WLTP-based tax system from January as all cars have to publish WLTP emissions figures from that date. If this is the case, many cars which are currently not subject to tax would be taxed at a rate of 4.75% of their price. Similarly, cars which move from the >120-<160g/km band to the ≥160-<200g/km band or from the ≥160-<200g/km to the ≥200g/km band would be subject to an additional 5% of their price in registration taxes.

The biggest impact on registration taxes in the EU5 if WLTP emissions figures were to be used is in France. New car buyers pay an increasingly punitive ′malus’ penalty tax dependent on the official emissions figures. This ranges from €50 for a car which emits 120g CO2/km to a maximum of €10,500 for cars which emit 185g CO2/km or more. Yoann Taitz, Valuations and Operations Director at Autovista France, has previously commented: ′An owner of a car having a CO2 that has increased from 120g to 130g will see his 50€ malus now increase to 300€. There would probably not be any potential consequences for discounting or tactical registrations in this scenario. Now, let’s consider an MPV having a CO2 increase from 120g to 140g. From a 50€ malus, the owner would now face a malus of 1050€. This is significant. The customer could review his priorities and may choose instead to buy a recent used car in order to avoid paying the malus. This will obviously hurt the OEMs if they fail to hit their new car targets, and they may be tempted to offer a 1000€ discount. However, this is very variable from one situation to another.’

This is already an issue with the switch from NEDC to NEDC-correlated figures in France but would be even more pronounced if the country adopted WLTP figures. For example, a car which has a current CO2 reading of 150 g/km under NEDC but 180g/km under WLTP would be subject to an additional €6750 in registration taxes. Admittedly, the increase for cars with lower emissions would be negligible but, rather worryingly, there would be no additional tax penalty for cars which already have reported CO2 emissions over 185g/km.

For these reasons, it is not expected that the governments of most European markets will follow the lead of Germany and Finland and introduce WLTP-based tax regimes in the near future. Certainly not without at least considering the deviation from NEDC to WLTP figures and adjusting the tax bands (in UK and Spain) or the emissions level from which a tax penalty is payable (in France).

As discussed above, the additional tax liability in Germany is negligible. This explains why Germany could easily adapt their existing tax regime to use WLTP figures already from 1 September. This approach will naturally generate additional tax income for Germany but with limited impact on consumers. Moreover, it presents Germany in a favourable light as they will already be calculating registration taxes on new cars based on the more accurate WLTP regime.

Italy’s new car registration taxes are based on the output (measured in kilowatts), the difference between NEDC and WLTP emissions figures will not impact taxation. In fact, the tax liability may even be lower for some cars as the addition of a petrol particulate slightly reduces the power output. Italy could therefore easily follow Germany’s lead, but the same cannot be said for the other EU5 markets.

In the UK, the vehicle excise duty (VED) payable in the first year of registration would not change significantly for smaller cars in the A and B segments (and environmentally-friendly variants of larger cars). However, the additional VED liability in the first year of registration could amount to an additional £725 (€817). This is the calculation based on an executive car in the E segment (or a D-SUV or D-MPV), which has NEDC CO2 emissions of 170g/km but 200g/gm under the new WLTP test. Additional VED would be payable in subsequent years of ownership, but in most cases, the additional cost to a UK new car buyer over the vehicle’s life cycle would not exceed £1000 (€1130).

In Spain, registration taxes are structured by CO2 emissions bands of ≤120g/km, >120-<160g/km, ≥160-<200g/km and ≥200g/km. Some model variants have already moved into a higher tax band as a result of the new NEDC-correlated emissions figures, but significantly more variants would be affected if Spain adopted WLTP emissions figures to calculate the tax rate. For example, a car which has CO2 emissions equal to or less than 120g currently pays no tax. However, most cars between 100g and 120g CO2/km under NEDC testing have figures in excess of 120g under WLTP testing. There is speculation that Spain may introduce a WLTP-based tax system from January as all cars have to publish WLTP emissions figures from that date. If this is the case, many cars which are currently not subject to tax would be taxed at a rate of 4.75% of their price. Similarly, cars which move from the >120-<160g/km band to the ≥160-<200g/km band or from the ≥160-<200g/km to the ≥200g/km band would be subject to an additional 5% of their price in registration taxes.

The biggest impact on registration taxes in the EU5 if WLTP emissions figures were to be used is in France. New car buyers pay an increasingly punitive ′malus’ penalty tax dependent on the official emissions figures. This ranges from €50 for a car which emits 120g CO2/km to a maximum of €10,500 for cars which emit 185g CO2/km or more. Yoann Taitz, Valuations and Operations Director at Autovista France, has previously commented: ′An owner of a car having a CO2 that has increased from 120g to 130g will see his 50€ malus now increase to 300€. There would probably not be any potential consequences for discounting or tactical registrations in this scenario. Now, let’s consider an MPV having a CO2 increase from 120g to 140g. From a 50€ malus, the owner would now face a malus of 1050€. This is significant. The customer could review his priorities and may choose instead to buy a recent used car in order to avoid paying the malus. This will obviously hurt the OEMs if they fail to hit their new car targets, and they may be tempted to offer a 1000€ discount. However, this is very variable from one situation to another.’

This is already an issue with the switch from NEDC to NEDC-correlated figures in France but would be even more pronounced if the country adopted WLTP figures. For example, a car which has a current CO2 reading of 150 g/km under NEDC but 180g/km under WLTP would be subject to an additional €6750 in registration taxes. Admittedly, the increase for cars with lower emissions would be negligible but, rather worryingly, there would be no additional tax penalty for cars which already have reported CO2 emissions over 185g/km.

For these reasons, it is not expected that the governments of most European markets will follow the lead of Germany and Finland and introduce WLTP-based tax regimes in the near future. Certainly not without at least considering the deviation from NEDC to WLTP figures and adjusting the tax bands (in UK and Spain) or the emissions level from which a tax penalty is payable (in France).

As discussed above, the additional tax liability in Germany is negligible. This explains why Germany could easily adapt their existing tax regime to use WLTP figures already from 1 September. This approach will naturally generate additional tax income for Germany but with limited impact on consumers. Moreover, it presents Germany in a favourable light as they will already be calculating registration taxes on new cars based on the more accurate WLTP regime.

Italy’s new car registration taxes are based on the output (measured in kilowatts), the difference between NEDC and WLTP emissions figures will not impact taxation. In fact, the tax liability may even be lower for some cars as the addition of a petrol particulate slightly reduces the power output. Italy could therefore easily follow Germany’s lead, but the same cannot be said for the other EU5 markets.

In the UK, the vehicle excise duty (VED) payable in the first year of registration would not change significantly for smaller cars in the A and B segments (and environmentally-friendly variants of larger cars). However, the additional VED liability in the first year of registration could amount to an additional £725 (€817). This is the calculation based on an executive car in the E segment (or a D-SUV or D-MPV), which has NEDC CO2 emissions of 170g/km but 200g/gm under the new WLTP test. Additional VED would be payable in subsequent years of ownership, but in most cases, the additional cost to a UK new car buyer over the vehicle’s life cycle would not exceed £1000 (€1130).

In Spain, registration taxes are structured by CO2 emissions bands of ≤120g/km, >120-<160g/km, ≥160-<200g/km and ≥200g/km. Some model variants have already moved into a higher tax band as a result of the new NEDC-correlated emissions figures, but significantly more variants would be affected if Spain adopted WLTP emissions figures to calculate the tax rate. For example, a car which has CO2 emissions equal to or less than 120g currently pays no tax. However, most cars between 100g and 120g CO2/km under NEDC testing have figures in excess of 120g under WLTP testing. There is speculation that Spain may introduce a WLTP-based tax system from January as all cars have to publish WLTP emissions figures from that date. If this is the case, many cars which are currently not subject to tax would be taxed at a rate of 4.75% of their price. Similarly, cars which move from the >120-<160g/km band to the ≥160-<200g/km band or from the ≥160-<200g/km to the ≥200g/km band would be subject to an additional 5% of their price in registration taxes.

The biggest impact on registration taxes in the EU5 if WLTP emissions figures were to be used is in France. New car buyers pay an increasingly punitive ′malus’ penalty tax dependent on the official emissions figures. This ranges from €50 for a car which emits 120g CO2/km to a maximum of €10,500 for cars which emit 185g CO2/km or more. Yoann Taitz, Valuations and Operations Director at Autovista France, has previously commented: ′An owner of a car having a CO2 that has increased from 120g to 130g will see his 50€ malus now increase to 300€. There would probably not be any potential consequences for discounting or tactical registrations in this scenario. Now, let’s consider an MPV having a CO2 increase from 120g to 140g. From a 50€ malus, the owner would now face a malus of 1050€. This is significant. The customer could review his priorities and may choose instead to buy a recent used car in order to avoid paying the malus. This will obviously hurt the OEMs if they fail to hit their new car targets, and they may be tempted to offer a 1000€ discount. However, this is very variable from one situation to another.’

This is already an issue with the switch from NEDC to NEDC-correlated figures in France but would be even more pronounced if the country adopted WLTP figures. For example, a car which has a current CO2 reading of 150 g/km under NEDC but 180g/km under WLTP would be subject to an additional €6750 in registration taxes. Admittedly, the increase for cars with lower emissions would be negligible but, rather worryingly, there would be no additional tax penalty for cars which already have reported CO2 emissions over 185g/km.

For these reasons, it is not expected that the governments of most European markets will follow the lead of Germany and Finland and introduce WLTP-based tax regimes in the near future. Certainly not without at least considering the deviation from NEDC to WLTP figures and adjusting the tax bands (in UK and Spain) or the emissions level from which a tax penalty is payable (in France).