EU new-car registrations tumble 19% in August

17 September 2020

17 September 2020

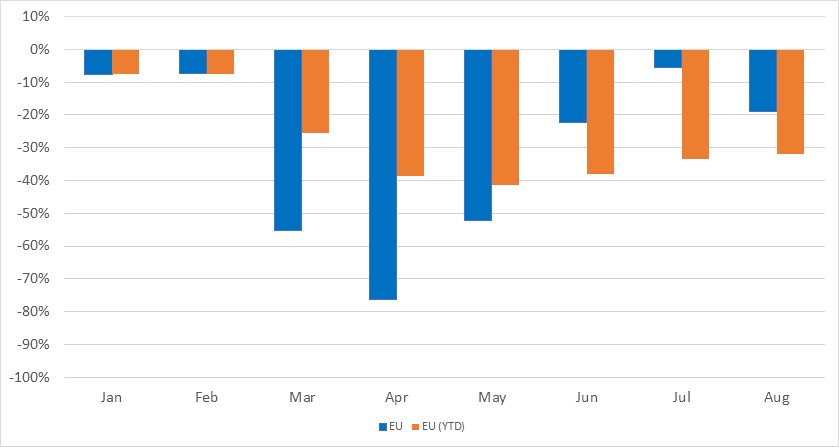

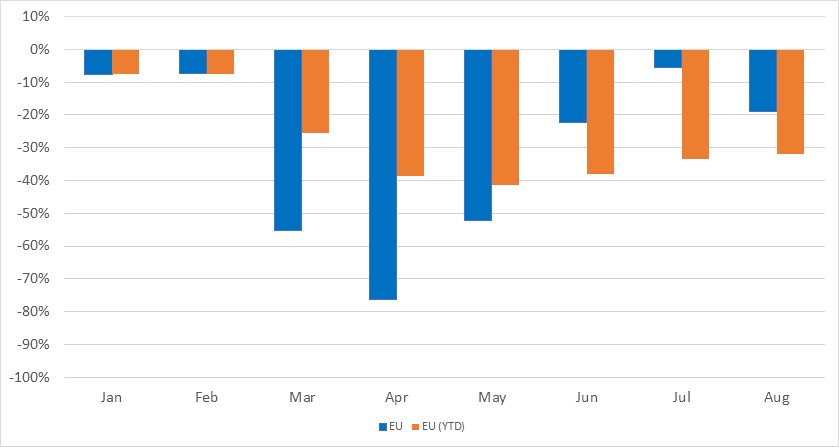

New-car registrations in the EU tumbled 18.9% year-on-year in August, according to figures released by the European Automobile Manufacturers’ Association (ACEA). The volume of new-car registrations fell from 949,034 units in August 2019 to 769,525 in August 2020. This marks the first deterioration in the monthly year-on-year figures since April, following a market contraction of 5.7% in July. Nevertheless, the decline is a significant improvement on the dramatic downturns of 55% in March, 76% in April and 52% in May.

EU new-car registrations, year-on-year percentage change, January to August 2020 and year-to-date

Source: ACEA

All 27 EU new-car markets contracted last month – apart from Cyprus, which enjoyed a 14.1% surge.

In Italy, the modest downturn in August was the fourth consecutive month of improvement in the fortunes of the new-car market. Nevertheless, the decline occurred despite the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). Italian new-car registrations were 11% lower in July than in the same month last year. A key factor in Italy’s July decline is that consumers decided to hold off until the new government incentives kicked in.

Reversal of fortune

The contractions in the other major European markets followed three months of improving fortunes as Europe emerged from coronavirus (COVID-19) lockdowns. This was not a complete surprise in France, however. Whereas the incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

In Spain, 66,925 new cars were registered in August 2020, 10.1% fewer than in August 2019. ′The month, which had started with a positive rhythm, saw its sales progressively decrease and it has not allowed the good recovery data of July to be consolidated. August is always a month of lower sales, due to the holiday period, but this atypical year is also influenced by uncertainty due to the health and economic evolution of the coronavirus pandemic,’ ANFAC, the Spanish vehicle manufacturers’ association, commented.

The biggest decline in the four major continental markets was in Germany, where new-car registrations fell by 20% in August, compared to the same month in 2019. This also meant a return to the double-digit declines suffered in Germany between February and June. In July, new-car registrations fell by only 5.4% year-on-year, buoyed by the increased incentives (from €6,000 to €9,000) for BEVs and PHEVs introduced at the start of the month. However, the majority of cars are not benefitting from the stimulus, hence the downturn.

In the smaller EU member states, year-on-year contractions of more than 30% were reported in eight markets, including Austria, Czech Republic and Hungary. However, some markets were far more resilient, with downturns of less than 10% reported in five markets, including Denmark, Ireland and Portugal.

Containing the fallout

In the first eight months of 2020, registrations of new cars in the EU fell by 32% as the weaker August figures were still an improvement on the 33.5% contraction suffered in the first seven months of the year. The greatest loss among the major EU markets was in Spain, which has contracted by 40.6% in the year-to-date, ahead of only Croatia (down 47.4%) and Portugal (down 42.0%).

As dealer activity has returned in EU markets and pent-up demand is ultimately satisfied, the economic fallout of COVID-19 will broadly dictate whether markets return to pre-crisis levels. The key to recovery therefore revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. Clarity on the allocation of aid resources provided by the European Recovery Fund, agreed on 21 July, will therefore also play a pivotal role in shaping the forward outlook for Europe’s new-car markets.

As the pandemic evolves, there are positive and negative impacts to consider, such as an aversion to public transport and increased working from home. And the threat of a second wave of COVID-19 infections and accompanying lockdowns cannot be ruled out.

Manufacturer performance

Among the leading European carmakers, Daimler, Jaguar Land Rover (JLR), Renault, PSA Group and Volkswagen Group all registered more than 20% fewer new cars in the EU in August 2020 than in August 2019. Mitsubishi suffered the greatest loss, with EU registrations down 38.5% year-on-year.

BMW Group and Hyundai, however, managed to register 6.8% and 1.9% more cars respectively in the EU than in August 2019. Fiat Chrysler Automobiles (FCA), Toyota and Volvo also performed comparatively well, only suffering single-digit declines in the month. FCA’s registrations were down 6.6%, buoyed by the stable demand in Italy.

Across Europe, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market.

Source: ACEA

All 27 EU new-car markets contracted last month – apart from Cyprus, which enjoyed a 14.1% surge.

In Italy, the modest downturn in August was the fourth consecutive month of improvement in the fortunes of the new-car market. Nevertheless, the decline occurred despite the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). Italian new-car registrations were 11% lower in July than in the same month last year. A key factor in Italy’s July decline is that consumers decided to hold off until the new government incentives kicked in.

Reversal of fortune

The contractions in the other major European markets followed three months of improving fortunes as Europe emerged from coronavirus (COVID-19) lockdowns. This was not a complete surprise in France, however. Whereas the incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

In Spain, 66,925 new cars were registered in August 2020, 10.1% fewer than in August 2019. ′The month, which had started with a positive rhythm, saw its sales progressively decrease and it has not allowed the good recovery data of July to be consolidated. August is always a month of lower sales, due to the holiday period, but this atypical year is also influenced by uncertainty due to the health and economic evolution of the coronavirus pandemic,’ ANFAC, the Spanish vehicle manufacturers’ association, commented.

The biggest decline in the four major continental markets was in Germany, where new-car registrations fell by 20% in August, compared to the same month in 2019. This also meant a return to the double-digit declines suffered in Germany between February and June. In July, new-car registrations fell by only 5.4% year-on-year, buoyed by the increased incentives (from €6,000 to €9,000) for BEVs and PHEVs introduced at the start of the month. However, the majority of cars are not benefitting from the stimulus, hence the downturn.

In the smaller EU member states, year-on-year contractions of more than 30% were reported in eight markets, including Austria, Czech Republic and Hungary. However, some markets were far more resilient, with downturns of less than 10% reported in five markets, including Denmark, Ireland and Portugal.

Containing the fallout

In the first eight months of 2020, registrations of new cars in the EU fell by 32% as the weaker August figures were still an improvement on the 33.5% contraction suffered in the first seven months of the year. The greatest loss among the major EU markets was in Spain, which has contracted by 40.6% in the year-to-date, ahead of only Croatia (down 47.4%) and Portugal (down 42.0%).

As dealer activity has returned in EU markets and pent-up demand is ultimately satisfied, the economic fallout of COVID-19 will broadly dictate whether markets return to pre-crisis levels. The key to recovery therefore revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. Clarity on the allocation of aid resources provided by the European Recovery Fund, agreed on 21 July, will therefore also play a pivotal role in shaping the forward outlook for Europe’s new-car markets.

As the pandemic evolves, there are positive and negative impacts to consider, such as an aversion to public transport and increased working from home. And the threat of a second wave of COVID-19 infections and accompanying lockdowns cannot be ruled out.

Manufacturer performance

Among the leading European carmakers, Daimler, Jaguar Land Rover (JLR), Renault, PSA Group and Volkswagen Group all registered more than 20% fewer new cars in the EU in August 2020 than in August 2019. Mitsubishi suffered the greatest loss, with EU registrations down 38.5% year-on-year.

BMW Group and Hyundai, however, managed to register 6.8% and 1.9% more cars respectively in the EU than in August 2019. Fiat Chrysler Automobiles (FCA), Toyota and Volvo also performed comparatively well, only suffering single-digit declines in the month. FCA’s registrations were down 6.6%, buoyed by the stable demand in Italy.

Across Europe, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market.

Source: ACEA

All 27 EU new-car markets contracted last month – apart from Cyprus, which enjoyed a 14.1% surge.

In Italy, the modest downturn in August was the fourth consecutive month of improvement in the fortunes of the new-car market. Nevertheless, the decline occurred despite the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). Italian new-car registrations were 11% lower in July than in the same month last year. A key factor in Italy’s July decline is that consumers decided to hold off until the new government incentives kicked in.

Reversal of fortune

The contractions in the other major European markets followed three months of improving fortunes as Europe emerged from coronavirus (COVID-19) lockdowns. This was not a complete surprise in France, however. Whereas the incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

In Spain, 66,925 new cars were registered in August 2020, 10.1% fewer than in August 2019. ′The month, which had started with a positive rhythm, saw its sales progressively decrease and it has not allowed the good recovery data of July to be consolidated. August is always a month of lower sales, due to the holiday period, but this atypical year is also influenced by uncertainty due to the health and economic evolution of the coronavirus pandemic,’ ANFAC, the Spanish vehicle manufacturers’ association, commented.

The biggest decline in the four major continental markets was in Germany, where new-car registrations fell by 20% in August, compared to the same month in 2019. This also meant a return to the double-digit declines suffered in Germany between February and June. In July, new-car registrations fell by only 5.4% year-on-year, buoyed by the increased incentives (from €6,000 to €9,000) for BEVs and PHEVs introduced at the start of the month. However, the majority of cars are not benefitting from the stimulus, hence the downturn.

In the smaller EU member states, year-on-year contractions of more than 30% were reported in eight markets, including Austria, Czech Republic and Hungary. However, some markets were far more resilient, with downturns of less than 10% reported in five markets, including Denmark, Ireland and Portugal.

Containing the fallout

In the first eight months of 2020, registrations of new cars in the EU fell by 32% as the weaker August figures were still an improvement on the 33.5% contraction suffered in the first seven months of the year. The greatest loss among the major EU markets was in Spain, which has contracted by 40.6% in the year-to-date, ahead of only Croatia (down 47.4%) and Portugal (down 42.0%).

As dealer activity has returned in EU markets and pent-up demand is ultimately satisfied, the economic fallout of COVID-19 will broadly dictate whether markets return to pre-crisis levels. The key to recovery therefore revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. Clarity on the allocation of aid resources provided by the European Recovery Fund, agreed on 21 July, will therefore also play a pivotal role in shaping the forward outlook for Europe’s new-car markets.

As the pandemic evolves, there are positive and negative impacts to consider, such as an aversion to public transport and increased working from home. And the threat of a second wave of COVID-19 infections and accompanying lockdowns cannot be ruled out.

Manufacturer performance

Among the leading European carmakers, Daimler, Jaguar Land Rover (JLR), Renault, PSA Group and Volkswagen Group all registered more than 20% fewer new cars in the EU in August 2020 than in August 2019. Mitsubishi suffered the greatest loss, with EU registrations down 38.5% year-on-year.

BMW Group and Hyundai, however, managed to register 6.8% and 1.9% more cars respectively in the EU than in August 2019. Fiat Chrysler Automobiles (FCA), Toyota and Volvo also performed comparatively well, only suffering single-digit declines in the month. FCA’s registrations were down 6.6%, buoyed by the stable demand in Italy.

Across Europe, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market.

Source: ACEA

All 27 EU new-car markets contracted last month – apart from Cyprus, which enjoyed a 14.1% surge.

In Italy, the modest downturn in August was the fourth consecutive month of improvement in the fortunes of the new-car market. Nevertheless, the decline occurred despite the new government incentives that came into effect at the beginning of August as part of the Decreto Rilancio (Relaunch Decree). Italian new-car registrations were 11% lower in July than in the same month last year. A key factor in Italy’s July decline is that consumers decided to hold off until the new government incentives kicked in.

Reversal of fortune

The contractions in the other major European markets followed three months of improving fortunes as Europe emerged from coronavirus (COVID-19) lockdowns. This was not a complete surprise in France, however. Whereas the incentives introduced on 1 June for new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) remain, the additional bonus for trading in older cars for cleaner new and used cars was exhausted before the end of July. The scrappage scheme reached its 200,000-vehicle cap after just two months, although the Ministry of Ecological Transition did announce the replacement of the recovery scheme with a conversion bonus, which has been in effect since 3 August.

In Spain, 66,925 new cars were registered in August 2020, 10.1% fewer than in August 2019. ′The month, which had started with a positive rhythm, saw its sales progressively decrease and it has not allowed the good recovery data of July to be consolidated. August is always a month of lower sales, due to the holiday period, but this atypical year is also influenced by uncertainty due to the health and economic evolution of the coronavirus pandemic,’ ANFAC, the Spanish vehicle manufacturers’ association, commented.

The biggest decline in the four major continental markets was in Germany, where new-car registrations fell by 20% in August, compared to the same month in 2019. This also meant a return to the double-digit declines suffered in Germany between February and June. In July, new-car registrations fell by only 5.4% year-on-year, buoyed by the increased incentives (from €6,000 to €9,000) for BEVs and PHEVs introduced at the start of the month. However, the majority of cars are not benefitting from the stimulus, hence the downturn.

In the smaller EU member states, year-on-year contractions of more than 30% were reported in eight markets, including Austria, Czech Republic and Hungary. However, some markets were far more resilient, with downturns of less than 10% reported in five markets, including Denmark, Ireland and Portugal.

Containing the fallout

In the first eight months of 2020, registrations of new cars in the EU fell by 32% as the weaker August figures were still an improvement on the 33.5% contraction suffered in the first seven months of the year. The greatest loss among the major EU markets was in Spain, which has contracted by 40.6% in the year-to-date, ahead of only Croatia (down 47.4%) and Portugal (down 42.0%).

As dealer activity has returned in EU markets and pent-up demand is ultimately satisfied, the economic fallout of COVID-19 will broadly dictate whether markets return to pre-crisis levels. The key to recovery therefore revolves around countries agreeing budgets for 2021, and improving economic certainty and consumer confidence to boost spending. Clarity on the allocation of aid resources provided by the European Recovery Fund, agreed on 21 July, will therefore also play a pivotal role in shaping the forward outlook for Europe’s new-car markets.

As the pandemic evolves, there are positive and negative impacts to consider, such as an aversion to public transport and increased working from home. And the threat of a second wave of COVID-19 infections and accompanying lockdowns cannot be ruled out.

Manufacturer performance

Among the leading European carmakers, Daimler, Jaguar Land Rover (JLR), Renault, PSA Group and Volkswagen Group all registered more than 20% fewer new cars in the EU in August 2020 than in August 2019. Mitsubishi suffered the greatest loss, with EU registrations down 38.5% year-on-year.

BMW Group and Hyundai, however, managed to register 6.8% and 1.9% more cars respectively in the EU than in August 2019. Fiat Chrysler Automobiles (FCA), Toyota and Volvo also performed comparatively well, only suffering single-digit declines in the month. FCA’s registrations were down 6.6%, buoyed by the stable demand in Italy.

Across Europe, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market.