EU new-car registrations fall 76% in April ahead of recovery

19 May 2020

19 May 2020

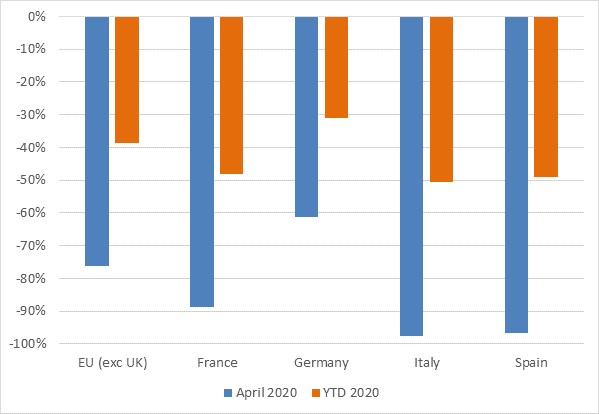

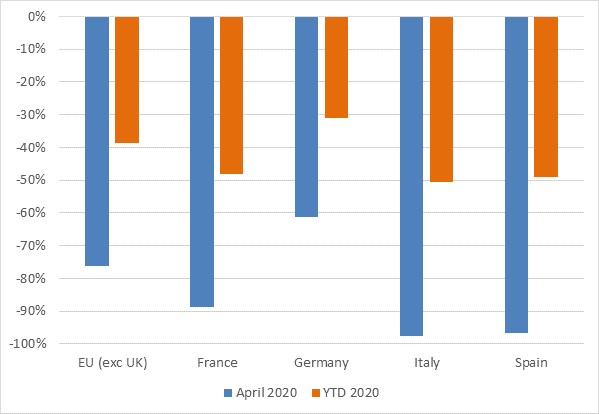

With lockdown measures in effect across numerous markets during April in an effort to control the coronavirus (COVID-19) pandemic, new-car registrations in the EU fell 76% year-on-year, according to figures released by the European Automobile Manufacturers Association (ACEA) today. The volume of new-car registrations fell from 1,143,406 units in April 2019 to 270,682 in April 2020. This follows a 55% market contraction in March but a recovery is now in progress as dealers reopen across the region.

All 27 EU markets contracted last month and among the big 4, the greatest declines were reported in Italy, Spain and France. In the smaller EU member states, year-on-year contractions of more than 85% were also reported in the new-car markets of Belgium, Croatia, Ireland and Portugal.

The 61% fall in new-car registrations in Germany amid the COVID-19 crisis was less dramatic than in the other major European markets. This is because dealerships in Germany have been allowed to resume selling cars as the Government relaxes lockdown measures, although the timing is down to individual states. Many dealers had remained open to carry out servicing and repairs so, following the implementation of safety measures, sales could resume relatively quickly.

Numerous smaller markets, where stringent lockdown measures have not been in force, proved far more resilient, including Denmark, Finland and Sweden. Nevertheless, in each of these markets, the volume of new-car registrations still contracted by more than a third.

Year-to-date registrations down almost 40%

In the first four months of 2020, registrations of new cars in the EU fell by 38.5% as the impact of the COVID-19 pandemic on the April figures expanded the 26% contraction in the first quarter. The greatest losses were again in France, Italy and Spain, where the market has roughly halved in the year-to-date. The EU market downturn was, however, compounded by a combination of tax changes introduced in some EU member states, which pulled demand forward into December 2019.

New-car registrations, year-on-year % change, April 2020 and year-to-date (YTD) 2020

Source: Autovista Group based on ACEA data

Short-term positivity, long-term uncertainty

As dealers are already reopening in EU markets affected by lockdowns, a healthy period of recovery is expected as the backlog is cleared and pent-up demand is released. Year-on-year growth in new-car registrations is already likely from May in Germany and June in France, Spain and Italy.

′China has already passed the first, and hopefully also last, wave of COVID-19 and has relaunched its car market. Looking at the first numbers from the Chinese market, the first positive prospects for European markets begin to appear,’ Roland Strilka, Autovista Group’s director of valuations wrote in a recent article.

This hypothesis is certainly supported by the recovery in dealer activity on online portals. In both Germany and Austria, the removal of used-car adverts in the week from 4 May to 10 May was back above the level recorded at the beginning of February and there are already clear signs of improvement in France and Italy too.

Source: Autovista Group based on ACEA data

Short-term positivity, long-term uncertainty

As dealers are already reopening in EU markets affected by lockdowns, a healthy period of recovery is expected as the backlog is cleared and pent-up demand is released. Year-on-year growth in new-car registrations is already likely from May in Germany and June in France, Spain and Italy.

′China has already passed the first, and hopefully also last, wave of COVID-19 and has relaunched its car market. Looking at the first numbers from the Chinese market, the first positive prospects for European markets begin to appear,’ Roland Strilka, Autovista Group’s director of valuations wrote in a recent article.

This hypothesis is certainly supported by the recovery in dealer activity on online portals. In both Germany and Austria, the removal of used-car adverts in the week from 4 May to 10 May was back above the level recorded at the beginning of February and there are already clear signs of improvement in France and Italy too.

Source: Autovista Group, Residual Value Intelligence, COVID-19 Tracker

Beyond the immediate clearance of the backlog and the release of pent-up demand, the economic impact will broadly dictate whether markets return to pre-crisis levels. There are also positive and negative side effects of the COVID-19 crisis to consider, such as an aversion to public transport and increased working from home.

However, there are already worrying signs that the recovery in Europe may not be as strong as in China, or even in the US. A survey by Ipsos has found that consumers in the big 5 European markets (including the UK) have less intention to buy a car, either new or used, than prior to the crisis. The study shows that 33% of respondents are less likely to make a purchase, compared to only 7% in China and 16% in the US. Similarly, despite the concerns surrounding the use of public transport, only 21% of European consumers are more likely to acquire a new car, compared to 63% in China and 32% in the US.

Manufacturer performance

Among the leading carmakers, it comes as no surprise that Fiat Chrysler Automobiles (FCA) suffered the greatest loss in EU demand in April, registering 88% fewer cars in the month due to the strict lockdown in Italy. Renault and PSA Group were similarly affected by the severe market contraction in France, registering 79% and 81% fewer cars in the EU respectively.

Daimler, Ford, Honda, Hyundai, Mazda, Nissan and Jaguar Land Rover (JLR) also suffered declines of more than 75% in EU new-car registrations in April. Aided by the limited impact of COVID-19 on the new-car market in Sweden, Volvo was the most resilient manufacturer in the month, but even registrations of the Swedish premium brand fell by almost two thirds across the EU.

After Volvo, Mitsubishi and BMW also performed comparatively well, with respective losses of 63% and 65% in the month. BMW was clearly buoyed by the reopening of dealerships in Germany but, like Mitsubishi, it offers a burgeoning range of electrified vehicles. In comparison, the VW Group and Daimler registered 73% and 79% fewer cars respectively in the EU in April.

As Europe emerges from lockdown, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market. The COVID-19 crisis has, however, also delayed the launch of some critical new EVs such as Volkswagen’s ID.3.

Source: Autovista Group, Residual Value Intelligence, COVID-19 Tracker

Beyond the immediate clearance of the backlog and the release of pent-up demand, the economic impact will broadly dictate whether markets return to pre-crisis levels. There are also positive and negative side effects of the COVID-19 crisis to consider, such as an aversion to public transport and increased working from home.

However, there are already worrying signs that the recovery in Europe may not be as strong as in China, or even in the US. A survey by Ipsos has found that consumers in the big 5 European markets (including the UK) have less intention to buy a car, either new or used, than prior to the crisis. The study shows that 33% of respondents are less likely to make a purchase, compared to only 7% in China and 16% in the US. Similarly, despite the concerns surrounding the use of public transport, only 21% of European consumers are more likely to acquire a new car, compared to 63% in China and 32% in the US.

Manufacturer performance

Among the leading carmakers, it comes as no surprise that Fiat Chrysler Automobiles (FCA) suffered the greatest loss in EU demand in April, registering 88% fewer cars in the month due to the strict lockdown in Italy. Renault and PSA Group were similarly affected by the severe market contraction in France, registering 79% and 81% fewer cars in the EU respectively.

Daimler, Ford, Honda, Hyundai, Mazda, Nissan and Jaguar Land Rover (JLR) also suffered declines of more than 75% in EU new-car registrations in April. Aided by the limited impact of COVID-19 on the new-car market in Sweden, Volvo was the most resilient manufacturer in the month, but even registrations of the Swedish premium brand fell by almost two thirds across the EU.

After Volvo, Mitsubishi and BMW also performed comparatively well, with respective losses of 63% and 65% in the month. BMW was clearly buoyed by the reopening of dealerships in Germany but, like Mitsubishi, it offers a burgeoning range of electrified vehicles. In comparison, the VW Group and Daimler registered 73% and 79% fewer cars respectively in the EU in April.

As Europe emerges from lockdown, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market. The COVID-19 crisis has, however, also delayed the launch of some critical new EVs such as Volkswagen’s ID.3.

Source: Autovista Group based on ACEA data

Short-term positivity, long-term uncertainty

As dealers are already reopening in EU markets affected by lockdowns, a healthy period of recovery is expected as the backlog is cleared and pent-up demand is released. Year-on-year growth in new-car registrations is already likely from May in Germany and June in France, Spain and Italy.

′China has already passed the first, and hopefully also last, wave of COVID-19 and has relaunched its car market. Looking at the first numbers from the Chinese market, the first positive prospects for European markets begin to appear,’ Roland Strilka, Autovista Group’s director of valuations wrote in a recent article.

This hypothesis is certainly supported by the recovery in dealer activity on online portals. In both Germany and Austria, the removal of used-car adverts in the week from 4 May to 10 May was back above the level recorded at the beginning of February and there are already clear signs of improvement in France and Italy too.

Source: Autovista Group based on ACEA data

Short-term positivity, long-term uncertainty

As dealers are already reopening in EU markets affected by lockdowns, a healthy period of recovery is expected as the backlog is cleared and pent-up demand is released. Year-on-year growth in new-car registrations is already likely from May in Germany and June in France, Spain and Italy.

′China has already passed the first, and hopefully also last, wave of COVID-19 and has relaunched its car market. Looking at the first numbers from the Chinese market, the first positive prospects for European markets begin to appear,’ Roland Strilka, Autovista Group’s director of valuations wrote in a recent article.

This hypothesis is certainly supported by the recovery in dealer activity on online portals. In both Germany and Austria, the removal of used-car adverts in the week from 4 May to 10 May was back above the level recorded at the beginning of February and there are already clear signs of improvement in France and Italy too.

Source: Autovista Group, Residual Value Intelligence, COVID-19 Tracker

Beyond the immediate clearance of the backlog and the release of pent-up demand, the economic impact will broadly dictate whether markets return to pre-crisis levels. There are also positive and negative side effects of the COVID-19 crisis to consider, such as an aversion to public transport and increased working from home.

However, there are already worrying signs that the recovery in Europe may not be as strong as in China, or even in the US. A survey by Ipsos has found that consumers in the big 5 European markets (including the UK) have less intention to buy a car, either new or used, than prior to the crisis. The study shows that 33% of respondents are less likely to make a purchase, compared to only 7% in China and 16% in the US. Similarly, despite the concerns surrounding the use of public transport, only 21% of European consumers are more likely to acquire a new car, compared to 63% in China and 32% in the US.

Manufacturer performance

Among the leading carmakers, it comes as no surprise that Fiat Chrysler Automobiles (FCA) suffered the greatest loss in EU demand in April, registering 88% fewer cars in the month due to the strict lockdown in Italy. Renault and PSA Group were similarly affected by the severe market contraction in France, registering 79% and 81% fewer cars in the EU respectively.

Daimler, Ford, Honda, Hyundai, Mazda, Nissan and Jaguar Land Rover (JLR) also suffered declines of more than 75% in EU new-car registrations in April. Aided by the limited impact of COVID-19 on the new-car market in Sweden, Volvo was the most resilient manufacturer in the month, but even registrations of the Swedish premium brand fell by almost two thirds across the EU.

After Volvo, Mitsubishi and BMW also performed comparatively well, with respective losses of 63% and 65% in the month. BMW was clearly buoyed by the reopening of dealerships in Germany but, like Mitsubishi, it offers a burgeoning range of electrified vehicles. In comparison, the VW Group and Daimler registered 73% and 79% fewer cars respectively in the EU in April.

As Europe emerges from lockdown, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market. The COVID-19 crisis has, however, also delayed the launch of some critical new EVs such as Volkswagen’s ID.3.

Source: Autovista Group, Residual Value Intelligence, COVID-19 Tracker

Beyond the immediate clearance of the backlog and the release of pent-up demand, the economic impact will broadly dictate whether markets return to pre-crisis levels. There are also positive and negative side effects of the COVID-19 crisis to consider, such as an aversion to public transport and increased working from home.

However, there are already worrying signs that the recovery in Europe may not be as strong as in China, or even in the US. A survey by Ipsos has found that consumers in the big 5 European markets (including the UK) have less intention to buy a car, either new or used, than prior to the crisis. The study shows that 33% of respondents are less likely to make a purchase, compared to only 7% in China and 16% in the US. Similarly, despite the concerns surrounding the use of public transport, only 21% of European consumers are more likely to acquire a new car, compared to 63% in China and 32% in the US.

Manufacturer performance

Among the leading carmakers, it comes as no surprise that Fiat Chrysler Automobiles (FCA) suffered the greatest loss in EU demand in April, registering 88% fewer cars in the month due to the strict lockdown in Italy. Renault and PSA Group were similarly affected by the severe market contraction in France, registering 79% and 81% fewer cars in the EU respectively.

Daimler, Ford, Honda, Hyundai, Mazda, Nissan and Jaguar Land Rover (JLR) also suffered declines of more than 75% in EU new-car registrations in April. Aided by the limited impact of COVID-19 on the new-car market in Sweden, Volvo was the most resilient manufacturer in the month, but even registrations of the Swedish premium brand fell by almost two thirds across the EU.

After Volvo, Mitsubishi and BMW also performed comparatively well, with respective losses of 63% and 65% in the month. BMW was clearly buoyed by the reopening of dealerships in Germany but, like Mitsubishi, it offers a burgeoning range of electrified vehicles. In comparison, the VW Group and Daimler registered 73% and 79% fewer cars respectively in the EU in April.

As Europe emerges from lockdown, manufacturers with a strong electric-vehicle portfolio are expected to perform better than those without as EV consumers are less likely to be tempted by used cars instead of new. This is because they tend to be less price-sensitive buyers but there is also limited availability of the latest electric models on the used-car market. The COVID-19 crisis has, however, also delayed the launch of some critical new EVs such as Volkswagen’s ID.3.