German new-car registrations down 61% in April

06 May 2020

6 May 2020

Germany saw a 61.1% downturn in the registration of new passenger cars in April. In a month marked by coronavirus (COVID-19) protective measures, the fall is light compared to the rest of the big 5 markets.

According to the automotive authority Kraftfahrt Bundesamt (KBA), 120,840 units were registered in April. Of these, 58% were for commercial use, while the private share accounted for 41.9%.

Declines across brands and types

According to the KBA, all German brands recorded double-digit declines, ranging from a 39.2% drop for BMW-owned Mini to 94.1% decline for Daimler and Geely brand Smart. VW achieved the highest share of registrations in April, with 17.2%.

Tesla was the only imported brand to achieve growth in registrations last month, up 10.4%. Other imported brands recorded double-digit declines. DS dropped 20%, while Mazda plummeted by 74.8%. Skoda was able to achieve the largest share of new registrations at 6%, followed by SEAT at 4% and Renault at 3.9%.

The SUV segment had the highest share of registrations at 20.3%, down 59.7% on April 2019. The compact class secured 20.1%, with a year-on-year decline of 61.8%. Accordingly, SUVs and the compact class accounted for one-fifth of new registrations. The luxury segment had the lowest share of sales at 0.8%. The minivan segment recorded the sharpest drop in registrations, at 84.3%.

Nearly half (49.9%) of newly registered cars had petrol engines, at 60,295 units. Diesel made up 32.1% with 38,836 cars. Hybrids accounted for 13.7% with 16,573 passenger cars, including 5,618 plug-in hybrids (4.6% share). Battery-electric vehicles saw 4,635 registrations (3.8% share). Natural gas came in at 286 registrations (0.2% sahre), and 191 liquid-gas powered cars were registered (0.2% share). Average CO2 emissions did fall by 4.9% to 150.9g/km.

Lockdowns loosen

′The downturn in new-car registrations in Germany in April was again less dramatic than in France, Spain, Italy, and the UK, as was the case in March,’ said Autovista Group senior data journalist Neil King. ′This is because dealerships in Germany have been allowed to resume selling cars as the Government relaxes lockdown measures, although the timing is down to individual states. Many dealers had remained open to carry out servicing and repairs so, following the implementation of safety measures, sales could resume relatively quickly.’

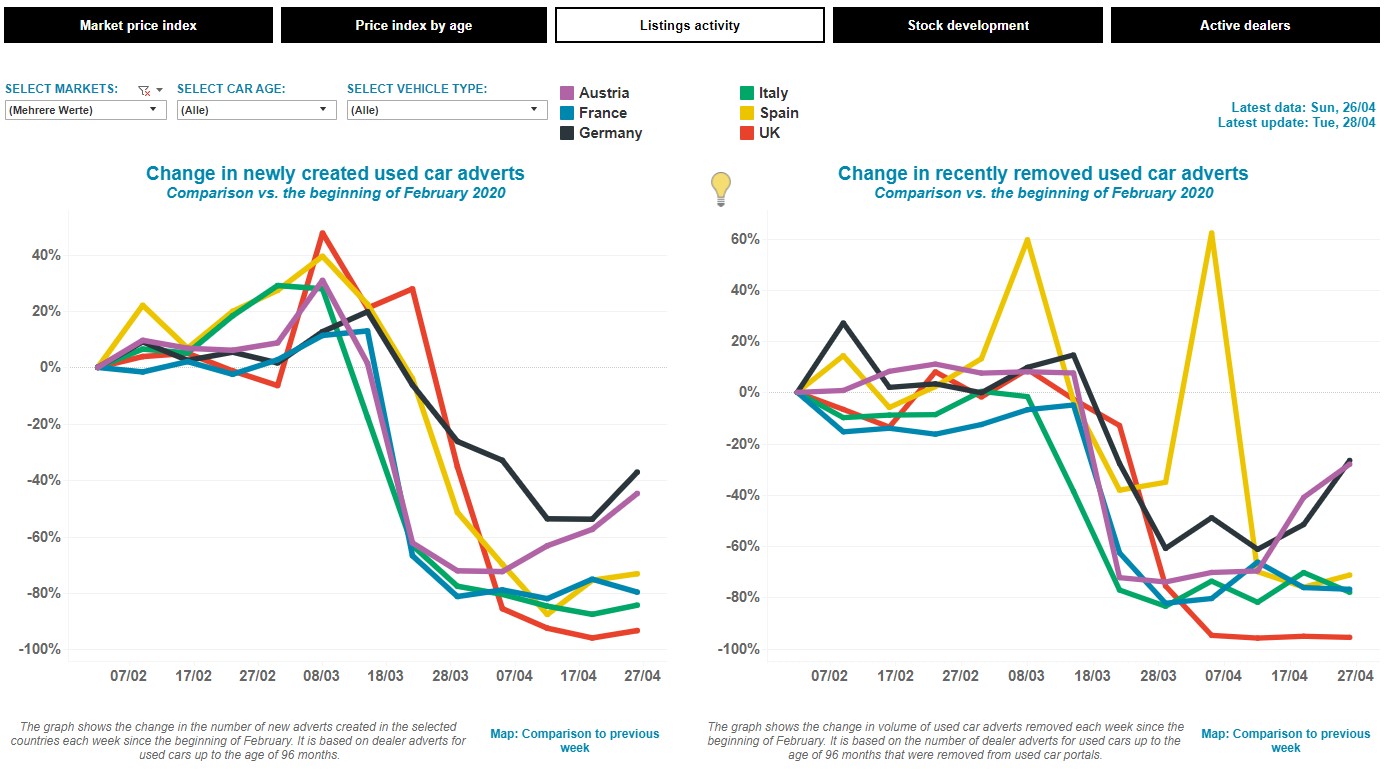

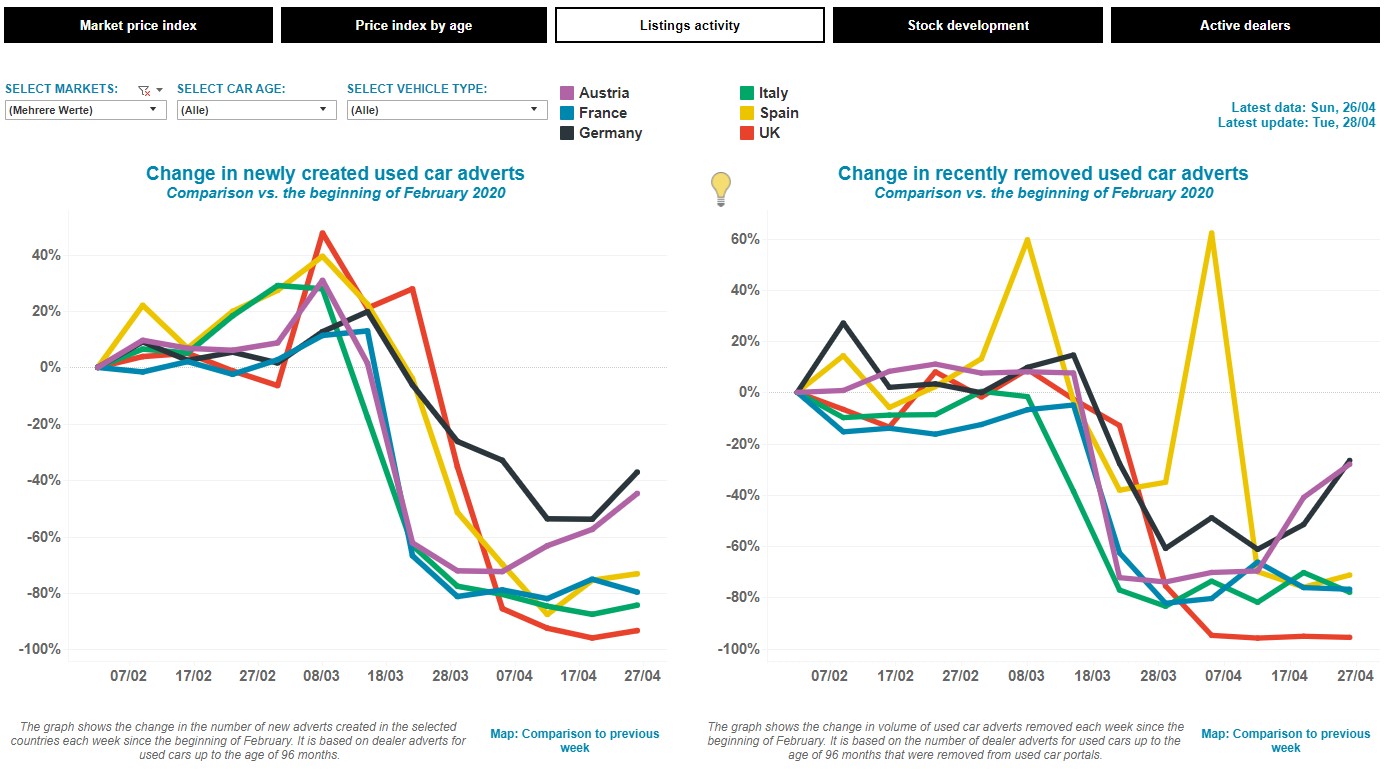

There has already been an upturn in dealer activity in Germany, with growth in the volume of used-car adverts being newly created on online portals between 20 April and 26 April and, moreover, being removed. This reflects not only the return of dealer sales activity but also the release of pent-up demand after weeks of closures. This positive development was expected and follows a similar resurgence in Austria, where dealers reopened earlier. Other countries will follow as lockdowns are relaxed and dealerships reopen.

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker

Source: Autovista Group – Residual Value Intelligence Coronavirus Tracker