CES 2020: Top 10 Takeaways – part 2

14 January 2020

14 January 2020

In part two of our CES 2020 overview, Autovista Group Chief Economist Christof Engelskirchen discusses the supplier and retail sides of the automotive market, as well as what future mobility may mean for city infrastructure, and even the skies.

Suppliers going all-out

The biggest difference from a supplier perspective in the disrupted automotive vertical is that they have the opportunity (and liability) to build and refine their position. Bertrandt was courting partners and featured their showcase HARRI, an innovation platform for solutions related to all aspects of automated, connected, and electric driving. Harman had an entire convention center off-strip populated with their hardware, software and cloud services focusing on bringing the connected car alive.

Automotive retailing moving online

Amazon was present with a large stand at a central location at the CES, and announced plans to become a major player in self-driving vehicle technology and connected cars. With their cloud-computing services via Amazon Web Services and their competence in logistics, we should expect the journey towards online car sales – new or used – speed up. Amazon may serve as a technology partner for OEMs, dealer groups and remarketers for the time being. There are more players who attempt to professionalise the online retailing experience, for example Modal featured their online retail solutions on the Honda stand. And there is pressure on dealers to jump on board. According to Modal, who I talked to at the show, 2.5 years ago 95% of dealers hated the idea of online car sales. Now 30% ″love it″. Give or take. Change is happening fast and will not be geo-fenced to the US.

Autonomous driving: L2+ and People movers

Autonomous driving was still a dominant theme but clearly less hyped than in previous years. The trend is pointing towards people movers in a shared-mobility setting rather than individual-mobility solutions. People talked about L2+ for individual-vehicle solutions. But technology for further improved autonomous driving is still prohibitively priced, for example due to the high costs of the inevitable lidar technology. New applications, maybe a crime prevention unit or cleaning robots as you can see on the pictures, will help create scale but a consolidation of players may be inevitable soon.

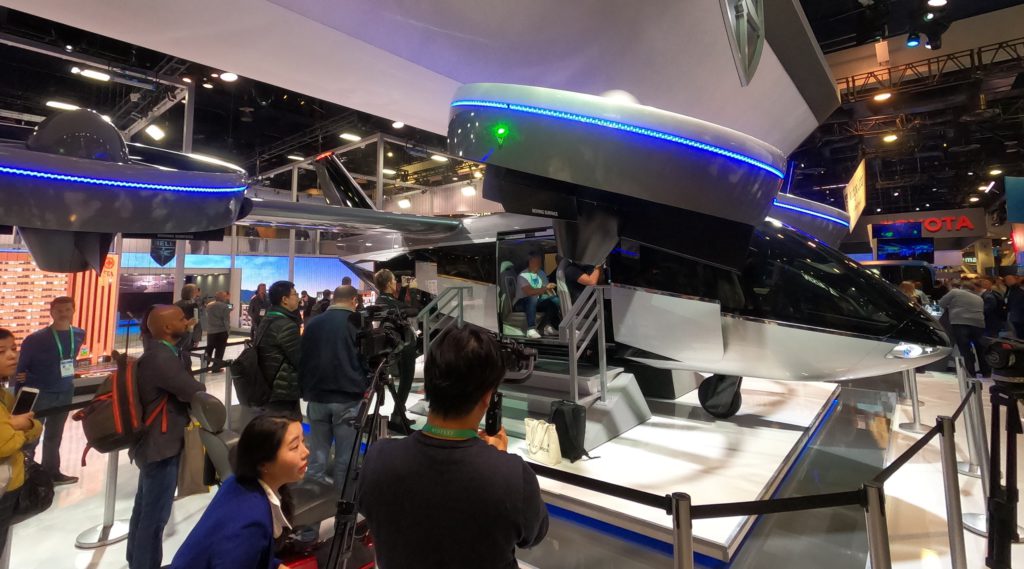

Moving traffic into the air

Drones have been more prominent this time at the CES than in previous years. Two people-mover prototypes were shown, one from Bell and one from a partnership between Hyundai and Uber. Would love to get my hand on the business case. Most likely it will not revolutionise the mobility of the nearer future but the use cases are clear at least. Butterfly drones were flying at the Daimler keynote, but they were operated by humans and not flying autonomously. More serious CES 2020 drone use cases are covered in this overview.

Smart Cities: infrastructure, consumer acceptance and policy challenges

There have been great conference sessions as well at the CES 2020. For example on Building a Smarter, Connected City. It all begins with infrastructure. AT&T claims having invested 130bn USD during past five years in the US Energy consumption will rise and grid reliability will be a major challenge. And Lisa Brown of Johnson Controls makes an excellent point that there are challenges in gaining trust with the consumers who will have to supply personal data for improved user journeys and to enable others to monetise the data. The panel discussed what the biggest hurdle to advances in Smart Cities is: policy, technology or customer acceptance? Maybe surprisingly after the one-hour discussion, the answer was neither technology nor customer acceptance. The unanimous answer was policy and regulation on city, regional, and national levels, which still represents a huge hurdle to scalability, in particular due to lack of or inconsistencies in policies.

You can read part one of our top ten CES 2020 takeaways here