Tesla Model S has class-leading residual values in Germany

28 March 2019

28 March 2019

By Neil King

Tesla beats domestic executive car rivals in Germany’s E segment, according to Autovista Group’s Residual Value Intelligence (RVI).

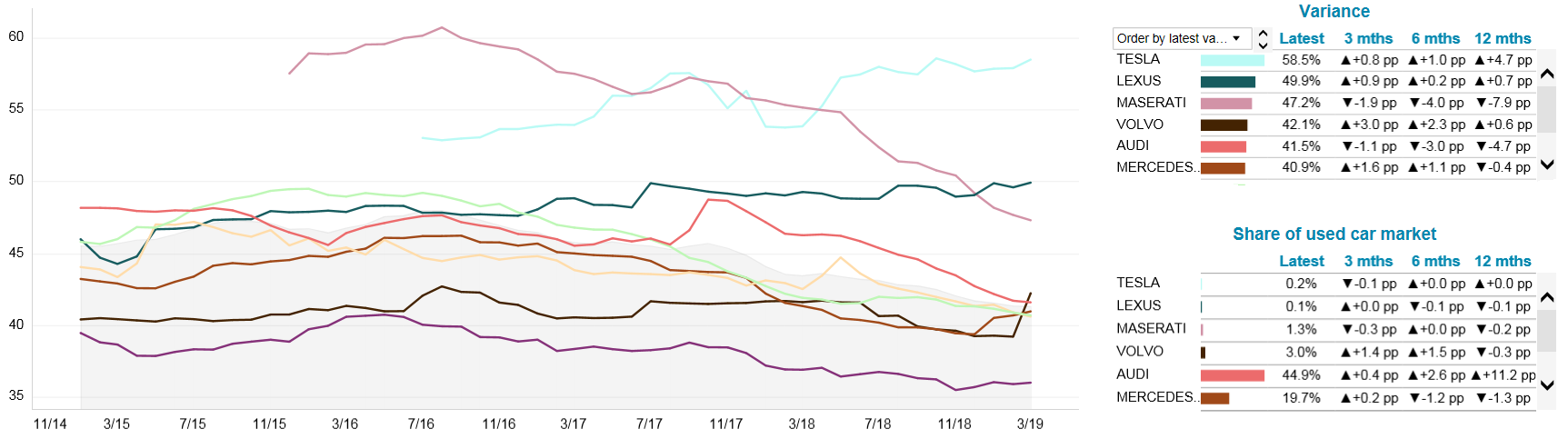

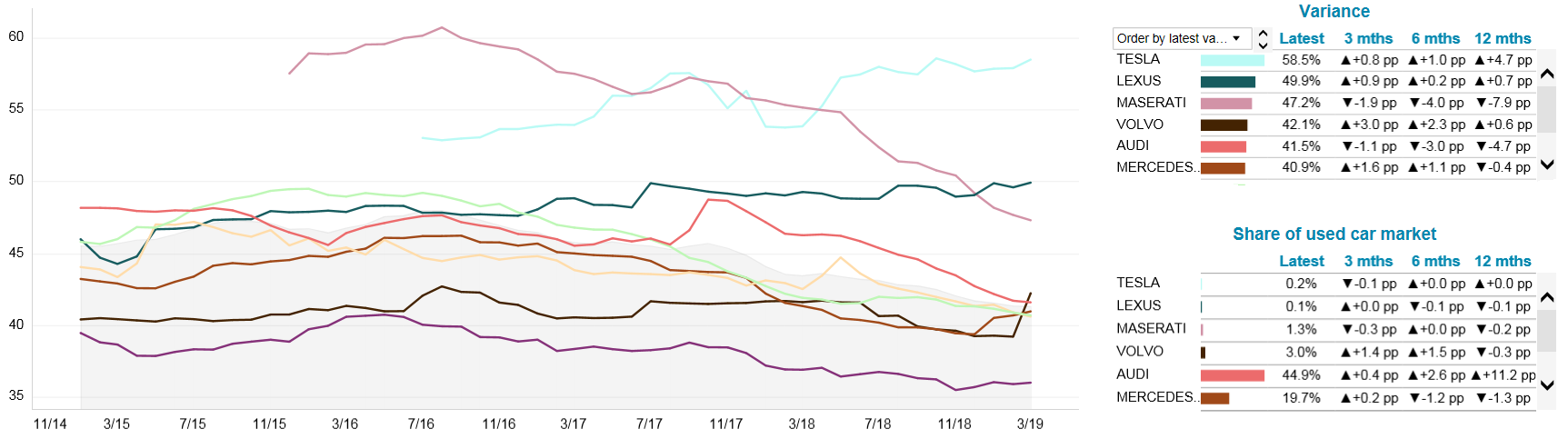

Tesla – represented by the electric Model S in the E segment – now retains an average of 58.5% of its value in the standard 36 month/60,000km scenario. This compares with just 41.2% for E-segment models. RVI data also reveal that the executive segment suffers the third highest depreciation in Germany, behind only the M (microcar) and A (mini car) segments.

Germany, trade RV%, 36months/60,000km, E-segment by brand, January 2015 to March 2019

Source: Residual Value Intelligence, Autovista Group

The RV performance of the Tesla Model S is therefore 17 pp (percentage points) ahead of the average achieved by used models in this segment in Germany. Given that the model is electric and that Tesla no longer guarantees the resale value of its cars, this is an astounding feat. Tesla accounts for only 0.2% of E-segment used cars in Germany though, which helps to keep values high.

Autovista Group will reflect the price changes recently announced by Tesla as soon as they become available and will also closely track their impact on used car prices. Based upon the strength of Model S values, Tesla should certainly easily withstand any disruption in Germany.

Maserati overtaken

Lexus is second in the market, 9pp behind Tesla, and Maserati is now a further 2pp adrift in third position.

Maserati became the instant RV class-leader in the E-segment in Germany as soon as its Ghibli executive saloon, launched in 2012, became available as a used car. However, the arrival of Tesla’s Model S as a three-year-old contender in the summer of 2016 quickly challenged Maserati for the RV crown and after much tussling, the electric car has been best-in-class since April 2018.

As the Ghibli has aged, Maserati has even been overtaken by Toyota’s premium brand Lexus. It may come as a surprise that Lexus, represented by the GS model in the E-segment, performs so well. There are, however, two reasons that contribute to this. First, the GS is largely offered as a hybrid, which is a rarity in this segment. Second, used volumes are incredibly low, accounting for just 0.1% of the E segment cars available on Germany’s used car market. The combination of these factors significantly bolsters used prices of the GS.

New challenger

Behind the three niche players in the executive car segment, the usual suspects of Audi, Jaguar, BMW and Mercedes fight a close battle. On average, executive models from these brands currently retain between 40%-42% of their value after three years and 60,000km.

These key players have a new serious challenger, however, as Volvo’s S90 saloon and V90 estate car are now coming onto the market as three-year-old used cars. Average values for Volvo cars in this segment jumped from 39% in February to 42% in March. Volvo has leapfrogged the big three German premium brands and Jaguar to claim fourth in the brand rankings.

Source: Residual Value Intelligence, Autovista Group

The RV performance of the Tesla Model S is therefore 17 pp (percentage points) ahead of the average achieved by used models in this segment in Germany. Given that the model is electric and that Tesla no longer guarantees the resale value of its cars, this is an astounding feat. Tesla accounts for only 0.2% of E-segment used cars in Germany though, which helps to keep values high.

Autovista Group will reflect the price changes recently announced by Tesla as soon as they become available and will also closely track their impact on used car prices. Based upon the strength of Model S values, Tesla should certainly easily withstand any disruption in Germany.

Maserati overtaken

Lexus is second in the market, 9pp behind Tesla, and Maserati is now a further 2pp adrift in third position.

Maserati became the instant RV class-leader in the E-segment in Germany as soon as its Ghibli executive saloon, launched in 2012, became available as a used car. However, the arrival of Tesla’s Model S as a three-year-old contender in the summer of 2016 quickly challenged Maserati for the RV crown and after much tussling, the electric car has been best-in-class since April 2018.

As the Ghibli has aged, Maserati has even been overtaken by Toyota’s premium brand Lexus. It may come as a surprise that Lexus, represented by the GS model in the E-segment, performs so well. There are, however, two reasons that contribute to this. First, the GS is largely offered as a hybrid, which is a rarity in this segment. Second, used volumes are incredibly low, accounting for just 0.1% of the E segment cars available on Germany’s used car market. The combination of these factors significantly bolsters used prices of the GS.

New challenger

Behind the three niche players in the executive car segment, the usual suspects of Audi, Jaguar, BMW and Mercedes fight a close battle. On average, executive models from these brands currently retain between 40%-42% of their value after three years and 60,000km.

These key players have a new serious challenger, however, as Volvo’s S90 saloon and V90 estate car are now coming onto the market as three-year-old used cars. Average values for Volvo cars in this segment jumped from 39% in February to 42% in March. Volvo has leapfrogged the big three German premium brands and Jaguar to claim fourth in the brand rankings.

Source: Residual Value Intelligence, Autovista Group

The RV performance of the Tesla Model S is therefore 17 pp (percentage points) ahead of the average achieved by used models in this segment in Germany. Given that the model is electric and that Tesla no longer guarantees the resale value of its cars, this is an astounding feat. Tesla accounts for only 0.2% of E-segment used cars in Germany though, which helps to keep values high.

Autovista Group will reflect the price changes recently announced by Tesla as soon as they become available and will also closely track their impact on used car prices. Based upon the strength of Model S values, Tesla should certainly easily withstand any disruption in Germany.

Maserati overtaken

Lexus is second in the market, 9pp behind Tesla, and Maserati is now a further 2pp adrift in third position.

Maserati became the instant RV class-leader in the E-segment in Germany as soon as its Ghibli executive saloon, launched in 2012, became available as a used car. However, the arrival of Tesla’s Model S as a three-year-old contender in the summer of 2016 quickly challenged Maserati for the RV crown and after much tussling, the electric car has been best-in-class since April 2018.

As the Ghibli has aged, Maserati has even been overtaken by Toyota’s premium brand Lexus. It may come as a surprise that Lexus, represented by the GS model in the E-segment, performs so well. There are, however, two reasons that contribute to this. First, the GS is largely offered as a hybrid, which is a rarity in this segment. Second, used volumes are incredibly low, accounting for just 0.1% of the E segment cars available on Germany’s used car market. The combination of these factors significantly bolsters used prices of the GS.

New challenger

Behind the three niche players in the executive car segment, the usual suspects of Audi, Jaguar, BMW and Mercedes fight a close battle. On average, executive models from these brands currently retain between 40%-42% of their value after three years and 60,000km.

These key players have a new serious challenger, however, as Volvo’s S90 saloon and V90 estate car are now coming onto the market as three-year-old used cars. Average values for Volvo cars in this segment jumped from 39% in February to 42% in March. Volvo has leapfrogged the big three German premium brands and Jaguar to claim fourth in the brand rankings.

Source: Residual Value Intelligence, Autovista Group

The RV performance of the Tesla Model S is therefore 17 pp (percentage points) ahead of the average achieved by used models in this segment in Germany. Given that the model is electric and that Tesla no longer guarantees the resale value of its cars, this is an astounding feat. Tesla accounts for only 0.2% of E-segment used cars in Germany though, which helps to keep values high.

Autovista Group will reflect the price changes recently announced by Tesla as soon as they become available and will also closely track their impact on used car prices. Based upon the strength of Model S values, Tesla should certainly easily withstand any disruption in Germany.

Maserati overtaken

Lexus is second in the market, 9pp behind Tesla, and Maserati is now a further 2pp adrift in third position.

Maserati became the instant RV class-leader in the E-segment in Germany as soon as its Ghibli executive saloon, launched in 2012, became available as a used car. However, the arrival of Tesla’s Model S as a three-year-old contender in the summer of 2016 quickly challenged Maserati for the RV crown and after much tussling, the electric car has been best-in-class since April 2018.

As the Ghibli has aged, Maserati has even been overtaken by Toyota’s premium brand Lexus. It may come as a surprise that Lexus, represented by the GS model in the E-segment, performs so well. There are, however, two reasons that contribute to this. First, the GS is largely offered as a hybrid, which is a rarity in this segment. Second, used volumes are incredibly low, accounting for just 0.1% of the E segment cars available on Germany’s used car market. The combination of these factors significantly bolsters used prices of the GS.

New challenger

Behind the three niche players in the executive car segment, the usual suspects of Audi, Jaguar, BMW and Mercedes fight a close battle. On average, executive models from these brands currently retain between 40%-42% of their value after three years and 60,000km.

These key players have a new serious challenger, however, as Volvo’s S90 saloon and V90 estate car are now coming onto the market as three-year-old used cars. Average values for Volvo cars in this segment jumped from 39% in February to 42% in March. Volvo has leapfrogged the big three German premium brands and Jaguar to claim fourth in the brand rankings.