Car-sharing companies state aims as rapid market growth predicted

14 May 2018

14 May 2018

Google’s self-driving car-sharing service Waymo is forecast to own 60% of the global market by 2030, putting others in a position to adopt the company’s technology for themselves or become obsolete.

The findings by investment bank UBS estimated that global revenues from the market would total $2.8 trillion (€2.3 trillion) by that time, with only a handful of carmakers able to operate their own systems and compete. Many manufacturers are racing to develop self-driving systems in order to get into the market of driverless car-booking, a new segment that is expected to offset car ownership in the world’s major cities in the coming decades.

UBS expects 12% of cars sold in 2030 will be for driverless taxi fleets, with a total of 26 million robotaxis in operation, according to the Financial Times. Private car sales will fall by 5%. As a result, it expects. The report predicts that demand for self-driving taxis will take off around 2026, depending on public acceptance of the technology in the face of recent crashes.

German expectations

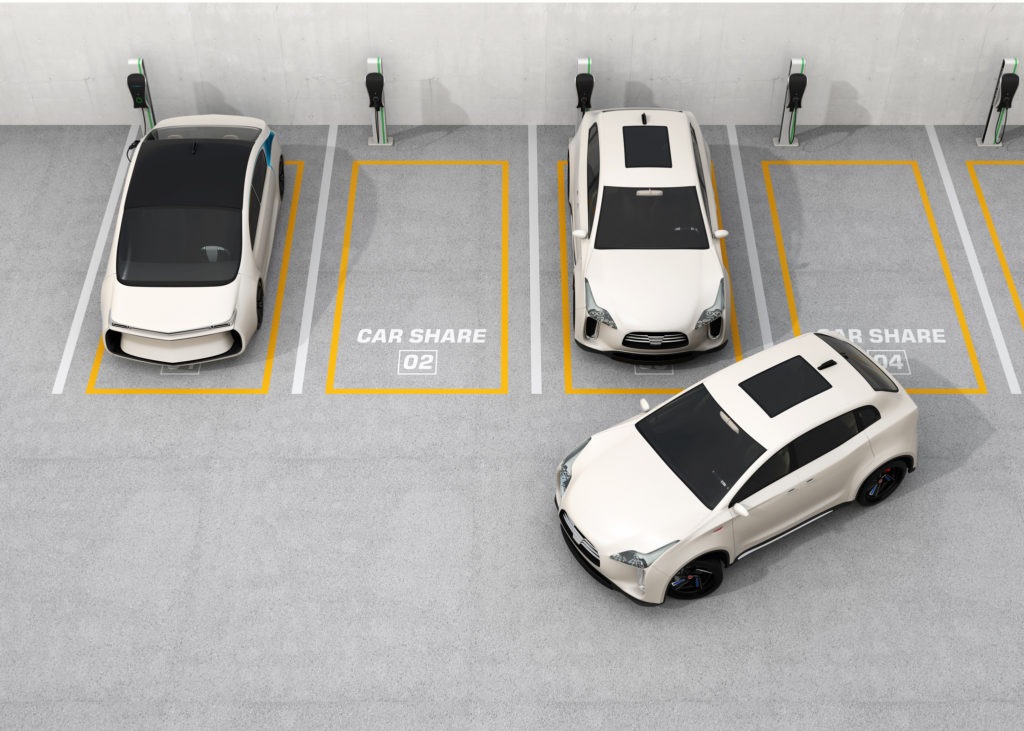

DriveNow, the car-share service operated by BMW, believes it will acquire a market share of 10% in passenger traffic over the next few years. The company recently entered a partnership with Daimler service car2go.

Speaking to Automobilwoche, Sebastian Hofelich, the head of the brand, said: ′We expect that every third drive will be shared in ten years Today, there are approximately 98 billion passenger-kilometres driven by private vehicles in the five DriveNow cities in Germany every year, and we made 90 million of them in 2017, which is a very small proportion DriveNow will have a market share of 10% in passenger traffic in ten years from now.’

Holfelich emphasised that autonomous driving is key in making such platforms work. However, the UBS report acknowledges that while this is the case, the costs of building a self-driving system from scratch, as well as the challenges of deploying it in cities across the world, will prohibit all but a handful of carmakers from competing in the most lucrative part of the market.

′Unlike most auto players, Google focused on [full self-driving technology] from the very beginning ″” more than five years before the auto industry started working on it,’ the report said.

Different approach

While BMW is expanding its services through DriveNow, its Mini brand is looking at a different way to enter the car-sharing market, through a new app designed to allow vehicle owners to share their car domestically.

To participate, owners will need to buy a module that will cost €99 for a three year period. This monitors the mileage that is clocked up outside of the main driver’s usage and charges 30 cents per kilometre, which the owner receives. The payment for the use of the car is made through PayPal.

The mileage cost has been calculated by Mini, taking into account maintenance and fuel, and the company believes it will allow drivers to spread the maintenance cost of a vehicle around those who use it. Bookings can be made via an app, which can then be managed according to when the car is least likely in use.