German new-car market takes a hit as vehicle production changes ‘dramatically’

06 April 2022

New-car registrations in Germany amounted to 241,330 units in March – a sharp drop of 17.5% compared to a year ago, according to the latest figures released by the Kraftfahrt-Bundesamt (KBA). Similar developments can be seen across Europe, with new-car markets, such as Italy, France, Spain, and the UK also taking hits.

During the first quarter of this year, the number of new-car registrations in Germany came to 625,954 units, a drop of almost 5% compared to the same period last year.

After two pandemic-stricken years, followed by a shortage of semiconductors, analysts had expected the German new-car market to slowly recover in 2022. February figures looked hopeful, but the war in Ukraine appears to be derailing those hopes. While carmakers and automotive suppliers are dealing with ongoing supply-chain shortages, uncertainty remains high.

Given recent economic and geopolitical developments, Autovista24 has adjusted its Germany forecast and now projects 2.75 million new-car registrations in 2022, an increase of nearly 5% year on year. Further slowdowns in the first half of the year can be expected, with more displacement likely to carry into 2023.

‘Vehicle sales and production conditions have changed completely and dramatically, preventing a meaningful retrospective as well as a serious forecast,’ cautioned Reinhard Zirpel, president of the Association of International Motor Vehicle Manufacturers (VDIK).

Disrupted supply chains

The war in Ukraine is further disrupting the automotive supply chain, not least because of a lack of car-specific wire harnesses that some carmakers, such as Volkswagen (VW), source from Ukraine. VW was forced to delay the launch of its electric vehicle (EV) ID.5 by a month, following shortages. The carmaker also temporarily halted production at its Zwickau plant due to supply bottlenecks.

In a statement to Autovista24, VW said ‘the currently difficult supply situation has led to production downtimes in some plants – including, as is well known, for several weeks at the MEB plant in Zwickau, where the ID.5 is also manufactured. We are therefore planning the market launch of the ID.5 for the beginning of May instead of April.’

Renault is also among the carmakers affected by supply issues. German media reports that the French company imposed a temporary freeze on orders for some electric-vehicle models, including the Megane E-Tech.

Car manufacturers report shortages

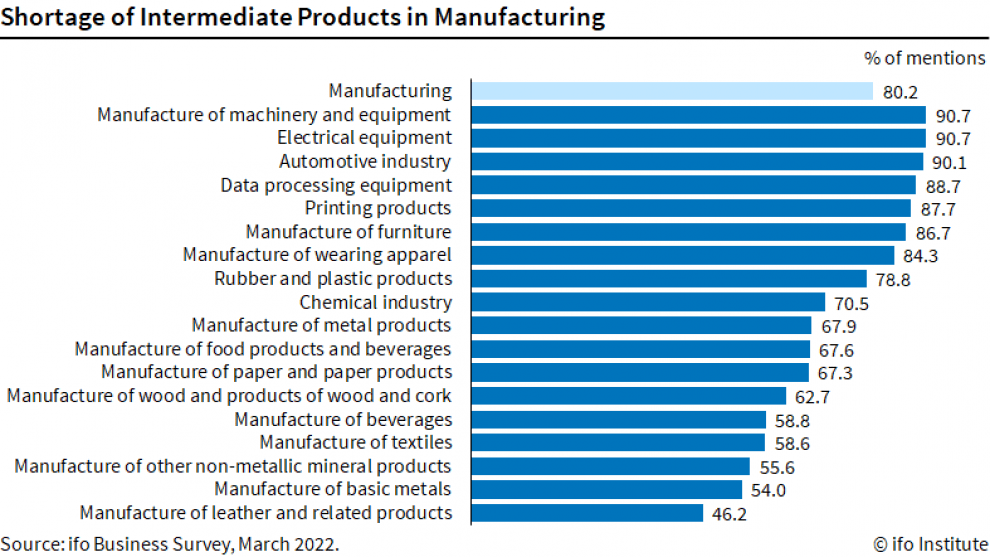

Car manufacturers in Germany are complaining of shortages, with 90% of automotive companies reporting supply-chain issues in March, according to a new survey by the Munich-based Leibniz Institute of Economic Research, the Ifo Institute.

‘The attack on Ukraine has made the situation even worse for many companies,’ said Klaus Wohlrabe, head of surveys at the Ifo Institute. ‘Supply chains now have new problems to cope with on top of the existing ones. Companies had originally expected the situation to ease in the summer, but any easing will now be delayed further.’

This comes after the institute cautioned in early March that the situation in the German automotive industry remains uncertain, with automakers’ price expectations rising sharply in February – before the onset of the war in Ukraine.

Meanwhile, the association of the German Automotive Industry (VDA) also warned of more interruptions. ‘We will have to adapt to the fact that logistics and supply chains will be severely disrupted or even interrupted over a longer period of time,’ said VDA president Hildegard Müller. ‘We expect sensitive effects on supply and logistics chains with repercussions on factories in Germany and Europe as well as elsewhere. Especially since the sanctions are not short-term.’

Oil, gas prices push up inflation

German inflation rose more than expected in March, following a surge in prices of natural gas and mineral-oil products after Russia's invasion of Ukraine. Preliminary data from the Federal Statistics Office shows that inflation is expected to have reached 7.3% in March, up from 5.1% in February.

Referring to the March data, the Statistics Office said that ‘a similarly high inflation rate in Germany was last recorded in autumn 1981, when mineral-oil prices had sharply increased as a consequence of the first Gulf war.’

Tight supply and uncertainties in the energy markets continue to affect energy prices. Even before Russia’s attack on Ukraine, high increases in energy prices were recorded in February by Germany’s Statistics Office. Year-on-year, imported energy costs were up 129.5% in February prices, while consumers had to pay 22.5% more for household energy and motor fuels than in February 2021, the Statistics Office said.