European new-car market outlooks downgraded despite confirmed recovery

25 July 2022

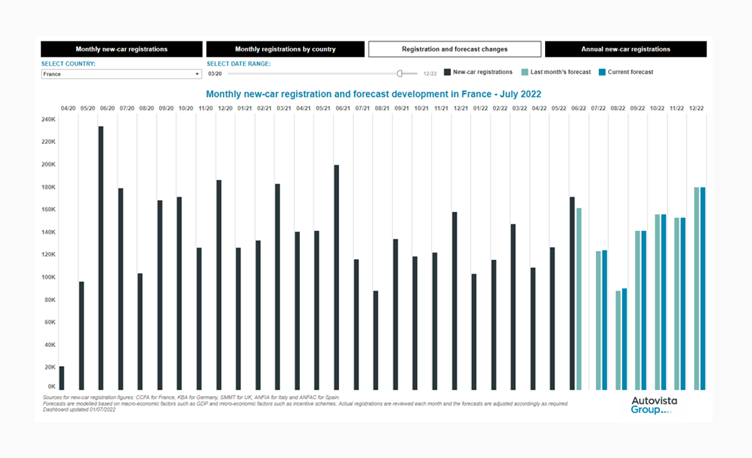

Autovista24 has revised its forecasts downwards for European new-car markets, except for a modest upward revision in France. Senior data journalist Neil King explains why.

Despite some steady progress across many markets in Europe, new developments mean forecasts for all key markets have been revised downwards. France is the only exception. Consequently, the overall European outlook is lower too. The region is not expected to return to the 2019 level this decade.

Overall, Europe’s big five new-car markets performed in line with Autovista24’s expectations in June. Spain and the UK were closely aligned with the Autovista24 forecast for the month and France even exceeded it, whereas Germany and Italy both performed below par.

The good news is that, adjusted for working-day effects, all the major markets – even Germany and Italy – showed signs of improvement compared to May, as too did Europe as a whole. This is seen both in the less severe magnitude of the year-on-year downturns, and higher seasonally-adjusted annualised rates (SAAR).

This confirms the recovery that Autovista24 had already factored into its outlooks, based on the assumption that the impact of the Ukraine war is lessening as alternative sources of raw materials and parts are secured.

Monthly new-car registrations, France, April 2020 to December 2022

Chinese lockdowns and displaced incentives

Autovista24 assumes that supply bottlenecks will continue to ease throughout the year. However, the VDA, Germany’s association of the automotive industry, has also cautioned that additional shortages along the supply chain have not only been caused by the war in Ukraine, but by renewed COVID-19-related lockdowns in China.

The heatwave across Europe is inevitably causing short-term disruption to supply chains and/or vehicle deliveries too. Although order books are full, inflationary pressure will compromise demand as consumers delay purchases.

In Italy, new-car sales have been restrained as consumers awaited purchase incentives announced in April. As these were reinstated on 25 May, an improvement in registrations, especially of electric vehicles (EVs), is materialising, albeit slower than Autovista24 had factored into its forecast for June. Moreover, the purchase incentives ‘are already exhausted for the 61-135g/km CO2 range, where the greatest number of requests was concentrated,’ commented Paolo Scudieri, president of the Italian carmakers’ association ANFIA.

Similarly, the UK government ended the plug-in car grant (PiCG), which offered up to £1,500 (€1,740) off the cost of a new electric car. Furthermore, the consumer prices index (CPI) rose by 9.1% in the 12 months to May 2022, up from 9% in April, and is likely to exceed 10% in the coming months. There was another interest-rate hike in June too, to 1.25%, with more expected throughout the year.

Accordingly, the forecasts for four of the big five European new-car markets have been downgraded this month. The exception is France, where the better-than-expected June result and an extension to the existing EV incentives to 31 December 2022 has prompted Autovista24 to increase its forecast for 2022, albeit by just 13,000 units.

Nevertheless, the net effect is that the combined 2022 forecast for the big five European new-car markets has been lowered from 8.26 million units last month, to 8.23 million units, equating to a year-on-year decline of 0.2%. Furthermore, the outlook for other European markets has been reduced too, with the entire European new-car market expected to fall 1.6% to below 11.6 million units. This is 26.7% lower than the 15.8 million new cars registered in 2019.

The ongoing semiconductor shortage is expected to see a large volume of registrations displaced into 2023 due to the associated impact on vehicle supply. With this displacement, double-digit growth rates are expected in all five key European markets in 2023.

However, Autovista24 does not expect to see a return to a semblance of automotive market normality until 2024. That year is also expected to benefit from a pull-forward effect as automotive manufacturers and consumers seek to register cars ahead of the EU Commission’s target of a 15% reduction in CO2 emissions in 2025, compared to 2021 levels.

Autovista24 foresees a modest correction in Europe’s new-car market in 2025, before growth returns from 2026 until 2029. This is ahead of the EU aiming for a 55% CO2 emissions reduction for cars compared to 2021 levels by 2030, under the Fit-for-55 package. This also coincides with the end of sales of new petrol and diesel cars in the UK.

Ultimately, Autovista24 predicts that the European new-car market will not return to pre-pandemic levels until the next decade, with another correction expected in 2035 with the EU phase-out of new internal-combustion engine (ICE) car sales, as recently endorsed by the bloc’s lawmakers.

The full interactive dashboard presents the latest and previous monthly forecasts for the big five European markets for 2022, as well as the annual outlook to 2025.