Used-car transactions fall across Europe in first three quarters of 2022

24 November 2022

The combined volume of used-car transactions across the big five European markets fell further than new-car registrations in the first three quarters of 2022, explains Autovista24 senior data journalist Neil King.

The used-car markets of France, Germany, Italy, Spain, and the UK all contracted year on year in the first three quarters of 2022. France and Germany endured the most pronounced declines and even the UK’s used-car market weakened more than the new-car market – despite expanding by 5.1% in the first quarter.

Used-car transactions in Italy and Spain contracted less than new-car registrations in the year-to-date, but the decline in the big five European used-car markets averaged 10.7%, compared to 10.2% for new-car markets.

Undersupply supports residual values

Used-car markets continue to be hampered by poor supply stemming from new-car delivery delays and show no signs of improvement as the cost-of-living crisis also impacts demand. Official data on used-car transactions in October (available for France, Germany, Italy, and Spain) confirm a further deterioration of the year-on-year downturns in the first three quarters of the year, except in Italy.

In contrast, new-car markets, albeit also contending with weakening demand, have grown year on year in recent months. This is because of the diminishing base of comparison from mid-2021 onwards due to mounting semiconductor shortages.

Weaker used-car demand would ordinarily have a negative impact on prices, but Autovista24’s latest Monthly Market Update (MMU) confirms residual values (RVs) are being maintained as undersupply remains a critical factor. The month-on-month deviations were all in a narrow range of -0.2% in the UK to 0.8% in Italy.

Used-car transactions across the big five European markets are predicted to end 2022 about 10% lower than in 2021, whereas the latest Autovista24 forecast sees a 5.8% decline in the combined volume of new-car registrations. Nevertheless, RVs will finish this year higher than in 2021, except in the UK.

Looking ahead, rising inflation and interest rates will not just curtail underlying demand for new cars, but also for used models as household budgets are squeezed. The tables are turning, however, and the anticipated year-on-year growth in new-car markets will exceed any improvement in used-car activity.

Although supply is expected to improve, this does not mean 2023 will be a rebound year for the automotive industry as economic headwinds buffet demand. Autovista24 forecasts that RVs will decline, or at best stabilise, across European markets in 2023 and 2024.

France, Germany, and the UK underperform

In the first three quarters of 2022, the French used-car market declined by 13.8% year on year, with fewer than 4 million transactions, according to AAA Data. This marks a slight deterioration from the 12.4% year-on-year decline in the first half and is also greater than the 11.8% downturn in the new-car market. There was no improvement in October either, with AAA Data reporting a 13.8% decline in the month.

‘The segment of used vehicles less than five years old continues its descent into hell (-25% or 137,266 units). Mechanically hit by the contraction of the new-vehicle market, it suffers from a lack of availability of recent equipment. On the other hand, the segment of used cars over 10 years old is the most resilient, with a contained decline of 4.6%,’ the data provider commented.

Compared to the first nine months of 2021, Germany’s used-car market contracted by 16.8% this year, with 4.28 million transactions. The country’s new-car market fared better, dropping by 7.4%, KBA figures reveal. This gap widened in October, with used-car transactions down 17% in the first 10 months of the year, compared to a 5.5% fall in new-car registrations.

The UK’s Society of Motor Manufacturers and Traders (SMMT) reports that 5.3 million used cars changed hands during the first three quarters of 2022, down 9.7% year on year. This marks a subtle recovery, whereby the volume of transactions was down 12.2% in the third quarter, after tumbling 18.8% in the second.

‘Given the short supply of new cars due largely to sustained chip shortages, a declining used-car market comes as little surprise, although it is great to see a growing number of used buyers able to get into an electric car. The demand is clearly there and to feed it we need a buoyant new-car market, which means giving buyers confidence to invest,’ commented SMMT chief executive Mike Hawes.

The UK’s new-car market had struggled even more in 2022. However, year-on-year growth since August means there were 8.2% fewer registrations than in the first three quarters of 2021.

Comparative resilience in Spain and Italy

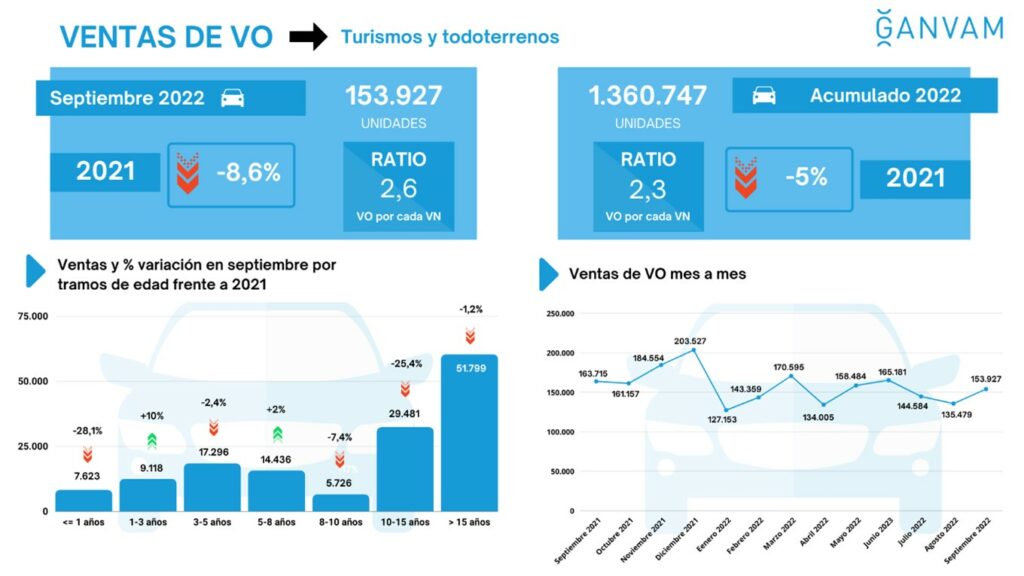

The number of used-car transactions in Spain fell by a comparatively resilient 5% in the first nine months of 2022, down to 1.36 million units according to dealers’ association GANVAM. Nevertheless, the Spanish market also worsened since the 4.5% decline in the first half. Meanwhile, the country’s new-car market slowly improved but still suffered a greater decline of 7.4% compared to January-September 2021.

Another year-on-year fall in used-car transactions in October means the Spanish market is 4.8% weaker in the year-to-date. But, new-car registrations grew year on year again last month and are down 5.8% compared to the same period in 2021.

In Italy, industry association ANFIA reports a total of 3.48 million used-car transactions in the first three quarters of 2022, equating to a year-on-year fall of 8.3%. This is weaker than the 7.1% contraction in the first half of this year, but used-car transactions gained 1.7% last month. Accordingly, the used-car market is down 7.3% in the first 10 months of 2022, essentially maintaining the downturn in the first half.

Meanwhile, new-car registrations in Italy have suffered the biggest drop among the big five European markets. Volumes tumbled 16.3% in the first three quarters of 2022, although this improved slightly to a 13.8% cumulative decline through October.