Monthly Market Update: Balance of weak used-car supply and demand maintains residual values

02 November 2022

Used-car transactions slowed across European markets in October as consumers contend with rising living costs and economic uncertainty. But undersupply means residual values (RVs) continue to track list-price increases.

Accordingly, average prices of three-year-old used cars, represented as a retained percentage of their original list price (%RV), were stable in October. The month-on-month deviations were all in a narrow range of -0.2% in the UK to 0.8% in Italy.

New-car registrations in Europe enjoyed their second consecutive month of year-on-year growth in September. The 7.9% gain was more than double the 3.4% recorded in August, which ended 13 consecutive months of decline. These figures confirm the expected modest improvement in new-car supply, which has been constrained by pre-existing semiconductor shortages as well as additional challenges caused by the war in Ukraine and COVID-19 lockdowns in China.

However, the situation is only slowly improving and the Autovista24 outlook for new-car registrations in Europe in 2022 and 2023 is poorer as the cost-of-living crisis engulfing the region weakens underlying demand. This means undersupply into the used-car market is expected to persist into 2024, which will continue to bolster RVs.

On the downside, the cost-of-living crisis is also eroding consumer desire and ability to buy used cars. The assumption of diminishing demand means the %RV is only forecast to edge forward, if not decline, across European markets in 2023 and 2024.

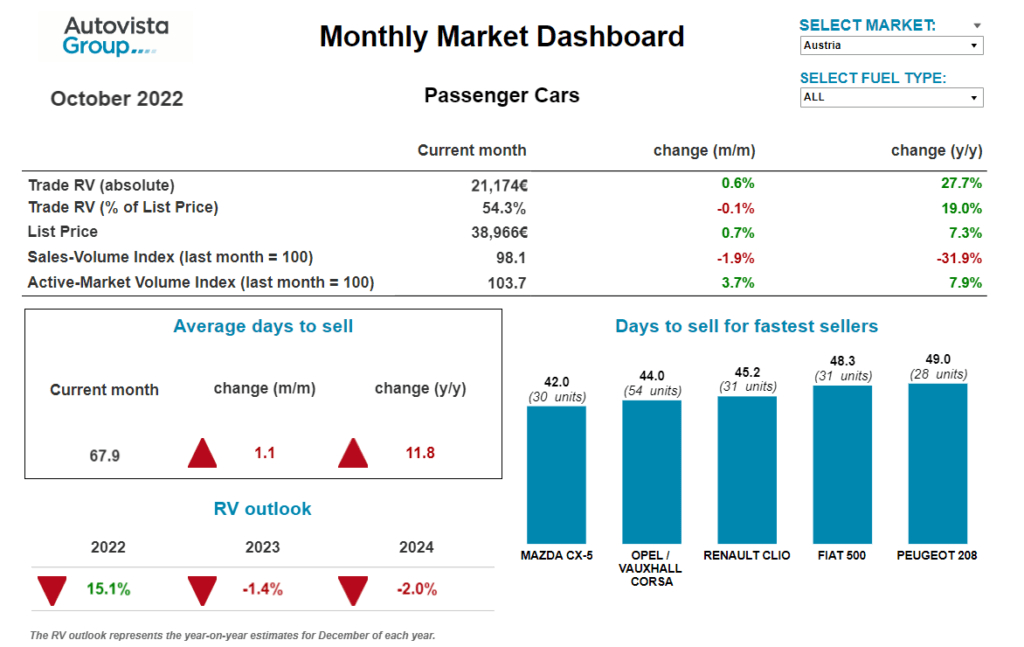

The interactive monthly market dashboard features Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, stock days, sales-volume and active market-volume indices.

Weak demand but low supply in Austria

The Austrian used-car market is showing signs of weakening demand, with increasing but still low supply. ‘As elsewhere in Europe, used-car transaction activity is slowing down compared to the first half of the year as the costs of living are rising,’ commented Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

On average, across all passenger cars aged two-to-four years, the supply volume in October was 3.7% higher than a month before and 7.9% higher than in October 2021. Last year however, supply was significantly lower than at the beginning of 2020. Meanwhile, the sales-volume index clearly shows weakening demand, with declines of 1.9% compared to September and 31.9% versus October 2021. Diesel cars are impacted the most, with the sales volume down 40.4% year on year.

Average days to sell have increased significantly, to 67.9 days. This development also confirms the slowdown of used-car demand. Hybrid-electric vehicles (HEVs) are currently selling the fastest, averaging 43.9 days, followed by battery-electric vehicles (BEVs) with 51.1 days, petrol cars with 67.9 days and diesel cars with 68.7 days. Plug-in hybrids (PHEVs) are selling the slowest, averaging 73.7 days.

With demand weakening, the average %RV of 36-month-old cars decreased by 0.1% month on month in October, with cars retaining 54.3% of their original list price on average. However, this is still a solid increase of 19% year on year. Hybrids are currently leading with value retention of 55.3%, followed closely by PHEVs (55%), diesel cars (54.8%), and petrol cars (54.1%). 36-month-old BEVs retain the lowest value, at 51.6% of list price.

As demand faces more weakness, further pressure on RVs is to be expected. However, the supply side will not change in the medium term, because new-car registrations are still markedly lower than before the crisis. 2021 was down 27% compared to 2019, and the outlook for 2022 is even below last year’s volume. ‘The supply of new cars will be the key factor in the future development of RVs. Supply chains were already disrupted and together with the semiconductor shortage, the war in Ukraine is leading to even longer delivery times for most new vehicles,’ Madas explained.

Due to this undersupply, Madas expects RVs of three-year-old passenger cars to stay high this year, gaining approximately 15% compared to December 2021. ‘Only when the volumes on the used-car market increase, or demand suffers significantly, are values likely to come under pressure. This will probably be the case over the course of 2023,’ he concluded.

Fuel shortages and higher ranges in France

The French used-car market has seen declining sales as demand weakens, and selling prices stabilise. With the current low availability of fuel due to strikes at refineries, a comeback of interest in electric vehicles is expected.

‘However, Tesla has announced higher prices at their superchargers, and an increase in electricity prices by around 15% to 17% in January will dissuade people from opting for BEVs. While incentives still stand at €6,000, this will decrease to €5,000 in 2023. In summary, the current climate is uncertain,’ explained Ludovic Percier, residual value and market analyst, France, at Autovista Group.

Nevertheless, used-BEV prices are currently increasing as the low availability of new cars helps used-car demand. There are more vehicles available on the used-car market with a higher range than last year, which is also supporting values, and part of the increase in new-car list prices is being transferred to used cars. However, sales volumes are lower in the used-car market too as the higher prices impact demand.

RVs of HEVs have peaked and remain stable, whereas prices of used PHEVs are falling for the first time and Percier expected bigger declines from mid-2023, with the end of leasing contracts pushing more vehicles onto the used-car market. ‘Diesel values continue to gain slightly and increases in petrol RVs are still visible, especially because of the high malus – not only for sports and exotic cars but also for larger SUVs and MPVs,’ Percier added.

Erosion of CNG cost savings in Italy

The sales-volume index of cars aged between two and four years was down slightly month on month in October. Compared to a year ago the drop is 9.1%, contrasting with the number of adverts increasing by 24.8% year on year.

Despite this, it currently takes on average 60 days to sell a used car, and the %RV is not showing any signs of decreasing, with further growth of 0.8% last month. ‘The situation is definitely more stable than a few months ago, but the downward phase has not yet begun. We have therefore revised our RV outlook and expect 2022 to close 13.2% higher than December 2021,’ explained Marco Pasquetti, head of valuations, Autovista Group Italy.

Among the most popular cars on the used-car market, it is not surprising that the Fiat Panda has been the fastest seller, averaging less than 37 days in stock. ‘After all, even in the new-car market, it is still by far the best-selling car in Italy,’ commented Pasquetti.

The %RV is growing for PHEVs and especially for BEVs, which are up 23.2% on October 2021. ‘BEVs are certainly supported by growing demand, but it should be highlighted that volumes are still very limited compared to traditional fuel types. Albeit with a few exceptions, it takes 84 days to complete a sale – more than 20 days longer than the average for a used car’ Pasquetti noted.

Although there is still a strong increase in the %RV for compressed natural gas (CNG) cars compared to last year, it is one of the few fuel types that decreased compared to last month, albeit only slightly (-0.3%).

According to data released by the Italian ministry of economic development’s pricing observatory, the CNG price rose from €0.66/m3 in the first quarter of 2021 to €1.984/m3 in the second quarter of 2022. ‘This is of course changing the minds of many Italians who previously preferred CNG to diesel or petrol because of the cost savings, which are no longer there,’ Pasquetti concluded.

Age profile a cause for concern in Spain

‘The Spanish new-car market faces the last quarter slightly cushioned compared to 2021, with upturns in the private and business sales channels – and even the rental sector, which had been the channel most penalised by the shortage of product,’ commented Ana Azofra, Autovista Group head of valuations and insights, Spain.

Nevertheless, it seems impossible for the new-car market to recover quickly as it is weighed down by high inflation, rising interest rates, general economic uncertainty, and a lack of product on the supply side. Specifically, there was a cumulative 7.4% year-on-year fall in registrations in the first three quarters of 2022.

The decline in the used-car market is slightly less severe, at around 5%, but it is still much higher in volume terms with fewer than 1.4 million transactions by the end of September. Currently, 2.3 used vehicles are being sold for every new vehicle. The profile of the increasingly ageing market remains a cause for concern, with vehicles over 15 years old accounting for one in three sales.

‘This situation cannot be resolved in the short term, as the supply of nearly-new and young used cars continues to shrink every month and is only at about half of the level in 2021. Deliveries to rental companies have allowed partial fleet renewal and helped to meet used-car demand. But the age profile has also changed as the cars coming from this channel are older than in the past and, logically, their use has been more intense,’ Azofra explained.

In these very special circumstances, and despite the shortage of supply, market stabilisation was confirmed in October. Transaction values have hardly moved at all, and stock days remain stable.

HEVs continue to perform better than internal-combustion engines (ICEs), which is favouring the selling days of Asian brands such as Toyota, Lexus, and Kia. Models such as the Toyota Yaris, Lexus NX and Kia Niro are being sold especially quickly. Nissan is also performing well in this respect, with the X-Trail and Leaf leading the selling-day rankings for diesel cars and BEVs, respectively. The Hyundai i20 leads the ranking for petrol cars.

Low supply shields RVs in Switzerland

The Swiss used-car market is showing signs of weakening demand, with increasing but still low supply. ‘With rising costs of living, used-car transactions are slowing compared to the first half of the year,’ noted Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

Across all two-to-four-year-old passenger cars, the supply volume in October was 4.2% higher than a month earlier and 29.5% higher than in October 2021. Supply was significantly lower last year than at the beginning of 2020. Meanwhile, the sales-volume index clearly shows weakening demand, with falls of 0.4% compared to September and 13.6% compared to October 2021. HEVs are impacted the most, with sales volumes decreasing by 48.4% year on year.

Despite weakening demand, the average value retention (%RV) of 36-month-old passenger cars grew slightly to 51.4% in October (up 16.8% compared to October 2021). BEVs posted particularly strong year-on-year %RV gains of 25.1%. Petrol cars are currently leading, however, retaining 52.2% of their original list price, followed by BEVs (50.4%), diesel cars (50.1%), and hybrids (49.2%). 36-month-old PHEVs retain the lowest value, at 47.7% of list price.

The average days to sell increased in October compared to September, with a passenger car aged two-to-four years in stock for 69 days. BEVs are selling quickest, after an average of 59 days, followed by HEVs after 62 days, diesel cars after 68 days, petrol cars after 69 days, and PHEVs after 80 days.

‘The disrupted supply of new cars, exacerbated by the war in Ukraine, and recent list-price increases are key factors in the future development of RVs. Supply chains are heavily affected, leading to long delivery times for most new vehicles,’ Annen emphasised.

As demand looks set to weaken further, Annen expects greater pressure on RVs. However, supply will not improve in the medium term as new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019). ‘Even as used-car demand cools, RVs of three-year-old used cars will remain high this year and are forecast to end 2022 approximately 12% up on December 2021, before declining over the years 2023 and 2024,’ Annen concluded.

UK RV decline ‘gentler than otherwise expected’

In the latter half of 2020, RVs stabilised in the UK, even growing slightly. But 2021 saw incredible increases because of strong demand and weak supply. In 2022, there has been a continuation of weak supply, but demand has also weakened in the first three quarters.

‘Over the past three years, Glass’s estimates that the UK’s new-car market lost in the region of two million registrations due to a combination of COVID-related production delays and component-supply issues. While bad news for manufacturers and consumers alike, the resulting knock-on effect of fewer cars entering the used-car market has played a significant role in propping up residual values. This supply and demand balance has led to a gentler decline in RVs than we could have otherwise expected,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

When the average residual value is expressed as a percentage of the new-cost price, a three-year-old car stands at 62.5%. This is down just 0.2% compared with September but remains 3.1% ahead of last year.

There are tentative signs that retail activity has begun to improve, with the average time it took a dealer to sell a used car falling by 2.7 days compared to September, albeit 7.4 days up on last year’s feverous activity. The active-volume index indicates an improving picture in terms of stock availability, being up 10.7% compared to September, whereas retail sales appear to have fallen 14.5%.

‘In view of broadly stable residual-value performance, Glass’s has upgraded its RV outlook. While we still expect to see a decline in RVs over the next couple of months, by year-end we estimate a year-on-year movement of circa -5%,’ Whittington surmised.

The October 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.