Monthly Market Update: RVs hold as lack of replacement cars prevents de-fleeting

04 October 2022

Although European used-car transactions are cooling as consumers contend with rising living costs and economic uncertainty, residual values (RVs) are keeping pace with list-price developments. Accordingly, average used-car prices, represented as a retained percentage of the original list price (%RV), were stable in September, with month-on-month deviations ranging from -0.1% in Spain to 1.3% in Austria.

New-car registrations across the region recorded year-on-year growth in August, finally putting an end to 13 consecutive months of decline. However, the recovery remains slow and supply into the used-car market is limited as rental and business channels hold on to their fleets because of the shortage of replacement vehicles.

With no improvement in the latest Autovista24 European market outlooks, the supply of new cars, and subsequently used cars, remains an issue that is expected to persist into 2024, which will continue to bolster RVs.

On the downside, the cost-of-living crisis is eroding the willingness – and budgets – of consumers to buy used cars, as well as new ones. Despite the supply challenges, the prospect of diminishing demand means prices may already have peaked in some countries and the %RV is forecast to edge forward, if not decline, across European markets in 2023 and 2024.

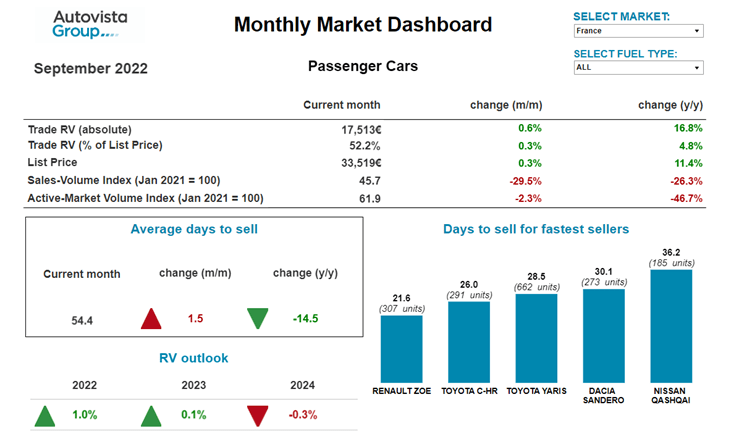

The interactive monthly market dashboard features Austria, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including residual values, new-car list prices, and stock days, as well as sales-volume and active market-volume indices.

Sales slow, supplies stabilise in Austria

The Austrian used-car market continues to be underpinned by demand outstripping supply, but the gap is narrowing. ‘As elsewhere in Europe, used-car transaction activity is slowing, and the costs of living are rising. This results in weakening demand compared to the first half of the year,’ noted Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

On average across all passenger cars aged two-to-four years, the supply volume in September was 0.7% lower than in September 2021. Already in 2021, supply was significantly lower than at the beginning of 2020. Compared to August, however, the supply situation has stabilised somewhat with a slight increase of 0.2% month on month.

The supply of battery-electric vehicles (BEVs) showed a strong downward trend again, with a drop of 43.3% year on year. Hybrid-electric vehicles (HEVs) are also missing from the market, with drops of 24% year on year and 8% compared to the previous month. Market activity shows strong demand for BEVs and hybrids of all types, leaving their supply short. Diesel cars are still missing from the market, with a drop of 8.7% compared to September 2021.

Days to sell have increased significantly to an average of 65.3 days. This development also confirms the slowdown of used-car demand. Days to sell have only decreased for BEVs, which are selling the fastest, averaging 47.8 days, followed by petrol cars with 63.2 days, diesel cars with 66.4 days and HEVs with 74 days. Plug-in hybrids (PHEVs) are selling the slowest, averaging 80.7 days.

Despite the weakening demand, RVs of 36-month-old cars have further increased, in both value (€RV) and retention terms. The %RV rose by 22.9% year on year and 1.3% month on month in September, with cars retaining 54.4% of their original list price on average. PHEVs are currently leading with a trade value of 55.7%, followed closely by diesel cars (55%), HEVs (54.5%) and petrol cars (54.3%). 36-month-old BEVs retain the lowest value, at 49.7% of the list price.

‘As the demand side points to a change in the near future, pressure on RVs is to be expected,’ commented Madas. However, the supply side will not change in the medium term, because new-car registrations are still markedly lower than before the crisis: 2021 was down 27% compared to 2019, and the outlook for 2022 is even below last year’s volume. The supply of new cars will be the key factor in the future development of RVs. Supply chains were already disrupted and together with the semiconductor shortage, the war in Ukraine is leading to even longer delivery times for most new vehicles.

Due to this undersupply, Madas expects RVs of three-year-old passenger cars to remain high this year, gaining about 15% compared to December 2021. Only when volumes on the used-car market increase or demand suffers significantly, are values likely to come under pressure. This will probably be the case during 2023.

Energy prices impact BEVs in France

Residual values continue to increase in France due to higher list prices and the low number of used cars on the market. ‘However, we observe slower growth as private buyers are more focused on older vehicles or a lower segment than usual, mainly led by budget constraints. Consumers are not following the price increases, with used cars aged over 12 years the least affected,’ explained Ludovic Percier, residual value and market analyst, France, at Autovista Group.

There is an uncertain climate for 36 and 48-month-old vehicles, but higher oil prices are motivating the purchase of BEVs. ‘However, some users have not had a great experience with the charging network over the summer and have asked dealers to take back their BEV in exchange for a car with an internal-combustion engine (ICE). This shows that charging points are a crucial element in the development of BEVs in the market,’ commented Percier.

A planned increase in electricity costs, albeit limited by the French government, has had a slight impact on BEV sales and Percier warns the impact will be greater once the price cap is removed. ‘There are more BEVs with higher ranges available on the used-car market than last year, but there is still a gap of 20 percentage points between a BEV and its equivalent ICE model. For diesel engines, however, RVs are approaching their peak, with only a very slight increase in September,’ Percier noted.

There have been lower fleet sales of PHEVs since July due to the increase in list prices. Companies are delaying the renewal of PHEVs or extending their lease contract period. ‘If they choose to change, they will opt for HEVs as they have a lower price gap compared to ICE cars than PHEVs. From July 2023, PHEVs will be more present on the used-car market, with a big return of leased vehicles. However, demand is still low among private buyers on the used-car market, which will lead to a drop in RVs,’ Percier concluded.

RVs stable as Italy elects new government

The residual values of almost all fuel types were stable in Italy last month, compared to August, with three-year-old cars retaining an average 50.3% of their price when new. Compared to a year ago, the %RV has grown 15.9%, in line with last month. The sales-volume index has fallen sharply however, by 9.2% compared to September 2021, while the volume of active advertisements represented by the active-market volume index grew by 25.2%.

‘The trend is now fairly well established, and we do not expect any major surprises between now and the end of the year. The outlook for year-end growth, of 11.6% compared to December 2021, is somewhat lower than the current year-on-year growth. However, this is not because we expect a decline in RVs, but because the comparison is against the 2021 closing figure, which was up sharply on the previous quarter,’ explained Marco Pasquetti, head of valuations, Autovista Group Italy.

The most significant RV growth is expected for full-hybrid vehicles, which have increasingly strengthened their position on the used-car market in recent months, with year-on-year growth of 19% in September. The outlook for the end of the year is for a 17.5% increase.

‘For 2023 and 2024, it will be important to understand whether the new government will decide to introduce changes to the incentive scheme and infrastructure development or stick to the same strategy as the previous government. This variable will especially affect battery-electric and plug-in hybrid vehicle values,’ Pasquetti concluded.

Young used-car suppliers ‘hold on to their fleets’ in Spain

In an increasingly uncertain environment, the new-car market’s chances of recovery are vanishing, with a year-on-year decline of 7.4% in the first three quarters. ‘The semiconductor crisis is not being quickly resolved and the current economic circumstances – high inflation, rising interest rates, and the threat of recession – are holding back demand and will continue to do so,’ commented Ana Azofra, Autovista Group head of valuations and insights, Spain.

The used-car market is also experiencing a decline, with transactions down about 5% in the year-to-date. ‘This almost quadruples when considering cars up to four years of age, which account for most dealer sales. The usual suppliers of these young cars – the rental channel and companies – continue to hold on to their fleets given the difficulty in renewing them. The trade is increasingly resorting to imports, which continue to grow and contribute to the rise in prices,’ Azofra explained.

In September, the average price of a three-year old used car with 60,000km on the clock, rose by 0.5% month on month, by approximately €100, to €19,869 (almost €3,800 more than in September 2021). Spain is one of the markets in which used car prices have increased the most, although the rate of growth has slowed down and the trend towards stabilisation was once again confirmed last month.

This is not only because of the moderation in prices, but also due to the increase – for yet another month – in the number of stock days, which increased by a further 3.5 days. At an average of 70 days, this is similar to pre-pandemic levels, the last stable period in the automotive sector.

However, analysis by fuel type reveals that stability is only found in diesel and petrol cars. ‘HEVs, PHEVs and BEVs are more dynamic, with fewer selling days and less pressure on their transaction prices,’ Azofra added.

Limited RV growth in Switzerland

For over two years, the Swiss used-car market has been characterised by healthy demand, low supply, and rising used-car prices. ‘Across all two-to-four-year-old passenger cars, the supply volume in September was 20.8% higher than a year earlier but, in 2021, supply was significantly lower than at the beginning of 2020. The sales-volume index in September was 9.4% higher than in August but 16.4% down year on year’ noted Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

Nevertheless, RVs have grown slightly quicker than list prices. This market environment has led to a further increase in the average %RV of 36-month-old passenger cars, to 51.1% (up just 0.5% month on month but 17.7% compared to September 2021).

Petrol cars posted strong year-on-year %RV gains of 16.8%, to 52%, as did diesel cars (up 18.4% to 49.7%) and BEVs (up 22.4% to 48.8%). Diesel cars are still missing from the market, with only a slight increase of 2% in the active-market volume index compared to September 2021. The supply of BEVs shows an especially strong downward trend, with a drop of 12.6% year on year.

The average days to sell increased in September compared to August, with a passenger car aged two to four years in stock for 67 days. BEVs are selling the quickest, after an average of 60 days, followed by diesel cars after 64 days, HEVs after 66 days, petrol cars after 68 days, and PHEVs after 83 days.

The disrupted supply of new cars, exacerbated by the war in Ukraine, and recent list-price increases are key factors in the future development of RVs. Supply chains are heavily affected, leading to long delivery times for most new vehicles.

As new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019), Annen concludes that the market parameters will not significantly change in the medium term, even as used-car demand cools. ‘RVs of three-year-old used cars will remain high this year and are forecast to end 2022 approximately 12% up on December 2021, before declining over the years 2023 and 2024.’

The September 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.