No improvement in European new-car market outlooks despite resumption of recovery

29 September 2022

Autovista24 has maintained its 2022 forecasts for most European new-car markets but revised Germany and the UK downwards, explains senior data journalist Neil King.

There was a return to year-on-year growth across Europe’s big five new-car markets in August. Three of the countries – France, Italy, and the UK – even exceeded Autovista24’s expectations and Spain was closely aligned, although Germany performed below par. Nevertheless, Autovista24’s 2022 outlooks for all five new-car markets have not been upgraded as supply improvements were already assumed, and the cost-of-living crisis threatens underlying demand.

The forecasts for Germany and the UK have been revised downwards, along with the assumptions for Europe beyond the big five markets, and the overall European outlook for 2022 is therefore lower too. As rising energy costs, inflation and interest rates curtail consumers’ purchasing power and willingness to commit to big-ticket items such as a new car, Autovista24 has also downgraded its outlooks for 2023 and beyond. The region is not expected to return to the 2019 level this decade.

Adjusted for the extra working day in August, Autovista24 estimates that Germany and the UK contracted 1.4% and 3.4% year on year, respectively. However, all the major markets showed signs of improvement compared to July, as too did Europe as a whole. This is reflected in both the year-on-year changes, and the higher seasonally-adjusted annualised rates (SAAR).

This confirms the recovery that Autovista24 had already factored into its outlooks, based on the assumption that the impact caused by the Ukraine war is lessening as alternative sources of raw materials and parts are secured.

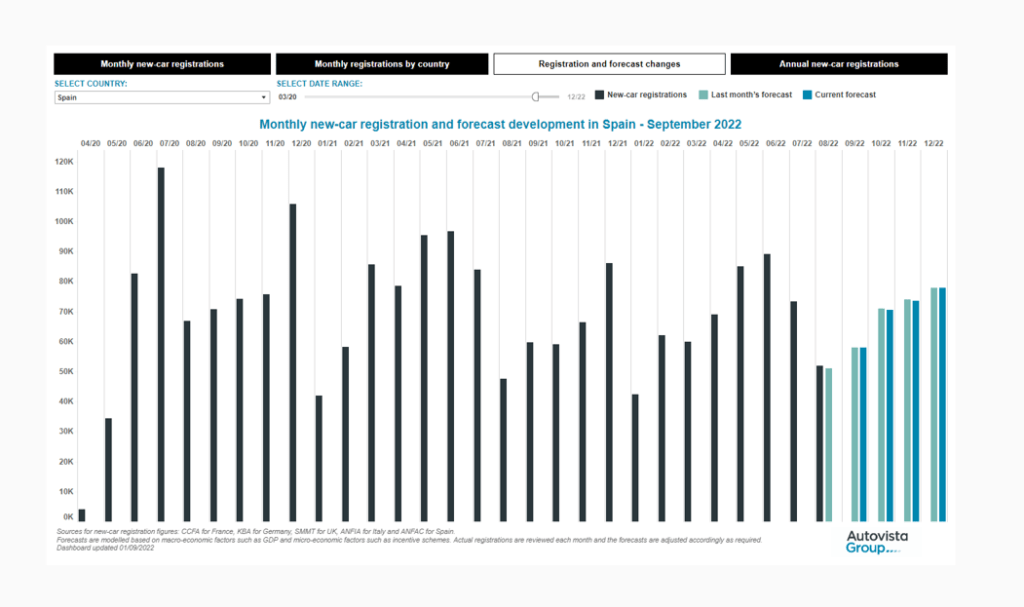

Monthly new-car registrations, Spain, April 2020 to December 2022

France, Italy, Spain outlooks maintained

The French new-car market has been heavily affected by regulatory changes introduced at the start of the year, but the cumulative decline in the first eight months of the year has improved to 13.8%. The recent extension to the existing incentives for electric vehicles (EVs), to 31 December 2022, will support French new-car demand in the coming months, but the volume forecast has been held at 1.57 million units, 5.2% lower than in 2021. Next year’s outlook has been reduced to 1.88 million new-car registrations, equating to growth of 19.7%. This remains 15% lower than the 2.2 million new cars registered in 2019, prior to the COVID-19 pandemic.

August marked the first monthly new-car market expansion in Italy since June 2021 and the SAAR, at 1.73 million units, was at its highest level since December 2020. Purchase incentives for electric vehicles were reinstated on 25 May and, at the beginning of August, the Italian government extended the availability of the incentives to rental and leasing companies, which were previously excluded.

Nevertheless, new-car demand will invariably suffer as businesses and consumers face higher energy costs and broader inflationary pressure. Autovista24 has maintained its forecast for 2022, at 1.37 million units, but has lowered the outlook for 2023 to fewer than 1.7 million units. At this level, the market would be 11.5% smaller than in 2019.

In Spain, year-on-year growth in August, of 9.1%, was the first since February, and the SAAR was the highest for any month in 2022, at 878,000 units. Accordingly, the year-to-date contraction has reduced to 9.4%, but the recovery remains fragile.

Tania Puche, communications director of GANVAM, has emphasised that sales to private buyers, which indicate the true health of the market, have been especially low because the ‘current climate of economic uncertainty does not invite buying.’

In this unfavourable climate, Autovista24 has not amended its forecast for 2022, which anticipates 813,000 new-car registrations, marking a year-on-year decline of 5.4%. For 2023, the market is no longer expected to exceed the one-million mark.

UK and Germany downgraded

Following five consecutive months of year-on-year declines, the UK new-car market marginally expanded in August and the SAAR increased to over two million units for the first time since August 2021. But this is no cause for celebration as the cost-of-living crisis intensifies, jeopardising the country’s automotive sector across the rest of this year and beyond.

Autovista24 has revised its 2022 forecast for UK new-car registrations downward, to 1.62 million units. This equates to a year-on-year decline of 1.6%, and a 29.9% contraction compared to the pre-pandemic level of 2019. Although countless new-car orders will not be fulfilled this year, inflation continues to soar, and the pound has devalued in the wake of tax cuts announced by the UK government. Further interest-rate hikes are therefore expected as the Bank of England attempts to bring rising prices under control. The weaker demand assumption means Autovista24 has reduced its new-car registrations outlook for 2023 to 1.92 million units.

In contrast to the other big European markets, the SAAR only improved slightly in Germany, from 2.51 million units in July to 2.52 million in August. In the first eight months of 2022, 1.64 million new cars were registered, a year-on-year fall of 9.8%. To put this into perspective, from January to August 2019, around 2.5 million new cars were registered, while in the same period in 2020, the country reported 1.78 million new-car transactions.

Rising energy prices and inflation are having a clear impact on consumer behaviour. With list prices increasing, customers are less willing to spend their money on higher-priced new cars. Analysts have also observed that the government’s planned reduction of subsidies for electric vehicles is having a dampening effect on buying patterns for new cars. Given the weaker order intake in the country and ongoing supply-chain disruption, Autovista24 forecasts that new-car registrations will fall by 5% this year to a total 2.49 million units.

Europe to contract 5% in 2022

The net effect of the downgrades in Germany and the UK is that the combined 2022 forecast for the big five European new-car markets has been lowered from 8.0 million units last month, to 7.87 million units, equating to a year-on-year decline of 4.5%. Furthermore, Autovista24 has reduced the outlook for Europe’s smaller markets too, with the entire European new-car market expected to fall 4.8% to 11.2 million units. This is 29.1% lower than the 15.8 million new cars registered in 2019.

The ongoing semiconductor shortage is expected to see a large volume of registrations displaced into 2023 due to the associated impact on vehicle supply. With this displacement, double-digit growth rates are expected in all five key European markets, and thus across the region, in 2023.

Autovista24 does not expect to see a return to a semblance of automotive market normality until 2024. That year is also expected to benefit from a pull-forward effect as automotive manufacturers and consumers seek to register cars ahead of the EU Commission’s target of a 15% reduction in CO2 emissions in 2025, compared to 2021 levels.

Autovista24 then foresees a modest correction in Europe’s new-car market in 2025, before growth returns from 2026 until 2029. This is ahead of the EU aiming for a 55% CO2 emissions reduction for cars compared to 2021 levels by 2030, under the Fit-for-55 package. This also coincides with the end of sales of petrol and diesel cars in the UK.

Ultimately, Autovista24 predicts that the European new-car market will not return to pre-pandemic levels until the next decade, with another correction expected in 2035 with the EU phase-out of new internal-combustion engine (ICE) car sales, as recently endorsed by the bloc’s lawmakers.

The full interactive dashboard presents the latest and previous monthly forecasts for the big five European markets for 2022, as well as the annual outlook to 2025.