UK new-car market faces growing derailment risk

07 September 2022

Following five consecutive months of year-on-year declines, the UK new-car market marginally expanded in August. But this is no cause for celebration as the cost-of-living crisis intensifies, jeopardising the country’s automotive sector across the rest of this year and beyond.

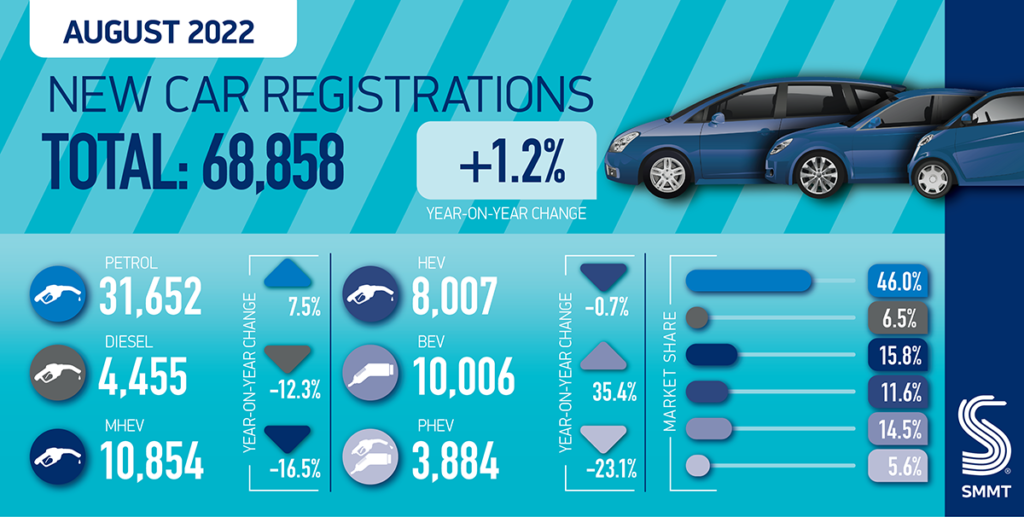

The Society of Motor Manufacturers and Traders (SMMT) reports that 68,858 new cars were registered in the UK during August, equating to year-on-year growth of 1.2%. ‘Despite the growth, August volumes were still the weakest for the month, bar 2021, since 2013 as supply-chain pressures continued to constrain the market,’ the association explained.

There was one more working day than in August 2021, and on an adjusted basis, Autovista24 estimates that the volume of registrations fell 3.4%. Nevertheless, this marks an improvement on the adjusted 4.7% downturn in July. Additionally, the seasonally-adjusted annualised rate (SAAR) increased to over two million units for the first time since August 2021.

This aligns with the resumption of market recovery in France, Italy, and Spain, following the debilitating impact of the heatwave on the new-car trading environment.

However, Autovista24 has downgraded its outlook for the UK new-car market as inflation continues to soar. Further interest-rate hikes are expected too as the Bank of England attempts to bring rising prices under control.

Inflation tops 10%

UK new-car registrations declined by 10.7% year on year in the first eight months of 2022, to 983,099 units. This is ‘more than a third (35.3%) lower than during the first eight months of pre-pandemic 2019 – demonstrating the scale of the challenge ahead in terms of recovery,’ the SMMT noted.

The market performed better in August than Autovista24 predicted, and supply is expected to improve throughout the remainder of 2022. However, the mounting financial pressure on businesses and consumers alike will inevitably suppress underlying demand.

The consumer prices index (CPI) exceeded the psychological threshold of 10% in the 12 months to July 2022, up from 9.4% in June. The Bank of England stated last month that it expects CPI inflation to ‘rise to just over 13% in 2022 Q4, and to remain at very elevated levels throughout much of 2023, before falling to the 2% target two years ahead.’

Inflation could climb even higher as wholesale gas and electricity costs surge in the wake of Russia’s indefinite shutdown of the North Stream pipeline. New Prime Minister, Liz Truss, is therefore considering plans to freeze household utility bills, adding at least £100 billion (€117 billion) to UK government borrowing.

‘We are battling inflation here, and this looks like a big stimulus at a time when the Bank of England is trying to dampen inflation,’ a former Chancellor of the Exchequer, Philip Hammond, said in an interview with Bloomberg. ‘That just implies we will end up with higher interest rates, bigger debt, and slower growth than we would otherwise have.’

This warning comes after the UK government terminated the plug-in car grant (PiCG) in June, which offered up to £1,500 (€1,748) off the cost of a new electric car.

‘August’s new-car market growth is welcome, but marginal during a low-volume month. Spiralling energy costs and inflation on top of sustained supply-chain challenges are piling even more pressure on the automotive industry’s post-pandemic recovery, and we urgently need the new Prime Minister to tackle these challenges and restore confidence and sustainable growth,’ commented SMMT chief executive Mike Hawes.

‘With September traditionally a bumper time for new-car uptake, the next month will be the true barometer of industry recovery as it accelerates the transition to zero-emission mobility despite the myriad challenges,’ Hawes added.

In this context, Autovista24 has subtly revised its 2022 forecast for UK new-car registrations downward, to 1.62 million units. This equates to a year-on-year decline of 1.6%, and a 29.9% contraction compared to the pre-pandemic level of 2019.

Although countless new-car orders will not be fulfilled this year, the weaker demand assumption means Autovista24 has also reduced its new-car registrations outlook for 2023, to 1.92 million units.

BEVs drive market growth

Despite the withdrawal of the PiCG on 14 June, the SMMT notes that ‘overall growth in the month was driven primarily by battery-electric vehicles (BEVs), which recorded a 35.4% increase in volumes and a 14.5% market share. However, growth in this segment is slowing, with a year-to-date increase of 48.8%, whereas at the end of Q1, BEV registrations had been up by 101.9%.’

Registrations of new plug-in hybrid (PHEV) vehicles declined 23.1% year on year, with their share falling to 5.6%, down from 7.4% in August 2021. Nevertheless, electric vehicles (EVs), comprising BEVs and PHEVs, accounted for one in five registrations last month.

Similarly, one in five new cars registered in the UK in the first eight months of 2022 was an EV. Although the termination of the PiCG, along with rising interest rates and inflation, will have a detrimental impact on EV uptake, their 2022 share ‘will continue to grow, to reach 22.6% as manufacturers prioritise investment in zero-emission vehicle production,’ according to the SMMT. The association’s latest forecast predicts that their share will rise further in 2023, to 27.8%.