European new-car market outlooks weaken amid July slowdowns

18 August 2022

In the wake of lost momentum in July and mounting financial pressure on households, Autovista24 has revised its forecasts downwards for European new-car markets.

In this latest Autovista24 video, editor Phil Curry and senior data journalist Neil King explore the latest new-car market developments and ramifications, including country-by-country analysis and forecasts, the pan-European outlook, and the long-term view.

Germany and Italy edged forward, Spain was stuck in neutral, and France engaged reverse last month. After factoring in the effect of one less working day than in July 2021, the volume of new-car registrations across the four markets averaged 9% below Autovista24’s expectations.

The UK bucked this trend and performed exactly as expected, suggesting the heatwave that engulfed Europe in July had a less detrimental impact on the island nation’s new-car sector.

The developments last month come after markets showed signs of improvement in June. This was seen both in the less severe magnitude of the year-on-year downturns, and higher seasonally-adjusted annualised rates (SAAR).

This confirmed the recovery that Autovista24 had already factored into its outlooks, based on the assumption that the impact caused by the Ukraine war is lessening as alternative sources of raw materials and parts are secured. Nevertheless, the market forecasts were revised downwards last month, except for France.

Improving supply, diminishing demand

Autovista24 assumes that supply bottlenecks will continue to ease throughout the year and any impact from the heatwave could see European markets playing catch-up in August. However, the lost momentum suggests that both the recovery of supply and underlying demand are weakening.

Furthermore, the VDA, Germany’s automotive industry association, has cautioned that additional shortages along the supply chain have not only been caused by the war in Ukraine, but also by renewed COVID-19-related lockdowns in China.

Accordingly, the outlooks for all of Europe’s major new-car markets have been reduced. This includes the UK, where inflation continues to rise, and the Bank of England has increased interest rates by the highest amount since 1995. Moreover, the bank predicts that the UK will fall into recession in the fourth quarter of 2022.

This is the first forecast that anticipates all the big five markets will contract in 2022. France, Italy, and Spain are forecast to fall more than 5% year-on-year, with modest declines in Germany and the UK.

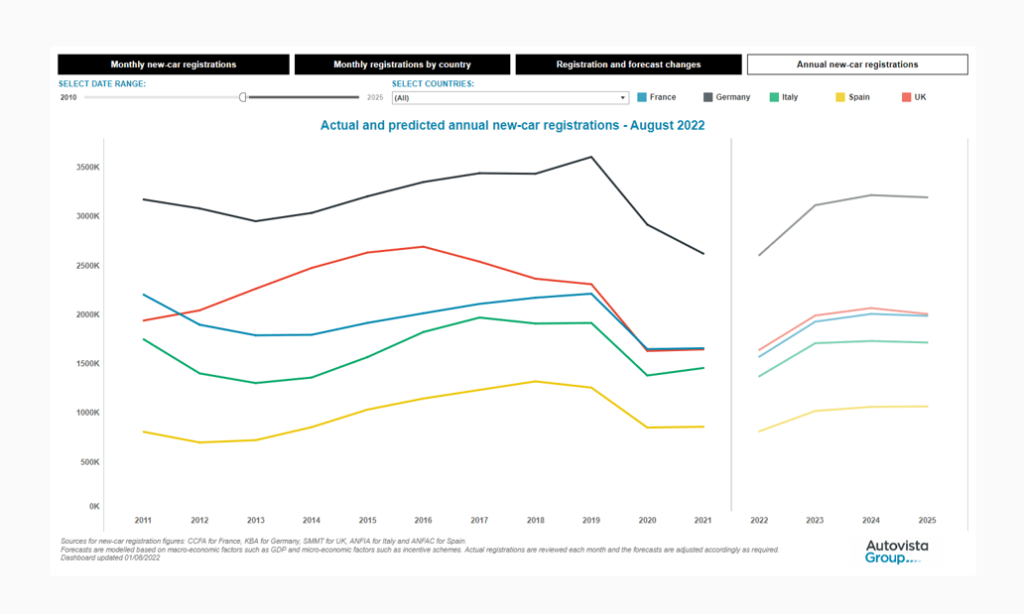

New-car registrations in Europe’s big five markets, 2011 to 2025

Consequently, the forecast for the entire European new-car market has been downgraded by more than 200,000 units this month. The region is predicted to contract for the third consecutive year, by 3.5% in 2022, to below 11.4 million units. This is 28% down on the pre-pandemic level of 2019.

Significant risks to this challenging forecast remain, depending on the duration and severity of the conflict in Ukraine and whether it extends further west, and beyond the country’s borders. Unlike previous crises, such as the global financial crash of 2008-2009, the new-car registrations outlook for western European markets hinges more on new-car supply than any economic impact on sales, at least in the short term.

However, underlying demand is also challenged as inflation continues to rise across Europe, curtailing purchasing power for big-ticket items such as cars. Furthermore, reduced – or even disconnected – gas supplies from Russia to continental Europe still pose a major economic threat.

Displacement extends into 2024

The ongoing semiconductor shortage will see registrations displaced into 2023 due to the associated impact on vehicle supply. With this movement, double-digit growth rates are anticipated in all five key European markets in 2023.

Autovista24 does not expect to see a return to a semblance of automotive market normality until 2024. That year is also expected to benefit from a pull-forward effect as automotive manufacturers and consumers seek to register cars ahead of the EU Commission’s targeted 15% reduction in CO2 emissions in 2025, compared to 2021 levels.

Autovista24 then foresees a modest correction in Europe’s new-car market in 2025, before growth returns from 2026 until 2029. This is ahead of the EU aiming for a 55% CO2 emissions reduction for cars compared to 2021 levels by 2030, under the Fit-for-55 package. This also coincides with the end of sales of new petrol and diesel cars in the UK.

Ultimately, Autovista24 predicts that the European new-car market will not return to pre-pandemic levels until the next decade. Another correction is expected in 2035 with the EU phase-out of new internal-combustion engine (ICE) car sales, as recently endorsed by the bloc’s lawmakers.

The full interactive dashboard presents the latest and previous monthly forecasts for the big five European markets for 2022, as well as the annual outlook to 2025.