Monthly Market Update: Modest RV growth in July despite stable new-car list prices

02 August 2022

Supply constraints in both the new- and used-car markets across Europe, together with rising inflation and energy costs, are playing a part in the development of residual values (RVs). July saw a more stable period, but a recoupling of supply and demand in the used-car market will place more focus on list prices for RV growth in absolute value terms (€RV).

During the last month, new-car list prices were stable across Europe, ranging from a 1.3% month-on-month decline in Switzerland to growth of just 0.3% in Spain. Residual values performed slightly better in value terms, resulting in modest growth of average used-car prices represented as a retained percentage of list price (%RV) in most markets.

The exception was Spain, where the average %RV gained 3% month on month. Used-car sales activity in the country is slowing far more than elsewhere, but supply is even more dramatically impacted, driving up RVs.

Although the June new-car registration figures confirmed expectations of a gradual recovery, Autovista24 downgraded its European new-car market forecasts in July – except for a modest upward revision in France. As the supply of new cars, and subsequently used cars, remains an issue that is expected to persist into 2024, this will continue to support RVs.

However, a steep ascent of raw-material and energy costs because of the Ukraine war, and rising inflation in general, is contributing to cooling demand for both new and used cars. With improving supply and diminishing demand, the %RV is forecast to decline, or at best stabilise, across European markets in 2023 and 2024.

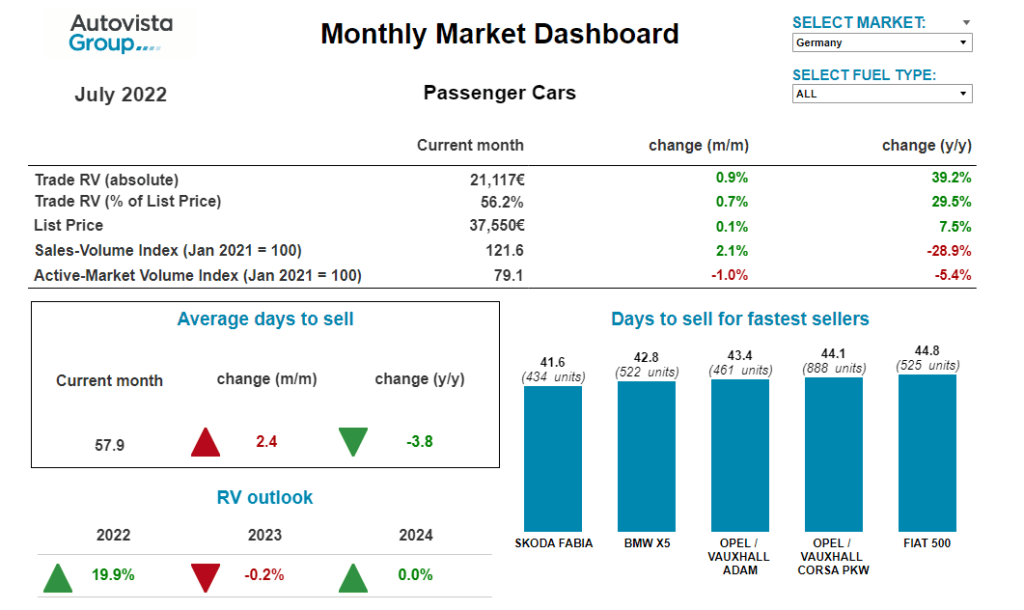

The interactive monthly market dashboard features Austria, Germany, Italy, Spain, Switzerland, and the UK. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices, as well as sales-volume and active market-volume indices.

Supply cannot meet used BEV demand in Austria

The Austrian used-car market continues to be underpinned by low supply. On average across all passenger cars aged two-to-four years, the supply volume in July was 10.8% lower than in July 2021, noted Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. Already in 2021, supply was significantly lower than at the beginning of 2020. However, this situation has stabilised somewhat compared to June, with a slight month-on-month increase of 1.2%.

Diesel cars are still missing on the used-car market, with a 17.2% shortfall compared to the same month last year. But the supply of battery-electric vehicles (BEVs) showed a far stronger downward trend again, with a 50.4 % year-on-year decline. Market activity shows healthy demand for BEVs and hybrid-electric vehicles (HEVs), leaving their supply short and boosting RVs.

Despite the general ongoing context of used-car demand outstripping supply, average days to sell increased slightly, to an average of 57.9 days in July. BEVs are selling the fastest, averaging 51.9 days, followed by petrol cars at 54.5 days and diesel cars at 59.1 days. Meanwhile, HEVs take an average of 71.4 days and plug-in hybrids (PHEVs) are selling the slowest, averaging 83.4 days.

This market environment has led to a further slight increase in RVs of 36-month-old cars, in both absolute value and retention terms. The %RV rose by 20.8% year on year (0.4% month on month) in July, with cars retaining 53.0% of their list price on average. Diesel cars and HEVs are currently leading with a trade value of 53.5%, followed closely by petrol cars (53.2%) and PHEVs (50.1%). 36-month-old BEVs retain the lowest value, at 46.4% of the list price.

The market parameters will not change in the medium term, because new-car registrations are still markedly lower than before the crisis (2021 was down 27% compared to 2019). ‘The supply of new cars will be the key factor in the future development of RVs. Supply chains were already disrupted and together with the semiconductor shortage, the war in Ukraine has led to even longer delivery times for most new vehicles,’ Madas commented.

Due to this undersupply, Madas expects the %RV of three-year-old passenger cars to continue to rise this year, by 11.8%. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023.

Weak tactical and fleet registrations in Germany

New-car registrations continue to struggle in Germany, especially in the channels that are most relevant for the used-car market. ‘Tactical registrations are now more than 100,000 units below last year’s weak level and fleet registrations, which are known for their relative stability, also show a drop of almost 30,000 units compared to the same period last year,’ highlighted Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

Accordingly, the market for very young used cars will continue to be undersupplied this year and next. The buyback years 2024-2026 will also be relatively weak for cars aged between two and four years. ‘Only dwindling purchasing power is preventing the further unchecked increase of used-car prices. Volumes on offer are slightly increasing again despite lower replenishment, which is due to high price levels and growing stock days. Purchasing decisions seem to be postponed in view of tighter and unsafe budgets or are being shifted to cheaper models’ Geilenbruegge added.

The RV outlook for the rest of this year and the coming years remains stable, but this does mean that the forecast 19.9% increase for 2022, i.e. the comparison of December 2022 versus December 2021, is disproportionately higher than for the coming years.

Even though value retention has been dampened for a short time, the used-car price development of HEVs continues to be optimistic. However, a strong discrepancy is building up between initial pricing and achieved transaction prices, which will no longer be supported by buyers in the foreseeable future and will then lead to stagnation.

‘As HEVs are more affordable than other electrified vehicles, fuel consumption is lower than for internal-combustion engines (ICEs), and the technological change is limited, these are obviously good arguments for the respective models from Toyota, Hyundai, and Honda, among others,’ concluded Geilenbruegge.

Divergent performance of new and old technologies in Italy

In July, the average %RV of a vehicle with 36 months/60,000km was 50.1% in Italy. This is essentially stable compared to a month ago but up on last year (+15.7%). This stability is the result of a slightly positive trend for petrol and diesel RVs, whereas values of HEVs, PHEVs and BEVs are down by 1.5% to 2% compared to June.

‘Although used-car prices are still strong compared to last year, it is surprising that in this generally positive situation, new technologies are on a downward trend, while traditional engines continue to grow in value, albeit only slightly,’ commented Marco Pasquetti, forecast and data specialist, Autovista Group Italy. ‘Even if there are many drivers to consider, the higher average list prices of these technologies and current concerns about high inflation and economic instability are part of the picture.’

Used-car sales are up both on last year (+5.9%) and June (+41.1%), with the sales-volume index of 148 a clear indication of a healthy second-hand market. ‘This is another reason why we see, neither in the short nor in the medium term, the preconditions for a reversal of the trend and a return of the used-car market to 2019 levels,’ explained Pasquetti. Accordingly, he has revised the RV outlook for 2022 upwards, with expected growth of 9.4% compared to December 2021, followed by a slight further increase in 2023 and a slow reduction in RVs from 2024.

Stock levels depleting in Spain, despite import boom

The picture that emerged in the first half of 2022 in Spain is very different from the one envisaged in the middle or end of 2021. ‘It was just a year ago that we saw used-vehicle transaction prices soar, driven by the shortage of supply caused by the COVID-19 pandemic, coupled with the semiconductor crisis,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

Azofra expected this scenario to start to stabilise in the first half of 2022 and adjust in the second half of the year. However, the war in Ukraine and the ensuing economic crisis have made the situation more adverse. The Spanish new-car market has endured a cumulative decline of 11% and the used-car market has fallen by 4.5%. Stock levels continue to deplete and are less than half of what they were last year, cushioned only by a boom in imports.

‘Naturally, all this has impacted the average value retention of used cars, which is up 20% compared to July 2021 and even 30% when considering petrol-powered cars. In general, the RV increases are affecting all powertrain types. This started with ICE cars, while HEVs joined the positive trend a few months later. In 2022, BEVs and PHEVs have also joined this evolution, with high fuel prices and the lack of availability of ICEs and HEVs orienting demand to electric vehicles,’ commented Azofra.

Despite the price craze experienced in recent months, the trend of the last two months is confirmed, which already points to a certain stabilisation of prices. The average number of days to sell a used car continues to rise, inflation continues to soar, and it is expected that the rise in interest rates announced by the European Central Bank (ECB) will weigh on the purchasing power of households. Accordingly, demand is forecast to recede in the coming months, for both new and second-hand cars, lowering RVs.

List prices fall but RVs stable in Switzerland

For over two years, the Swiss used-car market has been defined by healthy demand, low supply and rising used car-prices. ‘Across all two-four-year-old passenger cars, the supply volume in July was in line with the level of a year earlier. Already in 2021, the supply was significantly lower than at the beginning of 2020,’ noted Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

The sales-volume index in July was 3.9% higher than in June, but 18.2% down year on year. Nevertheless, RVs remain stable whereas list prices are down 1.2% compared to June. This market environment has led to a further modest increase in the average %RV of 36-month-old passenger cars in July, to 50.3% (up 19.1% compared to June 2021). Petrol cars posted strong year-on-year %RV gains of 18.5%, to 51.2%, as too did diesel cars (up 21% to 49.3%) and BEVs (up 18.6% to 47.2%).

BEVs and diesel cars in particular are less offered on the active market, with supply down 39.9% and 16.4%, respectively, compared to July 2021. For petrol cars, there are currently 10% more two-to-four-year-old cars offered than a year ago. The active-market volume of PHEVs is around 28% higher than in July 2021, whereas the volume of HEVs is stable.

The average days to sell increased in July compared to June, with a passenger car aged two to four years in stock for 63 days. BEVs are selling quickest, after an average of 58 days, followed by petrol cars after 62 days, diesels after 65 days, and PHEVs after 79 days.

The disrupted supply of new cars, exacerbated by the war in Ukraine, as well as recent list-price increases, are key factors in the future development of RVs. Supply chains are heavily affected, leading to long delivery times for most new vehicles.

‘As new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019), the market parameters will not significantly change in the medium term. The %RV of three-year-old used cars will remain high this year and is forecast to end 10% up on December 2021, before declining over the years 2023 and 2024,’ Annen concluded.

UK used-car market ‘on a rollercoaster ride’

‘Since the start of the COVID-19 pandemic, the UK’s used-car market has been on something of a rollercoaster ride, with unexpected peaks and troughs in demand. This rollercoaster ride continued into the first half of 2022 with a downturn in residual values,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

The UK’s unusual trading conditions continued throughout June and into July, with both poor demand and supply evident. As a result, hammer prices at auctions across the country began to stabilise, and whilst overall sales volumes are below the level seen last year, this strange supply and demand dynamic has resulted in a steadying development of RVs.

Used-car prices in the UK were essentially static in July with only a 0.1% movement compared to June, although comparisons with the same period last year show growth of 19.5%. The average number of days it took a UK dealer to retail a car also remained static in July, at almost 49 days.

‘This is 9.6 days longer than last year and gives a good insight into why auction activity is somewhat subdued – because dealers do not need to replenish stock as frequently,’ Whittington concluded.

The July 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.