Growing demand for trucks and vans, pushed by rising delivery needs

30 June 2022

The market for light-commercial vehicles (LCVs), such as vans, has seen strong demand, especially during the COVID-19 pandemic. Lockdowns forced shops to close with customers now increasingly relying on delivery services as a result. Notably, the courier, express and parcel (CEP) sector has been one of the key drivers in the LCV market.

A new CEP study from the Germany-based association of parcel and express logistics (BIEK) indicates that demand for LCVs will continue to be buoyant. The study found that the shipment volume of items in 2021 rose by 11.2% – 460 million units – to a total of 4.51 billion units. In Germany, 15 million units were delivered to nine million customers, both commercial and private.

Total turnover was up by more than 14% and amounted to €26.9 billion last year, while at the same time around 10,800 new jobs were added. Although a forecast for shipment volumes is not possible for 2022 due to the war in Ukraine, lockdowns in China, higher energy costs and the uncertainty among consumers, the BIEK expects the shipment volume to increase to 5.7 billion in 2026.

But why does this matter for the LCV market?

Stabilising effects on RVs

The healthy developments in the German CEP sector have a connection to RVs for LCVs, explains Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group), who joined Autovista24’s latest webinar on the European LCV market.

‘We often look at the development of demand for vehicles with a view to residual values (RVs). The study provides comprehensible and industry-related data as well as a forecast for 2026. It shows that the need for LCV transport has increased and will continue to increase and will generally generate further demand for LCVs in the coming years, both new and used,’ he said.

‘Since there is a production shortage at the same time and in the near future, at least for vans, this will have a negative effect on the supply of used LCVs and thus have a stabilising effect, possibly even increasing RVs.’

Geilenbruegge pointed out that in Germany the total mileage of LCVs weighing up to 3.5 tonnes has increased by around one third from 2014 to 2021 across all age categories from 0 to 20+ years, and is still growing by 3-4% a year.

These figures, which are released by the Federal Office for Motor Vehicles (KBA), reveal that the increase in mileage is especially true for older vehicles. ‘This means that the obvious additional demand for LCVs is covered by more vehicles across all age categories,’ said Geilenbruegge.

Supply chain and other challenges

The LCV market in Europe has been plagued by global supply-chain shortages, increased energy and fuel prices, as well as rising costs for raw materials. Delays and delivery issues, which can be widely observed across the automotive industry, are also impacting the market demand for LCVs – not least when it comes to pricing and RVs.

Countries such as Poland are known for being strong import markets for used vehicles. However, with supply shortages affecting availability for light-commercial vehicles in Western Europe, fewer LCVs are being exported to Poland. This then leads to even higher prices for LCVs in Poland compared to countries west of the border, noted Geilenbruegge.

As in Germany, the Polish CEP sector has seen an increase in shipment volume in 2021, with this figure rising by more than 20% year on year. LCVs are a hot commodity there.

‘We have an overdemand for LCVs and rather high registration levels in Poland,’ said Marcin Kardas, head of the editorial team at Autovista in Poland. The LCV market, he said, would be be driven by external factors, such as the rise of list prices for new LCVs and rapidly increasing used-car residual values.

Elsewhere in Europe, the LCV market in the UK is flourishing. Data from the Society of Motor Manufacturers and Traders (SMMT) shows that 2021 was a bumper year for LCVs, as their number on the road was up by 4.3% to around 4.8 million. The heavy goods vehicle sector saw a 2.5% uplift, with 604,035 trucks in Britain making national and international deliveries amid increased demand.

Indeed, order banks for new LCVs in the UK are already full for 2022. Demand for electrified LCVs is also on the rise. Electric-vehicle (EV) ownership has grown, with 26,990 vans, 993 buses and 313 trucks registered.

Electrification lag

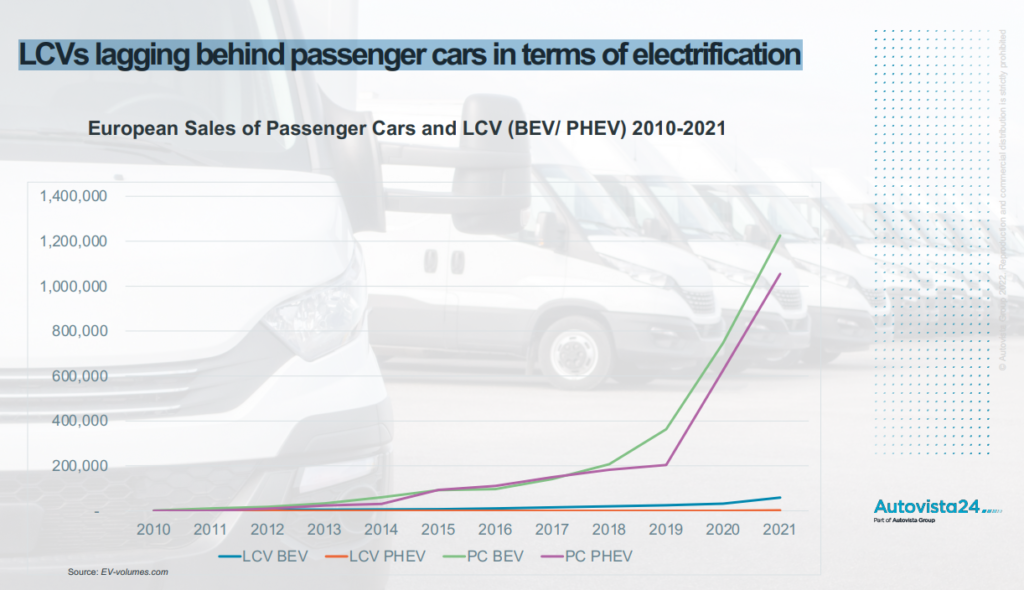

Panellists on the latest Autovista24 webinar on Europe’s light-commercial vehicle market highlighted that LCVs still lag behind passenger cars when it comes to electrification. Payload, total cost of ownership, and infrastructure concerns all pose their own challenges. However, as tougher CO2-targets will apply to LCVs in the future, the market is shifting towards electromobility.

‘I can see a real overdemand for electric LCVs in Poland,’ said Kardas. ‘There are a few reasons: existing incentive scheme, a policy regarding public companies to implement a specific share of “clean” vehicles into their fleets, and undersupply of BEVs at the moment. The biggest private group of clients are courier companies with their internal policies to reduce CO2 emissions globally.’

Meanwhile, in the UK commercial vehicle sector, around 0.6% of vans are plug-in electric. This indicates that the van sector is two years behind that of cars despite both vehicle classes having the same end-of-sale date for new petrol and diesel registrations, the SMMT noted. Fostering the sector’s transition to electrification would need a dedicated strategy, it said.

The BIEK study found that companies in the German delivery sector are pursuing ambitious goals for sustainability and low-emission delivery, especially in cities, where electric delivery vehicles are increasing. Considering that more than 80% of LCVs in Europe are diesel-powered, the market will have some catching up to do.