How do major European markets use electric-car incentives?

29 June 2022

Electric-vehicle (EV) incentives appear to have been a resounding success in many European countries. However, consumer popularity, socio-economic pressures, and government financing is leading some countries to reconsider these grants. Autovista24 editor Phil Curry and deputy editor Tom Geggus, consider the different schemes used across Europe’s major automotive markets.

Subscribe to the Autovista24 podcast and listen to previous episodes on Apple, Spotify, Google Podcasts and Amazon Music.

Show notes

Plug is pulled on UK plug-in car grant

Could Germany scrap EV incentives?

Statista: Number of new electric car registrations in Germany from 2003 to 2022

French electric-vehicle incentives shielded against quick resales

Government 2022 incentives all taken and assisting BEV residual values in Netherlands

How Norway and pop band A-ha paved the way for electric-car adoption

Norway is a leader in EV sales but has subsidised itself into a corner

Energypost.eu: Norway an EV role model?

Episode synopsis

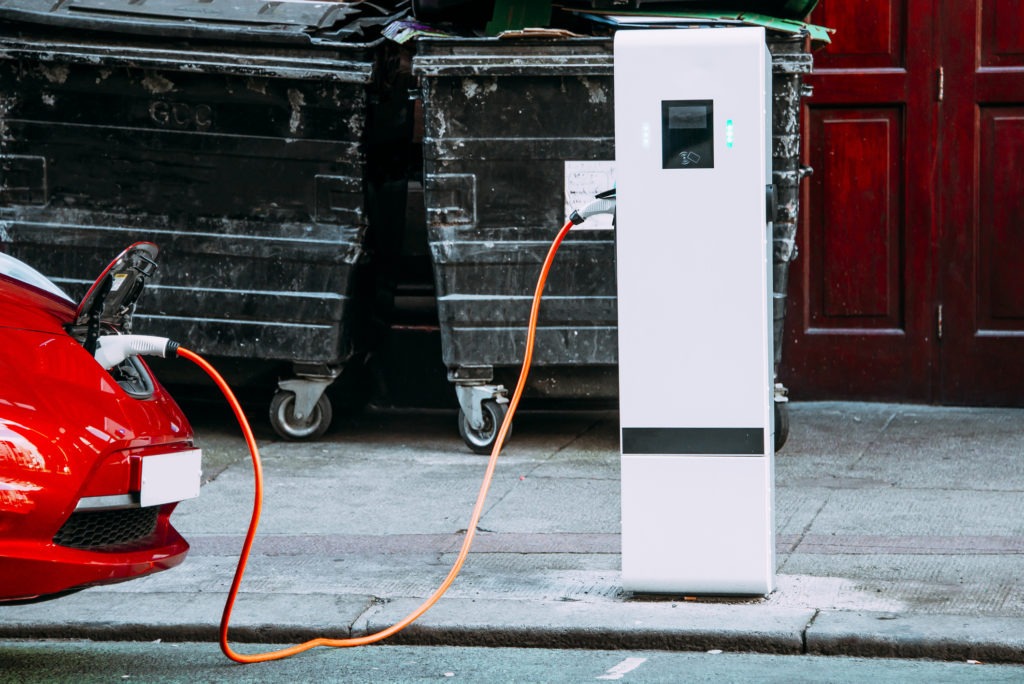

The UK government recently ended its plug-in car grant (PiCG) scheme. Since its establishment in 2011, the incentive programme has been whittled back from providing £5,000 (€5,778) towards an EV purchase to £1,500. The government claims the scheme successfully helped kick-start the country’s electric-car market. This means funds will now be directed elsewhere, including the incentivising of other electric-vehicle types, such as buses and taxis, as well as charging infrastructure.

While the news was not well received by the UK’s Society of Motor Manufacturers and Traders (SMMT), it did recognise the need for investment in battery-electric vehicle (BEV) charging points. Jayson Whittington, chief editor of Glass’s (part of Autovista Group), acknowledged that the move could lead to a ‘double-whammy’ for consumers. As incentives are withdrawn, carmakers could also end up increasing prices which were previously positioned below the funding threshold.

Could Germany end incentives?

Questions surrounding the viability of EV incentives have arisen in Germany. The country is seeing increased debt, due in part to the Ukraine war, and is looking at ways of cutting national spending. One idea, suggested by finance minister Christian Lindner, is to scrap incentives for all EVs. At present, no official decision has been made.

Not only would this save the country money, it would also remove the problem of overreliance on incentives as EVs become more popular. Electric registrations are rising, meaning increased payouts month after month. Germany must be wondering whether this rise is due to the popularity of EVs, or the fact that grants are offered for their purchase.

The recent exhaustion of funds in the Netherlands will act as an important case study for Germany. The country’s EV allocated €71 million for this year ran out, after allowing for 21,000 new vehicles to take to roads. Will this impact EV registrations for the rest of the year, and into 2023 once waiting times and supply constraints are taken into consideration? The answer may give Germany, and other countries, more information on what the scrapping of incentives could do to the market.

France guards its funds

EV incentives in France have been shielded against consumers looking to resell for a quick profit. If purchasers do not keep their new electric car for long enough or drive it far enough, they will need to return the funds to the government.

‘Many BEVs were bought in France with an incentive, which is among the highest in Europe, before being sold on in the Netherlands or Norway where there are incentives on used-BEV purchases,’ Yoann Taitz, Autovista Group’s regional head of valuations and insights for France and Benelux said. He went on to debate whether these restrictions will have any impact on the residual value of electric cars.s

Norway’s incentive conundrum

Norway has long been seen as the ‘poster-child country’ when it comes to automotive electrification, with over half of registrations in recent years coming from EVs. The country offers generous incentives and tax breaks, and the government can afford this thanks to its oil and gas exports. There are plans in place to ban the sale of new petrol and diesel vehicles by 2025, increasing the number of EVs on roads.

The country tried to relieve itself of dependency on EV incentives in 2017, introducing a tax on vehicles over a certain weight. Dubbed the ‘Tesla tax’ the proposals met with stanch opposition and were quietly dropped. Norway is therefore very reliant on incentives. However, as dependency on oil winds down around the globe, the country may no longer be able to afford to incentivise its EV market. Then again, the 2025 ban effectively removes choice from buyers. Therefore, Norway may try again to remove incentives after this date.