Monthly Market Update: RVs reflect list-price changes despite slowing used-car sales in June

29 June 2022

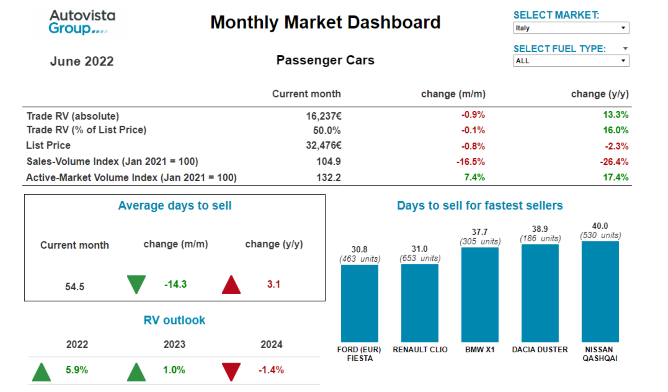

Used-car sales activity cooled in June 2022 across key West European markets except Germany. The sales-volume index suffered a double-digit month-on-month decline in Italy. However, residual values (RVs) tracked the development of new-car list prices, which rose in most markets.

The two exceptions were Italy, although RVs there fell in line with list prices, and the UK, which continues to suffer from weak activity in the used-car market as supply constraints meet high inflation.

Nevertheless, used-car prices continue to rise in value-retention (%RV) terms too, except in the UK, and the Autovista Group RV outlook has been upgraded in five of the seven markets covered in the monthly market dashboard.

This interactive dashboard features Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices, as well as sales-volume and active market-volume indices.

%RV growth limited but drives upgraded outlooks

Europe’s new-car market endured another double-digit decline in May as the war in Ukraine continued to disrupt supply chains and delay vehicle deliveries. However, registrations are showing slow signs of improvement, outside of Germany and the UK.

Autovista24 assumes that the impact caused by the Ukraine war and accompanying sanctions on Russia is lessening, as alternative sources of raw materials and parts are secured. This is factored into the registration outlooks, and as the May new-car registration figures were closely aligned with Autovista24’s assumptions, this points to a slowly improving supply situation.

Although pre-existing supply challenges will continue throughout 2022, and could even persist until 2024, the outlook for the second half of the year has been broadly maintained The forecasts for Germany and the UK were modestly downgraded this month.

A steep ascent of raw-material and energy costs due of the Ukraine war, and rising inflation in general, is contributing to the widespread rise in new-car list prices and cooling used-car transactions. As used-car supply and demand slowly recouple, residual-value growth is more closely associated with changes in list prices. This means that RVs are broadly stable in %RV terms.

In Austria, France, Germany, and Switzerland, the month-on-month %RV growth was between only 1% and 1.5% in June. Residual values are falling exactly in line with list prices in Italy, giving stable %RV development, and prices for used cars are falling faster than for new cars in the UK, resulting in a 2.4% month-on-month decline in the average %RV in June. Spain, therefore, is the only key market to enjoy healthy %RV growth, up 4% on May.

The %RV continues to climb every month in most markets as demand still outstrips supply, so we have upgraded the residual-value outlook for 2022 in Austria, Germany, Italy, Spain, and Switzerland this month. The outlooks for France and the UK are maintained.

Supply constrained in Austria, especially for BEVs

The Austrian used-car market continues to be underpinned by limited supply. On average across all passenger cars aged two-to-four years, the supply volume in June was 13.8% lower than in June 2021, notes Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. Already in 2021, supply was significantly lower than at the beginning of 2020.

Diesel cars are still missing from the market, with a drop of 19.4% compared to June 2021. But the supply of battery-electric vehicles (BEVs) showed an even stronger downward trend again, with a drop of 46.4% year on year. Market activity shows strong demand for BEVs and plug-in hybrids (PHEVs), leaving supply of both powertrains somewhat short.

In the ongoing context of used-car demand outstripping supply, average days to sell have been stable on a low level, with an average of 56.4 days. Hybrid-electric vehicles (HEVs) are selling the fastest, averaging 44.4 days, followed by BEVs with 44.8 days and petrol cars with 56.1 days. Diesel cars take an average of 56.9 days. PHEVs are selling the slowest, averaging 77.4 days.

This market environment has led to a further increase in RVs of 36-month-old cars, in %RV terms. This rose by 20.8% year on year in June, with cars retaining 52.8% of their list prices on average. Petrol cars are currently leading with a trade value of 53.3%, followed closely by HEVs (53.2%) and diesel cars (53.0%). At 45.9% of list price, 36-month-old BEVs retain the lowest value.

The market parameters will not change in the medium term, because new-car registrations are still markedly lower than before the crisis (2021 was down 27% compared to 2019).

‘The supply of new cars will be the key factor in the future development of RVs. Supply chains were already disrupted and together with the semiconductor shortage, the war in Ukraine is leading to even longer delivery times for most new vehicles,’ Madas commented.

Due to this undersupply, RVs of three-year-old passenger cars are expected to remain high, with the %RV forecast to end 2022 11.3% up on December 2021. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023.

RV growth in France ‘related to higher list prices’

Although the French used-car market remains reasonably dynamic, the increases in residual values are less pronounced than those observed until early this year.

‘The growth is related to higher list prices, along with supply drying up on the used-car market,’ commented Yoann Taitz, Autovista Group regional head of valuations and insights, France & Benelux. ‘Stock levels are very depleted, and the number of advertisements was lower in June than during lockdown periods in 2020. Dealers confirm that as soon as a used car becomes available, it is often sold within the day.’

The strong and steady list-price rises over several months are suppressing the %RV, even if values are increasing in real terms because of the current market conditions. Carmakers are seeking to compensate the lower volumes by increasing margins with higher list prices, but the result is that purchase decisions are increasingly delayed.

‘When a new car is a necessity, buyers are favouring smaller and older vehicles in order to stick to a budget, which is clearly not rising in line with inflation. As leasing offers are based on value retention, carmakers have to increase discounts to support sales,’ Taitz explained.

The dynamism of petrol cars in the French market is clear, especially when comparing the %RV increase in June with the slight list-price decreases. The high malus (tax penalty) on new petrol cars is making used-petrol cars much more attractive and the buyer is ready to pay more. Moreover, petrol cars that have the “Crit’air 1” badge allow drivers to enter cities without restrictions, at least for the time being.

The diesel used-car market is still dynamic as RV increases are supported by diminishing new-car supply. Although used demand is declining, the diesel share remains high, accounting for around 50% of used-car transactions. However, RVs of diesel cars in smaller segments, which are predominantly used in cities, tend to be stabilising, meaning that they have reached their peak. Indeed, in these segments, used-car demand is much less oriented to diesel than in larger segments. Stock days of diesel cars have increased to reach 60 days.

‘When considering all these developments, I consider that RVs will continue to increase in the coming months because of supply shortages, before stabilising at a high level, especially as diesel supply will continue to reduce month after month for environmental reasons,’ said Taitz.

‘Artificial’ dynamism of electric vehicles

Residual values of HEVs appear to have peaked as higher list prices have only translated into a slight rise in the %RV. Nevertheless, ‘HEVs have quick stock rotation as they offer a much better alternative than PHEVs for private users, as there is no need to recharge the battery,’ Taitz noted.

The PHEV market dynamism is relative and, in a way ‘artificial,’ especially when considering the increase in stock days (up 6.6 days over the previous month). The high list prices are still an issue given their usage, but RVs are driven by low volumes.

‘From Summer 2023, when PHEV fleet cars will massively come back onto the used-car market after three to four years, RVs will be negatively impacted. While the supply will increase a lot, the demand will essentially remain at a low level. PHEVs are favoured by companies for tax reasons, but private users typically prefer HEVs,’ Taitz clarified.

Demand for used BEVs continues to benefit from international events that have pushed French fuel prices over €2 per litre, despite the €0.18 per litre incentive provided by the French government. ‘This is clearly visible when looking at RV increases, coupled with lower stock days. However, new BEV buyers became a bit disillusioned during the spring holidays and long weekends, when they were confronted by the reality of the charging infrastructure in France,’ Taitz cautioned.

The arrival of the latest-generation BEVs as three-year-old used cars with higher ranges also explains their higher RVs. The gap of €3,000 between a used BEV and a petrol car is due to the great numbers of urban BEVs and the large volume of expensive petrol SUVs. The gap is even greater when comparing BEVs with diesel cars. ‘Any fair comparison between the different fuel types should therefore be done at a segment level, but BEV RVs are clearly below those of their ICE counterparts,’ Taitz concluded.

Stock days ‘harbinger of impending price stagnation’ in Germany

Through to May, new-car registrations in Germany were at a historic 20-year low, except for the lockdown-laden year of 2020. ‘Only registrations for fleets or commercial users are holding at an acceptable level, providing a somewhat more positive outlook for the future volume of two-four-year-old used cars expected in the years 2024 to 2026,’ highlights Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

The total volume of petrol cars that are registered commercially is back at the 2017 level, whereas diesel registrations have almost halved since then. Over 700,000 used-diesel cars have changed hands over the same period, indicating demand is still intense, and that the fuel type still accounts for 30% of the used-car market.

The combination of constrained supply and rising used-car demand, evidenced by the 3.2% month-on-month rise in the active-volume index in June pushed RVs up a further 2.6%. As new-car list prices only rose by 1.2%, the %RV increased at a slightly faster rate of 1.4%.

‘The general used-car price direction is still slightly upwards, especially in the older age brackets, but the consistently rising days to sell can also be seen as a harbinger of impending price stagnation. Only used BEVs are selling faster in June than in the previous month,’ commented Geilenbruegge.

The RV outlook for the rest of this year and the coming years remains stable but this does mean that the forecast 19.9% increase for 2022, i.e., the comparison of December 2022 versus December 2021, is disproportionately higher than for the coming years.

‘After the rapid rise in values since the middle of 2021, a value plateau at a high level can, therefore, be expected until at least 2025. Only the dwindling purchasing power will put a stop to the price surge and not make every retailer’s desired sales price possible,’ Geilenbruegge concluded.

RVs continue to fall in line with list prices in Italy

‘In the month of June, the trend was similar to that observed in May, whereby residual values are falling in line with list prices,’ said Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

New-car list prices are down 0.8% month on month in Italy, and RVs are 0.9% lower. Accordingly, there was stability compared to last month in %RV terms (down just 0.1%). On average, a vehicle with a mileage of 60,000km is repurchased three years later at exactly half the initial list price. Compared to a year ago, the increase is 16%.

‘It is still too early to see the effect of the government incentives for BEVs and PHEVs that were reintroduced on 25 May. These were exhausted in just 20 days for vehicles in the highest CO2-emissions threshold,’ Pasquetti noted.

On average, all the different fuel types are fairly stable compared to last month. The only exception is PHEVs, the average %RV of which fell by 1.5% compared to May. It is also interesting to note that the sales-volume index for June is 100 for PHEVs, meaning that used-car portal activity is at the same level as in January 2021.

In contrast, BEVs, with an index of 284.2 in June, are growing strongly on the used-car market. ‘A PHEV remains in stock for over 84 days on average, about a month longer than the overall result, which suggests that the used-car market is not yet ready for this fuel type without incentives,’ Pasquetti observed.

It is interesting to highlight that in June the fastest-selling cars (slightly over 30 days) were the Ford Fiesta and Renault Clio. ‘This is a clear sign that that the B segment is still very much in demand in Italy,’ Pasquetti concluded.

Imports bolster used-car stock in Spain

The Spanish new-car market continues to be weighed down by the shortage of product, and cumulative registrations are down 11.8% year on year. ‘Sales are more concentrated among private individuals and companies, with the rental channel finding it most difficult to source new cars,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

Interest in BEVs, PHEVs and HEVs continues to grow, with the latter being the third most popular fuel type in the country, accounting for over 25% of the market. In fact, three of the five fastest-selling used cars in Spain are Toyota hybrids. The Peugeot Rifter ranks fifth as the shortage of light-commercial vehicles is even greater than for passenger cars.

Due to the lack of stock, the used-vehicle market continues to evolve negatively, with a cumulative decline of 5%. Imports are helping to prevent this fall from being more dramatic, with volumes 60% higher than in the previous month. ‘This trend is giving some respite to dealers and, of course, to end buyers,’ noted Azofra.

Nevertheless, despite the subtle increase in used-car supply, transaction prices have continued to gain in recent months and were up 4% month on month in June in both value and %RV terms.

‘Values are expected to rise slightly further before August, when greater stability is foreseen. Developments that were highlighted last month, such as the extension of days to sell and a possible reduction of margins, continued in June too,’ said Azofra.

Furthermore, imports tend to increase the average value of used cars as they incur higher management and logistics costs and are usually better-equipped vehicles.

‘Ultimately, however, the local market cannot escape from the weight of transactions of vehicles older than 15 years,’ Azofra concluded.

RVs fare better than list prices in Switzerland

For nearly two years, the Swiss used-car market has been characterised by healthy demand, low supply and rising used car-prices. ‘On average across all two-four-year-old passenger cars, the supply volume in June was 4.9% below the level of a year earlier. Already in 2021, the supply was significantly lower than at the beginning of 2020,’ notes Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

The sales-volume-index in June is 4.9% lower than in May and 15.4% down year on year. Nevertheless, RVs remain stable even though list prices are down 1.5% compared to May. The average %RV has increased further in June, albeit by just 1.4% to 49.8%.

BEVs and diesel cars in particular are less offered on the used-car market, with supply down 37.8% and 20.2%, respectively, compared to June 2021. For petrol cars, there are currently 4.4% more two-to-four-year-old cars offered than a year ago. The volume of PHEVs is around 25% higher than in June 2021 whereas the volume of HEVs has decreased by 3.3%, but demand for both powertrains is significantly exceeding supply.

The average days to sell a used car increased slightly in June compared to May, with a passenger car aged two to four years in stock for 61.5 days. HEVs are selling quickest, after an average of 60 days, followed by petrol cars and BEVs after 61 days, diesels after 62 days, and PHEVs after 76 days.

This market environment has led to a further increase in the %RV of 36-month-old passenger cars, to 49.8% (up 19.1% compared to June 2021). Petrol cars posted strong year-on-year %RV gains of 18.7%, to 50.8%, as too did diesel cars (up 20.6% to 48.7%).

The disrupted supply of new cars, exacerbated by the war in Ukraine, as well as recent list-price increases are key factors in the future development of RVs. Supply chains are heavily affected for different parts and raw materials, leading to long delivery times for most new vehicles.

As new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019), Annen believes the market parameters will not significantly change in the medium term. RVs of three-year-old used cars will remain high this year and are forecast to end 2022 8.9% up on December 2021, before declining over the years 2023 and 2024.

RVs declined for seventh consecutive month in the UK

Residual values in the UK fell again in June, by 2.7% compared to May. ‘Although it was the seventh consecutive monthly reduction, the average RV at three years of age remained 22.8% above the same month last year,’ highlighted Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

Petrol cars at three years of age fared better than the average, declining by only 1.5% and RVs remained 23.5% above last June, whereas diesel cars fell 4.3% but remained a whopping 33.9% above last year. It is important to point out that although both petrol and diesel RVs are comparable in terms of age and mileage, it is clear by comparing the average trade RV of both used petrol (£13,034 (€15,089)) and diesel cars (£20,067) that the mix is very different.

BEVs were the only fuel type that bucked the downward trend in June, with their average RV increasing by 3.6% to £26,734.

‘BEVs are in high demand in the used-car market, and it is not uncommon for them to be offered for sale at 12 months old for close to their original cost new price. It is not clear if this demand is from the general used car-buying public, or from companies unwilling to wait the 12-month lead times to get a new one,’ noted Whittington.

The used-car market in the UK is currently experiencing very unusual trading conditions, with both poor demand and poor supply evident. ‘As a result, as June progressed, hammer prices at auctions across the country began to stabilise, and whilst overall sales volumes are below the level seen last year, this strange supply and demand dynamic is resulting in RVs beginning to stabilise,’ Whittington concluded.

The June 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.