How popular are used Audi models?

03 January 2022

As Volkswagen (VW) group’s second-largest supplier of registrations, Audi is of particular importance for the German carmaker, and not only as a premium brand. The overall profitability of the Bavarian OEM also plays a huge role.

Recently, the company’s CFO announced good news on this front. The chip shortage currently means mainly profitable models are being focused on and delivered. Profits are therefore expected to be slightly higher than last year. However, this is of limited help for the overall sales figures, and thus for Audi dealers, as in October there was a shortfall of 10% in new registrations, compared to the weak previous year.

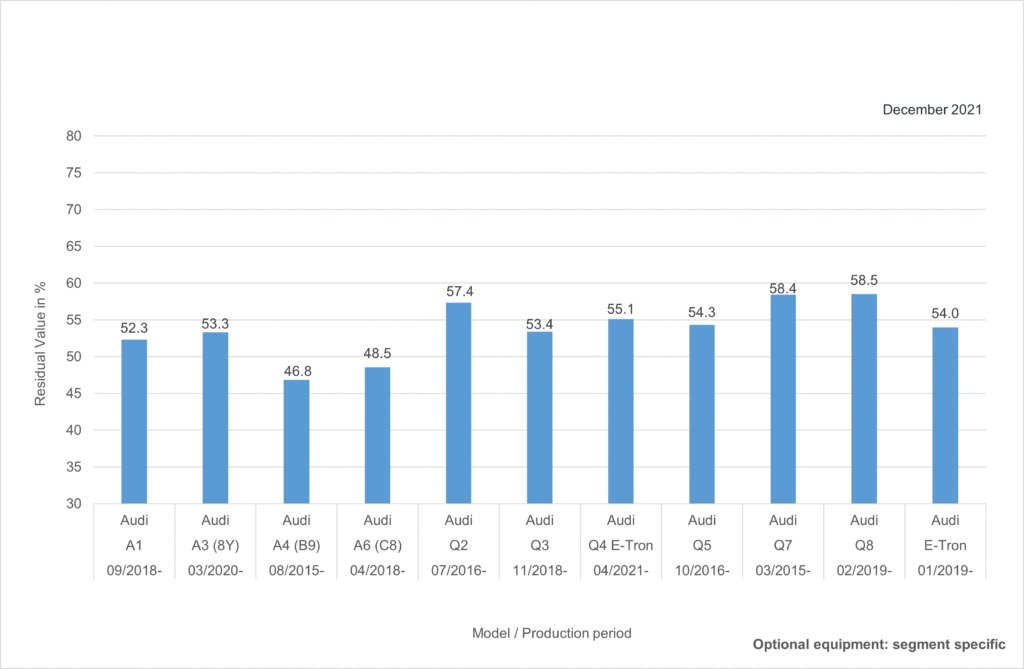

Forecast Retail Values in % (36 months / 60,000km)

The last two months were among the weakest for the Audi brand in the past 20 years, with little more than the WLTP-related drops in 2018. For a brand that now has more models on the market than its VW sister brand, this is hard to bear.

However, it is expected that the undersupply from the fleet, OEM/retail, and rental channels will also lead to the used-car business struggling to source stock in the coming years. But in terms of prices the outlook is favourable for the same reason, especially for diesel models because the supply volume has fallen significantly since the diesel crisis and is meeting demand that has stabilised at a reasonable level.

Yet, the rapid increase in electrically-chargeable vehicles (EVs) is noticeable. These are appearing increasingly in used-car channels and are collecting an above-average number of stock days. Since the future is purely electric for Audi, this is no reason to bury one’s head in the sand, but there is a need to actively convince consumers to switch to used e-Tron and plug-in models. Otherwise, this exponentially growing share of the market will, in future, be run by other remarketing players instead of dealerships and manufacturers.