Monthly Market Update: Used-car prices stubbornly resist weakening demand

02 September 2022

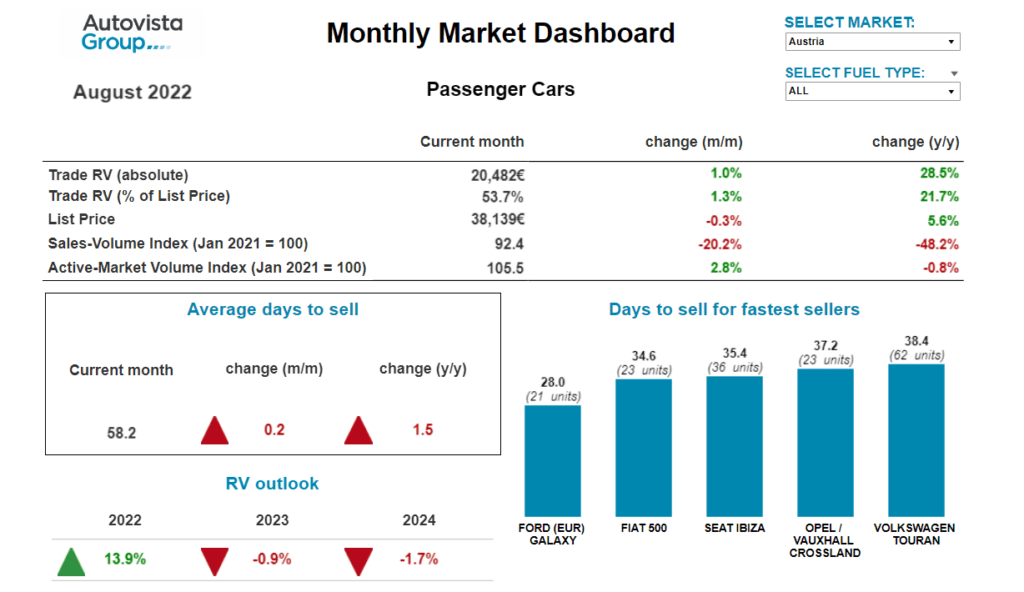

Despite slowing used-car sales activity across Europe in August as consumers contend with rising living costs, residual values (RVs) grew slightly quicker than list prices. This resulted in month-on-month growth of average used-car prices represented as a retained percentage of list price (%RV) in all markets, albeit ranging from only 0.1% in Spain to 1.3% in Austria.

The recovery of new-car registrations lost momentum in July, curtailing supply into the used-car market. Accordingly, Autovista24 downgraded its European new-car market forecasts last month. The supply of new cars, and subsequently used cars, remains an issue that is expected to persist into 2024, which will continue to support RVs.

On the other hand, used-car prices are under increasing pressure as used-car transactions retreat with the cost-of-living crisis further eroding the willingness of consumers to buy both new and used cars. Despite supply challenges, the prospect of diminishing demand means prices may already have peaked in some countries and the %RV is forecast to decline, or at best stabilise, across European markets in 2023 and 2024.

The interactive monthly market dashboard features Austria, Germany, Italy, Spain, Switzerland, and the UK. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices, as well as sales-volume and active market-volume indices.

Supply remains key RV factor in Austria

The Austrian used-car market continues to be underpinned by limited supply. ‘On average, across all passenger cars aged two-to-four years, the supply volume in August was 0.8% lower than in the same month last year. Already in 2021, supply was significantly lower than at the beginning of 2020,’ noted Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

Diesel cars are still missing from the market, with a drop of 8.3% compared to August 2021. But the supply of battery-electric vehicles (BEVs) showed an even stronger downward trend again, with a drop of 46.6% year on year. Market activity shows weakening demand for BEVs and hybrids of all types, but their supply remains challenging.

Nevertheless, the overall supply situation stabilised somewhat in August, with a month-on-month increase of 2.8%, but sales activity is slowing, and average stock days increased slightly to an average of 58.2 days. BEVs are selling the fastest, averaging 55.3 days, followed by petrol cars with 56.8 days, hybrid-electric vehicles (HEVs) with 58.9 days, and diesel cars with 59.1 days. Plug-in hybrids (PHEVs) are selling the slowest, averaging 65.2 days.

There was a modest increase in RVs of 36-month-old cars in Austria, in terms of both absolute values (€RV) and retention of list price (%RV). The %RV rose by 21.7% year on year (1.3% month on month) in August, with cars retaining 53.7% of their list prices on average. PHEVs are currently leading with a trade value of 55.0%, followed closely by HEVs (54.3%), diesel cars (54.1%), and petrol cars (53.7%). BEVs aged 36-months retain the lowest value, at 48.3% of list price.

Madas assumes the market parameters will not change in the medium term, because new-car registrations are still noticeably lower than before the crisis. Last year was down 27% compared to 2019, and the outlook for 2022 is even below last year’s volume. ‘Even with cooling demand, the supply of new cars will be the key factor in the future development of RVs. Supply chains were already disrupted, and together with the semiconductor shortage, the war in Ukraine and COVID-19 lockdowns in China have led to even longer delivery times for most new vehicles,’ Madas noted.

Due to this undersupply, Madas expects RVs of three-year-old passenger cars to continue to rise this year. ‘Only when the new-car market picks up significantly, and thus volumes on the used-car market increase, and demand diminishes, are values likely to come under pressure. This will probably not be the case before 2023.’

RV peak ‘possibly reached’ in Germany

The German used-car market continued to show signs of significant consolidation in August. Price development is tense, with few and infrequent increases, while stock days continue to rise.

‘This is another sign that “the air is out” and that the peak has possibly been reached across the board. More vehicles are currently flowing in than are flowing out and expensive vehicles are not moving on. However, a rapid and sharp drop in prices is not expected this year,’ commented Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

It is interesting to look at the latest new-car registrations data, i.e. the used cars of tomorrow. The total volume to July was 11% lower than in the same period last year, which is in part ‘due to the low motivation of manufacturers to steer the limited output that is available into the unprofitable dealer, manufacturer and, above all, rental channels,’ Geilenbruegge noted.

The share of so-called tactical registrations through these channels is at a historic low of less than one third, a figure that was last reached in 2002 – excluding 2009 when a scrappage scheme was in place. ‘There are bleak prospects, then, for the segment of very young used cars this year and next,’ Geilenbruegge surmised.

Also interesting is brand performance in view of the general supply shortages. Cupra, for example, is now only just behind its SEAT sibling and had already surpassed last year’s total by 2,000 units in July. So far this year, the Cupra Formentor is the second most registered C-SUV in Germany, behind the Volkswagen Tiguan and ahead of the Ford Kuga.

Newcomers that can deliver cars are doing well too. MG is just ahead of Honda with four models and a fifth, the MG4, is already in the starting blocks. Polestar is registering more cars than Jaguar, closely followed by Lynk&Co, which has moved ahead of Alfa Romeo and Lexus. ‘So, the used-car market of the near future will still have a volume problem, but it will become more diverse,’ Geilenbruegge concluded.

RV growth continues in Italy despite sales slowdown

Although the pace has slowed in recent months, the growth in residual values did not stop in August, with an average increase in the %RV of 0.3% compared to July and 16.2% compared to a year ago. This is despite the sales-volume index falling 8.1% compared to a month earlier, although it is 29.2% higher than in August 2021. The time a used vehicle remains in stock increased slightly, to 62 days, with the Toyota C-HR and Nissan Qashqai being the best performers in August in terms of sales speed.

‘Diesel is the fuel type with the most surprising results in terms of %RV development, with a 1.5% increase over a month earlier and 19.6% growth compared to August 2021,’ commented Marco Pasquetti, head of valuations, Autovista Group Italy.

The sales-volume and active-market volume indices of diesel cars fell similarly month on month, but Pasquetti notes that the respective index figures of 95.7 and 82.1, ‘indicate a greater fall in the active listings on the main online used-vehicle portals, of around 18%, compared to January 2021.’

The average %RV of BEVs is on a downward trend, with a month-on-month decline of 2.2% in August. Nevertheless, prices are significantly higher than a year earlier and RVs of liquefied petroleum gas (LPG) and compressed natural gas (CNG) cars, which are still well established on the Italian market, are positive too. Values of both fuel types have grown around 14% compared to August 2021.

Shift to cheaper, smaller, older used cars in Spain

The Spanish new-car market continues to post negative results, with a cumulative year-on-year drop of 9.4% for passenger cars and SUVs that, although steep, is less dramatic than the 30% contraction of the light-commercial vehicle (LCV) market.

‘The lack of semiconductors continues to limit the entry of LCVs into the market and, in addition, high inflation, fuel prices, and economic uncertainty are slowing down, or at least postponing, consumers’ purchasing decisions,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

The shortage of supply in the used-car market has, therefore, not yet been resolved, and continues to reduce the available stock volumes by almost a half compared to a year ago. This is partly why there is also a drop in the sales-volume index, which was down 12.1% year on year in August.

Economic uncertainty is also having an impact on the used-car market, although its most visible effect is not so much a lack of demand but a shift towards cheaper, smaller and – especially – older cars. Four out of 10 used cars sold in 2022 are more than 10 years old and, as an example, there are as many 15-year-old cars sold as new cars. In these circumstances, it seems difficult to move towards a less polluting fleet. As the stock of these vehicles is shrinking, their prices have continued to rise. Buyers pay 30% more today for a vehicle that is over seven years old than in August 2021.

‘Considering the market sector that most affects sales by professionals, the shortage continues to impact pre-owned cars up to four years old. Dealers have neither been able to feed on sales of new cars nor have they been able to feed on renewals of leasing and rental fleets. Imports have thus become a relevant source of sales, increasing by 50% so far this year,’ Azofra commented.

In this scenario, residual values of vehicles continue to rise, although not at the same speed as in previous months. August’s rise was less than 1% for the first time in months. Economic uncertainty is holding back demand and prices are beginning to peak. Nevertheless, compared to August 2021, the average price of a three-year old used car with 60,000 km has risen from €16,095 to €19,765, equating to a rise of €3,670 or 22%.

Sales slow but RVs outpace list prices in Switzerland

For over two years, the Swiss used-car market has been characterised by healthy demand, low supply, and rising used car-prices. ‘Across all two-to-four-year-old passenger cars, the supply volume in August was 10.9% higher than a year earlier and already in 2021, the supply was significantly lower than at the beginning of 2020,’ noted Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

The sales-volume index in August was 17.7% lower than in July, and 14.8% down year on year. Nevertheless, residual values have grown slightly quicker than list prices. This market environment has led to a further increase in the average value retention of 36-month-old passenger cars, to 50.8% (up 18.5% compared to August 2021). Petrol cars posted strong year-on-year %RV gains of 17.6%, to 51.6%, as did diesel cars (up 20.1% to 49.7%) and BEVs (up 21.4% to 48.6%).

Diesel cars are still missing from the market, with a drop of 8.7% compared to August 2021. But the supply of BEVs showed an even stronger downward trend again, with a drop of 31.6% year on year. Nevertheless, market activity shows comparatively strong demand for BEVs and hybrids of all types, leaving their supply short.

The average days to sell decreased in August compared to July, with a passenger car aged two to four years in stock for 64 days. Petrol cars are selling quickest, after an average of 63 days, followed by diesel cars after 66 days, BEVs after 69 days, PHEVs after 80 days, and HEVs after 85 days.

Disruption to the supply of new cars, exacerbated by the war in Ukraine, and recent list-price increases are key factors in the future development of RVs in Switzerland. Supply chains are heavily affected, leading to long delivery times for most new vehicles.

‘As new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019), the market parameters will not significantly change in the medium term, even as used-car demand cools. Values of three-year-old used cars will remain high this year, and are forecast to end 2022 approximately 11% up on December 2021, before declining over the years 2023 and 2024,’ Annen concluded.

Living costs affecting UK consumers’ willingness to buy

The average residual value of a three-year-old car in the UK increased by 3.8% month on month in August. ‘Whilst positive, this movement does not accurately reflect the country’s general used-car market, instead it reflects rising list prices and the shortage of three-year-old models available in the market,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

With new-car availability being hampered by long delays due to component supply, the contract-hire sector continues to experience a high volume of contract extensions. This is in turn leading to a reduction of de-fleeted cars hitting the wholesale market, creating a supply and demand imbalance for this age of car.

‘The average movement across all vehicle ages that Glass’s values in the UK was 0.02% in August compared to July, reflecting a stable overall market being influenced by generally low demand and supply,’ Whittington commented.

It took a used-car dealer 47.2 days on average to retail a unit in August, a similar time to last month, but this is 9.5 days longer than in August 2021. ‘Whilst it is possible that a shortage of “in-demand” cars could be contributing to this sales rate, it is more likely that cost-of-living pressures in the UK are affecting consumers’ willingness to commit to buy,’ Whittington concluded.

The August 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.