Mixed-up supply and demand affect automotive value chain

11 August 2022

The automotive industry faces a new dynamic of new-car and used-car supply and demand. Sonja Nehls, Autovista24’s principal analyst, looks at the consequences.

Residual values (RVs) have been on a growth trajectory for two years and are set to stabilise at a high level. Meanwhile, new-car registrations are under pressure and a market recovery has lost its momentum.

Used-car supply and availability has been outstripped by demand. However, inflation and consumer hesitancy are starting to slow things down. Cars – new or used – being a scarce commodity turns market dynamics upside down. This has implications along the whole vehicle lifecycle and value chain. The issues do not stop at having to pay more for a used car.

During this vacation season, many will have noticed the increased prices for rental cars. A week’s fee for a Renault Clio or similar will have at least doubled, and in some cases tripled, compared to a pre-pandemic vacation. While rental companies defleeted their cars in 2020, and did not take on new ones due to the major reduction in tourism, they now struggle with purchasing vehicles. Those they can acquire come at high costs, based on increased list prices, and with reduced discounts from carmakers.

Lack of cars

Leasing and other mobility providers are joining rental companies in their struggles to acquire new cars, especially the non-captive organisations. Besides focusing on private customers and more profitable models, OEMs are keen on maintaining influence over available vehicles, prioritising their captive mobility partners. Independent providers face long delivery times, higher list prices, and diminishing discounts. Subsequently, the high RV level fails to translate into lower leasing rates.

The limited supply is forcing leasing companies and customers to extend contracts. The Arval Mobility Observatory states that the average vehicle possession length in Europe increased to 5.6 years from 4.9 years in 2021.

A seller’s market

Carmakers find themselves in an unusual situation and are selective as to who they sell cars. Profitability has to be ensured with a considerably lower production volume. Private consumers, better-equipped models, and electric vehicles (EVs) are therefore the primary focus to meet profitability and CO2 emissions targets. Rental cars, typically smaller segments with simple to average equipment levels, and petrol engines, do not get any priority.

Carmakers’ H1 results show that this strategy is paying off so far. Stellantis’ record-making first half this year reflects a favourable vehicle mix and pricing effects. The Volkswagen (VW) Group also mentions an improved mix as a contributor to its robust H1 results, especially from premium and sport segments. Despite a volume reduction of 7%, Mercedes-Benz Cars increased Q2 revenues by 8% and EBIT by 20%.

The winners

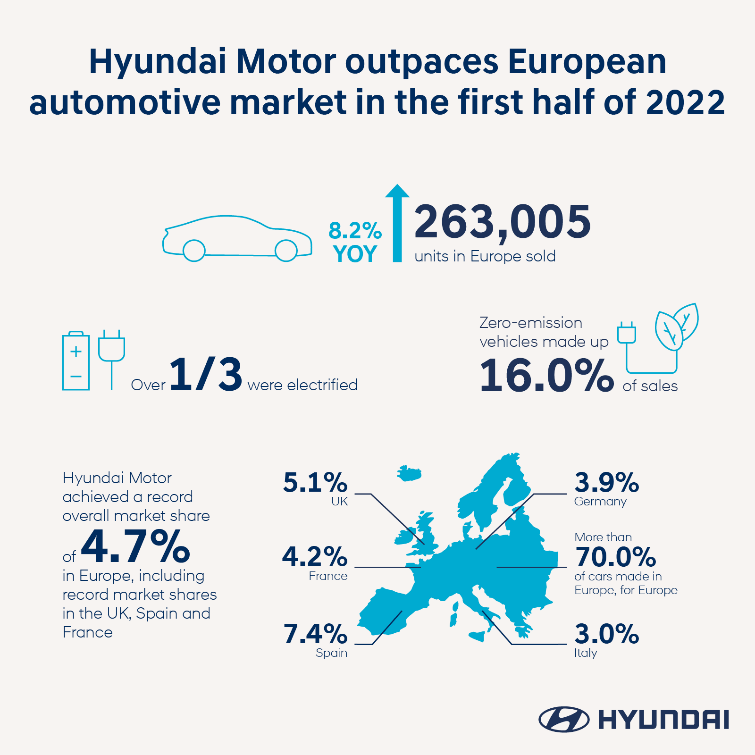

Those car manufacturers able to deliver vehicles are benefitting from new and additional sales opportunities with customers – both private and commercial. Hyundai Motor Europe achieved a record 4.7% market share during the first half of 2022 and sold 8.2% more units year-on-year.

Leasing companies are also more open to taking on board new brands, which is one of the drivers of MG’s sales success. Another is MG’s sales cooperation with established dealerships. Great Wall Motors has just announced they will sell their upcoming Wey and Ora models through the Emil Frey group, Europe’s largest car dealer. This is not a bad way to lay the foundations for a successful market entry.

While leasing companies endure supply and volume problems, they are benefitting from surging RVs. Leaseplan’s net result for the first half of 2022 is €684 million, a 93% year-on-year growth. Ted Gunning, CEO of Leaseplan, references the high used-car demand as a main contributor. Volkswagen Financial Services reported record earnings in the same period, with high remarketing revenues listed as key factors.

Harder to bag a bargain

For consumers a lot has changed in the new and used-car market. With carmakers not under pressure to sell massive volumes, discounts are considerably lower and there are fewer tactical registrations. Gone are the days of buying a new car with a 30% discount.

Additionally, the long delivery times for most brands make consumers turn to the used-car market. Car dealers also have an increased focus on the used-car business with their margins depending on it. With fewer new-car sales and less transactions overall, high used-car prices are maintained.

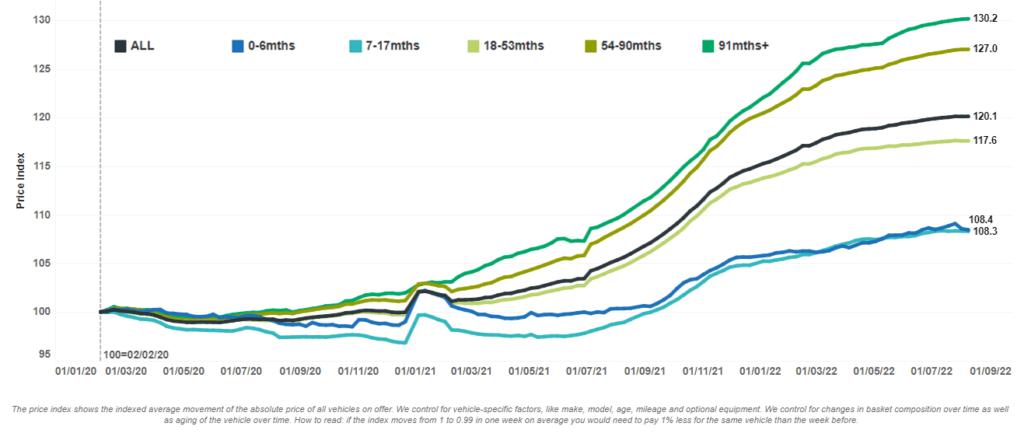

As available budgets did not grow accordingly, customers are shifting to older used cars. RVs for older vehicles saw the strongest price increases in most European countries, e.g. 30% for cars older than 91 months since the beginning of 2020 in Germany compared to an average of 20% for all vehicle ages.

Price index by vehicle age, Germany, January 2020 – August 2022

Besides this trend towards older used cars, there is the potential for used-car customers to downgrade to more affordable brands, downsize to smaller segments, and generally be more conscious about the equipment they really need in their cars.

With remote working being an option and generally reduced mileages, some customers will also consider getting rid of a secondary car and be more open to new mobility solutions.

RVs affecting the entire car lifecycle

Current supply and demand dynamics do not only affect the sourcing and purchasing processes, but also play a major role in insurance claims and vehicle repairs. The increased settlement values of total loss vehicles was a main driver behind a profit warning from Direct Line Group, one of the UK’s largest insurers. Policies were not priced to accommodate higher RVs, and policy holders will likely have to pay more upon renewal.

Autovista24 talked to Joe March, head of commercial and network management at The Green Parts Specialists, recently acquired by Copart UK. ‘A greater volume of vehicles, following an accident, have fallen into the repair chain process, rather than total loss,’ March said. He added that this results in ‘higher repair costs and lower profits. This is also impacted by poor parts availability and a saturated repair market. Policy holders are typically waiting as long as three months for their vehicle to be repaired.’

Rising inflation and repair costs, combined with insurers recognising their environmental obligations, have opened up opportunities in the green and used parts space for vehicle repairs. ‘Year-on-year, demand is up 28% in the B2B arena and increasing. The industry needs to be most cost efficient and green parts are just one of the ways which insurers are adopting to mitigate rising repair costs,’ March explained.

Have residual values reached a tipping point?

Across Europe there is a tendency for RVs to now stabilise on a high level. The used-car supply will remain restricted for years to come as the new-car gap progresses through the different stages of a typical vehicle lifecycle. RVs will not keep growing as they have since 2020, due to a loss in purchasing power and customers increasingly delaying their buying decisions.

The latest Monthly Market Update shows the tendency for longer stock days in almost all analysed markets. In July and August, this can be attributed to the summer vacation period, but Autovista Group experts expect this trend to continue as economic circumstances put pressure on disposable household incomes.