Swiss new-car registrations surge in first half of 2023 as used transactions stagnate

19 July 2023

Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of Autovista Group), examines the Swiss automotive market’s performance in the first half of the year.

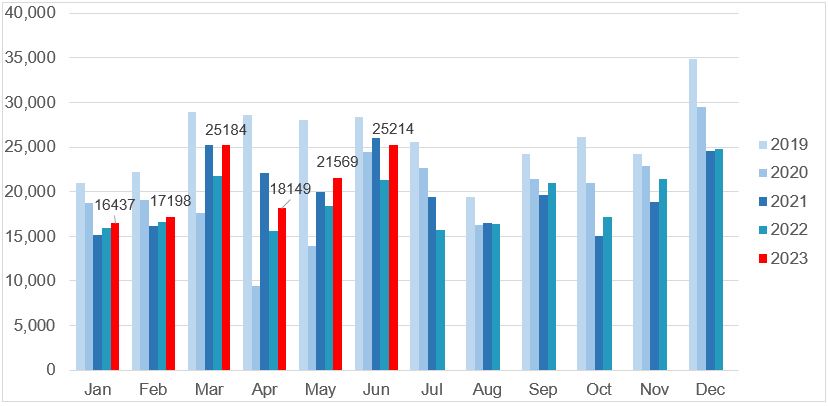

Since the autumn of 2022, Swiss new-car registrations have developed positively, and this trend continued into the first half of 2023. In the first six months of the year, figures were up 12.9% compared with the same period in 2022.

Despite the war in Ukraine and increased inflation, the driving force behind this change was likely the improved new-car supply situation. However, registrations were still down 21.3% on the first half of 2019, prior to the COVID-19 pandemic.

There were 25,214 new passenger cars registered in June, 18.5% more than in the same month last year, but 11.2% fewer than in June 2019. Despite the uncertainties, a further recovery of new-car registrations can be expected in the coming months.

The electrification of the new-car market continued too. Hybrid-electric vehicles (HEVs), plug-in hybrids (PHEVs), and battery-electric vehicles (BEVs) took a cumulative 54.8% share of the market in the year to date.

New-car registrations by month, 2019-2023

Used-car market uneven

The supply of used cars is now higher in Switzerland than it was before the COVID-19 pandemic, with the exception of very young used cars, aged two years old and below. Fewer new cars were sold between 2020 and 2022, meaning they are permanently missing from the used-car market, creating a gap in supply.

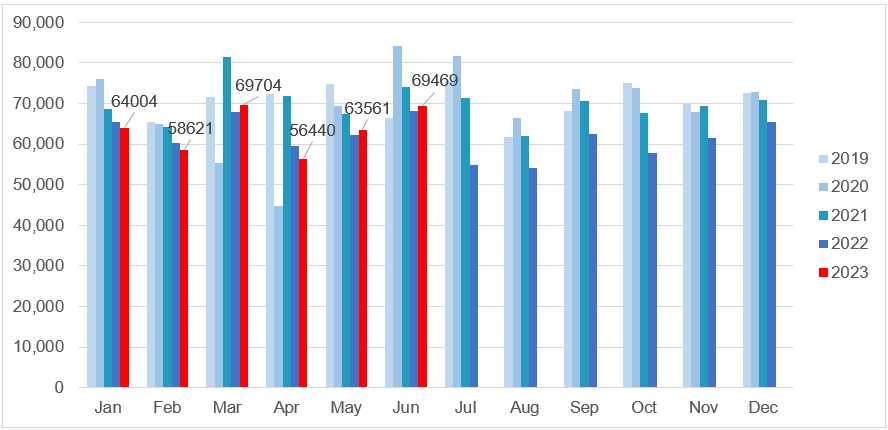

While used-car transactions in 2021 almost returned to pre-COVID-19 levels, there was a clear decline in 2022. Additionally, the figures for the first half of 2023 are stagnating, with changes of ownership reaching a volume of 381,799*. In June, the number of transactions sat at 69,469 units, up 1.8% on the previous year. This was expected due to the higher volume of new-car registrations in recent months.

The uneven development in the number of ownership changes is likely to continue in the second half of 2023, even if new-car registrations continue to recover. While the supply of used vehicles is now high again, demand in the market is declining.

Used-car transactions by month, 2019-2023

In recent months, the number of used cars on offer has recovered steadily, returning to the supply volumes of February 2020. Only the supply of two-year-old vehicles remains down, 22% lower than in February 2020. In all other age groups supply is clearly higher.

Falling demand has met increased supply, which is only scarce for very young used cars. As a result, previously high offer prices have fallen significantly across all fuel types and age classes. HEVs are an exception, which have hardly changed.

BEVs were also able to profit temporarily across all age groups, although this trend has seen a decline since last autumn. Young, modern electric models did benefit the most. Among 12-month-old used vehicles, BEVs still occupy second place in the residual value analysis, directly after HEVs.

*Since the beginning of 2022, the Federal Roads Office, ASTRA, has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s evaluations from 2022 onwards. Therefore, the figures for 2022 are based on ASTRA data. The values up to and including 2021 are shown according to the previous method. This must be taken into account when comparing the figures for 2022 with previous years. Comparisons are therefore only possible to a very limited extent, if at all.