Polish automotive market sees volatility in first half of 2023

13 July 2023

The Polish automotive market was characterised by considerable volatility in the first half of 2023. Marcin Kardas, head of valuations at Eurotax Poland (part of Autovista Group), explores the trends.

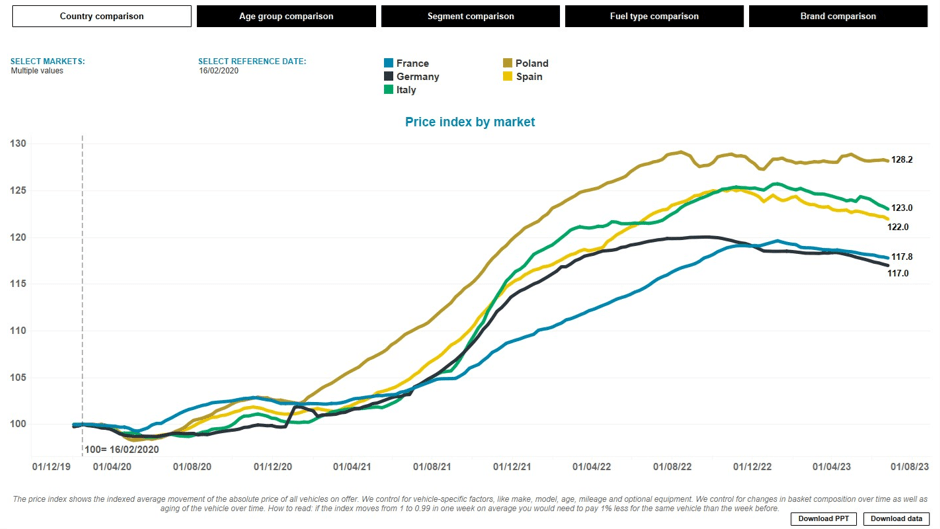

Demand for new and used cars gradually declined in the first half of 2023, while the fallout from the COVID-19 pandemic continued. This includes extended new-car delivery times and shortened supply to the used-car market, especially of younger models.

Used-car demand is still highly volatile in Poland. It held at a good level at the beginning of 2023, only to weaken a few months into the year, before improving once more. This high level of volatility is linked to fluctuating used-car supply.

Companies are struggling to sell larger fleets, which indicates how shallow the market is. However, the cars on offer are no longer attractive. They are the result of extended contracts, meaning their age and mileage is less competitive than before the COVID-19 pandemic. Importers and dealers, mainly offering younger cars in smaller quantities, have not seen a defined drop in demand yet. However, sales times are clearly extending, and transaction prices are stabilising.

Given the increasing sales price of new cars, residual values (RVs) are going into decline. New-car availability is increasing which means competition is returning to the market. But as demand weakens, discounting is making a comeback in the short term, a trend that is already evident in the premium segment. In the long term, competition will likely encourage the stabilisation of transaction prices.

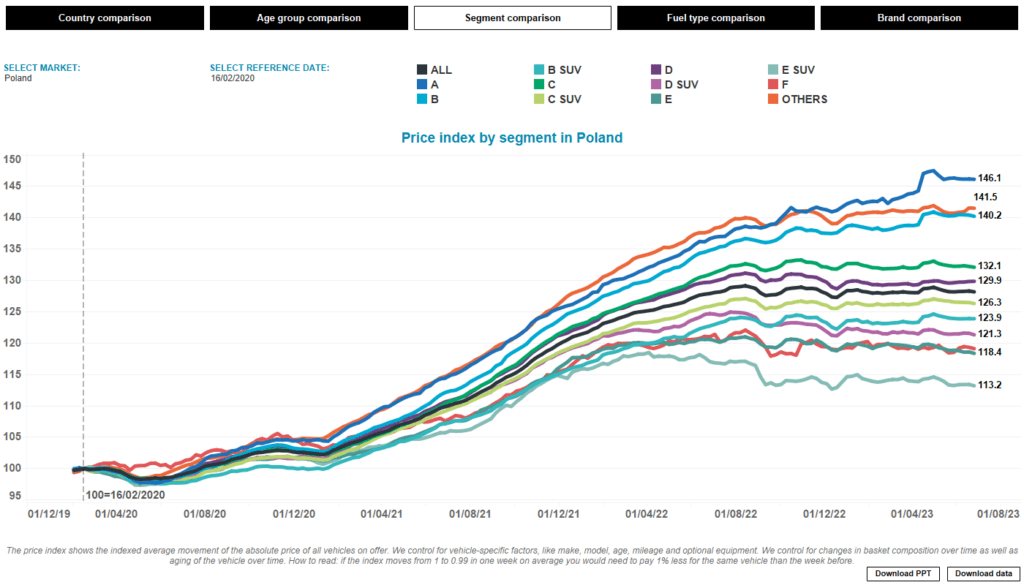

Segmentation effect

The decisive indicator for further market development is the size of the price index slopes. As these rise, the pressure on selling prices will increase while competition will force them down. This scenario is favoured by the falling Euro exchange rate, which has reduced the appeal of used cars from Poland and limited their export potential. As a result, this also creates conditions for an increase in used-car imports from abroad.

The volatile situation on the used-car market – caused by gradual fleet replacement, new-car discounts, and unstable demand – also translates into asking price changes, which have heavily fluctuated month to month. Only the small A and B-segments are still on an upward trend due to attractive prices and limited supply.

Downward trend yet to emerge

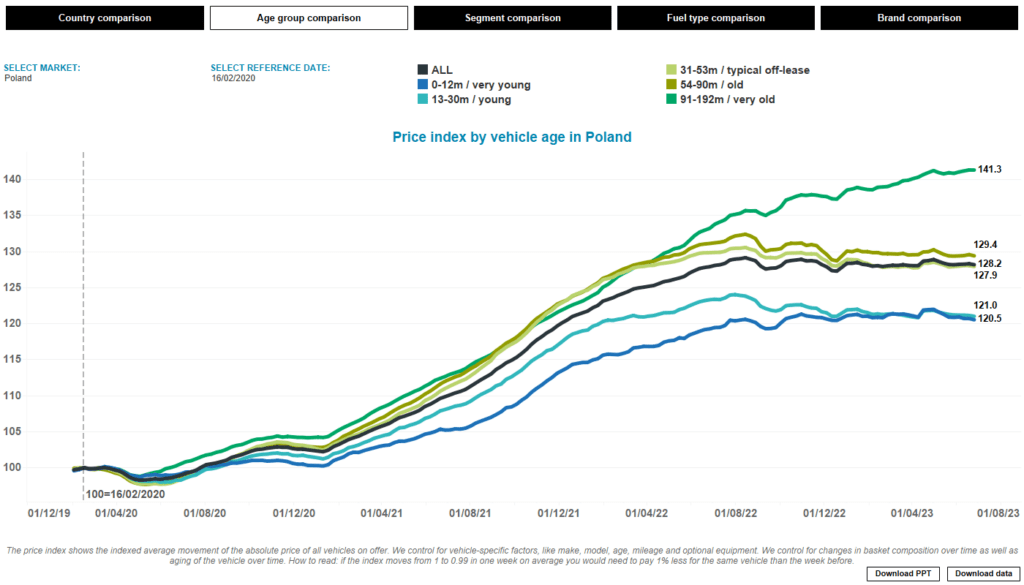

Analysing age ranges, cars over seven years of age have continued to gain value. The asking prices of younger cars are stabilising, but the downward trend is not yet visible.

The situation with offer prices mirrors the current state of the market across Europe. It seems the growth period is a long time past, with values depreciating naturally over time. This trend will be visible in Poland over time as high inflation and poor saturation of the used-car market are delaying the immediate effects.

Powertrains and pricing

Considering powertrains, internal-combustion engine (ICE) models are holding their value, while electric vehicles (EVs) are suffering a clear downward trend. There are several reasons for this. Tesla’s price cuts have caused confusion in the market, resulting in its competitors implementing their own reductions, which has affected the valuation of the youngest used cars.

Meanwhile, the supply of used EVs is gradually increasing due to subsidised cars in Western Europe being replaced. Weak demand for these models has resulted in a steeper decline in value. In Poland, there may be an imbalance between very low supply and weak demand.

Commercial conundrum

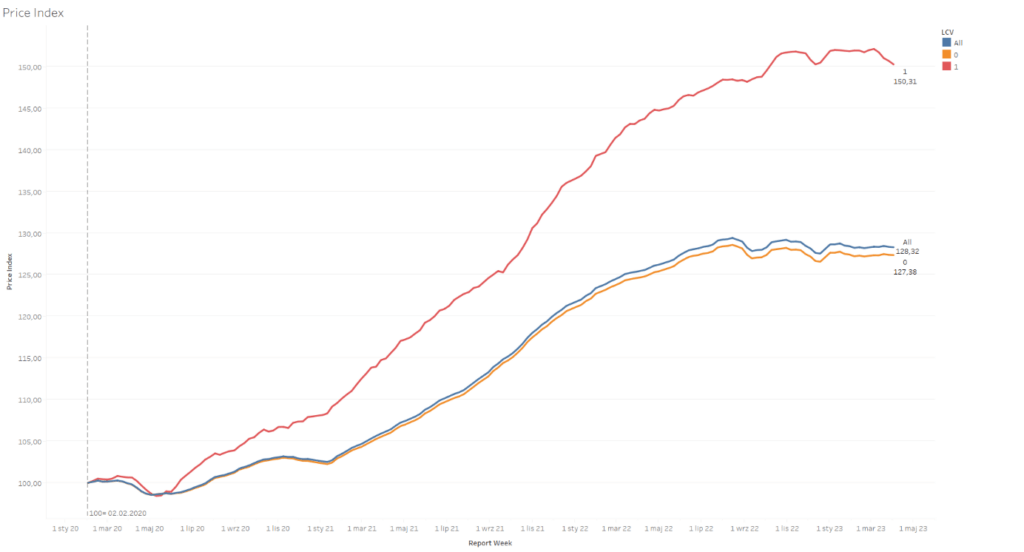

New and used vans are not selling as well as passenger cars. A downward trend has been noticeable since the beginning of the year, triggered by economic problems. Purchasing power is falling, which leads to reduced sales and lower demand for short-haul transport.

Vans, which drove the market last year, are experiencing a downturn. There is also a trend towards fleets extending the life of their cars and delaying replacement due to extremely high list prices of new cars.

The sharp decline of used-van values is affecting the market, as seen in the graph below (red line) compared to the relatively stable prices of passenger cars (orange line). The slopes are rising, with the market entering a period of recession.

The heavy truck market is experiencing a big problem, with demand declining as Europe sees an economic downturn. Meanwhile, the blockade of the border with Belarus, due to the war in Ukraine, has forced the diversion of trucks which has increased market competition. Fleets are shrinking as evidenced by the lack of work for drivers. At the same time, trucks ordered many months ago are not being collected by hauliers.

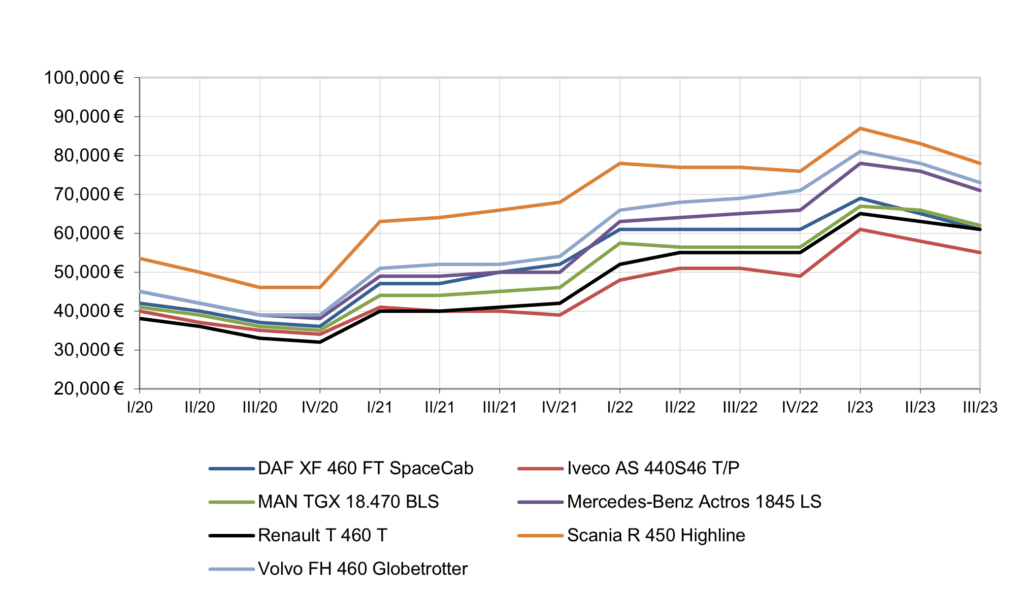

A look at the used market shows that the small supply of used tractor units is unable to sustain price levels, leading to a sharp fall in the second quarter of 2023. In the construction vehicle segment, the supply of used dump trucks has increased while prices are falling. The market for distribution vehicles up to 18 tonnes gross-vehicle weight is reacting similarly. The transport boom is weakening, and this trend is likely to last for a long time.

Average value of a three-axle tractor unit on the Polish market

Compared with new-car registrations, trucks are holding their own while the van market is suffering. From January to May, Poland saw 197,091 new passenger cars registered, a 14% year-on-year increase, according to data published by PZPM. There were 14,130 new truck registrations, up 10.3%.

Meanwhile, 25,507 new vans were registered, down 2.1% compared with 2022. But one has to take into account the drastic supply shortage of new vehicles in 2022. Therefore, due to long production times, the current year-on-year growth does not accurately reflect the current market situation.