Charging incentives needed for BEV buyers as UK registrations rise

06 July 2023

June marked the 11th consecutive month of growth for the UK new-car market, as registrations continued their recovery from supply constraints.

The latest figures released by the Society of Motor Manufacturers and Traders (SMMT) show that 177,266 passenger cars were registered in the sixth month of 2023, representing a 25.8% increase over the same period in 2022. The market is up 18.4% year to date, with 949,720 registrations over the first half of the year.

This is set against a time when the market was beginning to see an end to supply-chain shortages which had crushed new-car deliveries for months. Production lines had been hampered by a lack of semiconductors, a hangover from the COVID-19 disruption. With the backlog of deliveries starting to make their way to customers from August 2022 onwards, the rest of this year could see more stable figures.

When adjusted for working days, however, year-on-year growth was only 14.3%, with two more working days in June. Moreover, the seasonally-adjusted annualised rate (SAAR) retreated to below 1.7 million units. The numbers are still below the pre-COVID levels of 2019, 20.7% down in June and 25.2% down across the year.

As the cost-of-living crisis continues and households see their budgets squeezed, it may be some time before the market recovers to pre-pandemic levels. This is highlighted by the fact that growth in June was driven mainly by large fleet registrations, which were up 37.9% to 92,699 units, while private demand only grew 14.8% last month, according to SMMT figures.

Petrol leads but market share drops

Petrol led the way again last month, with a 22.7% increase in registrations, including mild hybrids. However, its market share dropped by 1.4% compared to June 2022. Diesel powertrains, including mild hybrid, saw registrations decline 13.5%, with the 7.3% market share representing a 3.3% decrease.

Therefore, internal-combustion engine (ICE) vehicles saw a market-share decline of 4.7% last month. this was taken up mostly by plug-in vehicles, incorporating plug-in hybrids (PHEVs) and battery-electric vehicles (BEVs), which increased their market share by 3.5%.

BEVs increased their registrations by 39.4% with 31,700 units taking to the roads. However, it is businesses and fleets, rather than private buyers, that continue to drive this growth, thanks to the attractive fiscal incentives on offer.

Manufacturers are offering a range of BEV deals to private buyers, including flexible subscription models and attractive finance rates. However, the SMMT believes more could be done by other stakeholders to make all-electric vehicles more compelling.

One issue holding back BEV uptake is the cost of public charging. Plugging in a vehicle at home can result in cost-per-mile savings of up to 70% compared with refuelling an ICE vehicle. This is thanks to a 5% VAT rate on energy prices, but those who do not have off-street parking, or are unable to install a domestic charging point, pay the full 20% VAT rate on public chargers. The SMMT suggest that VAT equity would make switching to a plug-in vehicle feasible for more people regardless of home ownership or property status.

‘The new car market is growing back and growing green, as the attractions of electric cars become apparent to more drivers,’ commented SMMT chief executive Mike Hawes. ‘But meeting our climate goals means we have to move even faster.

‘Most electric vehicle owners enjoy the convenience and cost saving of charging at home but those that do not have a driveway or designated parking space must pay four times as much in tax for the same amount of energy. This is unfair and risks delaying greater uptake, so cutting VAT on public EV charging will help make owning an EV fairer and attractive to even more people,’ he added.

Plug-in vehicles forecast to overtake ICE

The latest EV-volumes.com (part of Autovista Group) forecast for 2023 and 2024 has been reduced, with the UK now expected to see registrations rise by 15.5% this year, and 5.9% next year. The figures suggest that the UK market will continue to grow, but full-year volumes will not return to pre-COVID-19 levels before 2028.

‘With inflation remaining stubbornly high and the 13th rise in interest rates since December 2021, our forecast for 2023 and 2024 has been reduced to 1.86 million units and 1.97 million units, respectively,’ commented Neil King, forecasting lead at EV-volumes.com. ‘However, the market share of BEVs and PHEVs is developing nicely in line with the latest EV-volumes forecast, which calls for BEVs and PHEVs to gain 17% and 6% market share respectively in 2023.’

The current forecast also projects that by 2026, plug-in vehicles will have overtaken ICE models, including mild hybrids (HEVs), to become the leading powertrain type in the country. This growth will continue to accelerate towards the ban on new petrol and diesel models in 2030, with BEVs reaching over a million registrations for the first time in 2027.

Sustainability grows

The UK industry is calling for more support from the UK government as it faces a number of challenges, including a skills shortage, potential of trade tariffs with the EU, and a transition to new technologies. This support, listed as five pledges in a new SMMT report, suggests the market could deliver up to £106 billion (€124 billion) to the economy and help the country achieve its net-zero targets.

Already, UK vehicle manufacturing is reducing its carbon footprint. Last year saw emissions per vehicle fall by 2.8%, while at the same time producing a record-high proportion of electric vehicles (EVs), according to the SMMT’s annual Sustainability Report.

While EVs require more energy to produce, manufacturers have been able to advance production efficiencies. Last year’s CO2 output was down by nearly 17,700 tonnes, the equivalent carbon reduction of more than 800,000 trees.

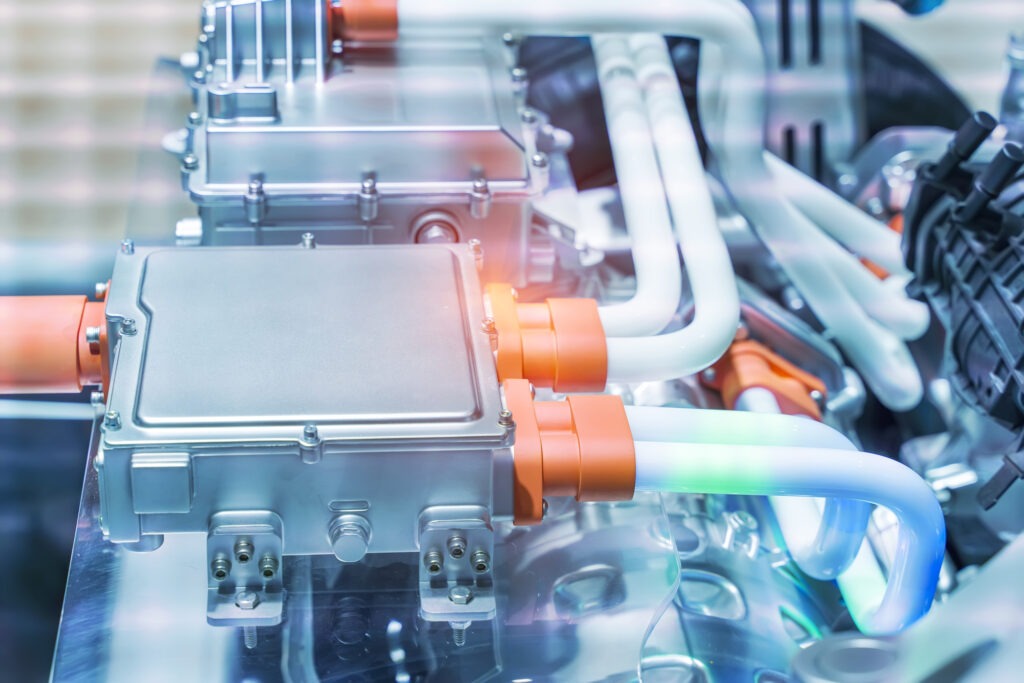

Yet while the country is scaling up its EV output, battery production is lagging, with up to 90GWh of gigafactory capacity needed by 2030 to meet the UK’s manufacturing needs. With the post-Brexit ‘Rules of Origin’ enshrined in the Free Trade Agreement set to be adopted from the start of 2024, the need to rapidly expand battery-manufacturing capabilities in the UK is as important as ever. ‘

As demand for electric vehicles continues to grow at home and overseas, the UK can distinguish itself as a low-carbon manufacturing nation, but this depends on critical investment in gigafactories and the affordable, renewable energy needed to power them. The sector has made huge strides in recent years but there is much more to be done,’ added Hawes.