UK automotive industry outlines requirements for future success

30 June 2023

The latest SMMT International Automotive Summit promoted the image of a resilient UK industry facing a wave of political and economic challenges. From Rules of Origin to skills shortages, special content editor Phil Curry picks out the key points.

The UK’s automotive industry has been through a long period of tough challenges but has remained resilient. There are more obstacles ahead, but they can be tackled together, especially if the country’s government works with the market to adopt five key pledges.

Plans have been outlined in a new report published by the Society of Motor Manufacturers and Traders (SMMT) and highlighted at the recent SMMT International Automotive Summit, held in London. There, figures from across the industry, including manufacturers, suppliers, and aftermarket, came together to discuss the ongoing issues and how the automotive industry is preparing to tackle them.

There were also talks from numerous politicians. With a general election due before the end of 2024, the industry needs to be sure that whichever party is in government, it will pledge to help secure the future of the UK’s automotive industry.

More than most

While the European automotive market has had to tackle COVID-19 and a supply-chain crisis, the UK has also struggled through years of uncertainty surrounding Brexit. Seven years after the crucial referendum, the ghost of the subject remains, with the ‘Rules of Origin’ targets set to be adopted at the start of 2024. This could lead to tariffs on trade between the UK and EU if not met.

The industry is also continuing to face a skills shortage, as it transitions from a mechanical and engineering market to one of software and coding. Additionally, inflation and increased energy costs – although these have started to decline – present economic pressures.

The move to electrification is presenting problems too, with rising research and development costs, the need for a localised supply chain and, crucially, improved charging infrastructure to encourage sales. All of this is taking place in an increasingly competitive market, with various new players entering the country and challenging incumbent manufacturers.

But if these challenges are causing concerns within the UK industry, it was not evident at the SMMT Summit. Instead, the theme of resilience shone through, with speakers highlighting not what could go wrong, but what was needed for the country to succeed as a leader in the automotive world.

‘Our theme today is very much about resilience and thankfully, given the recent headwinds, it is something the automotive industry has in spades,’ SMMT chief executive Mike Hawes told the press prior to the event. ‘I cannot say we have got through Brexit because it continues to challenge us in certain ways. We got through COVID-19, but of course, we now as an industry and as an economy face spiralling inflation, interest rate rises and a cost-of-living crisis.

On top of this, there is the need to tackle climate change. ‘The government has set the industry some very tough targets and the industry is committed to meeting them. But to do this, we need this government and the next one, whatever shape, colour, political hue it may be, to make sure that conditions are right, to ensure that we can make that transition,’ Hawes added.

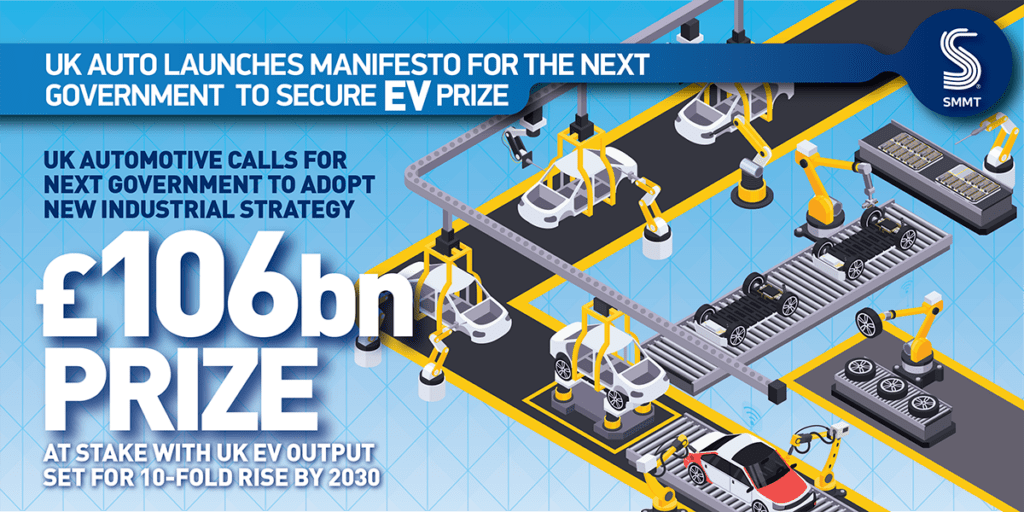

The SMMT report, Manifesto 2030: Automotive growth for a zero-emission future, highlights the potential of the UK’s automotive market and the five pledges it needs from the government. These, the industry body states, will ensure not only its success but the potential economic benefits.

‘This is our manifesto, and we want it to be part of the next government’s manifesto,’ added Hawes. ‘The prize for delivering all of this, if we can make the transition and get the investment, totals about £106 billion (€123.4 billion) by 2030, if we can get the UK plants to be making the electric vehicles (EV) with battery production to support. This manifesto would help to increase EV production in the UK tenfold, to around 750,000 units per year by the end of the decade. So, it is a win for the industry, it is a win for the government, and it is a win for the country. But to do it, to get it there, we need the right strategy.’

Rules of origin

One of the biggest threats to the industry stems from Brexit. Within the UK-EU Trade Agreement is a clause concerning ‘Rules of Origin’. Under this, a condition stipulates that from 1 January 2024, 45% of an EV’s value must be sourced from the UK or the European Union, otherwise export tariffs of 10% will apply.

However, the COVID-19 pandemic and the following supply-chain crisis derailed the timeline for establishing a localised EV supply chain, especially when it comes to batteries, which make up the majority of the value.

‘Our most important relationship is with the EU,’ stated Tim Slatter, chair of Ford of Britain and Ireland. ‘We have a trade cooperation agreement which is fabulous, a result of post-Brexit negotiation, and within that, there is the Rules of Origin agreement, which was architected three or four years ago, and it comes into effect next year.

‘It means that a large proportion of battery-electric vehicles must be produced either in the EU or the UK. There are very specific regulations for the battery itself, and it is difficult for the industry to meet those requirements within this timeframe.’

With just six months to establish a localised battery supply chain, including materials, and with very few gigafactories and mining operations in the UK and Europe at present, the situation seems impossible.

‘Ford will be making eight electric vehicles in Europe for the European market,’ added Slatter. ‘All of those batteries will be produced in Europe or the UK, but they will still not meet the regulations under Rules of Origin. That is because what matters is what goes inside the battery, specifically the cathode active material, which is about 50% of the value of the cell. This becomes the responsibility of tier two and tier three suppliers to develop in a chemical plant, and that is just not ready now. So, we really need to adjust the timeframe, so we do not end up taxing the decarbonisation strategy.’

The importance of a clear, transparent, and tariff-free trading relationship with the EU was echoed by Konstanze Scharring, director of policy and government affairs at the SMMT. ‘I think from a strategic perspective, the UK absolutely needs to have a policy towards trade and investment that is open, not protectionist going forward. It needs to put automotive, and our new global supply chains, out there and provide continued access for our products. We need to make sure that all the deals we strike, and our relationship with the EU, retain tariff-free access for our products and for those from the EU itself.’

One problem with the Rules of Origin agreement is the time it was agreed and how circumstances have evolved since. ‘The trading cooperation agreement was agreed a number of years ago,’ stated Ben Gardner, senior associate at law firm Pinsent Masons. ‘If we look at how much the world has changed since then, we have had a pandemic, we have seen the start of a war, there has been a number of issues and external factors that are affecting the roadmap that we agreed to over three years ago. So, I think there is some collective common sense needed between the UK and Europe, just to realise that things have moved on and, for our collective good and our ongoing collaboration, we do need to agree a suitable middle ground and some reasonable deadlines for meeting these rule of origin targets.

‘There seem to be positive rumblings coming out of Brussels, and the European Automobile Manufacturers Association (ACEA) wants to push the targets and the deadlines back, but all it takes is one fly in the ointment and we could find ourselves stuck in a really difficult situation,’ he added.

Skills shortage continues

Another big challenge the UK’s automotive industry currently faces is a skills shortage. While this is not a new subject, it is also not one that can be solved overnight. Across the industry, there is a lack of skilled workers, and not enough new starters to help offset those leaving their jobs.

‘We have always complained that we have a skills deficit in the automotive sector, but I would say that we need to be thinking as innovatively towards attracting new talent as we are with the technologies we are developing,’ commented Julia Muir, founder of the Automotive 30% Club. ‘One of the shared themes we are finding amongst our members is that we not only struggle to find people with the ability to learn the technical and technological skills, but we also struggle to find the people with the core foundation of employability skills. So, diligence, conscientiousness, dependability, and the ability to communicate, for example.

‘As our technological skills requirements increase, we also need people with the human skills, and the relationship skills, to be able to explain this huge innovative transformation that is taking place in the sector,’ she added.

One problem the industry faces is that it is no longer an engineering-based market. Muir stated that when visiting schools to talk about careers, she described the automotive industry as one of ‘advanced technology’. This brings new problems, as rather than being one of the oldest engineering job markets, the sector now features the newest technology.

‘We are competing with many different industries that are faster than automotive, even when you are looking at software engineers, for example,’ added Helen Foord, head of global government affairs at McLaren Automotive. ‘There is a real short-term issue, and we have to look elsewhere, including outside the UK.’

‘It is a fact that our sector is now in competition with sectors that maybe youngsters find a little bit more glamorous than automotive,’ added Muir. ‘If they want to work in technology, are they thinking of working in Google or Facebook rather than working in automotive?’

An area that the skills shortage is heavily impacting is the aftermarket, especially vehicle servicing. This industry has been going through a long period of upheaval thanks to changing technologies, long before the introduction of EVs. Injection systems, electronic controls, connected technologies and fewer mechanical components mean that those working in the aftermarket require additional and constant training.

‘We have 175,000 technicians in the UK at present, stated Andy Hamilton, group CEO at LKQ Euro Car Parts. ‘There are 23,000 vacancies. When you then look at the capabilities of existing groups, they are not yet ready for new technology to come in through. For example, with advanced driver-assistance systems (ADAS), we have around 3,000 technicians in the UK training at present, but within the next seven years, we will need 106,000. We have the same challenge with EV and hybrid technology.’

It is a fact that our sector is now in competition with sectors that maybe youngsters find a little bit more glamorous than automotive.

Julia Muir, Automotive 30% Club

Andy Turbefield, head of quality at Halfords, suggested reasons as to why the aftermarket is struggling when it comes to balancing the skills of its workforce. ‘Our vehicle technicians are not getting any younger,’ he stated. ‘As such, they perhaps do not want to engage in so much training on the new technologies that are coming through.

‘We should also be seeing a large number of apprentices qualifying who started their roles two and three years ago. Unfortunately, during COVID-19, many apprentices fell out of employment, as did other people, meaning they are not there to bring new skills to the market.’

Yet the market faces challenges in bringing skilled workers into the industry. ‘The technician shortage is well known,’ commented Simon Villanueva, director of legal and public affairs at Volvo Trucks. ‘But we have an image problem. The image of a technician in greasy overalls is history now, but people still perceive it that way.

‘Diversity is also an issue. We have an aging male workforce, and we need to change that. At Volvo, we are working hard to make sure all our sites have facilities available for female technicians, even if we do not have them there, because it is what we have to do, to ensure that when we do bring a diverse workforce in, we are ready.’

Villanueva also pointed to problems with the UK’s apprenticeship schemes. ‘It is a fantastic scheme,’ he stated, ‘but the amount of funding allowed for technician training is not enough. We used to have 100 colleges delivering technician training in the UK. There are less than 40 now, and it is reducing constantly because they cannot make it work on the funding available.’

Political allegiance

The UK will go through a general election in the next 18 months. While the outcome is far from certain, whichever side gains power, the message from the automotive industry is clear. It must work together with the market to ensure it can build a sector that can take advantage of new technologies and lead in Europe, and to make sure the entire UK can benefit, from north to south, as part of levelling up scheme.

With this in mind, the SMMT invited MPs from both leading UK political parties to address the conference. The first was Conservative government minister Kemi Badenoch, secretary of state for the Department of Business and Trade. Set up earlier this year, this department will work with industries in the UK and address domestic and international trade concerns.

‘We cannot have economic growth without the automotive sector, we cannot have levelling up without the automotive sector,’ Badenoch stated. ‘I think it is amazing that automotive businesses have survived so many of the shocks of the past few years, many of which we thought were once in a generation, and they just keep coming.’

Badenoch also addressed the US Inflation Reduction Act (IRA), stating that while it seems to be working for America, it is not something that will be adopted in the UK. ‘We are not going to copy and paste exactly what is happening in another country and transport it to the UK,’ she stated. ‘We have to do what is right for our own economy. We must do what works well where we have a comparative advantage. So, we will come out with plans soon.’

We cannot have economic growth without the automotive sector, we cannot have levelling up without the automotive sector.

Kemi Badenoch MP, Department for Business and Trade

Labour’s Louise Haigh, shadow secretary of state for transport, dismissed this angle. ‘The IRA is reshaping global economics and will help secure the jobs of the future. The Biden administration is rebuilding America’s manufacturing base with a more active state and a more modern industrial strategy. Elsewhere, other nations are following suit.

‘In Australia, the Government’s Powering Australia plan will generate 600,000 jobs across the country, burning investment and cutting energy bills. Germany has committed to the biggest industrial modernisation in more than a century. Yet while the US and our allies charge ahead, our Conservative Energy Secretary calls those policies dangerous. Almost a year on from the Inflation Reduction Act, there has still been no UK response.’

Haigh also pledged that, should Labour win the general election, it would look to provide £2 billion to fund eight new gigafactories in the UK, which should help localise supply chains for domestic manufacturers and provide an opportunity for the UK to supply the EU with the technology.

A bright future if conditions are met

Speakers also discussed ways of ensuring the industry is more sustainable, highlighting the work they are doing in all corners of the country and joining various segments of the market to reduce environmental impact.

Technology is also being deployed to help this cause. AI is used to inform businesses about efficiency in supply chains and manufacturing. Infrastructure is being put in place to develop new powertrain technologies, and the market is more aware of digital infrastructure than ever before to track progress and improve the sustainability push.

Inflationary pressures also loom large, with more than 80% of companies responding to SMMT’s latest automotive business confidence barometer reporting rising input costs, which are limiting profitability and acting as a stop on investment. Competitive energy prices are critical to long-term domestic EV production, with more than nine-in-10 firms citing the importance of energy price mitigation measures as essential to further investment. The UK automotive sector is facing electricity costs that are more than double those of EU rivals, with the added challenge of long lead times to secure essential new-grid connections for renewable investments.

Manufacturers big and small, premium and niche, are working together to build the UK industry into a leading force. However, without the right support, this work may still come to nothing. The most pressing issue is that of Rules of Origin, which must be addressed soon, or it may be too late to prevent tariffs on UK-EU automotive trade.

But all challenges must be tackled on a united front. The SMMT manifesto has been designed to help any political party better understand the industry, with pledges that can be easily inserted into their own promises. These pledges are exactly what the UK automotive market needs, meaning it has done a lot of the hard work already. There is a bright future ahead, as long as the government, investors and the industry can work together to achieve it.