2021: Another year of crisis for Swiss new-car registrations

21 January 2022

Autovista Group’s Swiss market analysis team, led by Robert Madas, head of valuations at Eurotax Switzerland, look at the current state of the country’s automotive sector.

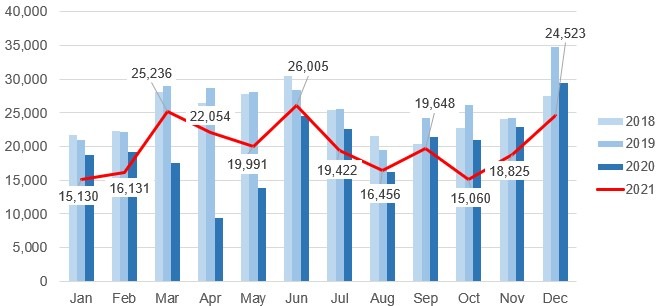

For the second year running, COVID-19 has impacted the Swiss car market. Since the beginning of the pandemic in spring 2020, new-car registrations have been consistently well below prior levels. A lack of semiconductors, raw materials, and the associated delivery delays of new vehicles prevented a recovery last year despite high demand. Only electrically-chargeable vehicles (EVs) experienced a renewed boom.

Considering the development of the used-car market and residual values in 2022, the supply situation is decisive. Madas and the team believe that as long as the number of new-car registrations is significantly lower than before the pandemic, the supply of used cars will remain tight due to the lack of supply, and prices will continue to rise for the time being. Only in the course of this year, provided that supply increases significantly, should used-car prices stagnate or even weaken slightly.

In 2021, there were 238,481 new-car registrations, with only 0.7% growth year-on-year and 23.4% behind 2019. There were 105,860 electrified registrations, including 66 hydrogen fuel-cell (FCEV) models. This is more than 50% up on 2020.

Battery-electric vehicles (BEVs) were able to increase from 19,503 to 31,823 registrations (up 63.2%) reaching a market share of 13.3%. They were followed by hybrid vehicles (mild and plug-in hybrid) with an increase of 62.3% to 52,181 units and a market share of 21.9%. Plug-in hybrids with charging capability follow with an increase of 51% to 21,790 units or 9.1% market share.

Weak upswing expected in 2022

‘In 2022 we expect a slight recovery in the new-car market, but from today’s perspective, the result will probably still be below the years before the pandemic. At most, 260,000 to 270,000 new-car registrations are realistic,’ says Madas. ‘The result will, however, be heavily dependent on the availability of semiconductors and raw materials, i.e. whether the new cars ordered can actually be delivered.’

New-car registrations by month 2018-2021

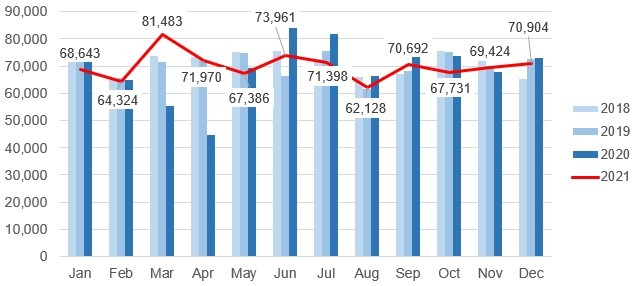

The used-car market has been at a high since the summer of 2020 and is determined by both constantly demand and decreasing supply. Even in the first year of the pandemic, the number of changes in ownership was 830,634 (down 2.1%), only slightly below the previous year’s figure of 848,100. For the whole of 2021, used-car registrations rose by 1.1% to 840,044, compared to 2020. This means the used-car market in 2021 was only slightly below the level of 2019.

The supply shortage in the used-car segment is illustrated by the volume of active offers at the end of 2021. It was 29% lower than at the beginning of February 2020, i.e. before the pandemic took hold (trend stagnating at a low level).

Scarce used-vehicles supply

‘For 2022 we expect stagnating to slightly declining owner changes due to the still low supply of second-hand vehicles and correspondingly tight supply. 835,000 to 845,000 car-owner changes are realistic – and thus a level almost like before the pandemic,’ estimates Madas.

Used-car registrations by month: 2018 – 2021

Due to good demand and a constantly decreasing supply, used-car asking prices have risen steadily in 2021. Compared to the price level at the beginning of February 2020, the price index at the beginning of this year is on average around 11% higher before the start of the pandemic. ‘Stable demand is currently meeting with too little supply. Almost all age classes are now affected, very young used cars as well as medium and older vehicles. The biggest drop in supply was recorded in the age class up to two years with a minus of 37% compared to February 2020,’ said Madas.

The past year was marked by a further increase in residual values that started in the autumn of 2020. Due to the aforementioned supply shortages, prices for diesel and petrol vehicles benefited in particular, whereas hybrid and especially BEVs reacted with a delay and to a lesser extent. Compared to the beginning of February 2020, the offered prices of passenger cars have increased by around 11%. The age group of second-hand vehicles, five years or older, saw above-average growth.