Full-year 2021 second worst for UK new-car market since 1992

07 January 2022

Full-year 2021 new-car registrations in the UK remained firmly below pre-pandemic levels, but more battery-electric vehicles were registered than in the previous five years. Autovista24 senior data journalist Neil King explores the latest developments and the outlook.

In total, 108,596 new cars were registered in the UK last month, according to data released by the Society of Motor Manufacturers and Traders (SMMT). This was exactly in line with Autovista24’s forecast for the month and, in turn, for 2021 as a whole.

Compared to December 2019, registrations declined by 27.1%, in line with the 26.1% downturn in November. There was an extra working day in last month, but also in November. On an adjusted basis, Autovista24 calculates that the market fell by 30.6% and 29.5% respectively in the past two months.

As UK dealers endured lockdowns and subsequent releases of pent-up demand during 2020, year-on-year comparisons are highly misleading. Therefore, comparisons against 2019 are a far better indicator of the market’s performance.

‘Desperately disappointing year’

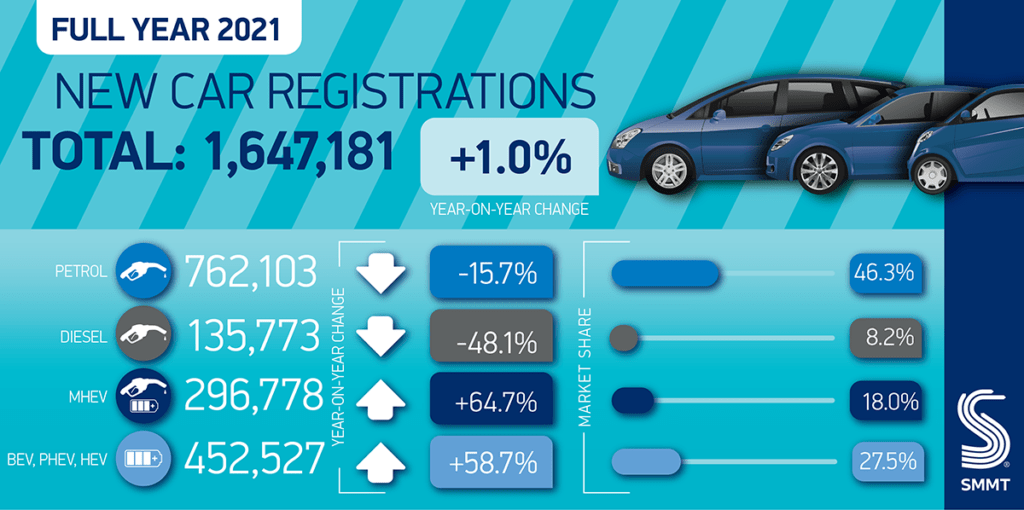

In the full calendar year, fewer than 1.65 million new cars were registered in the UK, equating to a contraction of 28.7% compared to two years ago. Year-on-year growth, albeit of only 1%, was positive as in France, Italy, and Spain, whereas the German market contracted by 10%.

‘It has been another desperately disappointing year for the car industry as COVID-19 continues to cast a pall over any recovery. Manufacturers continue to battle myriad challenges, with tougher trading arrangements, accelerating technology shifts and, above all, the global semiconductor shortage which is decimating supply,’ said SMMT chief executive Mike Hawes.

Reinforcing Hawes’ comments, the UK is also contending with higher energy costs and fuel prices as well as a new wave of COVID-19 cases, especially of the Omicron variant. Nevertheless, with supply bottlenecks expected to ease over 2022, and December and full-year 2021 performing exactly as expected, Autovista24 has maintained its 2022 forecast at 1.86 million new-car registrations. This would equate to 13% year-on-year growth.

One in four cars electrified in 2021

Despite the disappointing market performance, registrations of electrically-chargeable vehicles (EVs) surged in 2021 to gain a share of 18.5%, up from 10.7% in 2020. This is more than double the 8.2% share of diesel cars, including mild-hybrid (MHEV) models. Adding in the 8.9% share of hybrid electric vehicles (HEVs), more than one in four new cars registered in the UK last year featured an electrified powertrain.

2021 was ‘the most successful year in history for electric-vehicle uptake as more new battery-electric vehicles (BEVs) were registered than over the previous five years combined,’ the SMMT highlighted. BEVs enjoyed the greatest growth rate of all powertrain types in 2021, increasing by 76.3% year on year with 109,727 registrations.

‘The UK finished 2021 as the third largest European market for new-car registrations but the second largest by volume for plug-in vehicles and the second largest for BEVs. It is only in ninth position overall, however, in Europe for BEVs by market share, underlining the progress still to be made, despite the UK having among the most ambitious targets of all major markets with the end of sale of new petrol and diesel cars scheduled for 2030,’ the SMMT added.

Challenges ahead

There are positive factors to support the ongoing rapid growth of EVs in the UK, with more models entering the market and supply constraints easing during 2022 - especially with double-digit year-on-year growth anticipated after the growth of just 1% in 2021.

However, there were two cuts to the Plug-in Car Grant (PiCG) in 2021. ‘Furthermore, the slow pace of growth in on-street public charging – where, on average, 16 cars potentially share one standard on-street charger – could put the brake on EV demand and undermine the UK’s attractiveness as a place to sell electric cars,’ the SMMT emphasised.

Drive Electric predicts that there will be more than 330,000 registrations of BEVs in the UK in 2022, up 73% on the 2021 tally and thus repeating the growth rate last year. ‘EV registrations will continue to increase, however issues such as the semiconductor shortage will still have an impact on the availability of vehicles as we enter 2022. We see this challenge improving by mid-2022 and sales for the remainder of the year should offset the slow start, helped by yet more new EV models coming to market,’ commented Managing Director Mike Potter.

Drive Electric forecasts that around 50% of UK new-car registrations in 2025 will be BEVs, but also outlines the positive and negative factors that are influencing forecasts. Above all, cost reduction and development of the UK’s charging infrastructure are critical for sustained long-term growth of electromobility.

'Recent cuts to incentives and home charging grants should be reversed and we need to boost the roll out of public on-street charging with mandated targets, providing every driver, wherever they live, with the assurance they can charge where they want and when they want,’ Hawes concluded.