UK new-car market gains in February but Ukraine conflict threatens recovery

04 March 2022

The UK new-car market made further gains in February but events in Ukraine will slow progress on the road to recovery, explains Autovista24 senior data journalist Neil King.

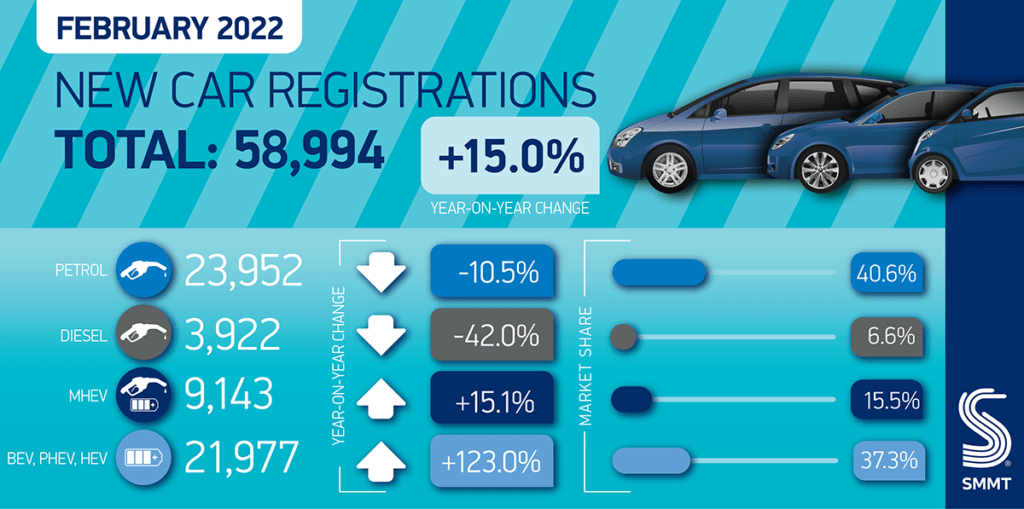

In total, 58,994 new cars were registered in the UK last month, according to data released by the Society of Motor Manufacturers and Traders (SMMT). This marks year-on-year growth of 15%, following the 27.5% rise in January. Cumulative registrations in the first two months of the year grew by 23%, to 174,000 units.

However, the base of comparison is incredibly low. National lockdowns in England and Scotland were announced on 5 January 2021, with ongoing restrictions across the rest of the UK, meaning dealerships were only open for ‘click-and-collect’ services. To add perspective, the market has contracted by 24% so far this year compared to both pre-pandemic 2020 and the 10-year average achieved between 2011 and 2020.

Nevertheless, the two consecutive double-digit growth rates are far more appealing than the double-digit declines recorded in the second half of 2021. Furthermore, Autovista 24 calculates that the seasonally-adjusted annualised rate (SAAR) rose further to 1.86 million units in February, the highest level recorded since August.

Could the Ukraine conflict cause disruption?

In addition to ongoing supply constraints and rising energy costs, taxes, and interest rates, the recovery of UK new-car registrations faces a significant new threat from events in Ukraine.

Although Russia’s invasion has already caused a surge in global gas and oil prices, leading to record fuel prices at UK pumps, the primary concern is not new-car sales, i.e. order intake. The greater impact stems from the increased disruption to automotive supply chains, which are already plagued by semiconductor shortages.

Numerous carmakers have announced operations suspensions in Russia, but production is also affected in western Europe. This includes a shutdown of the Mini Oxford plant from 7 to 11 March. The BBC points to a shortage of parts from Ukraine as the cause.

This is expected to curtail registrations of new cars in the UK in March, but the impact will be far greater from April as delivery delays leave orders unfulfilled. The month of April will be further weakened as there will be one less working day than in 2021.

Autovista24 assumes that the disruption to car production will reduce throughout the year, albeit after securing an alternative supply of critical raw materials and/or components that are sourced from Russia and/or Ukraine. Nevertheless, the expectation for the supply improvements that are factored into the outlooks for new-car registrations, has been lowered. Moreover, not all losses are forecast to be recovered by the end of 2022.

Consequently, the previous forecast of 1.9 million new-car registrations this year has been slashed to 1.83 million units, although this still represents year-on-year growth of 11.3%. As thousands of car sales in 2022 will not be converted into registrations until 2023, the market is forecast to expand by 15.8%, to over 2.1 million units.

There are significant downside risks to this challenging forecast. Consideration must also be given to the duration and severity of the conflict in Ukraine, and whether it extends beyond the country’s borders. Unlike previous crises, such as the global financial crash of 2008-2009, the car-registrations outlook for the UK hinges far more on new-car supply than any economic and/or inflationary repercussions for demand.

One in four new cars is an EV

In better news, the electrification of new cars in the UK continued apace in February, with electric vehicles (EVs) accounting for one in four new-car registrations. Registration volumes of battery-electric vehicles (BEVs) almost trebled compared to a year ago, gaining a 17.7% share, and plug-in hybrids (PHEVs) grew almost 50%, maintaining the 7.9% share achieved in January. The combined 25.6% share of EVs was more than double that of diesel cars, including mild-hybrid diesels, and almost half the 52.9% captured by petrol cars.

‘When combined with hybrid (HEV) registrations, electrified vehicles accounted for more than a third of all new cars leaving dealerships,’ the SMMT noted. However, the association cautioned that ‘February is typically the lowest volume month, as many buyers delay purchases until the ‘new plate’ month of March, and fluctuations in supply for some key models can have a more pronounced effect in terms of market share.’

It is not all plain sailing for EV uptake going forward as the Electric Vehicle Homecharge Scheme (EVHS), which provides funding for homeowners to install a charging point, is due to end in April.

‘Despite February’s traditional low registration numbers, consumers are switching to EVs in ever-increasing numbers. More than ever, infrastructure investment needs to accelerate to match this growth,’ commented SMMT chief executive Mike Hawes.

‘The government must use its upcoming Spring Statement to enable this transition, continuing support for home and workplace charging, boosting public charge-point rollout to tackle charging anxiety and, given the massive increase in energy prices, reducing VAT on public charging points. This will energise both consumer and business confidence and accelerate our switch to zero-emission mobility.’