Are large passenger vans an emerging segment in Austria?

03 March 2022

Rainer Hintermayer, market analyst at Eurotax Austria (part of Autovista Group), analyses the development of large passenger vans (LPVs) in Austria, a segment that shows promise.

High demand for LPVs is anticipated in Austria. Accordingly, they achieve robust residual values (RVs) as three-year-old used vehicles and in our 36-month RVs forecast, which holds particularly true for the bestsellers from Volkswagen (VW) and Mercedes-Benz.

Until a few years ago, minivans such as the VW Sharan or Ford Galaxy were very popular vehicles on the market – both as company vehicles due to the right to deduct input tax, and as family transporters.

However, now that SUVs are becoming more prevalent, minivans are falling out of favour with buyers. Their market share has dropped from 4.3% to a mere 1.5% in the last five years. But SUVs usually offer less room, so when more space is required for family, hobby or work reasons, buyers increasingly opt for LPVS as an alternative as these offer up to nine seats and a lot of storage space.

There might also be others reasons why consumers find multivans appealing. An emission tax (NoVA) has been in place for light-commercial vehicles (LCVs) since the middle of 2021. And the fact that the commercial vehicle models are growing closer to the passenger-car versions in terms of price could also lead to additional demand for models in the T segment.

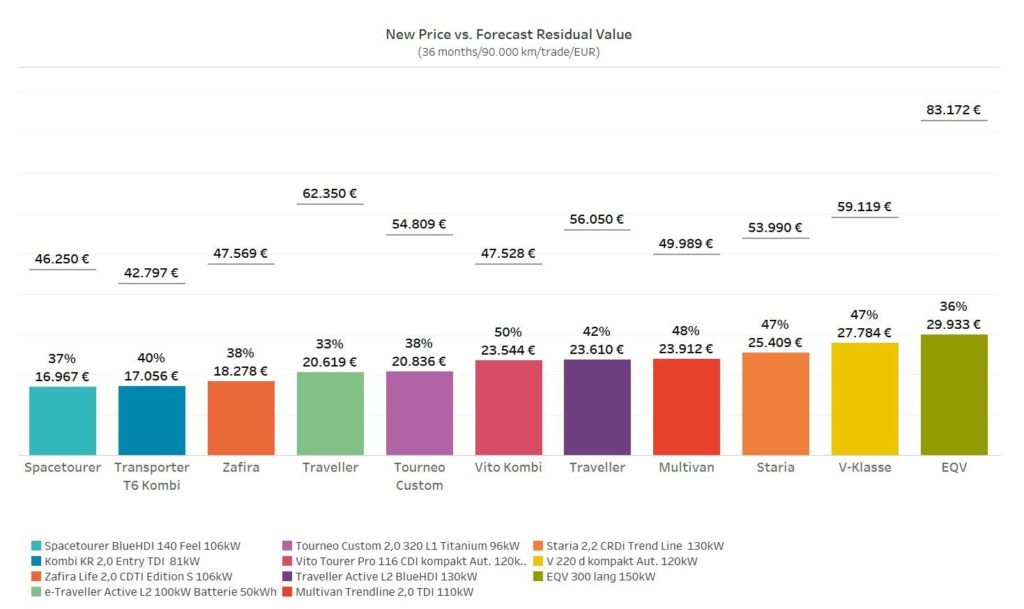

New price vs. forecast residual value: 36 months / 90,000km (trade)

The forecast chart (above) shows the development for 36 months/90,000 km in trade value. It reveals high RVs for Multivan, Vito station wagon and V-Class, analogous to used-car values. The forecast for the electric versions are correspondingly lower, due to the further technological development to be expected by then with regard to battery size, charging speed and range, as well as the relatively high purchase prices.

LPV RVs hold up well and achieve average RVs of 60% in retail as three-year-old used vehicles with 90,000km. The Multivan and the V-Class, the two top sellers, enjoy high demand and are traded at around 67% and 63.5%, respectively, after 36 months. Additionally, the significant supply shortage is having an impact on this segment. Compared to the beginning of 2021, the sales price for three-year-old used LPVs are approximately 6.5 percentage points higher.

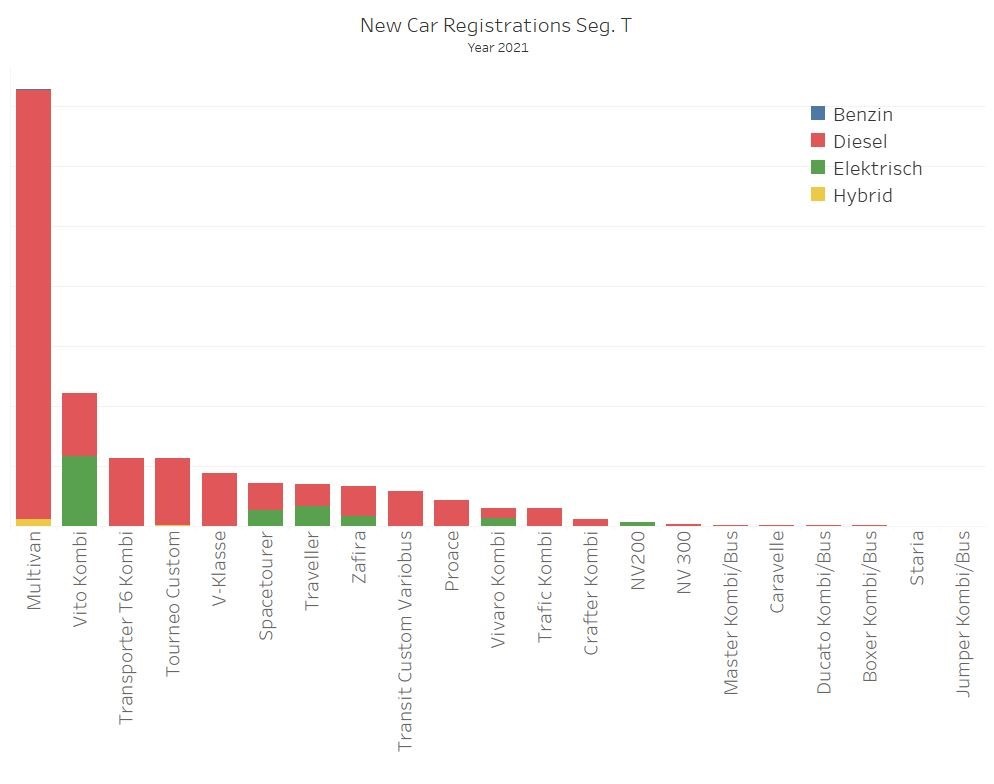

New-car registrations in the T segment 2021

Cars in this segment are mainly powered by diesel engines, but the share of purely electric drives quadrupled from 3% in 2020 to almost 13% in 2021, with the Mercedes e-Vito topping the list ahead of the Stellantis models Citroen e-Spacetourer, Peugeot e-Traveller, and Opel Vivaro-e and Zafira-e.

LPVs reached a market share of 3.5% within new-car registrations in 2021, compared to 3.1% in 2020. It is mainly dominated by the VW Multivan, which ranks well ahead of the Mercedes Vito Kombi or the more luxurious V-Class, as well as the VW T6 Kombi and the Ford Tourneo Custom. The Hyundai Staria, an eye-catching model in terms of its design, was added to the list last year.