BEVs buck the trend in struggling UK new-car market

07 June 2022

The UK new-car market suffered a significant year-on-year decline in registrations in May as supply shortages continued to bite. Battery-electric vehicles (BEVs) and, to a lesser extent, hybrid-electric vehicles (HEVs), bucked the trend, however, with double-digit growth.

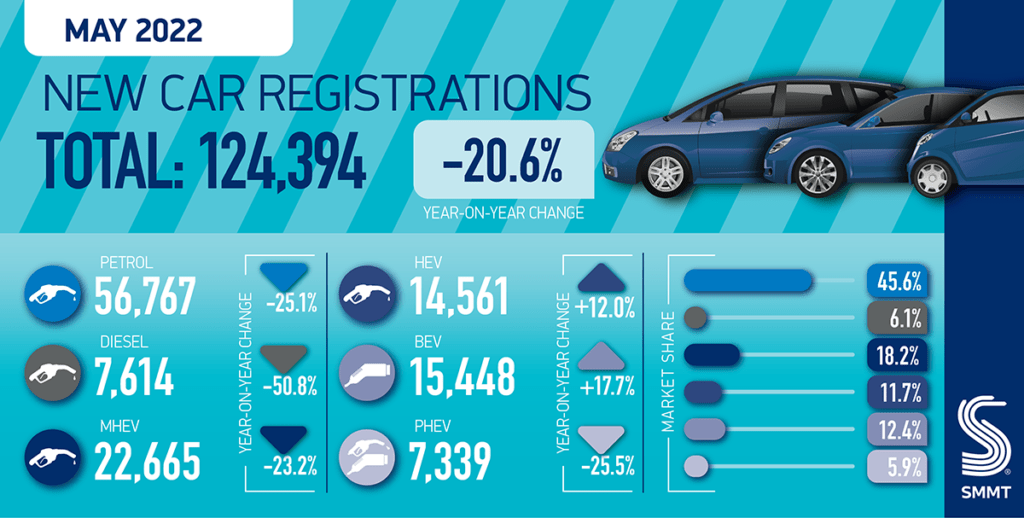

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) show that the new-car market declined by 20.6% last month, with 124,394 registrations. Moreover, there were two more working days than in May 2021 and on an adjusted basis, Autovista24 estimates that the year-on-year fall was 28.2%. This is a severe deterioration from the adjusted 11.4% downturn in April, with the seasonally-adjusted annualised rate (SAAR) receding from 1.8 million units to just 1.45 million units.

Despite the sharp overall market decline, BEVs fared very well, with registrations growing by 17.7% year on year to 15,448 units. This increased their market share to 12.4% in May, making them the second-largest powertrain after petrol.

The SMMT commented that last month was ‘the second weakest May since 1992, after the 2020 pandemic-hit market, as supply shortages continued to hamper new purchases and the fulfilment of existing orders. The decline, compared with the first full month of reopened showrooms in May last year, demonstrates the impact of continued global supply-chain disruptions, with the market 32.3% below the 2019 pre-pandemic level despite strong order books.’

Interest rates and inflation weaken outlook

The run-up to the UK’s two-day bank holiday on 2 and 3 June to celebrate the Queen’s Platinum Jubilee may have curtailed activity towards the end of the month. However, the market still performed slightly below Autovista24’s expectations.

In the first five months of the year, 661,121 new cars were registered, 8.7% down on the same period in 2021. ‘This is 40.6% below the five-year average recorded from January to May, as the UK new-car market continues to struggle to emerge from the impact of the pandemic,’ the SMMT noted.

Inflation surged to 9% in April, threatening to exceed 10% in the coming months, and there was another interest-rate hike in May, with more expected throughout the year. In this context, Autovista24 has revised its forecast for UK new-car registrations in 2022 downward, to a year-on-year increase of 3.6%. This would equate to around 1.71 million units taking to the roads, which is 26% below the pre-pandemic level of 2019.

Private-consumer and fuel-type prioritisation

Although order intake is strong, the weakening performance of the UK new-car market in May contrasted sharply with the subtle recovery in France, Italy, and Spain, as well as the comparative stability in Germany. This suggests manufacturers are prioritising Europe’s left-hand-drive markets over the right-hand-drive UK market. However, even within the country, there is prioritisation of more profitable vehicle deliveries for private consumers.

‘While private consumer purchases fell 10.3%, their market share increased year on year by 6.1 percentage points to 53.2%, in part due to manufacturers striving to fulfil deliveries – particularly of electric vehicles – to private buyers, with the commensurate effect on the business and large-fleet sectors, which now comprise 46.8% of the market,’ the SMMT noted.

Similarly, prioritisation is supporting the double-digit growth in registrations of BEVs and HEVs last month, which rose by 17.7% and 12% year on year, respectively. The growth in BEVs even propelled them to be the second most popular powertrain in the country, capturing a 12.4% share.

‘In yet another challenging month for the new car market, the industry continues to battle ongoing global parts shortages, with growing battery-electric vehicle uptake one of the few bright spots. To continue this momentum and drive a robust mass market for these vehicles, we need to ensure every buyer has the confidence to go electric. This requires an acceleration in the rollout of accessible charging infrastructure to match the increasing number of plug-in vehicles, as well as incentives for the purchase of new cleaner and greener cars,’ said SMMT chief executive Mike Hawes.

Despite falling demand, petrol remains the most popular fuel-type choice in the UK, gaining a 59.1% market share in May (including mild-hybrid petrol cars). The demise of diesel continues, accounting for only 10.8% of the market (including mild-hybrid diesels), behind the HEV share of 11.7%. Demand for plug-in hybrids (PHEVs) is also waning, with the 25.5% year-on-year decline pushing their market share down to only 5.9%. Nevertheless, electrified vehicles accounted for three in 10 new cars registered in the UK last month.

‘Delivering on net-zero means renewing the vehicles on our roads at pace but, with rising inflation and a squeeze on household incomes, this will be increasingly difficult unless businesses and private buyers have the confidence and encouragement to do so,’ Hawes concluded.